Lubricant trends

Advances in automotive lubricant design

04 March 2025

16 April 2024

Gulf Oil reveals growth opportunities for vehicles and lubricants in a vibrant Indian market

Not only is India a huge and growing market but also new policy decisions and changing consumer demographics are creating the potential for volume and value growth in the automotive and lubricants sectors. Following his keynote presentation at this year's ICIS World Base Oils and Lubricants Conference in London, Ravi Chawla, MD & CEO of Gulf Oil India, talks to Insight about some of the challenges and opportunities he sees ahead.

Ravi Chawla, Gulf Oil India, at the 28th ICIS

Ravi Chawla, Gulf Oil India, at the 28th ICIS India is one of the world’s fastest growing major economies and is now the third largest automotive and lubricant consuming market. As Gulf’s Ravi Chawla explains, not only is it a sizeable market but also there is tremendous opportunity for growth. “Our economy is being driven by a rapidly expanding middle class and brisk digital transformation. By 2027, forecasters suggest we are on track to become the world’s third largest economy, overtaking both Japan and Germany, with GDP exceeding five trillion US dollars in this timeframe. India of course has a large population, some 1.4 billion people, which means we have a substantial consumer base and a large workforce. That’s why we are seeing growth month after month.”

In Ravi’s view it is the changing population demographic that is really driving much of the growth in India today. “The share of the middle class has more than doubled in the last 20 years and it is forecast to continue to grow well into the future. We can expect these affluent consumers to transform consumption patterns, with an increased demand for high quality products, brands and services.” As he continues, India is also investing heavily in the future. “India has long been a service market, but now it is becoming a manufacturing hub. To support this transition, central and state governments are investing in infrastructure as a priority, with 1.7 trillion dollars expected in the next four to five years. We already have the 2nd largest road network in the world but now it’s all about targeting 200,000 kilometres by 2025. And it’s not just about the roads – there are targets for expansion in rail networks, airports and in improving connectivity to the ports – it’s a huge amount of progress.”

However, when it comes to vehicle ownership, Ravi confirms that currently there is a relatively low penetration. “Only some 8% of families own a car, while 47% of households own a two-wheeler, which means there is significant scope for development. We can expect to see growth in both segments in the coming years as improving incomes and an increasing need for personal mobility push up sales."

In FY 2023-2028 forecasts suggest increases of about 9 to 11% in two-wheelers and 5-7% in passenger cars sales. We can also expect the sales of commercial vehicles and construction equipment to rise.Ravi Chawla, Gulf Oil India

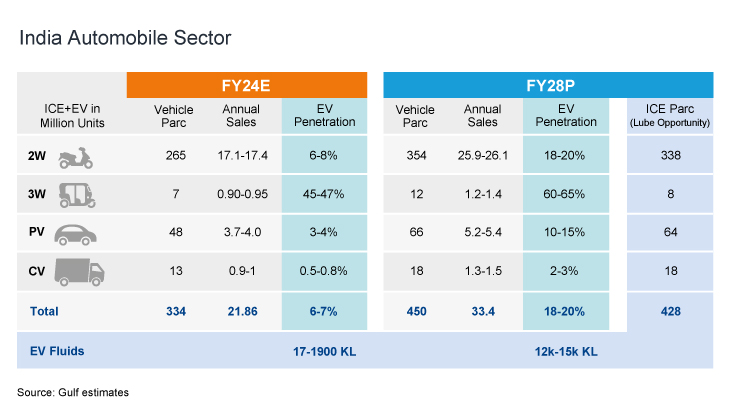

A key question that remains is how fast will electric vehicles (EVs) penetrate the automotive landscape in India? Here Ravi has broken down the outlook by vehicle type to give his view across the different sectors at two- and three-wheelers, passenger cars and commercial vehicles, which you can see in the figure below.

