Commercial vehicles

ACEA HD Sequences released

22 January 2025

23 May 2018

Changing performance needs of commercial vehicle engines

Commercial vehicle OEMs are working hard to provide products that meet both emissions legislation and customers’ requirements for increased reliability, durability and value. Bengt Otterholm, Lubricants Co-ordinator at Volvo Group Trucks Technology, talks to Insight about some of the resulting trends that are shaping Volvo’s future requirements for lubricants.

The Volvo Group, one of the world’s largest manufacturers of trucks, buses, construction equipment, marine and industrial engines, employs almost 100,000 people, has production facilities in 18 countries and sells its products into more than 190 markets.

Its global trucks operation encompasses the Volvo, Renault, Mack and UD truck brands. Driven by a desire to create value for its customers, the basis of Volvo’s strategic direction is developing products that grow its customers’ revenues and decrease their costs. In support of these goals, Bengt says there are specific lubricant performance attributes that Volvo values.

Bengt Otterholm, Volvo Group Trucks Technology Infineum International Limited

The lubricant performance attributes most important to Volvo is to ensure expected durability and reliability of the engines. In essence, this means preventing severe deposits and premature wear. This may seem boring and old but it is the way it is. However, recently also the engine oil contribution to decrease fuel consumption has come into focus but then at no expense of the durability and reliability requirements.

The ACEA European Oil Sequences, which provide a set of performance requirements that offer protection for the majority of the European vehicle fleet, clearly go some way to addressing these needs. Bengt, who is Chairman of the ACEA heavy-duty diesel (HDD) lubricants subgroup, says they have been designed to deliver a level of performance on which consumers can rely. “The Sequences, which are currently being updated to ensure they continue to reflect engine hardware needs, provide a high and relevant baseline performance level, ensuring fit for purpose engine oils in the market place.”

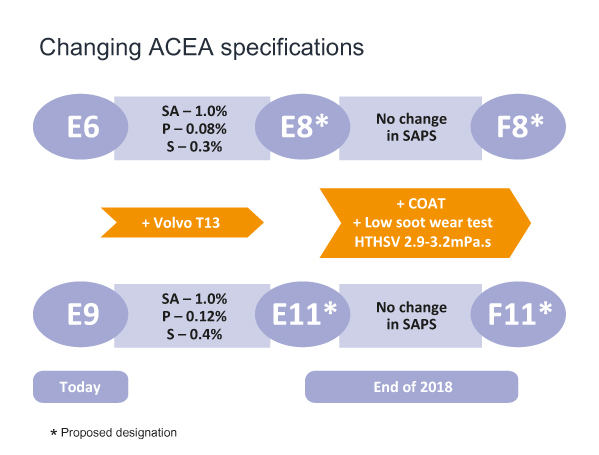

The key changes on the HDD side are the upgrades to the ACEA E6 and E9 categories and the introduction of fuel economy grades.

“The introduction of the Volvo T13 test will substantially increase the oxidation stability of the oils,” Bengt explains, “and this performance increase means that there is a need for new numbering, where E6 becomes E8 and E9 becomes E11."

"New low viscosity F categories with HTHS from 2.9 to 3.2 mPa.s, equivalent to API FA-4, are also being introduced. Although fuel economy is the key driver here, additional requirements in terms of the Caterpillar oil aeration test (COAT) and low soot wear are also being added. Currently, E8, E11, F8 and F11 are the proposed new designations, which are still to be finalised.”

Bengt Otterholm, Volvo Group Trucks Technology Infineum International Limited

The ACEA sequences are important to Volvo, and I believe to all ACEA members, since they provide a high and relevant base performance level ensuring fit for purpose engine oils in the market place. From this base performance level, we can build our individual engine oil requirements by adding additional test requirements and in some cases tighter limits.

