Base stocks

Unlocking the potential of re-refined base oils

08 April 2025

25 February 2020

Unravelling some of the uncertainties

As the number of available base stock options continues to grow, lubricant suppliers are looking for clarity in their differences and to better understand their relative benefits. Giovanni Loizzo, Infineum Base Oil Procurement Leader, explores some of the base stock related questions most frequently asked by lubricant formulators designing advanced engine oils.

Base stocks are the main constituent by volume in lubricants, accounting for anywhere from 75 to 90% of a passenger car or heavy-duty engine oil formulation. The properties of base stocks can vary enormously from one to another, and they can have a major impact on lubricant performance. Additives are required to enhance the performance of the base stock and to deliver additional beneficial properties to the lubricant, such as wear protection and cleanliness.

Some of the first questions we encounter are about the names and characteristics used to differentiate base stocks in the market.

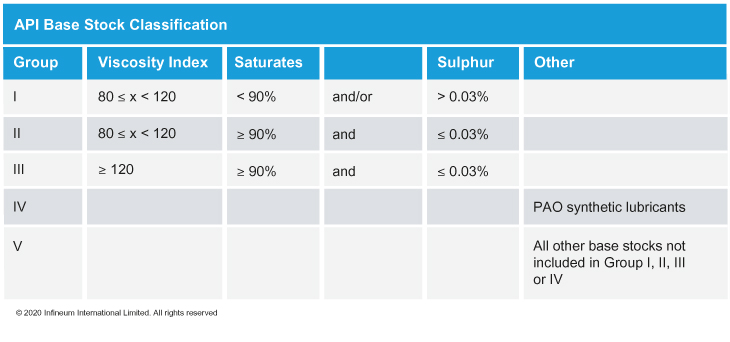

To ensure that the performance of engine oil products is not adversely affected when different base stocks are used interchangeably, the American Petroleum Institute (API) has developed five broad categories.

| Group I, II and III | All paraffinic base stocks refined from petroleum crude oil; the severity of the manufacturing process increases from Group I to Group II to Group III. |

| Group III | Also includes synthesised base stocks, for example, liquid hydrocarbons derived from natural gas (GTL), coal (CTL), or biomass (BTL). |

| Group IV | Dedicated to polyalphaolefins (PAO), synthesised from ethylene derivatives (olefins C8/C10/C12). |

| Group V | Includes everything else, such as synthesised esters or polyalkylene glycol (PAG) and also naphthenics, which are obtained from naphthenic crude under conventional refining processes. |

Based on other characteristics, such as kinematic viscosity at 100°C (KV100), viscosity index (VI) and manufacturing process, some additional names are also used in the base stock market:

| KV100 value | This discriminates ‘light grades’, ‘heavy grades’ and ‘brightstock’ and is associated with the base stock symbol. For example, PAO 4 is a Group IV light grade with KV100 of 4 cSt. |

| SN | Based on manufacturing process, the symbol SN (solvent neutral) is used to discriminate Group I base stocks. For example, SN150 means a Group I grade with KV100 of 5 cSt. |

| ‘Synthetic’ | This term is used to discriminate synthesised base stocks such as GTL or PAO. |

| ‘+’ | More recently, and outside of the API definitions, base stocks with high VI are marked with a ‘+’ symbol. For example, Group II+ means a VI greater than 110, Group III+ means a VI greater than 130. |

The key lubricant performance properties of base stocks, such as oxidation, volatility, traction and low temperature performance, tend to improve when moving from Group I to Group IV. Solvency power is an exception since it decreases with increasing levels of saturates.

Another set of questions we hear are around base stock mix and usage. Here we are often asked how the base stock mix can be varied when formulating engine oils and why base stock consumption among regions differs?

