Base stocks

Unlocking the potential of re-refined base oils

08 April 2025

Please note this article was published in June 2014 and the facts and opinions expressed may no longer be valid.

05 June 2014

Uncertainty remains in the volatile global base stock market

A number of industry contacts share their views on some of the key trends and drivers shaping the rapidly changing global base stock market.

Having recovered from the slump of the global economic slowdown, the base stock market has entered a period of change, and with this comes a huge array of challenges. To get a better understanding of the market Insight spoke to a number of industry players from around the world. This first feature in a series of three, gives a quick overview of the key aspects of the Group I and Group II markets.

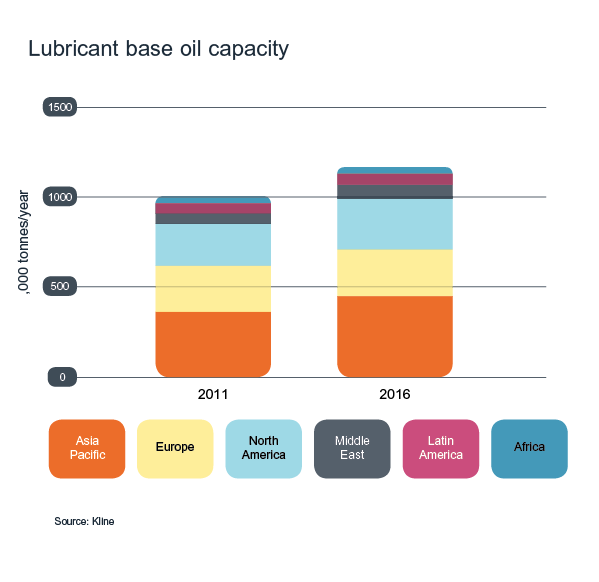

While overall lubricant demand growth is expected to remain sluggish, project announcements to date indicate that more than 150,000 barrels/day of new base stock capacity could come on stream in the next 10 years – with production capacity increasing in all regions. This means operating rates are likely to be relatively low in the next five years, with margins being reduced throughout the base oil business.

The relative uptake of the wide variety of available base stocks will vary considerably from region to region and from application to application.

“Today, a lubricant blender needs access to a full range of base stocks to meet the performance requirements of much more diverse and demanding lubricant products,” says George W. Arndt, Jr., Director of global base stock & specialty sales for ExxonMobil Fuels and Lubricants. “The specific mix of Group I, II, II+, III, III+ and PAO will depend on the specific mix of engine oils, industrial oils, marine and process oils that a blender produces for their specific market.”The reformulation trends needed to meet tougher crankcase lubricant specifications have pushed Group I base oils out of most of the newer automotive lubricant formulations.

“As environmental regulations have been tightened and the quality requirements for lubricants have been raised, the transition from Group I to Group II to Group III has been an obvious trend in crankcase formulations.”

Jin Hur, Senior Vice President, Base Oil Business, SK lubricants

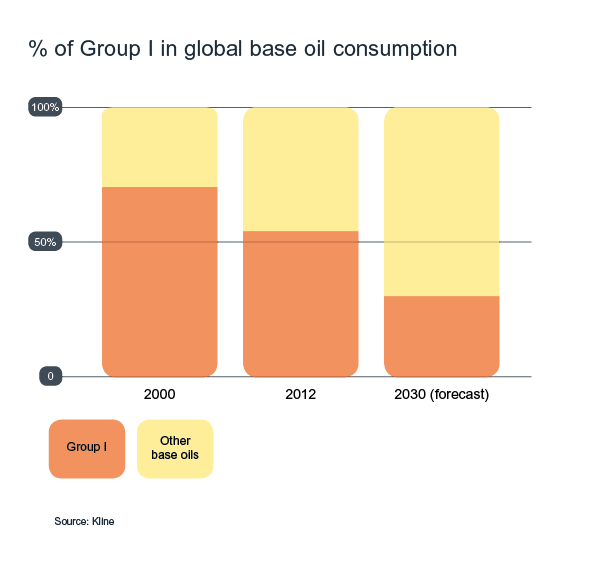

As a result, the proportion of Group I in global base stock consumption has fallen – a trend that is likely to continue.

Decline in demand has been felt most acutely in Europe, and North America, where plant closures have been announced. Most recently we hear of Shell’s plans to close its 350Kt Group I Pernis base oil unit in the Netherlands by the end of December 2015. The unit is 60 years old, and the significant investment required to bring it up to today’s standards is untenable, given the current base oil market dynamics and demand evolution.

Of the remaining facilities, some are at risk while others are working hard to improve the properties of their products to ensure they meet their customers’ needs.

