Sustainability

Designing more sustainable lubricants

03 October 2023

07 November 2023

Lubricants industry facing critical challenge of meeting technical requirements and sustainability ambitions profitably

As the automotive industry innovates to meet sustainability, decarbonisation and emissions reduction ambitions they are looking to the lubricant and additives industry for support. In this fast changing world, more sustainable lubricants that can meet ever tightening specifications, while also improving fuel economy, have a key role to play. In this Q&A session, Joerg Simon, Sustainability Lead at Infineum, talks about developing these advanced products and the possible solutions to value capture challenges.

What progress has been made across the lubricants value chain towards decarbonisation and, in your opinion, has it been fast enough?

The lubricants industry is working together across chemicals and lubricants companies on carbon footprint methodology. Raw material suppliers are working to incorporate circular and lower carbon materials in their products. OEMs are actively considering Product Carbon Footprint (PCF) specifications to supplement their decarbonisation ambitions, while lubricant customers are also testing circular and PCF requirements. At the same time, we are all working hard to increase the use of green energy and to reduce the greenhouse gas (GHG) emissions from our operations. Meanwhile, the regulators are considering how and when to set their own related restrictions across the industry landscape, including for lubricants. So, are we moving fast enough to decarbonise and stay ahead of the regulation? I personally see a lot of effort and action, but only gradual progress.

In my view, the economic question is what’s holding us back. I think the key to truly unlocking the potential of our industry, so we can contribute to the global decarbonisation effort, lies in understanding and realising the value we contribute. Our success here will depend on cross-industry collaboration, openly sharing our knowledge and working together to develop and scale up new solutions. We also need to understand how these solutions and our decarbonisation efforts can create value. In addition, increased effort is needed on the implementation of critical methodology such as lifecycle assessment (LCA) and PCF to create a pre-competitive environment to enable value creation and capture.

We all know that decarbonisation and reaching net zero is a long journey, but it is only reachable if we do the right things now. Not just in our own companies, but together across our value chain. This proposed collaboration, value creation and methodology effort would help lay the foundation for the decarbonisation of the lubricants industry.

There is clearly much effort and collaboration needed to progress sustainability ambitions, so what has the lubricants industry been doing?

The lubricants industry is making steady progress on its decarbonisation journey. The American Petroleum Institute (API), through collaboration between lubricant and additive company stakeholders, has produced the first edition of Technical Report 1533, which provides methodology and best practice for lubricants LCA and a comprehensive guide to understanding and calculating the carbon footprint of lubricant products. It is expected to be a long-standing document, frequently updated to keep pace with change.

Building on the API work and tailoring it to European needs, the Technical Association of the European Lubricants Industry (ATIEL) and the Union of the European Lubricants Industry (UEIL) have also drafted their own guidance. In addition, the Additive Technical Committee (ATC) has endorsed the Together for Sustainability Guideline as the most appropriate PCF calculation methodology for the global fuels and lubricants additives industry. While work is still needed to evolve these practices and improve the supporting data quality, this is a very positive first step in defining the harmonised PCF methodology we need for our lubricant value chain.

These PCF and circularity specifications and requirements can help, assuming they are based on sound methodology and reliable data. But, are we moving at a pace to keep ahead of regulations, and can we ensure our transition to a lower-carbon industry can be done without sacrificing product performance or increasing costs? I would suggest we really need to crack the value question as a priority.

Can you explain the value capture dilemma and talk about some of the potential solutions?

One option is that the lubricants industry needs to make substantial investments to develop more sustainable lubricants that also support decarbonisation and continue to protect vehicle hardware over longer drain intervals. But, in a fast changing market, where new hardware and lubricant performance specifications are being introduced, it is important to ensure these investments can be recovered in a sensible timeframe. The dilemma for the industry is how best to manage the costs associated with this transformative change and to balance economic and environmental sustainability.

In our view, there are a number of potential solutions to make an impact and progress now. I would like to highlight three of them in more detail:

With regards to in-use benefits, our industry has a long history of providing in-use benefits whether that be through fuel economy improvement, longer oil life or longer engine life. These benefits also bring a significant reduction in CO2 for the end user. While it’s imperative that we maintain, and further improve, this performance aspect of our lubricants, it does not address the net zero ambitions of lubricant and additive companies. By the same token, we must not compromise performance in the process of lowering the carbon content or increasing the circularity of lubricants. But, there remains an opportunity to contribute to global decarbonisation through these in-use benefits and it is important to ensure all stakeholders recognise the value lubricants bring in this respect.