“Today the vehicle parc in India stands at 334 millions of which 6-7% are electric, although it is a very different picture in the various vehicle classes. We are seeing significant growth in the electrification of three-wheelers, modest penetration in two-wheelers and passenger cars and only a very small uptake in commercial vehicles. However, in this latter segment we can envisage faster growth in the electrification of buses and light commercial vans. Looking ahead at electric vehicle penetration five years from now, we can expect growth across all the segments as OEMs launch new models, subsidies continue, charging infrastructure improves and battery cost per kwh reduce. This will present opportunities for EV-fluids such as transmission oils, coolants and brake fluids.”

However, Ravi does not see growth in EVs as the end of the internal combustion engine (ICE) in India.

We estimate sales of vehicles containing an ICE will continue to grow and that more than 90% of the vehicle parc will contain an ICE in 2030.Ravi Chawla, Gulf Oil India

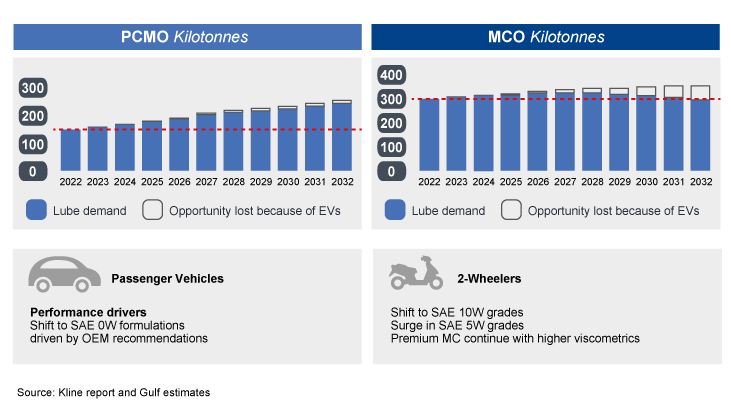

"So," he continues, "there's still going to be enough lubricant consumption across these sectors and that's the new lubricant opportunity. India is a bright spot in the global lubricants market with the strongest potential for lubricant demand among the major consuming markets. We can expect demand for automotive, industrial and the other lubricants to go up from 2.9 to 3.4 million tonnes from 2022 to 2032. Despite decarbonisation, we’ll see volume growth of 3% and value growth of 6% CAGR over the same period. Although some industry players feel we can grow even faster. With India the 3rd largest lubricants market globally, we call this ‘Shining Bright’ unlocking growth opportunities in the India lubricants market.”

Over the next decade Ravi sees huge potential for lubricant manufacturers in India as the increasing need for mobility drives up the vehicle parc. “The emergence of EVs combined with the continued growth in ICE use means lubricant demand will grow and we will also see new demand for EV-fluids. Currently we expect EV-fluid demand to be fairly small – some 12,000 to 15,000 litres by 2028. But, what we can also expect to see is an increase in demand for premium quality engine oils and a shift to a premium quality market with the increased use of lighter viscosity and synthetic oils in automotive applications."

In the commercial vehicle segment Ravi also anticipates strong demand growth in the next five years. “We expect lubricant demand potential to be higher in on-road vehicles than in the off-road segment, mainly owing to an increase in e-commerce, a need for larger trucks and the improving road networks. Here emissions regulations and increased service intervals are likely to drive up the demand for energy efficient, low viscosity synthetic lubricants.”

With decarbonisation high on the agenda, the Indian government has set targets for future EV sales. However, Ravi says he expects the automotive sector to take a more multi-fuel approach. “The government has set really aggressive EV sales targets of 30% for new passenger cars and 80% of two- and three-wheelers by 2030. I personally believe that there are a lot of challenges in meeting these numbers specifically around creating recharging infrastructure, vehicle affordability and the availability of green energy."

I think we will see a multi-pronged approach including the use of bio fuels, hydrogen and synthetic fuels to complement the electrification efforts.Ravi Chawla, Gulf Oil India

"In our view, this diverse automotive landscape will demand dedicated and energy efficient lubrication solutions, which will drive volume and value growth well into the future.”

Sign up to receive monthly updates via email