Fuels

Reported sludging incidents rise

04 November 2025

30 September 2025

Fuel additives ensure the safe, efficient, and reliable operation of engines running on lower carbon methanol fuels

The use of methanol in marine and other large engine applications is gaining momentum. Many of the major OEMs have announced new technology developments and retrofit options that are making the adoption of this greener fuel a reality - today. Frank Simpson, Technologist at Infineum, explains how fuel additives are helping to lower the technical barriers to methanol use, enabling early adopters to take advantage of the benefits this lower carbon fuel can deliver.

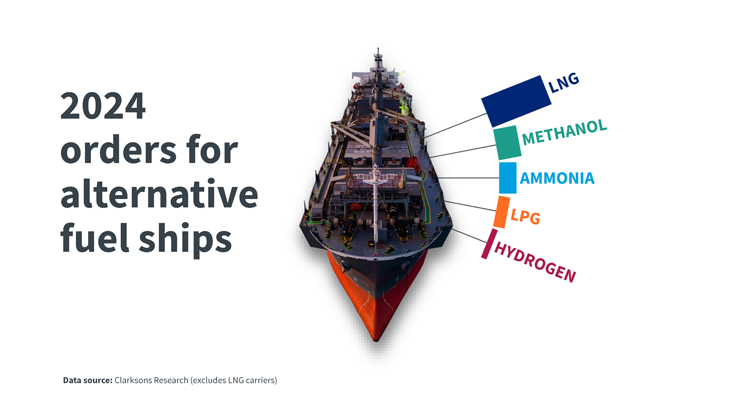

In a world under pressure to cut exhaust emissions, as it heads towards a net zero future, the adoption of cleaner burning and more sustainable fuels, including natural gas, methanol, ammonia and hydrogen, is gaining significant attention. In the maritime industry, data show that in 2024 some 50% of all tonnage ordered was alternative fuel capable, and forecasts suggest that by 2030 20% of all fleet capacity will be able to run on alternative fuels.

Methanol is a simple alcoholic fuel without any carbon-carbon bonds that, on combustion, produces less NOx, SOx, CO2 and particulate matter emissions than conventional hydrocarbon fuels. With a long history of use in cars, motorbikes and even monster trucks, methanol fuel is now a promising alternative fuel for the marine industry. It is easy to store, handle and bunker, is clean burning, and water soluble, with low acute toxicity to aquatic life in the event of spills. Although uptake is currently low, these advantages, along with the potential to help improve ships’ Energy Efficiency eXisting ship Index (EEXI) and Carbon Intensity Indicator (CII) ratings, mean its uptake as a marine fuel is expected to grow rapidly in the short term, providing a bridge to a net zero future.

According to the Global Maritime Forum methanol is rapidly moving from concept to early scale adoption. It says more than 60 methanol capable vessels are in operation and 300 more are on order and that bunkering is available at around 20 ports.

One of the main factors limiting methanol adoption in ships is the lack of availability of green methanol for bunkering.

Although we can expect significant investment in production, competition from other industries will be high.

The world’s largest bunkering port in Singapore reports that methanol bunker sales have grown from 300 tonnes in 2023 to 1,600 tonnes in 2024. While this represents a very small proportion of the almost 55 million tonnes total sales, it is anticipated that the demand for methanol as a marine fuel in Singapore alone could exceed one million tonnes per annum before 2030. Although this forecast is subject to support from regulations and the pace of global supply chain and infrastructure development.

Many major OEMs, including Everllence (formerly MAN Energy Solutions), Caterpillar Marine, Cummins, WinGD and Wärtsilä, have dual fuel methanol capable engines available for marine applications now. Orders are being placed for methanol and ‘methanol ready’ ships, and both two and four stroke OEMs report retrofitting orders for main engines to run on methanol. Early adopters, including Maersk, Van Oord and Stena Line, are proving that the journey to greener fuel is not only possible but is already underway.

Everllence, for example, has a portfolio of two and four stroke methanol capable engines. Its aim is to provide engines that can run on currently available fuels with the best efficiency and that can adapt to green methanol when circumstances (availability, port infrastructure, favourable price etc.) make it practical to switch.

Maersk has already invested in methanol capable ships from Everllence. In June, the Berlin Mærsk was the 14th dual fuel newbuild to enter their fleet. It will be followed by a further six large container vessels. In addition Everllence completed the first retrofit of an existing Maersk large container vessel to a dual fuel methanol engine in November last year. Maersk says it sees retrofits as an important alternative to newbuilds in the transition from fossil fuels to low-emission fuels.

