Marine engines

Unlocking the full potential of methanol

16 April 2024

08 November 2017

Additives can help refiners respond to new demands from the marine market

The bunker world is about to experience a period of unprecedented change as the industry prepares for new global low sulphur limits, which come into effect in early 2020. Insight looks at the possible bunker fuel quality issues that could arise and highlights where additives can be used to help overcome them.

The International Maritime Organization (IMO) is bringing in increasingly stringent emissions regulations to ensure shipping meets its environmental obligations. The 2015 introduction of 0.1% sulphur fuels in emission control areas (ECA) presented challenges for fuel buyers and suppliers in terms of fuel choice, quality and compatibility. But, for refiners, the transition went very smoothly. This is mainly because shipping in ECA accounts for only a small percentage of marine fuel consumption – with the switch thought to have increased middle distillate demand by only some 25 million tons/year.

The next round of IMO sulphur cuts will take effect on January 1 2020, when the global sulphur cap will be lowered from 3.5 to 0.5%. The implications of this move will be felt far more widely.

Shippers have three key options to meet the new sulphur requirements:

While scrubbers and LNG are both viable options for shippers, it is thought that they can only really be considered as longer-term solutions. In our view, the low sulphur fuel option has the highest impact on refiners. They will need to find cost effective ways to increase the production of low sulphur bunker fuels in time for the 2020 deadline. And, with global net marine fuel demand for the oceangoing fleet estimated to be 250-285 million mt., the effects on the refining industry will be significant.

In the coming years significant change is forecast in the demand for marine fuels and the value opportunities for low sulphur products are expected to grow.

Infineum has a unique combination of advanced additive technologies and technical expertise that can help to overcome the challenges expected in this changing landscape.

The 2020 low sulphur cap not only affects the heavy fuel oil (HFO) market, but also shakes up the whole production barrel. However, despite the tight timescale, there is still a level of uncertainty on the best approach here. Some analysts predict an increase in demand for distillate-type bunker fuels, others forecast a growth in hybrid fuels (which are neither distillates nor residual fuels) and there is also a view that the best option is to optimise production of low sulphur fuel oils (LSFO) by upgrading heavier residues.

