Base stocks

Unlocking the potential of re-refined base oils

08 April 2025

30 October 2018

Meeting demand continues to rely on availability of essential raw materials

As the automotive industry works to meet tighter CO2 emissions legislation, there is a growing demand for advanced lubricants formulated with high quality base stocks. Insight Editor, Rose Gill, talks to Jasper Smets, EMEA PAO Product Manager at Chevron Phillips Chemical Company LP, about his views on the global low viscosity PAO market.

The need for transportation to comply with more stringent fuel economy standards is expected to further stimulate demand for higher quality lubricants, which will in turn drive the use of higher quality base stocks, including low viscosity poly-alphaolefins PAOs.

“Synthetic base stocks are carefully designed, not refined,” explains Jasper Smets from Chevron Phillips Chemical Company LP (CPChem). “PAOs are synthesised by a two-step reaction sequence from normal-alphaolefins (NAO), which are derived from ethylene. The high stability of the PAO molecule, combined with other performance characteristics, make it attractive for use in automotive engine oils to ensure engine protection in increasingly severe conditions and to help in meeting evolving emissions standards.”

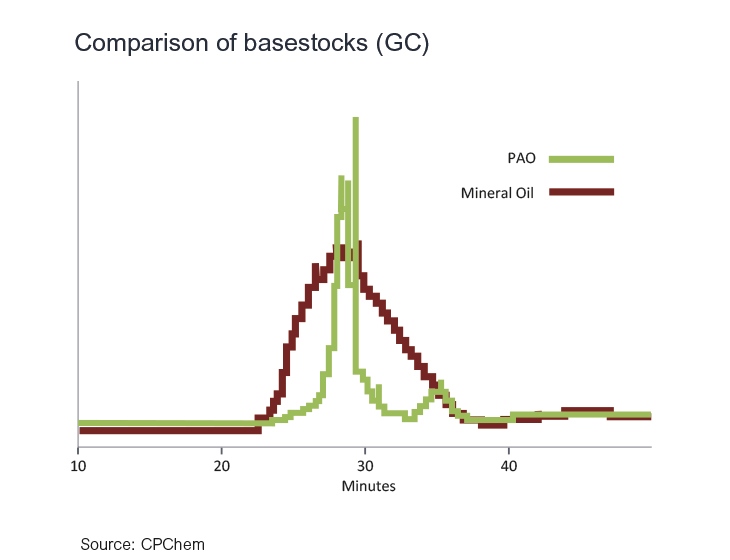

PAO has a very narrow molecular weight range compared to Group III mineral oil

PAO has a very narrow molecular weight range compared to Group III mineral oil

When compared to Group III base stocks, CPChem says the very narrow molecular weight range of PAOs means they can deliver improved volatility and higher viscosity index. In addition, they note a number of additional advantages over mineral base stocks including:

“In terms of heat removal,” Jasper continues, “we have seen 10-15% higher specific heat for PAO over a wide temperature range compared to an equivalent mineral oil. This means it can absorb more heat and better conduct heat away from lubricated parts. At the other end of the temperature scale,” he adds, “the combination of PAOs’ excellent viscometrics and low pour points reduce strain on engine parts, batteries and starter motors making cold-weather vehicle starting easier.”

PAO production is firmly tied to the availability of NAO, which is derived from ethylene, which is in turn produced from either natural gas or petroleum. Raw material availability and price volatility have been key challenges for industry participants. However, increased oil production in the OPEC countries, the U.S. and possibly Russia ensure petroleum feed stock supply. In addition, the North American shale gas revolution, which has provided a source of low-cost feed stock, should result in healthy derivative operating rates.

“Ethylene demand, which in the past five years has grown by some 28 million tonnes, is mainly driven by polyethylene, ethylene oxide, EDC and Ethylbenzene demand,” Jasper explains.

We are now entering a new era of growth and world ethylene demand could reach more than 190 million tonnes by 2023.Jasper Smets, CPChem

"With this in mind, we have successfully introduced feed stock and commenced operations of a new ethane cracker at our Cedar Bayou facility in Baytown, Texas. At peak production, the unit will produce 1.5 million metric tons per year and will be one of the largest and most energy efficient crackers in the world. We will use this additional capacity to meet the needs of our derivative units and to feed our NAO plants.”

