Base stocks

Unlocking the potential of re-refined base oils

08 April 2025

13 December 2022

Rising margins for refined products dampen outlook for base stock production

The refining world, still suffering from the impacts of the COVID-19 pandemic, is now being further challenged by geopolitical tensions, logistics challenges, economic uncertainty and pressure to decarbonise. Guo Harn Hong, Lead Base Oils Analyst at Argus Media, talks to Insight about how the current pressures in the various regional markets are influencing supply/demand balances and explores the challenges he sees ahead.

The past few years have been particularly challenging for both base oil producers and their customers as a series of unprecedented shocks have hit the industry. As Argus Media’s Guo Harn explains, while pressures are easing slightly, in a world still feeling the effects of the pandemic, there is much uncertainty ahead. “Refineries are really driven by fuels production and the major impact of COVID-19 on the refining industry was a weaker demand for all transportation fuels as mobility restrictions were introduced across the world in an effort to slow the spread of the virus. This led to rising inventories of fuels, which meant refiners had to cut back on throughput and production. The knock on effect was that less feedstock was available for base stock production. But, at the same time, lubricant demand, particularly in sectors such as manufacturing, industrial fluids and machine oils, remained steady, which resulted in very high base stock prices compared to previous years.”

Looking at supply, Guo Harn sees a disparity between theoretical and actual figures and a continued uncertainty ahead. “In the last 5-10 years, on paper at least, if you look at base stock production based on nameplate capacity there has been more supply than demand. In reality, over the last 2-3 years, driven by the pandemic and various geopolitical tensions, we have seen more supply disruptions, although I think we could be moving back to an over supplied market scenario."

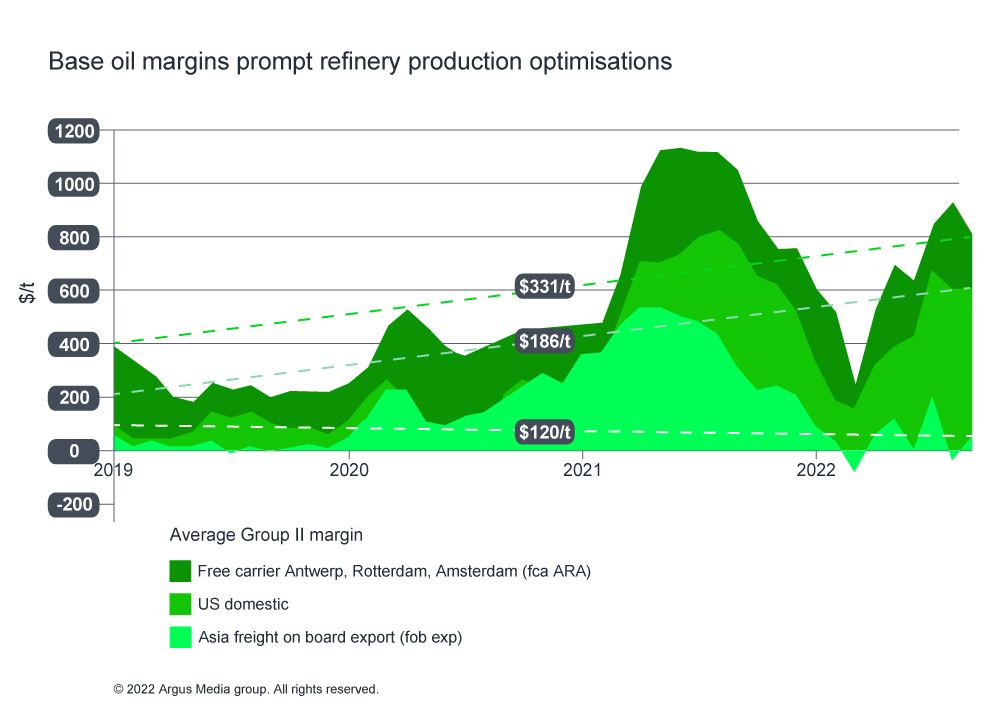

"Right now what is keeping base stock supply tight is that given relatively high fuel prices vs base oil prices, refiners are incentivised to produce the former."