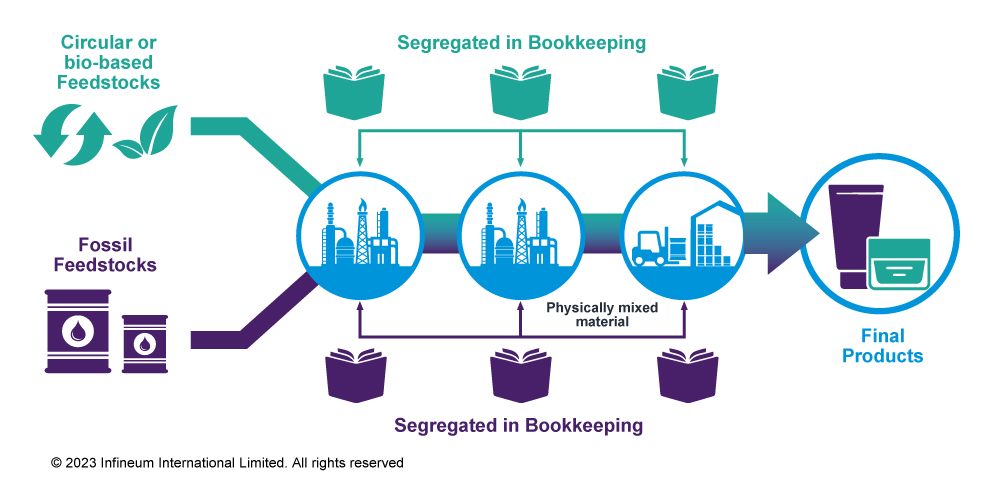

Mass balance is an approach that can be used to assign the PCF and/or circular benefits of a material to specific markets, products or customers in the value chain. For example, we are using re-refined base oils in additive packages and here the circular benefit is tracked and then allocated to where it’s most valued

It is a process that requires close collaboration amongst value chain partners. Tracking the material and related data to avoid double counting really needs the application of digital tools to work alongside corporate ERP systems. Mass balance is one option to gradually introduce more sustainable materials without the need for significant investments at the start.

Last, but not least, our industry has been successful in collaborating to develop effective lubricant specifications when new performance requirements emerge. Industry PCF and circularity specifications may now provide an opportunity to not only decarbonise but also to enable value capture. The incentive for this approach is to ensure the right balance of lower carbon and higher performance is maintained without sacrificing in-use benefits. A risk that comes with any such specification is the potential to commoditise the market and limit the ability to differentiate products on this basis. But, in the absence of these specifications, there is also a risk that regulators may impose them. It is important to consider this approach carefully, ensuring the necessary methodology and data quality is in place to set meaningful but feasible specifications for PCF and circularity.

Mass balance chain of custody solutions: example of re-refined base oil use

What sustainability and decarbonisation actions has Infineum been taking?

Our industry is facing daunting sustainability and decarbonisation challenges. Infineum has responded by making sustainability an integral part of our business that now shapes our strategic direction, including how we invest in technology and production facilities. In addition we have defined provisional roadmaps to 2030 for achieving a 50% reduction in greenhouse gas (GHG) emission intensity against a 2018 baseline for scope 1 and 2 and expect our efforts could also reduce scope 3 emissions by about 20%. And we have announced our ambition to reach net zero for scope 1 & 2 operated asset GHG emissions by 2050.

Our 2022 Sustainability Report details some of the progress we have made in our efforts to use fewer non-renewable resources, produce less waste and reduce GHG emissions. In addition, it shows our commitment to personal and process safety at our sites and how we are working to create a diverse, equitable and inclusive working environment whilst also making many positive contributions to the communities in which we operate. Click here to read the full report.

We have been working to lay down foundations for wider industry decarbonisation and have made progress. But, we need to step up the pace to ensure this challenge can be met in a profitable and timely way without compromising the value chain or product performance. Addressing the value question is likely to be the most important enabler and I think we have shown that there are a number of options we should be developing together to drive the decarbonisation of our lubricants industry forward.

Visit the sustainability pages of our website to find out more about what we have been doing.

Sign up to receive monthly updates via email