Small Engines

New JASO T903 motorcycle specification

04 July 2023

08 July 2025

A growing motorcycle market presents new challenges and opportunities for lubricants

As motorcycle OEMs work to reduce emissions while also delivering new fuel efficient models for consumers and an exciting ride for leisure users the market is diversifying. Etienne Martin, Infineum Personal Mobility Product Manager, explores the trends in this growing market and looks at how motorcycle lubricant formulations are evolving to keep pace with the changes.

2024 global two-wheeler sales reached almost 62 million, with sales in India and China accounting for more than 50% of the total. Sales in India were up on the previous year, while in China, as consumers opted for four wheels rather than two for commuting, sales were down. In the rest of the world’s top ten markets Thailand was the only other market to experience a sales decline.

In several developed countries, tough economic conditions mean some consumers are buying motorcycles owing to the high costs of buying, running and maintaining cars. Conversely, in growth economies, commuters are opting to use two-wheelers rather than walking or using public transport and recreational use is growing as consumer buying power and desire to ride for leisure rise.

Looking at the OEMs, Honda is out in front holding almost a third of global sales. Of the world’s top 10 OEMs, which together accounted for 75% of last year’s sales, only one, Mexico based Italika, comes from outside of India, Japan and China.

According to the European Association of Motorcycle Manufacturers (ACEM), new motorcycle registrations in five of the largest markets in Europe (France, Germany, Italy, Spain and the UK) reached more than 1.15 million units in 2024 – up more than 10% vs 2023. However, part of this growth is linked to stock registrations ahead of the new Euro5+ emissions standard, which was introduced on 1 January 2025. As anticipated, there has been a market correction, with sales from January to April 2025 reported to be down by more than 13% over the same period in 2024.

In the US, more than 580,000 two-wheelers were sold in 2024, and in this largely leisure-use market, more than 50% of sales were for motorbikes rather than moped and scooters. Honda, with 20%, held the largest share of the market, just outpacing Harley-Davidson, while together the other leading Asian motorcycle brands, Yamaha, Kawasaki, and Suzuki, made up almost 30% of the total 2024 US motorcycle market.

Growth is expected in the coming years as motorcycle use for both recreational and commuting purposes increases.

It is a complex market, and forecasts on the global uptake of electric two-wheelers vary wildly. On one hand, the perceived environmental benefits, along with lower maintenance costs, could boost the global growth of electric sales. In addition, their use could be expected to grow for commercial purpose for last mile delivery. However, factors including limited power output and vehicle range, battery life, and a lack of charging infrastructure, combined with rapidly changing incentives may constrain the market.

In India, despite the government's electric vehicle (EV) penetration target of 80% by 2030, only 6% of last year’s more than 20 million two-wheeler sales were EVs. The main reasons for consumer reluctance include high initial purchase costs, range anxiety and lack of recharging infrastructure. However, a combination of government initiatives and OEM actions are being introduced with the aim of addressing these concerns.

While in China, electric models accounted for more than 50% of two-wheeler sales in 2024, there has been a decline in consumer interest. Two key factors are driving this trend. First more consumers are using two wheels for pleasure rather than commuting, with larger petrol bikes becoming popular. Second, because EV OEMs are adding new features and more power to their electric models, they are becoming more expensive for consumers to buy.

It is a very busy and fast changing market, one that is full of technology innovation, which we will continue to watch with interest.

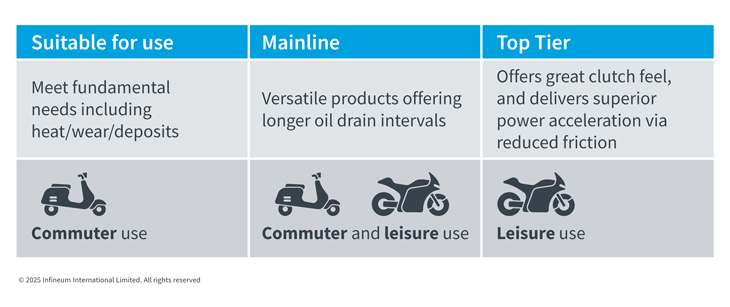

There is huge regional variation in motorcycle use - particularly between users who rely on their machines for transportation and those who enjoy them for recreation. The commuter market is dominated by smaller mopeds and scooters, that need to be reliably in operation every day, with bikes generally travelling some 10,000 km each year. In the leisure market, larger bikes are kept for many years, but on average only cover 2,000 km yearly. As shown below, these two markets have different lubrication requirements.

Infineum divides lubricant products for the two-wheeler market into different categories that are designed to specifically target the needs of these end user groups.

A large percentage of bikes sold last year were powered by an internal combustion engine. With many OEMs committed to a net zero emissions future, there is a lot of work going on to make these machines as clean as possible. We are seeing investments to improve the fuel efficiency of the ICE system and the bike in general as well as the development of powertrains that can run on different energy sources, including carbon neutral fuels.

OEMs also need to meet increasingly stringent emissions regulations, which are made even more challenging with the use of new test cycles. These changes are driving OEMs to modify conventional hardware, software and engine operation and to introduce new aftertreatment systems, which are now subject to increased scrutiny via the mandatory use of on-board diagnostic systems.

Three way catalyst compatibility is now a critical requirement for motorcycle lubricants worldwide.

Although motorcycle regulations do not include greenhouse gas emissions or fuel economy limits, consumers put a high value on fuel efficiency and hardware reliability, which means OEMs are looking for lubricants that can support these needs.

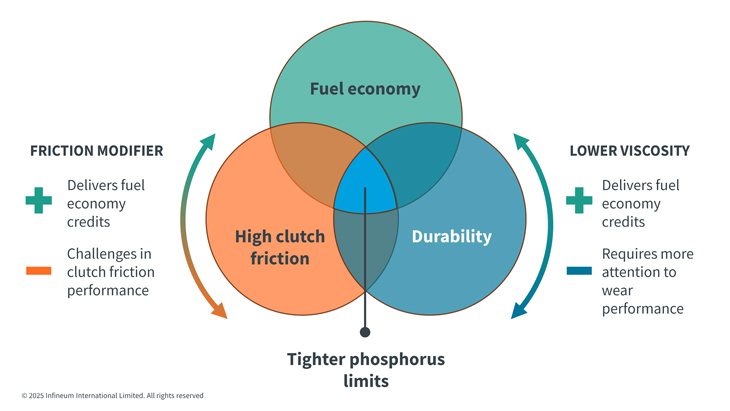

However, designing lubricants that support extended catalyst life, maintain hardware durability and protection throughout their lifetime in the engine, while also providing improved fuel efficiency and rider experience is a real technical challenge. Something that becomes even harder to achieve as motorcycle oils move to lower phosphorus levels and lower viscosity grades.

Read an article here about the latest JASO T 903:2023 motorcycle four-stroke cycle gasoline engine oils specification, which includes information on the introduction of lower phosphorus levels.

A balanced formulation approach is critical to meet all the performance requirements – with no compromise on durability being of utmost importance.

Infineum offers several well balanced motorcycle products that have been designed to meet the different needs of both the leisure and commuter markets.

This enables motorcycle lubricant marketers to take advantage of the opportunity to differentiate their products by offering proven low viscosity motorcycle-specific lubricants capable of addressing all of the key end user requirements.

Sign up to receive monthly updates via email