NAO is used as a PAO feed stock and CPChem reports that it currently accounts for some 30% of world NAO supply and expects global NAO capacity to increase by more than 20% in the coming five years.

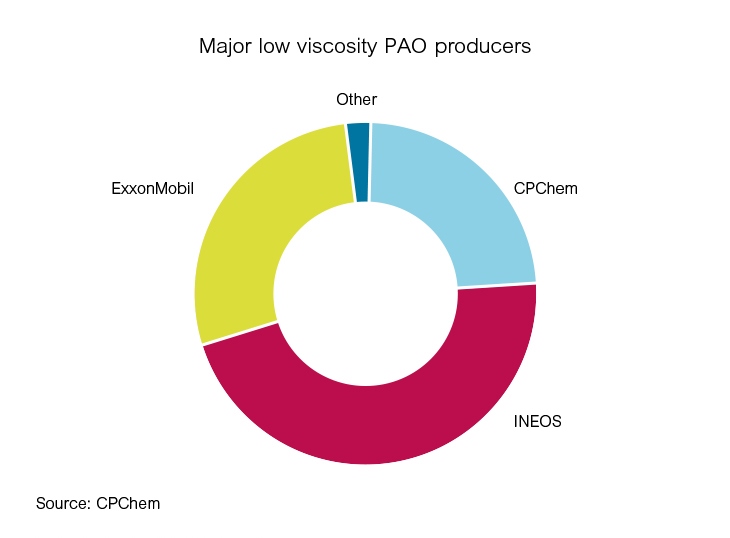

Looking at low viscosity PAO production, in 2017 world capacity was estimated to be ~500kMT/a – with the main players being CPChem, Ineos and ExxonMobil. “Currently CPChem has two plants in Texas and one in Belgium, which account for almost a quarter of global production,” Jasper reports.

“In the automotive industry I expect evolving engine oil specifications, emissions legislation and fuel economy requirements to increase demand for PAO - driving new capacity additions, global low viscosity PAO supply could be expected to reach ~600kMT/a by 2020.”

Improving fuel economy is one of the key drivers for change in the automotive industry. Using lower viscosity fluids in engine oil applications, which reduces hydrodynamic friction, is one of the strategies being used to help improve fuel economy performance. As the industry moves towards the use of thinner SAE 0W-20 viscosity grades, with HTHSV below 2.6 cP, the value of PAO is likely to increase.

CPChem says that the use of PAOs can offer advantages when developing lower viscosity lubricants. “In traction testing we have found that oils formulated with PAO have a lower coefficient of friction than Group III and III+ mineral base stocks. Depending on the level of PAO used in an SAE 0W-20 formulation, we have seen in the region of 0.7 to 1.4% overall energy savings. You might see this as a fairly small efficiency gain, but OEMs are looking for every possible contribution from every part of the vehicle system as they work to meet increasingly tough greenhouse gas emissions. In addition, when a 1-dodecene based feedstock is used to produce for instance a PAO 5, PAO 6 HVI or PAO 7 cSt product then the Noack volatility can even be much lower."

The lower Noack volatility of PAOs enables formulators to blend thinner oils and, with less oil loss at high-temperatures, we are also seeing lower oil consumption and fewer emissions, two additional benefits that are valued in many applications. Jasper Smets CPChem

However, the industry is trending towards even lower viscosities. SAE 0W-16 is already available and some OEMs are starting to look at SAE 0W-8 and even 0W-4 grades. Looking ahead, some forecasters expect these SAE 0W-X grades to account for around 30% of the passenger car lubricant market by 2026.

As Jasper confirms, the limits on lowering the lubricant’s viscosity grade are inexorably tied to the properties of the base stock. “In my view, as OEMs look to push viscosities down to SAE 0W-16 and below, volatility and high temperature/high shear viscosity will be limiting factors. This will drive up the need for high quality base stocks, such as PAO, which can offer stable viscosity, high viscosity index and low volatility. Then it’s really down to the formulator to decide how best to balance the lubricant to meet the market requirements of lengthening hardware life, reducing tailpipe emissions, hauling heavier loads and saving money at the fuel pump.”

Sign up to receive monthly updates via email