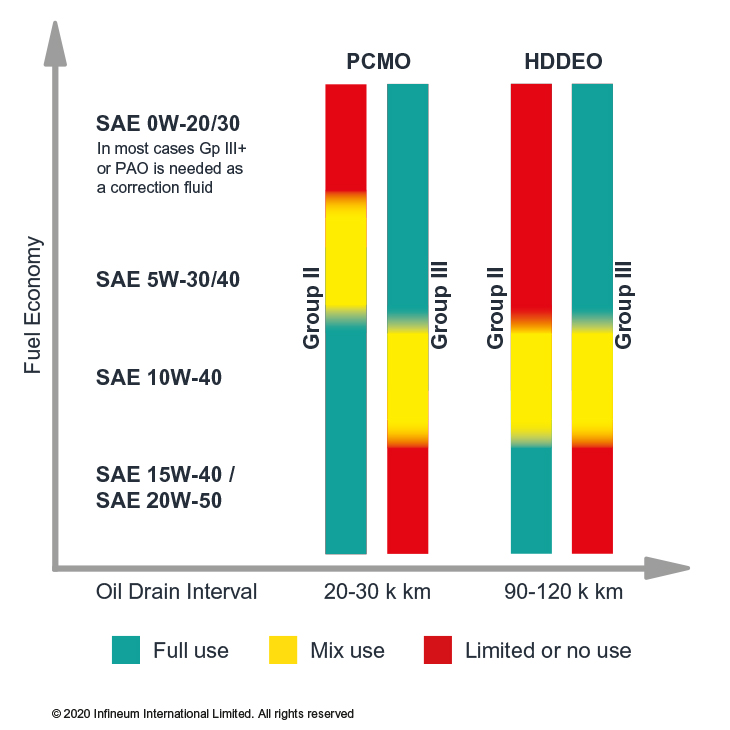

Performance is clearly the first criteria in base stock selection. For example, top tier applications such as SAE 0W-X oils require excellent static and dynamic performance at high and low temperatures. This type of lubricant needs to be formulated using high quality base stocks such as Group III+ and PAO, at least as correction fluids.

For lower performance levels, multiple base stock options are available. In these applications, base stock choice is generally influenced by considerations such as supply reliability and total formulation cost, factors that can vary by region. For example, in the past 10 years low/medium tier lubricants have been formulated with Group II in North America, while in Europe a Group I/Group III mix has been used, this selection is based on the different regional availability of these base stocks.

Depending on API Group and end application, there are rules on interchangeability among base stocks (BOI). For example, lubricant blenders have limited flexibility to interchange Group III, used in OEM approved factory fill applications, while they have much greater flexibility on Group I to use in for example SAE 20W-X service fill applications.

We have also seen a growing interest concerning the so-called ‘green’ - re-refined and bio-based - base stocks. The feedstock for re-refined base stocks is waste oil, which is processed into a higher value stream through a combined physical and chemical transformation. The resulting products are generally Group I and Group II. However, the improving quality of automotive lubricants is mirrored in the quality of used oil, making re-refineries a potential new source of Group III supply. There are examples of Group III+ bio base stocks, which are produced from plants such as sugar cane, soya beans, and other renewable agricultural, marine, and forestry materials.

Supply and demand volumes for these base stocks are still minor when compared to conventional base stocks. But, demand is expected to grow as the impact of sustainability drivers on the base stock market increases.

Finally, we also receive a number of questions regarding the key drivers and trends impacting the base stock market.

The base stock market is influenced by demand drivers, which are common to those of the lubricant industry, and also by supply drivers, which heavily depend on the dynamics of the physical complex incorporating the base stock unit (e.g. refinery or chemical plant).

On demand trends, the shift towards higher quality base stocks is driven by increasingly demanding requirements regarding fuel economy performance, oil drain interval (ODI) and the environmental emissions of lubricants.

At some point, Group I is likely to exit the automotive sector, while demand for Group II and Group III should continue to grow.

In terms of volume trends, demand is pushed up by economic growth (especially in Asia). It is also pushed down by longer ODI and by a higher penetration of electric vehicles (EV) into the automotive sector – the latter being something which might become much more impactful than today in the 2030s.

On supply trends, base stock capacity expansions and rationalisations are heavily influenced by interaction with fuel units, as only 1% of each barrel of crude oil ends up as base stock. For example, the new regulation on low sulphur marine fuels (IMO 2020) is expected to increase feedstock competition between base stock and fuel units. This could mean Group I plants are more exposed to rationalisation since, generally speaking, they are less profitable and flexible than Group II plants. However, base stock capacity expansions can also be opportunistic: for example, when a refinery invests in a big fuel hydrocracker (FCC) it gains access to both feedstock and technology which can be used in a new Group II/III plant.

These demand and supply trends have led to a base stock market, which is over-supplied in the near term, although there are some differences among API groups and regions. This means, on one side, some end users are choosing to use higher quality base stocks, even when not technically necessary – perhaps for performance gains or to simplify logistics. On the other side, refiners are diverting feedstock, or even base stocks, to fuels production with increasing fragmentation of quality.

It is not yet clear how fast or how far sustainability will influence the current base stock industry demand and supply drivers.

However, considering that this megatrend translates into stronger development of greener energy and feedstock and more efficient process technologies, the complexity of the future base stock market is likely to increase vs. today.

Sign up to receive monthly updates via email