Base stocks

Unlocking the potential of re-refined base oils

08 April 2025

11 April 2018

Increased availability of Group II base stocks offers opportunities for differentiation

The automotive industry is constantly working to meet ever tightening emissions and fuel economy targets. Following his presentation at the ICIS World Base Oils Conference, Infineum’s Yannick Jullien talks to Insight about the impacts this trend is having on lubricant quality and base stock selection in Europe.

Over the past 26 years, from Euro 1 to the current Euro 6, which was implemented in 2014, European regulations have been progressively cutting emissions from vehicles. This has driven the need to introduce hardware systems to remove, trap or convert pollutants such as carbon monoxide, unburnt hydrocarbons, oxides of nitrogen, particulate matter and carbon monoxide. This has also pushed OEMs and oil marketers to develop thinner and more fuel efficient crankcase lubricant to reduce carbon dioxide (CO2) greenhouse gas emissions.

However, the performance of these hardware systems can be affected in a number of ways. For example, catalytic converters such as diesel oxidation catalysts and selective catalytic reduction systems are very sensitive to poisoning by phosphorus and sulphur components. In addition, the efficiency of diesel and gasoline filters, used to remove particulates, can be impaired by ash. Finally, lowering lubricant viscosity raises concerns of potentially increasing wear, which in the worst-case scenario could result in high abrasion or seizure of engine parts.

To help protect hardware systems, chemical limits, which control the levels of sulphated ash, phosphorus and sulphur (SAPS), have been included in lubricant specifications.

This led to the first layer of fragmentation in the European lubricant market. The tightening limits for sulphur, combined with the need for improved viscometrics for fuel economy improvements, have limited the need for Group I base stocks in modern crankcase lubricant applications.

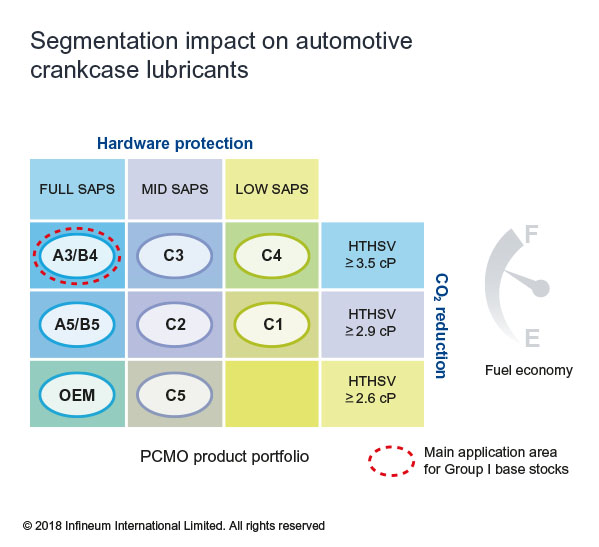

Today, we have a highly complex passenger car lubricant product portfolio. First, there are various SAPS levels – full, mid and low. But, as OEMs look for further fuel economy improvements, this fragmentation is being further exacerbated by different high temperature high shear viscosity (HTHSV) levels – ranging from 3.5 down to 2.9 and 2.6 cP. This has moved the market towards a matrix of eight different categories, mostly supported by an industry or OEM specification. If we try to position Group I base stocks into this complex environment we find that they mainly fit in the A3/B4 full SAPS performance box with HTHSV ≥ 3.5 cP.

The complex passenger car lubricant product portfolio is challenging for Group I base stocks

Looking ahead, with a continued market driver for fuel efficiency, we can expect OEMs to lower HTHSV even further, with an apparent primary objective of developing oil with HTHSV as low as 2.6 cP to optimise fuel economy. Already, we are aware that some lubricants with HTHSV lower than 2.6 cP are being studied.

The most useful viscosity grades in this modern lubricant environment are SAE 5W-20 and 0W-20 the latter accounting for the bulk of demand.

However, SAE 0W-16/12 grades are starting to gain some attention from a development standpoint with HTHSV below 2.6 cP. There is also a large window of different volatility requirements, with Noack ranging from 13% down to 10%. This further limits the use of Group I, pinning it into the high HTHSV area and a Noack at the higher end of the range.

The fragmentation does not even stop there; individual OEM specifications increase it still further. We have already covered the two-dimensional fragmentation created by HTHSV and SAPS. Now, the combination of challenging fuel quality and engine durability requirements has spurred the development of new specifications with challenging performance criteria. This might be, for example, in terms of improved cold temperature capabilities, low-speed pre-ignition prevention, biodiesel compatibility or wear control in the presence of soot.

These requirements create a third dimension of fragmentation, making it extremely challenging to develop a single lubricant with multiple claims, and creating a more demanding environment for lubricant marketers.

In addition, the resulting proliferation of products in the marketplace creates significant logistics challenges for our industry.

With Group I being squeezed out of the passenger car motor oil (PCMO) market, and at a slower rate out of the heavy-duty diesel engine oil (HDDEO) market, it is interesting to explore the benefits Group II products can deliver. Clearly, their lower sulphur means no harms for catalyst use and their better saturates provide opportunities for longer oil drain intervals due to stronger oxidation performance. However, Group II can also provide additional benefits outside of the basic attributes defined by base oil classification – for example in cold starting (CCS) and Noack performance.

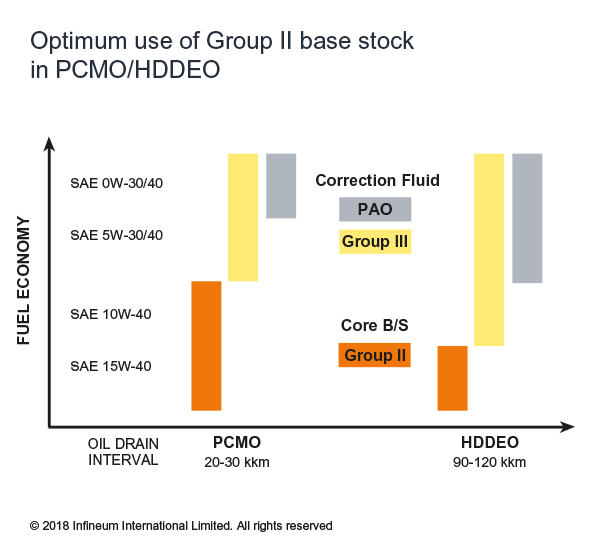

Within crankcase formulations, Group II base stocks are being used in slightly different ways.

There are significant differences between optimum base stock use in different applications

PCMO, SAE 15W-40 and 10W-40 and HDD SAE 5W-40 grades can be formulated using 100% Group II base stocks. Group III and PAO can then be used to different extents to correct thinner viscosity grades. The main difference between these applications is the longer oil drain interval required for HDD oils, which makes additive package formulation more challenging from a viscometrics standpoint. Here, the use of higher qualities or higher concentrations of correction fluid is necessary when moving down to thinner grades from SAE 10W-40 for HDDEO and 5W-X for PCMO.

Group II base stocks provide a clear opportunity for product differentiation. However, in the past Group II supply in Europe has been met mainly through imports, which have come largely from the US.

To meet the anticipated growth in demand, we are seeing a number of investments in Group II capacity in EMEA, including at ExxonMobil’s Rotterdam refinery and by Luberef in the Middle East and Rosneft in Russia.

The increasing availability of Group II products in Europe is good news for formulators who can take advantage of their improved CCS and higher saturates, which, as an example, enable the creation of new, cost-effective, Euro VI compliant HDDEO and mainline PCMO products.

Sign up to receive monthly updates via email