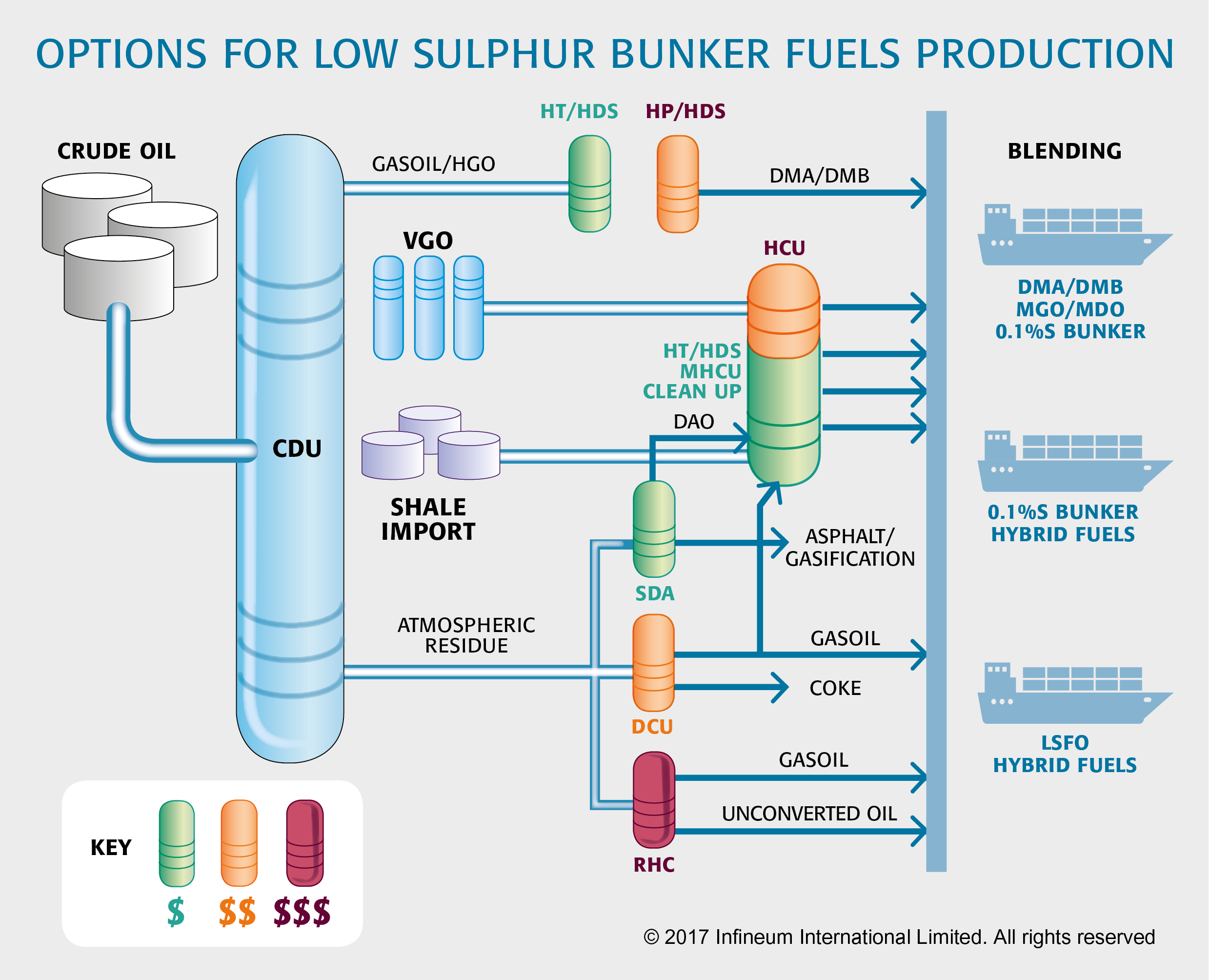

With this uncertainty in mind, the fuels experts at Infineum have explored the different solutions available for the production of low sulphur marine fuels and assessed the level of investment each requires.

| CDU | Crude Distillation Unit | HT | Hydro-treater |

| DCU | Delayed Coker Unit | LSFO | Low sulphur fuel oil |

| DAO | De-asphalted oil | MDO | Marine diesel oil |

| DMA/DMB | Marine distillate fuel grades | MGO | Marine gas oil |

| HCU | Hydro-cracker Unit | MHCU | Mild Hydro-cracking Unit |

| HDS | Hydro-desulphurisation Unit | RHC | Residual Hydro-cracking Unit |

| HP HDS | High Pressure Hydro-desulphurisation Unit | SDA | Solvent De-asphalter Unit |

| HGO | Heavy gas oil | VGO | Vacuum gas oil |

As more low sulphur fuels are added to the bunker fuel market, fuel additives will help to ensure cold flow and handling issues are avoided.

Starting at the top of the blending column, distillate bunker fuels can be blended from various components. Depending on the sulphur level of the crude oil, it may be possible to use straight run with a blend of hydro-treated and/or hydrocracked materials.

