Lubricant trends

India shining bright

16 April 2024

Please note this article was published in June 2016 and the facts and opinions expressed may no longer be valid.

03 June 2016

Changes and challenges drive the demand for advanced lubricants

Insight explores how cost pressures and emission reduction requirements are creating new issues concerning hardware durability that increase the need for tailored and highly specialised lubricants in the marine and gas engine markets.

Marine challenges

The marine industry is going through some interesting times, with reduced freight volumes and overcapacity bringing a high level of uncertainty. 2015 saw both the Baltic Dry Index (BDI) and China Containerized Freight Index (CCFI), which represent the freight rate of dry bulk and container ships, hit a historic low. At the same time, world fleet capacity is increasing – with some expecting it to double over the next 20 years. And, although there is likely to be some increase in scrapping rates, the shipping industry is expected to face overcapacity until 2020 and beyond.

But, despite this rather gloomy outlook, in our view, the increasingly stringent emissions regulations being introduced are currently having the biggest impact on the marine world.

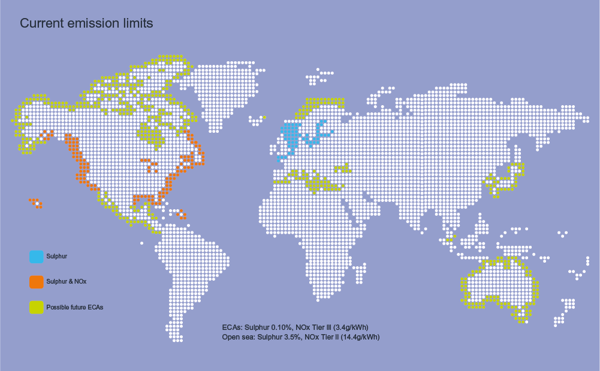

Measures are being introduced to prevent and control the main air pollutants, including oxides of nitrogen (NOx) and sulphur oxides (SOx), found in the exhaust gas of ships. Limits are being tightened at different rates in open waters and in emission control areas (ECAs), which have already been implemented in some coastal waters.

In open waters Tier II NOx regulations of 14.4 g/kWh were implemented in 2011 and will apply for the foreseeable future. In American emission controlled zones a tough Tier III NOx limit of 3.4 g/kWh was introduced in January 2016. This huge reduction in NOx emissions impacts the hardware used on board ships and, with a wide variety of solutions and potential combinations available, lubricant formulations will need careful consideration.

Where exhaust gas recirculation (EGR) is used, marine lubricants may need enhanced soot handling and dispersancy to prevent an increase in visible exhaust emissions, which would have severe implications for ship operators. Selective catalytic reduction (SCR) is another option, but the key drawback here, apart from the additional urea equipment and infrastructure required, is the potential for catalyst fouling owing to ash precursor material in the fuel. Current OEM guidelines say operators should use lubricants suitable for the worst-case fuel on board. For heavy fuel oil 30, 40 or even 50 and higher BN oils are still the mainstay for four-stroke engines.

Industry needs to draw on learnings gained from the use of these technologies in other transport sectors.

Close collaboration with OEMs is increasingly important so that hardware technology and marine lubricant systems can be co-engineered.

Plans to cut the sulphur cap in open waters from 3.5% to 0.5% by 2020 will be reviewed once the results are available from a study that is looking at the availability of fuel oils that meet the new sulphur target. However, the sulphur limit inside ECAs has already been reduced from 1.0 to 0.1%.

In our view, as ECAs are introduced more widely, ship owners will need work hard to ensure they comply with these tightening limits while retaining profitability.

Various solutions are being implemented for sulphur reduction. Vessels operating solely in ECAs are generally opting for a single fuel strategy, using either high sulphur residual fuel with an exhaust gas scrubber, or running on more expensive low sulphur fuels or liquid natural gas (LNG). For vessels constantly going in and out of ECAs, a fuel-change practice is more common, using LNG or low sulphur diesel to comply with the ECA requirements and switching to high sulphur residual fuel in international waters.

