Fuels

Driving hydrogen forward

21 January 2025

25 May 2021

Exploring the impact of IMO 2020 and future greenhouse gas targets on marine fuels

In 2020, on top of COVID-19, the IMO 2020 sulphur regulations had wide-reaching impacts on the marine fuels world. Insight talks to Steve Bee, Group Commercial & Business Development Director at VPS, about the ways marine fuels have been impacted, the issues that have been reported and how the future is shaping up.

Steve Bee, Group Commercial & Business

Steve Bee, Group Commercial & Business Following the implementation of the IMO sulphur cuts in January 2020, the number of marine fuel quality issues was higher than in the previous year. And, in 2021 the marine press is still reporting fuel quality concerns after bunkering – a situation Steve confirms through his observations of the issues. “At VPS, which is the world’s largest bunker fuel testing company, we have seen a significant rise in the level of off-specification very low sulphur fuel oils (VLSFOs)."

"During 2020, 6.3% of VLSFOs were off-specification, yet in December 2020 that level was up at 8.8%, rising to 11.8% in January 2021, with half of the off-specs relating to sulphur."

"Our experience to date shows that VLSFOs can quickly destabilise once on-board the ship and that these fuels can have a shelf life of less than three months. To overcome some of the issues observed with the use of VLSFOs, we have been involved in a number of research and development projects using fuel additives. What we have seen in these studies is that additives can provide a positive effect in terms of improving fuel quality, especially for stability and for marine gas oil (MGO) lubricity.”

However, the issues have not been confined to stability. On-board wax issues have also been reported. “In our bunker fuels testing, we have seen a number of cases of waxing, due to the higher paraffinic content within VLSFOs,” he explains. “If a vessel undertakes pour point and wax appearance temperature /wax disappearance temperature (WAT/WDT) testing, these can provide valuable information regarding the storage and transfer temperatures of the fuel.”

In Steve’s opinion, the data from these tests is changing the advice on storage temperatures and helping to avoid further wax related issues. “In October 2019, VPS introduced a proprietary WAT/WDT test method, which had an immediate and increasing level of uptake from ship operators. Currently for VLSFOs, we are finding that the average WAT is 20°C higher than the average pour point."

"The historical advice of storing fuels at 10°C above pour point can be irrelevant as the fuel may be producing wax at temperatures higher than this."

"The average WDT is currently 15°C higher than the average WAT. So, in our view, a combination of pour point and WAT can assist in determining the storage and transfer temperatures of VLSFOs and, should wax precipitate, then the WDT can determine the temperature to which the fuel must be heated to dissolve the wax.”

However, with these lower viscosity VLSFOs it’s a careful balance, as he explains. “What we are seeing is that VLSFO viscosity is often too low, leading to leakages within the fuel system. This situation is exacerbated when the fuel is heated - for example in the case of a high pour point and/or WAT, which could lead to severe operational issues. Here we can see an opportunity for fuel viscosity modifier additives that have demonstrated the ability to achieve the desired effect.”

One of the key questions before the implementation of the IMO 2020 sulphur cuts was how many ship operators would choose to use scrubbers and continue to use high sulphur fuel oils (HSFO). And here, Steve suggests the picture will continue to evolve as fuel pricing changes.

“What we observed between February and December 2020 was a month-on-month increase in the number of HSFO fuel samples."

"This would indicate an increase in scrubber usage over the course of 2020. At present HSFO is significantly less expensive than MGO/VLSFO and, should the price differential increase, it makes the investment and the return-on-investment in scrubbers more attractive, which means we would expect to see a continued increase in their use.”

How to decide on the best tests to accurately assess the quality of marine fuels is a much debated industry topic – particularly in establishing if fuels are fit for purpose over their entire lifetime. “At VPS we always advise customers to use the latest (2017) version of ISO 8217 for fuels used in marine diesel engines, to give the best protection when using today’s fuels,” Steve confirms. “However, fuels are constantly evolving and as such the standards by which we assess their quality also need to evolve – although it is a real challenge for the standards to keep pace with changes we are seeing in the fuels. This is why we see ship operators turning to additional testing in order to ensure more comprehensive damage prevention and asset protection.”

One such test is the Turbiscan test. Here, despite advice from CIMAC that it is not suitable for determining compatibility, it is being used as a compliment to the potential total sediment (TSP) test to assess sedimentation. “VPS offers the Turbiscan test and a number of shipping company customers are requesting it. We have completed extensive correlation work relating to this test, with positive results. However, when dealing with fuels of very low asphaltenic content, the Reserve Stability Number (RSN) measurement is less reliable.”

