Small Engines

New JASO T903 motorcycle specification

04 July 2023

12 December 2013

Designing motorcycle oils that meet the needs of OEMs and end users

In the increasingly complex world of motorcycles, lubricants need to deliver exceptional engine, gear and clutch protection. Insight looks at the challenges and examines Infineum's response to the changing market landscape.

If you were to write a list of recession-proof industries, you might not put the motorcycle industry at the top. But, it appears that even in tough economic times, the registration of new motorcycles continues to increase – although regional variations are emerging.

In the North American and European markets, where some 50 million motorcycles cruise the roads, sales of new machines fell sharply in the economic downturn – and in Europe sales are still in decline. However, in North America where sales are currently relatively flat, many expect the market to experience some growth in the next few years.

North America remains a predominantly leisure-user market, and big, traditional names like Harley Davidson continue to lead the way.

Until recently Europe had been seen as a leisure market for the motorcycle industry, but over the last few years a commuter market has started to emerge. The desire for a journey to work that costs less in fuel and is less affected by congestion has increased the popularity of smaller ~150cc machines.

While new motorcycles registrations across Europe fell from 2.7 to 1.5 million in 2012, which has in turn increased the average age of the continent’s motorcycles, end user numbers continue to grow for the service fill market.

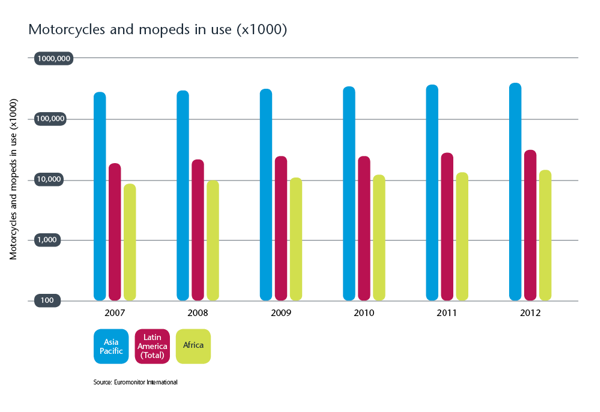

In the markets of Asia Pacific, Latin America (LA) and Africa where two wheelers are primarily used as an everyday mode of transport, user growth has been on a steady upward trajectory.

Two-wheeler growth has been on a steady upward trajectory

These diverging growth and usage requirements really split the market in two. In Asia, LA and Africa end users are demanding low running costs and improved fuel economy to save money, and OEMs are driving fuel economy improvements to capture sales. In the US and Europe motorcycle users are now expecting their lubricants to help keep their machines reliably on the road for longer.

These expectations are reflected in lubricant marketing, which would previously have been around power and performance but has shifted to messages around protection and fuel economy.

This split is further reflected in the global motorcycle lubricant market, which is becoming more complex as OEMs and users look for very specific performance attributes, which appear to go beyond the specifications. Lubricant suppliers must ensure their products not only deliver against these diverse requirements, but also maintain a high level of durability across the three critical areas of hardware: the gearbox, the clutch and the engine.

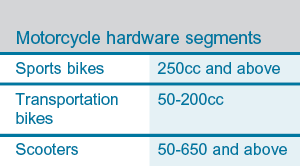

Added to these geographic differences is a second layer of complexity, which comes from the fact that the motorcycle market is split into various hardware segments, each with its own set of lubrication requirements.

The sports sector is typically seen as an ageing bike population. Machines are purchased as a long term, luxury item rather than as a day-to-day tool for commuting. Many of these bikes have just a single oil drain each year, with the bike remaining unused for long periods. Riders treasure their bikes and expect the lubricant to offer a high level of hardware durability.

The transportation sector, which covers the majority of bikes purchased in Asia, is focused on low ownership costs and reliability. Oil drain intervals tend to be between 3000-5000 kilometres, and lubricants are expected to deliver both fuel economy and durability to help reduce running costs while increasing length of ownership.

The scooter sector is a fast growth market with a changing demographic, with many new owners being young professionals and women. Although drain intervals and lubricant demands are similar to the transportation sector, fewer riders carry out their own maintenance. Typically used for commuting, journeys are relatively short, and the scooter starts and stops regularly. This means the lubricant must be able to deliver sufficient protection and fuel economy at lower operating temperatures.

In recent years, passenger car motor oils (PCMO) have moved to lower viscosity grades for fuel economy performance. And the levels of zinc, phosphorous and other extreme pressure additives have also been reduced, owing to the potential harmful effects they may have on aftertreatment hardware. While these changes have helped in the automotive sector, PCMO can no longer provide balanced protection to the engine, gears and clutch of four-stroke motorcycles.

While a number of oils including both passenger car and motorcycle oils claim JASO (Japanese Standards Organisation) performance, they may not meet the real needs of the modern motorcycle. JASO provides a universal motorcycle industry oil specification that sets acceptable limits for parameters including phosphorous, sulphated ash and oil volatility.

Oil manufacturers need to meet these specifications in order to achieve JASO certification. Unfortunately, in order to meet these specifications, some oil manufacturers will take an existing oil formulation and modify it just enough to qualify for certification - allowing them to minimise overall business complexity. In some cases the oil may not provide optimum performance for the three key hardware areas of a motorcycle over the typical 4,500 km oil drain interval.