However, there are cost and availability challenges associated with each approach. For the foreseeable future, the availability of low sulphur marine diesel oil combined with lack of investment in liquid natural gas infrastructure and the improvement in scrubber technology means it is likely that heavy fuel oil will remain the fuel of choice for most marine applications.

No matter which fuel or fuel combination is selected, lubricant formulations must deliver sufficient engine protection.

International Marine Organization (IMO) says international shipping is the most energy efficient mode of mass transport and only a modest contributor to overall CO2 emissions. In a recent study the organisation reports that on average in 2012 international shipping accounted for over 2.8% of annual global CO2 emissions. While future economic and energy developments will impact maritime CO2 emissions, the organisation projects a significant increase in the coming decades as sea transport continues to grow with world trade.

IMO has adopted Energy Efficiency Design Index (EEDI), a mandatory technical and operational energy efficiency measure to reduce CO2 emissions from international shipping. But, right now, it is the need to cut costs that is the key driver for fuel economy improvement – which translates into lower CO2 emissions.

Despite the recent drop in fuel prices the message from operators is that reducing fuel costs is still essential.

Wind propulsion, slow steaming, new engine designs, the use of alternative fuels, new propeller design and improved aerodynamics are just some of the solutions being explored. However, certain hardware and operational measures introduced to reduce fuel consumption have led to cold corrosion, which is currently the biggest concern for two-stroke marine engines.

Growing gas engine market

Despite the fall in crude prices the use of gas continues to grow. This means it is inevitable that the number of stationary engines will also increase, whether they are involved in moving gas from wellhead to consumer, or in generating power. This growth, combined with changes in engine technology and an increase in the use of severe gas types, looks set to drive substantial increases in the demand for advanced gas engine lubricants.

Gas engines oils must not only protect the engine by preventing deposits, corrosion and wear, but they must also minimise engine downtime and continue to deliver protection over extended oil drain intervals so that operators can maximise output and reduce running costs.

In certain regions, the increased use of landfill and biogas presents additional formulation challenges particularly in terms of controlling combustion acids. Specific to landfill gas is the need to control siloxanes, which can lead to hard silica deposits on the cylinder heads and valves.

Striking the correct sulphated ash balance in the finished oil is one of today’s key formulation challenges.

Because the gaseous fuel does not provide any lubrication, ash, derived from the detergent and antiwear additives, is needed to form a protective layer over the valves. However, it is a really fine balance, too much ash and valve torching or guttering can occur, whereas too little ash can cause valve recession. Both of these scenarios can result in loss of engine power and require additional expense and unplanned engine downtime to rectify.

To meet industry requirements for improved power output, reliability and reduced emissions OEMs are developing new high efficiency engines with increased compression ratios and turbocharger pressures and improved combustion control and valve timing. These engines, present even greater lubrication challenges – particularly in terms of oil life and hardware protection.

Lubricant producers must also recognise the impact of formulating in different base stocks to ensure that the final lubricant is harms free and maintains performance throughout its lifetime in the engine.

While Group II base stocks have been used in gas applications in North America for some time, Europe has traditionally formulated in Group I. However, as the higher quality base stocks become more available and less expensive we are seeing some European OEMs looking to benefit from the performance advantages Group IIs can bring.

European OEMs are looking to benefit from the performance advantages of Group II base stocks

Additives can make a real difference in this growing and increasingly challenging market segment. However, understanding the benefits that each component can deliver, their positive and negative interactions on each other, and striking the right balance of component types in order to offer sufficient protection is essential.

In our view, tailored gas engine oils using advanced additives are increasingly required to deliver enhanced protection over extended drain intervals in the harsh conditions encountered in today’s reciprocating gas engines.

This is an exciting time in the marine and gas engine markets and the lubricants industry is already developing high quality oils so that it can be ready to meet growing demand.

Sign up to receive monthly updates via email