“We continuously evaluate our assets to determine how, in an evolving marketplace, we can best serve and fulfill our customers’ requirements for quality base stocks to support their finished lubricants needs.”

George W. Arndt, Jr., Director of global base stock & specialty sales for ExxonMobil Lubricants & Specialties

Group I producers are also focusing on other sectors, where, although they are faced with stiff competition from a variety of products, there is a continued demand for conventional base stocks.

“In the next 25 years we believe around a third of lubricant demand will still be for Group I and we will continue to be in Group I production for a number of years to come.“Hasan Al Zahrani, President and CEO of Lubref

In some areas Group I refineries are busy converting to the production of higher quality base stocks. Hasan Al Zahrani, President and CEO of Lubref, explains how the company is driving the Group I to II migration trend in its plants in Saudi Arabia. “While we will maintain Group I and bright stock production our Group II will enable us to meet the demands of a number of stakeholders. I don’t really see any competition between Group I and II. Each has its own niche markets and end users, and they complement each other.”

“We saw the main challenge of moving our customers to Group II being the speed at which they could convert their manufacturing from Group I to Group II,” he continues. “But the more we talk with them the less of a challenge I see. It’s a matter of what is going to happen, how it is going to happen, and in what order is it going to happen - but definitely it’s happening.”

However, despite the trend for refinery conversion, a core of large, integrated Group I producers will remain to satisfy the continuing demand for Group I, higher viscosity solvent neutrals, bright stocks and petroleum waxes – the latter of which are only produced in Group I refineries.

“Certainly the overall drive for energy efficiency and higher performance requires more light viscosity, high VI base stocks for some products,” confirms George W. Arndt, Jr. “But, the global growth in heavy-duty vehicles, and an anticipated recovery in global marine should increase the demand for conventional base stocks as well. So overall, we see the base stock mix becoming more complex.”

In Europe, blends of Group I with Group III and additives provide one potential opportunity for Group I refineries. For example in gas engine oils for power generation the combination would deliver not only low emissions and low viscosity, but also solvency and solubility from the Group I.

"I wouldn’t be surprised to see the combination of Group I and Group III – something we have seen in the past 15 years in the automotive sector - being adopted for certain non-automotive applications."

Thomas Guinot, Global Services Manager, Base oils, Neste

Markets like marine and industrial will continue to use Group I base stocks in large quantities. But, the requirements of modern automotive engine lubricants in areas such as lower viscosity and volatility really drive the use of higher quality of base stocks.

“As the performance and quality level of engine and transmission hardware improves, automotive lubricant specifications are becoming more and more stringent,” says SK’s Jin Hur. “Consequently, it is becoming more important to choose the right base oil for the purpose.”

Recognising this shift in the products needed to meet evolving technical requirements, many major base oil producers have plans to add capacity to higher quality base stock production.

“The increasing supply of Group II means it will primarily replace Group I,” says Thomas Guinot. “But, with the increasing requirements for pollution control we believe that Group III will be the base stock of choice for top tier automotive in the long run.”

Capacity addition is certainly the trend in the Group II world. The biggest addition in 2014 is Chevron’s $1.4 billion Pascagoula plant, which once complete will position the company as the largest Group II supplier with a global slate. The new facility should begin ramping up production from the second quarter to its 25,000 barrels per day capacity, which will expand global Group II capacity by nearly 10%.

In terms of distribution, Chevron will not only become the biggest Group II supplier in North America, but also has plans to put its Pascagoula base oils into the global supply network, and is investing in new supply hubs, which could affect the global movement of base oil.

“Outside of North America all regions are adopting higher-quality and higher-performance lubricants, and the increased capacity of Group II will enable that trend to continue.”

Matt Hauschild, New Business Development Manager, Chevron Global Base Oils

In Europe for example, Chevron has been laying the groundwork by investing in the region for four years ahead of the Pascagoula plant capacity coming online.

“We have been developing a portfolio of approvals and product qualifications for the European market. Here the highest volume products are generally heavy-duty 10W and 15W fluids - ideal applications for Group II base oils, explains Matt Hauschild. “In many cases we found that we can meet the performance requirements and standards in these applications that the old combinations of Group I and Group III cannot meet.”

Lubref is another Group II supplier with its sights set on markets outside of its traditional home ground. “We’ll maintain the Kingdom of Saudi Arabia as our main target, followed by the Middle East especially the GCC countries,” confirms Hasan Al Zahrani. “But definitely we’ll be targeting specific geographical areas in Asia and Africa. Some of our specialty products will also be going into Europe. So we’re expanding from being local and regional to being more international.”

