Base stocks

ExxonMobil on base stock trends

12 December 2023

Please note this article was published in December 2014 and the facts and opinions expressed may no longer be valid.

04 December 2014

Base stock suppliers look for new opportunities in an oversupplied market

Insight talks to industry stakeholders about some of the key trends and drivers shaping the rapidly changing global Group III base stocks market.

The previous base stock feature, published in September 2014, focused on the challenging and changing poly alpha olefin (PAO) and gas to liquids (GTL) markets. This third feature in the base stocks series gives the views of some of the industry players on Group IIIs.

Tighter emissions regulations, longer drain intervals and the use of lower viscosity grades to deliver fuel efficiency are driving the use of high performance lubricants in transportation. This is in turn driving up the demand for high quality Group III base stocks. In this article we use the term ‘Group III+’. Similar to Group II+, the ‘+’ is not a base oil category, but a marketing term used to define higher viscosity index (VI) base stocks. Since Group III defines VI as >120, Group III+ base stocks can vary significantly!

The mature markets of North America and Europe are expected to continue to demand significant volumes of Group III in the future. This is also likely to include a steady increase of high VI Group III base stocks in markets where thinner grades become a primary requirement to meet challenging fuel economy performance requirements.

Right now, the production deficit in North America and Western Europe make them attractive markets for any Group III surplus.

It is likely that the Middle East and Asia, where most of the Group III capacity increases have been implemented, will emerge as key exporters to these two regions for the immediate future.

However, the new Repsol and Korean SK Lubricants’ joint venture plant in Cartagena began shipping product this October. The largest facility of its kind in Europe, the plant has a capacity of 630,000 tons of Group II and III base stocks, which are destined for the EU market and which could substitute some current imports.

It is not only the traditional markets that are gaining Group III suppliers’ attention - many have their sights set on some of the world’s growth economies.

The markets of Brazil, Russia, India and China (BRIC) are presenting interesting opportunities for Neste. “Although the BRIC economies are experiencing a slowdown, they will continue to drive the demand for mobility and also the need to control pollution,” says Thomas Guinot, Global Services Manager, Base Oils, Neste. “Having said that, the national oil companies in these BRIC economies, along with the global and national lubricant makers, have been putting a lot of resources and focus into their lubricants business recently, with the ambition of being truly global.”

Group III suppliers must address the requirements of the BRICs with consistent quality and production reliability, with a large coverage of approvals and with some level of differentiation.

Thomas Guinot, Global Services Manager, Base Oils, Neste

Despite this increase in demand, Group III base stocks have moved from a position where demand exceeded supply, to one where supply greatly exceeds demand.

Clearly increases in Group III and GTL capacity have impacted this situation and Jin Hur, Senior Vice President, Base Oil Business, SK lubricants, explains this transition. “In 2011 Group III supply was extremely tight, but then the global economic recession caused lubricant demand to plummet. At the same time, new Group III capacities began to come online. As a result, there has been a temporary imbalance between supply and demand. However, we expect this situation to end soon since there will be no significant increase in Group III production capacity in the coming years, and the demand for Group III will increase in all regions.”

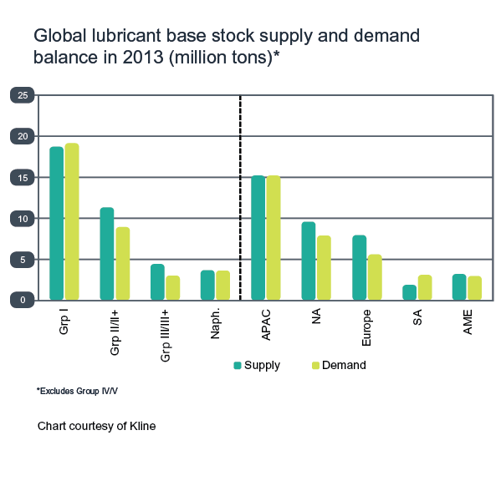

Group II/II+ and III/III+ have significant surpluses of supply over technical demand, which is driving their substitution of Group I

Group II/II+ and III/III+ have significant surpluses of supply over technical demand, which is driving their substitution of Group I

Many refer to high VI Group III base stocks as ‘Group III+’, which is considered to be a marketing term as opposed to a specifically defined API Group. High VI means these stocks can be used to formulate low viscosity engine oils.

Some of the main questions around investment plans are those concerning Group III+ capacity increases, which may be required to respond to the expected demand for thinner SAE 0W-XX grades.

SK for one is actively promoting high VI Group III. “Group III+ provides performance benefits over Group III in formulating high performance motor oils thanks to its superior VI, lower Noack volatility, and outstanding low temperature properties,” says Jin Hur of SK. “It is also more cost effective since it allows for a significantly lower PAO treat in these formulations.”