Currently, in terms of chemical limits, Volvo’s specification requirements are identical to ACEA E9. But, looking ahead, Bengt can see a need for change. “Emission legislation is getting more and more severe,” he explains. “To help vehicle manufacturers to comply, a complex mix of sophisticated oxidation and reduction catalysts as well as diesel particulate filters (DPF) are being used. The catalysts are sensitive to chemical poisoning and deactivation, in addition, incombustible salts formed in the combustion process can clog the DPF. Many of these detrimental components have their origin in the engine oil additive packages, which means in my view it is imperative that the components known to be harmful are reduced. This is why we have chemical limits in our specifications today, maximising the allowed concentration of sulphated ash, sulphur and phosphorous (SAPS) of the finished lubricants.”

“Together with our catalyst suppliers, we are continuously looking at the deactivation processes caused by engine oil components."

I can see there may be a need to tighten current chemical limits and possibly to introduce new elements in the future.

Bengt Otterholm

"While, the effects of potential poisons on catalyst activity are difficult to prove," Bengt continues, "the impact of ash build-up, and hence increased back-pressure over the DPF is more straight forward. This means I definitely expect to see a reduction of the sulphated ash levels of oils in the future, below the current 1% maximum.”

Right now in the market we have a real mix of chemistries – from high, to mid and low SAPS levels. However, Bengt believes this picture could change, with less and less use of high SAPS oils in the future. “High SAPS oils, in particular those with high sulphated ash levels and hence high base number, can be needed in markets where fuel sulphur levels are still high - typically 500 ppm or higher."

Because modern additive technologies can efficiently neutralise acidic components, which are formed when sulphur-rich fuels are burned, good engine protection can be achieved by using mid or even low SAPS oils.Bengt Otterholm

"However", he explains, "this of course requires more recent ACEA or API specifications to be used in such markets, and it is essential that end users respect the oil drain interval reductions recommended by OEMs.”

With sustainability high on the industry agenda, we were also keen to understand Bengt’s view on the impact of the increased use of alternative fuels on the lubricant. “Gaseous fuels, such as compressed and liquid natural gas, have little impact on engine oils,” he explains, “since engines are already well protected by current low ash oils like ACEA E6. However, the same may not be true for bio-based fuels. Fatty acid methyl ester (FAME)-type fuels can cause rapid oil degradation in cases where fuel dilution occurs, for example through various post injection strategies. Typically, OEMs respond to this by reducing the oil drain interval if FAME-type fuels are used. Hydrogenated vegetable oil biofuels, on the other hand, do not have this negative impact and can normally be used without restrictions.”

The improvement of customers’ profitability is a key driver for innovation at Volvo. In their view, on average, about 30% of the total cost of a truck in use relates to fuel, which has resulted in a focus on improving the fuel efficiency of their vehicles. Here, Bengt sees a role for engine oils.

Bengt Otterholm, Volvo Group Trucks Technology Infineum International Limited

Legislation and customer demands continue to drive the development towards more and more fuel efficient engines and vehicles. The engine oil can contribute to relatively small savings, typically in the order of 1-2% depending on reference point, engine design and drive cycle, but it is a very cost effective way to accomplish these savings by reducing the engine oil viscosity and hence reducing the hydrodynamic losses in the engines. I don't believe the is a need for an industry common fuel economy test, I'm sure that each individual OEM will assess this performance in their own ways.

Bengt says that the need to gain fuel economy improvements while extending oil drain intervals will be key drivers for the next Volvo specifications. “The current Volvo VDS-4.5 specification, which was introduced in September 2016, ahead of API CK-4 first licensing date and with more severe limits, is likely to be replaced in the first quarter of 2019. To meet our requirements we will use the base level of API FA-4 or ACEA F11 and increase the severity of the Volvo T13 test.”

Looking ahead, Bengt can see the need for another decrease in viscosity by 2025. “Yes, in the future I think we will need to lower viscosity even further to gain additional fuel economy benefits. But,” he concludes, “Volvo will not accept any compromise on reliability, durability or oil drain interval.”

Sign up to receive monthly updates via email