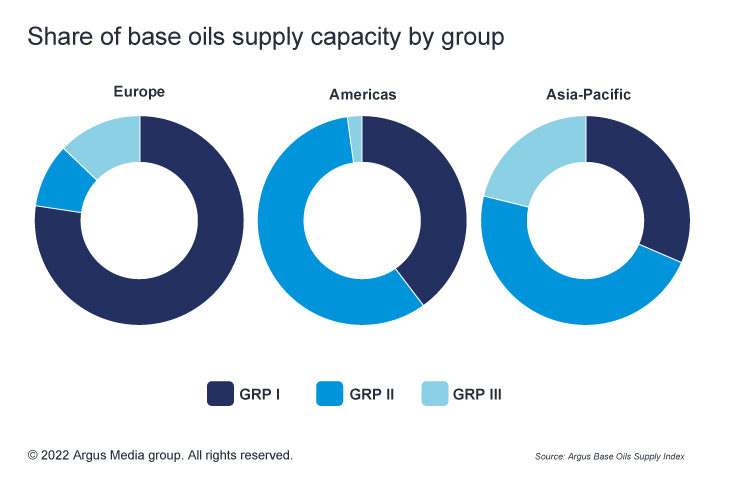

However, as Guo Harn continues, the base stock supply picture is quite different across the three main regions. “In Europe the majority of production is Group I, while the US produces more Group II and in Asia Pacific production is quite balanced across the Groups.

Although COVID-19 lockdown restrictions have been easing and refinery throughput is starting to increase, it appears there is not much light at the end of the gloomy tunnel. “Yes, in the last few months we have seen an increase in base stock supply and a little bit of downward pressure on prices across the base stock Groups,” Guo Harn continues. “But we also see a change in dynamics arising from the situation with Russia, where the majority of base stocks for export are typically delivered to ports in the Baltic and Black seas. However, the impact of recent sanctions has resulted in a tightness of lawfully available supply for distributors and traders operating in these regions."

How long the Russian supply disruption will continue is impossible to call but add in the logistical complications that are plaguing the industry and it becomes clear that significant pressure remains. “The current shipping complications, container shortages and high freight rates are slowing down the movement of products. This means that supplies can remain trapped – a factor that is exacerbating the wide price spread we are seeing across the regions.”

And it does not stop there, as economic uncertainty also has a big part to play in the future base stock picture. “Inflation remains high in US and Europe, ranging from 7-9%, which has prompted, and is set to prompt, further hikes in the cost of borrowing until prices increase at a slower rate. This will slow market activity. In our experience, because lubricant demand tracks GDP growth quite closely, we can expect a slow-down in the demand for lubricants. However, this is not a global trend, we are seeing some different dynamics across the regions. In Asia Pacific, for example, where inflation is much lower than in the US and Europe, demand is a bit more resilient with policy makers soon having room to adjust their monetary policies. This is also because, especially in China, things are just showing signs of opening up post pandemic as the country eases its zero-COVID policy. It is our expectation that even though the spread remains quite wide now, as China opens up, demand in that region is starting to rise and, if that really continues to be the case, we should expect prices to rise in Asia Pacific vs US and Europe, which will then narrow the regional spreads.”

In terms of the different base stock Groups, Guo Harn also expects to see some differences in demand patterns. “In my view, if you look at Group I, it has very niche applications, such as metalworking and process fluids, while Groups II and III are far more related to the automotive sector. This means in terms of demand, I would say Group I is a little more resilient because those applications are unlikely to move away from traditional Group I base stocks. However, we have seen more Group I plant closures and more startups and capacity expansions of Group II and III plants so looking ahead we can expect Group I supply to stay flat or tighten. In the higher quality base stocks, I can see a couple of factors that might impact demand. First there all the regulations that have been introduced to curb automotive tailpipe emissions – such China Stage VI, India’s Bharat Stage VI and Euro 7 and then we have seen a tightening of ILSAC, ACEA, dexosTM and other engine oil specifications. All these activities point towards an increase in demand for premium, light-grade base oils, which have properties such as lower sulphated ash, phosphorus and sulphur (SAPS) content and lower HTHS viscosity – attributes that will be needed to help meet these latest regulations."