Steve also has some input on the debate regarding the ability of the current Calculated Carbon Aromaticity Index (CCAI) or the Estimated Cetane Number (ECN) to predict the combustion quality of VLSFOs. “In my view, the CCAI is not particularly relevant to modern-day fuels. ECN is calculated from the ignition parameter Main Combustion Delay (MCD). High ECN means short MCD, which is favourable, whereas low ECN means longer MCD, which is less favourable. However, factors such as engine type, design, load and engine condition all play a role in affecting the ignition characteristics of the fuel being used.”

Looking ahead, the fuel mix can be expected to change in response to regulatory pressures, which will continue to impact testing requirements.

“What I see ahead is a fuel mix that includes even more fuel types as the drive to reduce greenhouse gas (GHG) and carbon dioxide emissions gathers momentum."

"At present, VLSFO accounts for 66% of all fuel samples received by VPS, with around 20% HSFO, 12% MGO and 2% ULSFO. I think VLSFO will be the most frequently used marine fuel for the next few years. However, we are seeing a growing interest in biofuels, plus shipping companies are also seriously looking at methanol and ammonia, whilst liquid natural gas (LNG) is increasing in demand too. As marine fuel blends become more complex and the pace of change accelerates, I think additional tests, such as WAT and further stability/sediment test methods, along with Gas chromatography–mass spectrometry (GCMS) to assess chemical contamination, should be considered for potential inclusion within ISO 8217.”

As the world focuses on climate change, the efforts to curb the emissions of GHG are intensifying. In the marine industry, The IMO has set a goal of cutting GHG emissions from international shipping by at least 50% from 2008 levels by 2050.

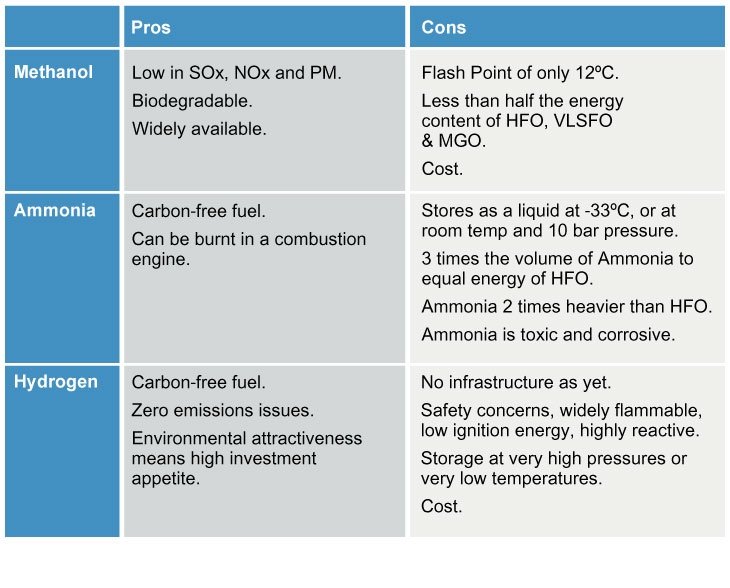

This is driving a number of OEMs and ship operators to enable the use of alternative, lower carbon fuels such as LNG and LPG, ammonia and hydrogen. However, as Steve explains each of these fuels have pros and cons.

“In my view, as long as we understand the concerns associated with the use of these alternative fuels in advance, then hopefully effective fuel management processes can be put in place to avoid major issues.”

LNG and biofuels are already part of the more diverse multifuel world. “On the plus side for LNG, it has low emissions of SOx, NOx and particular matter, which means no exhaust gas treatment is required. It also emits less CO2 than conventional marine fuels, while providing the same amount of propulsion power. However, it is mostly methane, a potent GHG gas and there are availability, handling and operational issues associated with its use. As for biofuels, these can be used in existing infrastructure and engines without modification and emit less GHG, SOx and NOx. But on the down side here I see potential concerns around contamination with water and microbes and long term storage. In addition, fuel availability and cost are issues, with on-road transportation competing for scarce supply.”

Other lower carbon fuel options are undergoing field trials and Steve summarises their pros and cons in the table below.

With the industry under increasing pressure to reduce GHG and other emissions we can expect the supply chain complexity to increase as more of these new fuel options become available. And, the quest to reduce emissions and improve fuel economy will continue to drive change to hardware, fuels and operations. “I see a lot of focus on reducing emissions from the fuel, which may lead to some form of carbon-trading scheme in the future.

"I think ship operators will look for anything to help lower fuel use in order to cut emissions and reduce running costs."

"The options here might include speed optimisation, power and propulsion effects, or even additives to achieve reduced emissions. As the marine world looks to continue to reduce emissions we can expect to see further significant changes and challenges ahead.”

Sign up to receive monthly updates via email