Base stocks

Unlocking the potential of re-refined base oils

08 April 2025

24 August 2021

Circular solutions create high quality base stocks to support sustainability targets

The introduction of regulatory mandates plus pressure from consumers mean sustainability is now a high priority across the energy and transportation sectors. As the world increasingly looks for circular solutions, which allow carbon to be used again and again, Insight talks to Marco Codognola, CEO of Itelyum, about the ways in which re-refined base stocks are helping organisations towards their sustainability targets.

Marco Codognola, CEO of Itelyum

Marco Codognola, CEO of ItelyumSustainability is now driving the actions of many organisations in the transportation and energy industries. We have already seen a number of vehicle OEMs publish science-based sustainability targets and even in some cases net zero commitments. And, in order to meet these ambitions, they are looking right across the wider value chain for improvements. Lubricants have a part to play here and, as Marco Codognola from Italian re-refiner Itelyum explains, interest in re-refined base stocks looks set to grow.

“I see the drive for sustainability as one of the key factors shaping the re-refined base stock market."

"Mid to long term," he continues, "trends clearly identify three key objectives: recycling, protection of the environment and carbon footprint reduction, in pursuit of a sustainable future. While it’s clear these objectives can be met with re-refined base oils, producers must be in a position to offer the lubricant industry interchangeability with conventional Group I, II and III base stocks and, in addition, OEMs and lubricant manufacturers need to adopt eco-design approaches involving re-refined products.”

As the industry works to reduce CO2 emissions, the improvement of fuel economy performance will continue to be a high priority. In response, lubricants have been trending to lower viscosities to deliver fuel economy benefits – something Marco sees reflected in the quality of used oil collected. “This trend means the re-refined base stocks we produce are suitable for formulating such lubricating oils. What we are also seeing in the market is a growing number of lubricant producers focused on new developments based on re-refined base oils. This is a consequence of the industry awareness that both quality and sustainability are important and also the demand from consumers who want to buy sustainable products.”

The growing interest in a more circular lubricant industry means that, contrary to the downward trend expected in the area of conventional refining technology, Marco expects the re-refining sector to grow in the coming decades. “The global market for lubricants is roughly 38 Mtons and the current global capacity of re-refining is more than 2 Mtons, with European re-refining capacity being more than 800 Ktons. The commitment of the European industry association of re-refiners (GEIR) to sustaining and promoting the role of re-refining in Europe, combined with the enforcement of a sustainable approach in the EC and the empowerment of its potential within the lubricants industry will all drive up the demand for re-refined products in the future."

"To meet growing demand we already have plans to increase our current Group II capacity by more than some 40 Ktons.”

Clearly the re-refining approach has a number of sustainability benefits. Not only does it have high yields but also, according to the API, it uses some 50% less energy than that required for refining crude oil to produce base oil and it also means less virgin oil is consumed. “When we benchmark the environmental benefits of re-refined base oils against primary production, regenerated base oils produce half the emissions of CO2, 4 times less emissions of fine dusts, 5 times less emissions of acidifying substances (NOX, SO2 and NH3) and equivalent primary resource savings (crude oil). These savings have been certified in a Life Cycle Assessment performed by an external independent company (IFEU)."

"Conditions being equal, the use of re-refined base oil in a lubricant leads to 50% savings in terms of emissions.”

In addition, re-refining helps to resolve the disposal issues of used lubricants, which is set to become a higher priority in Europe when the EC examines data from its Member States with a view to adopting targets to promote the regeneration of waste oils. Marco sees this as a key step towards removing the barriers to the broader adoption or re-refined base stocks. “Currently there are limitations in the overall offering of re-refined base stocks, since not all countries are structured to adopt a virtuous circle of collection & re-refining. The new EC regulation is expected to improve the situation with the adoption of regeneration targets in each EU country by 2022. Significant investments in re-refining facilities will be required to keep quality high and aligned with industry requirements. In Italy, thanks to the National Used Oil Consortium (CONOU), quantities and qualities are the highest in Europe. CONOU is committed to checking the quality of the oil collected and also carries out specific actions towards used oil producers to ensure proper segregation of such a waste to keep quality as high as possible and to maximise regeneration.”

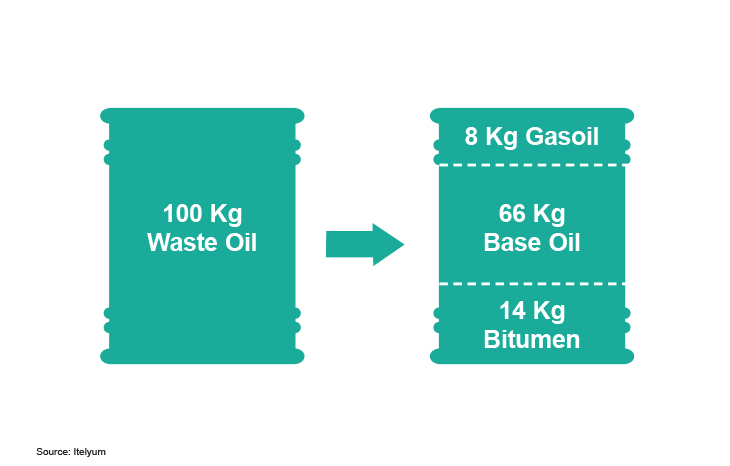

Itelyum has regeneration plants in Italy that, using technologies such as catalytic hydrofinishing, have the annual capability to re-refine 180 Ktons of waste oil into Group I and II base oils, gasoil and bitumen.

Itelyum says its regeneration processes are efficient and give high yields

Itelyum says its regeneration processes are efficient and give high yields

Italy is ahead of the rest of Europe in terms of re-refining and, according to Itelyum, the regeneration of used lubricating oil has to-date saved the country some 3 billion euros due to lower oil imports. “Currently about 30% of the lubricant market in Italy is made up of regenerated base stocks,” Marco confirms. “Itelyum already re-refines nearly 90% of Italian used oil and import limited amounts of foreign used oil from bordering countries. However, in other parts of Europe, the gap between oil collected and oil burnt is still significant. This is something we expect the upcoming EC regulation to change since it dictates clear and stringent rules in waste management in order to minimise the negative consequences on human health and the environment. In fact, this directive recognises the priority of recycling in waste management.”

The use of recycled products certainly looks set to grow in the pursuit of sustainability goals. Achieving the right balance between the desire for sustainability and the need for supply reliability and proven performance is clearly important.

“In our view the performance of re-refined base stocks can be equivalent to or even better than conventional high quality Group II and III products."

"And, thanks to their excellent quality, they can be used in all applications and everywhere around the world. We think that re-refined base stocks will be a valid option to back current Group III base stocks. However, the demand balance between Groups I, II and III, and their relevant production costs, determine the market balance. What we have seen in the past year, despite the disruptions to base stock supply and demand caused by the COVID-19 virus, is that re-refined base stocks have shown an incredible resilience. Because of that reliability, we are experiencing growth in demand on top of the already anticipated sustainability driven demand.”

Sign up to receive monthly updates via email