The maiden call of Berlin Maersk at the Port of Tanjung Pelepas (PTP), Malaysia in July 2025

The maiden call of Berlin Maersk at the Port of Tanjung Pelepas (PTP), Malaysia in July 2025

Wärtsilä launched its Wärtsilä 32 methanol engine in 2022. It lists five other methanol engines that will become commercially available in the near future from the smaller auxiliary engine for container vessels or car carriers, options for ferries and luxury cruise ships through to engines for larger applications such as cruise ships and merchants. Wärtsilä’s €50 million investment in its Sustainable Technology Hub this year should help to accelerate time to market for those methanol engines still in development.

Back in 2015 the Stena Germanica, retrofitted with a Wärtsilä methanol capable engine, became the world’s first commercial ship to run on methanol as its main fuel. Now Stena Line says it is investing in new methanol capable ships and modifying existing tonnage to run on alternative energy sources such as e-methanol.

International marine contractor, Van Oord, is involved in the construction of offshore wind farms where it uses a wide range of offshore installation vessels. The latest, The Boreas, is fitted with a Wärtsilä 32 Methanol engine. In May 2025, The Port of Amsterdam hosted its first ship-to-ship methanol bunkering operation, supplying Boreas with green methanol. Van Oord also has two subsea rock installation vessels with methanol engines which are due for delivery in 2028/29.

The Boreas, is fitted with a Wärtsilä 32 Methanol engine

The Boreas, is fitted with a Wärtsilä 32 Methanol engine

Beyond the maritime industry, methanol is gaining traction in applications such as power generation and heavy-duty industrial use.

In the power generation sector dual fuel methanol turbines are an emerging technology that offer environmental benefits and fuel flexibility.

Last year the Net Zero Technology Centre (NZTC) and Siemens Energy demonstrated the operation of a gas turbine on methanol, reporting 80% reduction in NOx emissions compared to traditional fuels. GE Vernova says its turbines support fuel flexibility to allow the use of the most economically available fuel, with both methanol and hydrogen on the list of options.

As for on-road trucks, Geely’s first Farizon methanol truck rolled off the production line in 2022, and the organisation showcased its new Hometruck equipped with a 260kW methanol REV system at Auto Shanghai 2025. It is reported that some 5,000 heavy duty trucks are already running on methanol in China. In the off-road sector, in China, several companies including Weichai, Nuohao and XCMG have methanol powered products on offer to support a greener mining future.

There are a number of advantages associated with the use of methanol as a marine fuel. However, there are also several challenges associated with its use – particularly around hardware protection, production and supply chain availability, and technology readiness that may not be easy to overcome.

Additives can resolve potential lubricity and corrosion challenges enabling methanol to be used as a single fuel solution, an approach that simplifies logistics, reduces storage complexity, and streamlines fuel management.

In 2024, the International Organization for Standardization (ISO) issued a new document, ISO 6583:2024, outlining the requirements for methanol as marine fuel. The specification defines three categories of marine methanol grades A, B and C (MMA, MMB, MMC).

The MMA grade includes additional requirements for particle count and lubricity, the latter of which is currently managed through agreements between buyer and seller. Looking ahead, as methanol adoption grows, we can expect lubricity to be formalised as a quantified Pass/Fail limit.

Infineum has been heavily involved in the development of these clear fuel specifications that are designed to support the use of methanol as a more sustainable marine fuel.

The high frequency reciprocating rig (HFRR) lubricity test used for the specifications was developed by our fuel experts, who are also active members of the technical committees that are continuing to write and update them.

By reducing the technical barriers to adoption, lubricity additives and corrosion inhibitors are helping to make methanol a practical, scalable and more sustainable fuel solution. Infineum is proud to be working with some of the early-stage marine methanol projects.

By ensuring engine protection and reliability, for both new builds and retrofits, our fuel additives can help to extend engine lifetime, reduce maintenance and deliver cost advantages through more durable hardware.

Infineum has a first of its kind lubricity additive for alcoholic fuels, such as methanol, which delivers enhanced lubricity performance compared to on-spec diesel, and we are ready to support the industry’s early methanol adopters.

To explore how fuel additives can help you in your transition to lower carbon fuels contact your local sales representative here or contact our team at marinefueladditives@infineum.com

Sign up to receive monthly updates via email