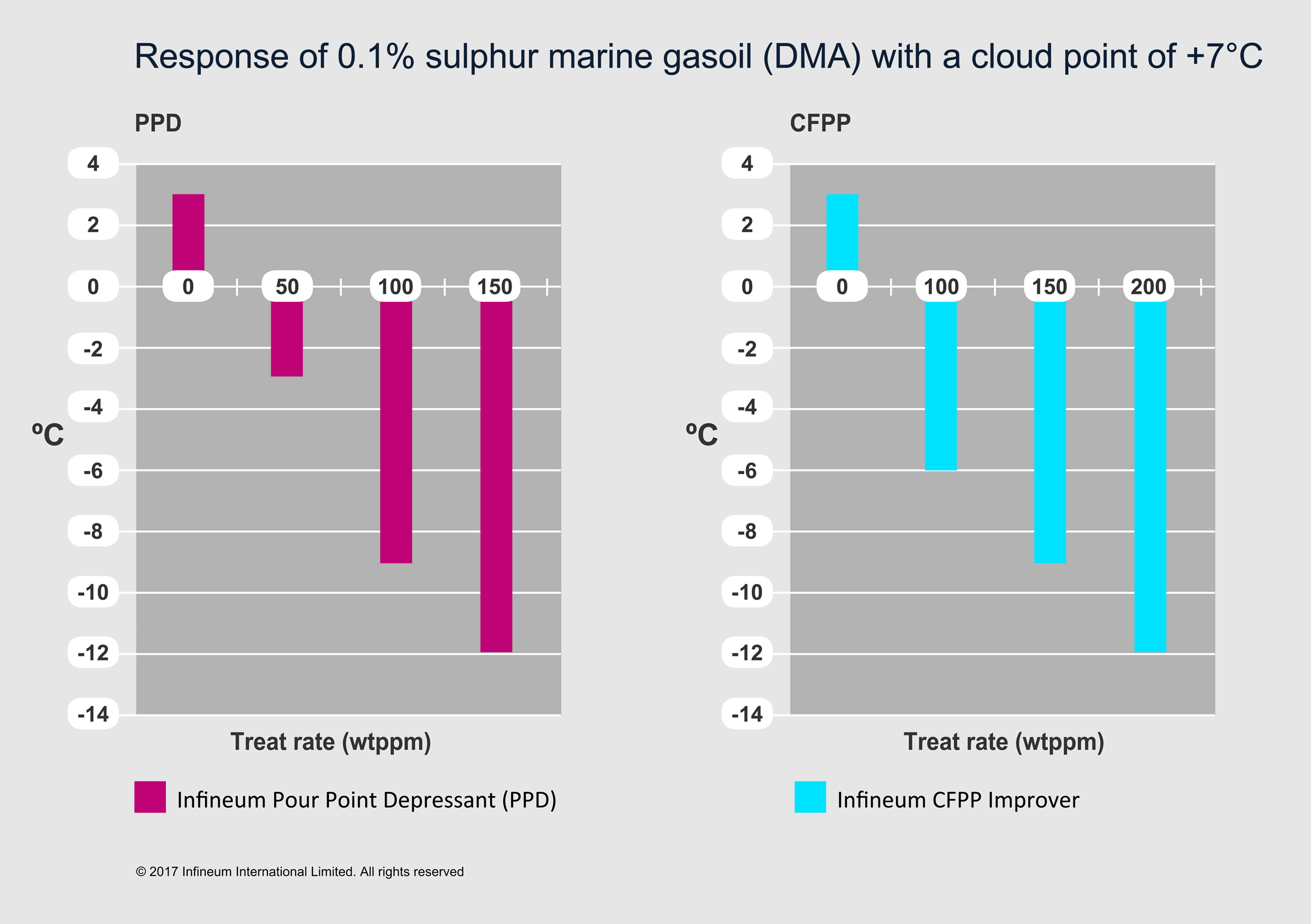

The challenge to be met here is that ISO 8217, which specifies the requirements for petroleum fuels for use in marine diesel engines, calls for a -6oC pour point (PP) in winter and 0oC in summer. Pour point additives can be used to optimise the resulting blend and to meet the pour point cold flow specification. Additionally, as ISO 8217 now calls for cold filter plugging point (CFPP) reporting, a need for more advanced cold flow additive technologies could arise to meet a potential future CFPP specification.

Infineum PP and CFPP depressant additives achieve reliable performance in low sulphur marine distillate fuels

Infineum PP and CFPP depressant additives achieve reliable performance in low sulphur marine distillate fuelsHybrid fuels could be produced from conventional distillates blended with de-asphalted oil (DAO), vacuum gas oil (VGO) and/or unconverted oil. Depending on the level of sulphur in the crude oil, these hybrids can be blended from straight run materials or after hydro-treatment.

Cold flow additives can be used here to allow high pour point materials to be used for hybrid fuel production, while still ensuring low temperature operability is improved to make these fuels fit for purpose. This is potentially the most economical solution for both fuel producers and end users.

Low sulphur HFO can be produced from DAO, VGO, gas oil and unconverted oil. Refineries can optimise the production of LSHFO by upgrading heavier residues – although this can be a costly route. Specialised cold flow additives are required in this option to ensure the low temperature operability of the resulting fuel is maintained.

Clearly there are a number of available options for increasing low sulphur marine fuel production (and the ones identified are a small portion of the possible combinations). Unfortunately, this creates an additional challenge - the incompatibility of the different fuel types, which can result in vessel operability issues. In our experience, this issue can be addressed by preventing asphaltene precipitation.

Fuel additives can be used as an effective asphaltene dispersant to improve fuel compatibility.

It is clear that the transition to low sulphur marine fuels will have far reaching implications – way beyond the refinery. Bunker traders and shipping operators are also interested in the quality of future bunker fuels and the issues that could arise from their use. Since they drive bunker demand, these stakeholders will be keen to understand how the supply side is gearing up for 2020.

Infineum has already experienced a similar transition to low sulphur fuels in the automotive world, which means we really understand the issues associated with this complex journey.

In the run up to 2020, we are closely monitoring the transition in the marine market and have added bunker fuel samples from all the major ports to our bi-annual winter diesel fuel survey, the results will be published in 2018.

Read the 2016 marine fuel quality survey here

The changes and the opportunities that the low sulphur challenge brings to the entire bunker fuel supply chain are continuing to emerge. It’s a really interesting time in the marine bunker world, and Infineum is looking forward to supporting refiners as they work to make the new low sulphur fuels fit for purpose now and in 2020.

Sign up to receive monthly updates via email