Base stocks

Unlocking the potential of re-refined base oils

08 April 2025

09 April 2019

Exploring the impact of new demand trends and the latest capacity increases

ExxonMobil used this year’s ICIS World Base Oils Conference in February as a platform to announce that Group II product shipments from its Rotterdam refinery had commenced on time. Insight took the opportunity to talk to Ted Walko and Sylvie Houry, from ExxonMobil Basestocks & Specialties, about the refinery expansion and their views on trends in the global base stocks market.

At ICIS London, Sylvie’s presentation on the future of Group II in Europe looked at the impact of new capacities and evolving specifications. She gave her thoughts on the effects these activities in Europe might have on the global Group II base oils market. “In the coming years, we expect Group II demand to continue to grow worldwide and to significantly grow in Europe,” she explains. “This is primarily driven by two key macro-trends in the automotive industry: improved energy efficiency and lower emissions.”

To ensure compliance with mandated emissions limits and fuel economy targets, OEMs are making significant hardware changes and demanding larger fuel economy contributions from the lubricant. These trends, combined with longer oil drain intervals, mean robust oils that are able to provide excellent hardware protection in more severe operating conditions are required.

Finished lubricants in automotive applications have different requirements than in the past. In particular, in Europe they need to comply with more stringent industry requirements. As a great example, the 2016 ACEA specifications, which are trending towards more energy efficiency, lower emissions, and Group II base stocks due to their high performance, low volatility, good oxidation stability, can really help meeting these more stringent requirements. So, we see the demand clearly picking up, again in Europe, and in the rest of the world.

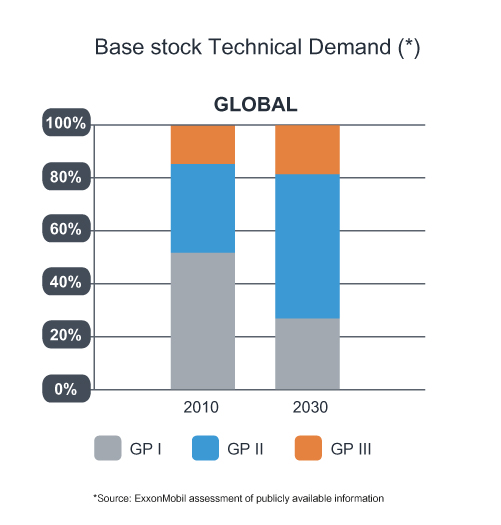

Group II is expected to make up about half of the total worldwide base stock demand by 2030 and Ted goes on to explain how automotive lubricant formulators are becoming far more creative in their use of these base stocks.

What we are seeing from our customers when it comes to Group II, we are seeing them start to look at Group IV plus Group II blends being more cost-efficient sometimes than purchasing Group III outright. So, we are seeing our customers be much more creative in how they achieve that performance at the lowest possible cost.

While Group II delivers most value to automotive lubricants, compared to some other applications, Sylvie highlights other suitable areas. “Group II can also bring benefits to some targeted industrial applications,” she confirms. “They allow longer drain intervals thanks to better oxidation stability and viscometric properties. This is particularly the case for gas engine and turbine oils where oil durability and improved deposit control under severe operating conditions are important.”

The on-time completion of the $1 billion hydrocracker expansion project at Rotterdam in the fourth quarter of 2018 allowed production to start in February 2019. With a capacity of about 1 million tons/year, Rotterdam is the first world-scale Group II production facility in Europe and Sylvie envisages significant change ahead on the supply side.

Our expectation is that the Rotterdam production will, of course, replace most of the products currently imported from other regions.

Group II products from Rotterdam are set for delivery to ExxonMobil’s customers during the first quarter of 2019. Sylvie outlines what she sees as their key target segments. “The two base stock grades that we are producing, EHCTM50 and EHCTM120, have been designed to offer benefits to the automotive lubricants sector. We estimate that the SAE 5W / 10W- passenger car oils and 10W / 15W heavy-duty engine oils will represent about two-thirds of the European automotive lubricants demand by 2030. This is why our products have been designed to enable finished oil blenders to optimise their formulations and capture substantial cost-savings in these growing segments.”

ExxonMobil says that the increased storage capacity now available at Rotterdam will help to ensure improved supply reliability and enable much shorter lead times to local customers. “We believe supply is best positioned in the local geography,” Ted explains, “which is why we've invested in Rotterdam and are commercialising that production right now, supplying European customers with local product.”

The focus of Rotterdam is clearly to serve local customers, but Sylvie adds another perspective to the supply outlook.

We are now the only world-scale producer of Group I and Group II in Americas, in Europe, and in Asia. And that means that while Rotterdam products are expected to remain primarily in Europe, and Africa, and the Middle East, they may also supply other regions.

ExxonMobil says the successful completion of the Rotterdam expansion signals the end of the project, but has confirmed that a number of other expansion activities are underway.

We also announced in 2017 an expansion in Singapore. We'll be bringing additional barrels to the market mid-year this year, for Singapore to satisfy our customers' demands. We also announced last year that in 2023 we would be making a significant investment in Singapore to significantly expand Group II production, along with introducing an extra heavy high-vis product.

In Europe, in addition to existing terminals in the UK, the Netherlands and Italy, ExxonMobil has announced a new hub terminal for vessel and truck loading is now operational in Valencia, Spain. The organisation says that it will continue to expand its Group II supply capabilities with a hub terminal in Hamburg, Germany, scheduled for late summer 2019.

The Rotterdam and Singapore refinery expansion projects will also increase the production of ultra-low sulphur diesel fuel. This is a timely addition since demand can be expected to grow as a result of the International Maritime Organization (IMO) sulphur cuts that are just nine months away. Ted outlines his thoughts on how the 0.5% sulphur cap is likely to affect the wider base stock supply landscape. “At Exxon Mobil we're paying close attention to IMO 2020. Although we anticipate significant impacts for the marine industry, we believe Group I demand will continue to be strong and that it will continue to have a solid place within the shipping industry.”

Although Group I capacity is expected to continue to fall, ExxonMobil says it has a high commitment to supply this product in the long term. The organisation expects Group I to still account for some 20% of global demand in 2030, offering advantages in marine, gear oil and other applications. Its use is also expected to grow owing to the continued industrial growth in emerging markets such as Africa, India and Latin America. However, Ted can see challenges and uncertainty ahead as a result of IMO 2020.

Although we anticipate significant impacts from the IMO 2020, we believe Group I demand will continue to be strong and will have a solid place within the marine shipping industry. On the supply side, that's where things may change. You see, this production of this lower sulphur fuel will challenge the economics of many refiners, particularly the low-complexity ones. They'll have tough decisions to make. Will they invest to de-sulphurise and destroy resid? Or, will they choose to get out of base stock production moving forward? That's where we believe the biggest impact is going to be.

Clearly, this is a time of unprecedented change in the lubricants and base stocks industries. In such a complex and uncertain environment organisations need to be more agile in order to anticipate changes. In addition, the ability to manage supply chain complexity, secure affordable and reliable supply and to select the right base stock to meet specific technical challenges will be key future success factors.

Sign up to receive monthly updates via email