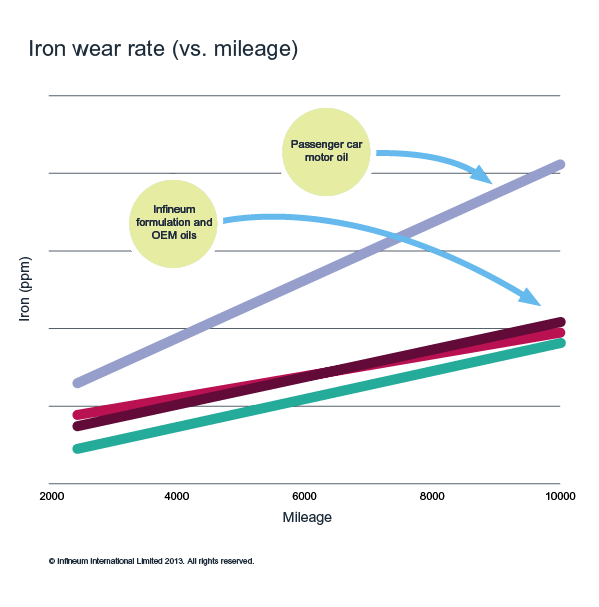

Infineum continues to test both PCMO and motorcycle oil (MCO) products. In a recent Infineum programme in Bangkok, busy motorcycle taxi and courier riders were used to help simulate real world operating conditions in an extreme environment. The higher iron-wear trends observed in the test results clearly demonstrate that passenger car oils were unable to provide adequate protection to the engines.

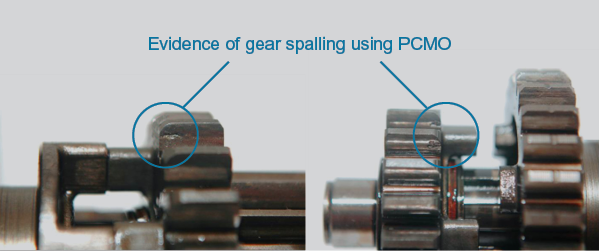

Many oils are not designed to offer gear protection, simply because the engines and gearboxes in cars use their own specific oils. Today’s low viscosity oils, designed to deliver improved fuel economy, may not offer sufficient protection to motorcycle gears, and may even have the potential to cause gear failure.

Phosphorus is known to form a protective film between metal parts, which can provide some protection against wear and gear pitting. But, if the oil film becomes very thin, raising lubricant phosphorus limits alone cannot guarantee sufficient protection. In addition, we know that the future tightening of emissions regulations is likely to force a reduction in phosphorus due to its impact on the catalyst.

OEMs have provided oil quality limits, such as HTHS (>2.9 mPa.s) and phosphorus (0.08-0.12 ppm) to offer minimum protection,. But to ensure hardware protection they are keen to have a gear pitting test – although this still appears to be some way off.

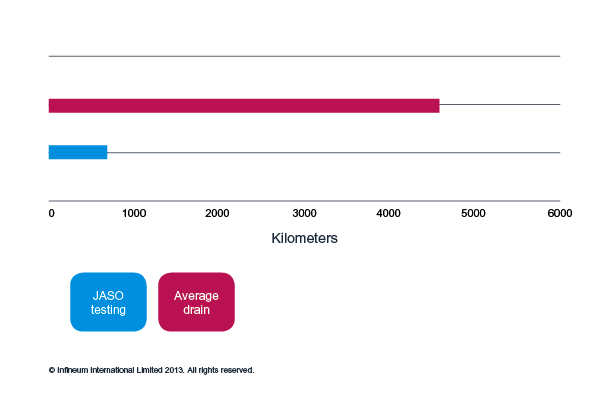

To meet the JASO specification, oils must deliver clutch friction to 1,000 cycles (or gear changes), a stretch for many PCMOs, but a minimum requirement that many oils can meet. However, we estimate that this equates to only around 670 kms, whereas most average oil drains are about 4,500 kms.

From our experiments we conclude that the JASO T903 friction test, when running 1000 cycles, only provides minimum standards for motorcycle clutch friction durability performance but does not provide an adequate assessment of clutch durability or 'clutch feel' over the typical drain intervals for motorcycle oils. It is clear that some products offer the minimum specification requirement but over the typical drain interval provide poorer clutch performance and could have a negative effect for the rider.

These issues have driven the need for tailored motorcycle oils that are specifically designed to address both end user and motorcycle hardware needs.

Motorcycle oils must be carefully balanced to provide optimum performance in all three areas of a motorcycle: clutch, gearbox and engine – even beyond the current motorcycle oil specifications.

This changing and complex market, combined with the increasing inappropriateness of PCMO for motorcycle lubrication, spurred Infineum to apply its technical expertise to the development of additive technology specifically for motorcycle lubricants.

The result of this effort is the launch in 2014 of the first SAE 5W-30 product in the market that is more in line with end user expectations and that can deliver ultimate motorcycle protection equivalent to or better than higher viscosity grades.

In prototype testing, this new product has already demonstrated outstanding performance in three key areas:

Sign up to receive monthly updates via email