This is however a complex area, which is mainly driven by OEM specifications. Because these specifications are not all the same, the PAO, Group III, and III+ base oils mix can vary depending on which characteristics in the specification are the most challenging to meet. At Infineum we believe part of our job is to provide the most cost effective and supply reliable formulation solution to the market. Group III+ type stocks will help, but ‘+’ could be 130 or 150 VI. To correct it, a formulation may require a lot more Group III+ than just using less PAO with conventional Group III. Group III at 130 VI vs. a Group III with a VI similar to PAO can make a very large difference.

Group III+ demand will increase in top tier market because it gives OEMs and lubricant manufacturers both performance and cost competitiveness.

Jin Hur Senior Vice President, Base Oil Business, SK lubricants

Neste’s Thomas Guinot shares the optimism around Group III+ growth. “In the next 3-5 years Group III+ could represent up to 5-10% of the total Group III demand globally. I think further growth will depend on the cost between this new segment and Group III and IV and the technical demand from OEMs.”

Despite the enthusiasm for Group III+ its production presents its own set of challenges. “It is difficult to convert all Group III production into Group III+ because you need to find the right process with the right feedstock to produce cost competitive products,” continues Neste’s Thomas Guinot. “Today, supply security, production reliability, global availability and approvals are still the priority for Group III suppliers to address market needs. It is also important not to over formulate products for markets or regions that do not require them, which means we should be enhancing Group III average performance to meet market needs.”

Regardless of their views on Group III, PAO and Group III+ use, the key focus for all Group III producers right now is how to differentiate in an oversupplied market.

“In our view the industry should look seriously at redefining the Group III molecules or API categories,” says Neste’s Thomas Guinot. “We believe that viscosity index or saturates are not enough to characterise Group III, and a combination of cold cranking simulator and Noack are more and more important in new high tier formulations.”

Chemlube’s Joe Rousmaniere has a suggestion for taking differentiation a step further. “The key characteristics of Group III base stocks are high viscosity index and low volatility. When VI is pushed up above 130 they added a ‘+’. The next big step could be to add an ‘L’. The new ETRO 4/12 Noack from PETRONAS demonstrates that it is possible – let’s see if others follow.”

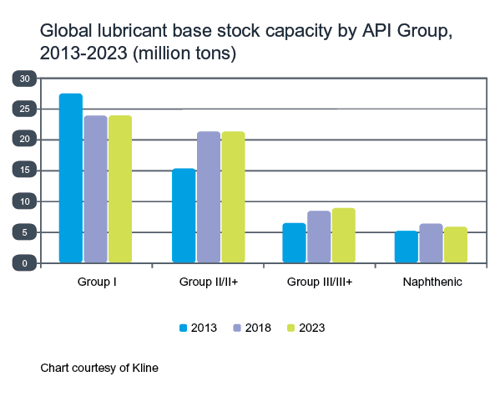

In a recent report, Kline estimates that planned Group II/II+ and III/III+ capacity additions will keep the market long.

Nearly 10 million tons of new Group II/III capacity is planned, which is offset by reductions in Group I supply

Nearly 10 million tons of new Group II/III capacity is planned, which is offset by reductions in Group I supply

Slower demand growth combined with rapid Group II and III capacity additions could depress capacity utilisation in the medium term. This means the continued closure of high cost plants is almost inevitable, and although Group I is likely to have the highest number of casualties, small or less efficient Group II plants could be at risk.

We would also note, fuels demand from a given refinery plays a significant role in determining whether a base stock plant can remain open or not. The global economics of a Group I plant are highly dependent of the amount of added value materials (e.g. Brightstock, waxes) produced or extracted from the manufacturing process. The flexibility to access and process cheaper feedstocks has also become critical in the overall economic equation to maintain competitiveness of manufacturing base stock irrespective of their ‘Group’ classification.

With the expectation that the market will remain in surplus, the new capacities coming online across the world will no doubt impact trade flows.

Competition will remain high and it will be an exciting market to watch as Group III suppliers continue to look for innovative ways to differentiate their products to ensure success in the increasingly oversupplied global marketplace. Regional supplies could also change once technical demand catches up with current capacity. In an earlier article we noted that Sasol plans to build a GTL plant in the US, but this is probably at least five to seven years away.

Formulation complexity will only increase with the introduction of lower viscosity and more demanding OEM specifications. We believe that current Group III will be fit for purposes for the new SAE 0W-16 viscosity grade, similar to current SAE 0W-20 base stock appetites. The introduction of viscosity grades as low as SAE 0W-4 will require much higher VI base stocks to maintain performance. These changes will also place increasing investment challenges on all stakeholders.

In our view, the various performance features of Group III make base oil interchange (BOI) and viscosity grade read across (VGRA) guidelines a significant challenge.

Joan Evans, Global Industry Liaison Manager, Infineum

Infineum believes that the industry will need to continue to bring forward data to help define appropriate BOI/VGRA guidelines, and base stock Group alone will no longer be enough. This is especially true as there is such a wide range of products within both API Group II and III – it may be prudent for API to address the growing need for base stock category redefinition.

Sign up to receive monthly updates via email