"The impact of these emissions standards towards new demand for Group II and III base stocks is not materialising yet.”

All these changes in demand and supply are impacting base oil price spreads. “First while the demand for Group II & III is rising, supply from Asia Pacific is also increasing which means there is not as much price pressure on premium grade base stocks as we expected. However, we are seeing a very narrow spread between Group I and Group II base oil prices as supply increases counter growth in demand.”

In addition to the pressures already mentioned, Guo Harn anticipates that some changes relating to environmental, social, and governance (ESG) and sustainability concerns could have significant impacts on the future base stock market. “Currently some 70% of base stocks are used in automotive applications, a figure that could take a hit if there is a significant increase in the use of full battery electric vehicles across the regions over the next 10-30 years. If this were to occur, the combination of weaker demand and increased supply would put downward pressure on Group II & III prices. In fact, I would not be at all surprised if over the next 5-10 years Group II will actually be at a discount to Group I. You can be sure that the players in the market are looking at these trends and although some might have plans for permanent Group I plant shuts right now, if the market dynamics continue to change there may be even more of an incentive for them to reverse those decisions.”

In terms of sustainability targets, Guo Harn suggests support is needed to encourage the use of re-refined and bio base stocks.

"Government support and the development of logistics channels are needed to encourage the use of more sustainable base stocks."

"For example, if you look at parts of Europe, Australia and North America there is a strong pick-up of these products. In Asia Pacific we are seeing only limited interest – although some refiners are starting to look at the opportunities that exist in the market for these more sustainable products. However, when I consider the demand aspects, I have more questions than answers: can applications use re-refined or biobased products; can these new base stocks cater to the demands of the latest specification severity; is there sufficient supply of high quality sustainable product to cope with changing demand patterns? That leaves refiners and potential uses with a lot of aspects to consider.”

Base stocks account for only a very small proportion in terms of refinery production output and competing for attention is always a challenge. “Currently a number of base stocks are at a discount compared to refined products, which is atypical. This is especially the case in Asia Pacific, partly a reflection of rising supply capacity vs other regions and owing to weaker demand in this region – especially as China is still only at the early stages of opening up after the pandemic and demand here is still low. In the US some base oil prices are currently at a discount to diesel and eventually we can expect refiners to tweak their production streams to produce more of the higher priced product. In Europe, if you look at regional prices, they are reliant on Group II and III overseas supply, so margins of these products are little healthier vs the other regions. However, if they drop any further refiners here will have to think about optimising their production streams.”

As Guo Harn continues, “It really depends on the specific region, the import and exports and exchange rates, but definitely over in Asia Pacific there is a lot of downward pressure on prices right now and we should expect refiners to cut base stock production. And of course, refined product prices have been supported by OPEC+, which has imposed deep cuts in production and with the flow from Russia starting to slow I think that we are going to see quite a big change in regional spreads over the coming months.”

There has been so much change in the market in recent years that, as Guo Harn concludes, the future dynamics are very hard to call. “With COVID-19 and some big changes such as emissions reduction legislation only just behind us we are now facing geopolitical tensions and inflation pressures. These huge unknowns mean there is a very murky picture as to where the base stock market is going. For example, if I look back to the introduction of the IMO 2020 emissions reduction legislation in the marine market, there was a real expectation that supply would all move to higher total base number Group II & III products and that over time Bright stock demand might increase because of its use as a viscosity modifier. But none of this materialised. Why? Because when the pandemic struck, faced with the resulting demand implications everything was pushed back, which clouded the whole supply and demand dynamics.”

“Looking ahead, and adding in logistics challenges to the long list of uncertainties that are exacerbating the supply demand dynamics in every region, the global picture is just getting more complex. In my view, it is only when all these factors start to ease that we will have more clarity on where the supply demand fundamentals are heading. “

Sign up to receive monthly updates via email