But as Matt Hauschild explains, in Chevron’s eyes the opportunities lie not only in the expanding global automotive world, but also the wider lubricants market. “When customers take Group II into their blend plants for their automotive products, we’ve seen them move to Group II in their industrial products and their natural gas products because they realise the performance benefits that Group II can bring in those product lines as well.”

More Group II capacity is on the way in a number of regions and from a number of other suppliers including: ExxonMobil, Shell, and Petrobras in the next few years.

“Our recently announced expansion of our Baytown Raffinate Hydroconversion Unit (RHC) unit installs our MSDW catalyst to improve the low temperature properties of our Group II+ EHC 45, and allows us to introduce a new Group II EHC 65 product,” explains George W. Arndt, Jr., from ExxonMobil. “Designed with a slightly heavier viscosity than our current EHC 60, it optimises SAE 15W-40 heavy-duty engine oil (HDEO) blending by eliminating the need for an additional higher viscosity component. And, when EHC 65 is blended with the new EHC 45, it enables SAE 10W-30 HDEO, helping to meet future generation lubricant needs.”

Although not all applications will necessitate Group II, economics will play a role. If it is less expensive to formulate and utilise Group II, there will be movement to these stocks. Group II and III will need to be stocked, putting further cost pressure on marketers who also maintain Group I inventories.

Once applications start to move to Group II, going back becomes more difficult as marketers/additive companies take advantage of the formulation benefits they bring. On the other hand, many existing lubricants formulated with Group I base stocks are expected to continue to have a long life in many markets, and blenders would encounter challenges and costs reformulating these older products onto Group II.

The growing desire for sustainability, combined with an abundance of used oil is helping the re-refined industry to take off around the world.

“People are becoming more and more serious about sustainability, and green products that are better for our environment will come to play an increasing role in the future.

Fran Lockwood, Senior Vice President, Ashland Consumer Markets

Certainly in some markets these sustainable products have real potential for growth. “In some regions of the world these products are already of high interest,” Fran Lockwood continues. “For example, with some of the pollution levels in Asia, we expect to see increasing environmental regulations and maybe more acceptance of these greener products.”

Re-refineries convert used oils into high quality Group I and II base stocks, which can produce lubricants that meet the latest performance requirements. We asked Curt Knapp, Executive Vice President, Marketing and Oil Re-refining Sales at Safety-Kleen about the quality of the base stocks they can produce from used oils. “All our re-refined base oils are Group II, and our 120 Neutral cut has the best NOACK Volatility of any other Group II. A large majority of re-refiners are hydrotreating, which means they can make a Group II, and I am only aware of one North American refiner who is not using hydrotreating, and they produce Group I.”

“Over time, and as the pool of used oil improves, we will see Group III type re-refined base stock products.”Curt Knapp, Executive Vice President, Marketing and Oil Re-refining Sales at Safety-Kleen

Customer education, investment in infrastructure, tax incentives and a strong regulatory push are likely to be needed to increase the pace at which these ‘green-oils’ move into a more mainstream position in the lubricants industry.

A lack of understanding about re-refined base stock performance had been a barrier to their growth, but in Curt Knapp’s view this is now being addressed. “The perception of re-refined stocks is definitely improving, but we still are in the phase where we need to drive awareness and understanding in order to increase this further,” he confirms.

“Our product quality always gets the highest marks in the regular customer satisfaction surveys, which are conducted by an independent 3rd party. And when a large corporate fleet pilots our product and compares it with their currently used product, they are impressed as it always performs as well, and in many cases better, than the major brands they had been using.”

However, this additional capacity is coming on line at a time when virgin base stock supply is plentiful in most Groups and in most regions. This puts significant pressure on green refiners, and may slow or stop the introduction of further new plants, and raises concerns about the profitability of some.

In summary, the global base stock market continues to face changes and challenges. Group I refiners will face increasing pressure, but with their ability to rebalance viscosity grades and focus on specialties and co-products such as paraffin waxes and aromatic extracts, many of the more efficient Group I plants should continue to find profitable options for continued operation.

Increased availability of higher quality base stocks will more than satisfy the demand for higher quality finished lubricants. However, this proliferation of base stocks creates new challenges in terms of determining reasonable paths to establish rules for both base oil interchange and viscosity grade read across guidelines. And this is one area that the industry needs to handle with care.

It seems highly likely that this fast changing market - driven by global demand patterns, raw material costs and local supply and demand imbalances – will continue to be challenging for some time to come.

In our next base stock feature we will hear the views of suppliers on the growth of Group III and cover the uncertainties over GTL projects and the fine balance surrounding PAO supply.

Sign up to receive monthly updates via email