CIMAC 2025

OEMs outline challenges ahead

08 December 2025

Maritime industry looks for ways to cut emissions today as it works towards a net zero greenhouse gas emissions future

With the International Maritime Organization’s countdown to net zero emissions inexorably ticking down, the industry is looking for cost effective, readily available options to meet the interim targets, while also exploring ways to meet the 2050 net zero goal. Infineum’s Dewi Ballard, Fuels Product Manager, and Rob Glass, Operational Marketing Manager, explore the ways that fuel and lubricant additives can help improve efficiency and reduce emissions today as the industry works to fully commercialise future fuel options such as ammonia.

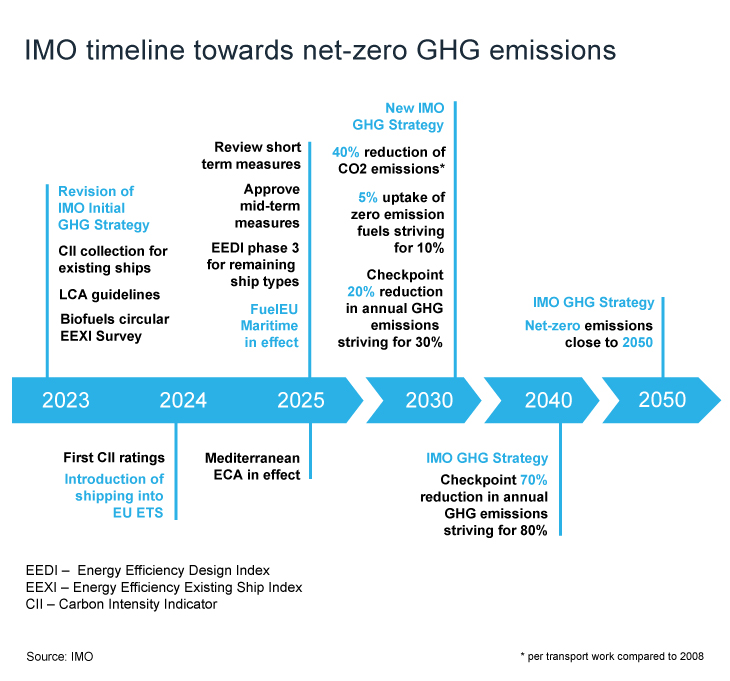

Following on from the International Maritime Organization (IMO) 2020 sulphur cuts, probably the largest regulatory change to fuel composition that the maritime industry has ever seen, the IMO has now set a path to reach net zero greenhouse gas (GHG) emissions by 2050.

IMO says international shipping, which transports some 90% of the world's transported goods, is the least environmentally damaging mode of transport when its productive value is considered. But, in its most recent study, the organisation reports CO2 emissions from ships are estimated to have increased by more than 9% from 2012 to 2018. Reversing this trend is a key goal and a big driver for change.

In its revised greenhouse gas reduction strategy, agreed in July 2023, IMO has set out very clear ambitions, aiming for net zero greenhouse gas emissions as close to 2050 as possible.

The IMO timeline also includes a commitment to ensure the uptake of zero and near zero greenhouse gas fuels by 2030, with checkpoints along the way.

From January 2023, it became mandatory for ships to calculate their attained Energy Efficiency Existing Ship Index (EEXI) and to start fuel consumption data collection. The first annual reporting on fuel consumption is complete, and the first CII ratings, which go from A down to E have been made.

IMO says the first set of data has been submitted by 28,620 ships, with a combined 1,301 million GT. Of those ships, for the 2023 reporting period, 24,653 ships reported operational CII ratings. 78% of the CIIs reported met the ‘C’ or better target. However, 1,541 vessels reported an ‘E’ rating, which means they must now adopt a plan of approved corrective action. These data show that a significant portion of the world's fleet is already falling behind the targets.

A 2% CII reduction factor will be applied every year, from 5% in 2023 reaching 11% by 2026, with further reduction figures for 2027 to 2030 under development. This means some of the 3,931 ships reporting a ‘D’ in 2024 could slip into the ‘E’ category and even those ships reporting A-C ratings cannot be complacent. IMO is set to review the effectiveness of its implementation by 1 January 2026, and if needed adopt further amendments. Penalties for non-compliance could also be introduced as part of these measures.

The good news is that the IMO targets are technology neutral, which means ship owners and operators are free to decide how best to gain and retain a C or better rating.

What this means for the wider industry is increased complexity - a wider range of fuels, fuel blends and engine types, which increase the demand on the lubricant in use – and new additive technologies will be needed to help ensure trouble free operation.

In addition, at the IMO Marine Environmental Protection Committee meeting in April this year an agreement on carbon pricing for global shipping was reached, which is a significant step towards reducing GHG emissions from the sector.

A global fuel standard, will gradually reduce ships' annual GHG fuel intensity (GFI), which is the amount of GHG emitted per unit of energy used, calculated using a well-to-wake approach. Ships emitting above GFI thresholds will need to acquire remedial units to offset excess emissions, while those using zero or near-zero GHG technologies will be eligible for financial rewards.

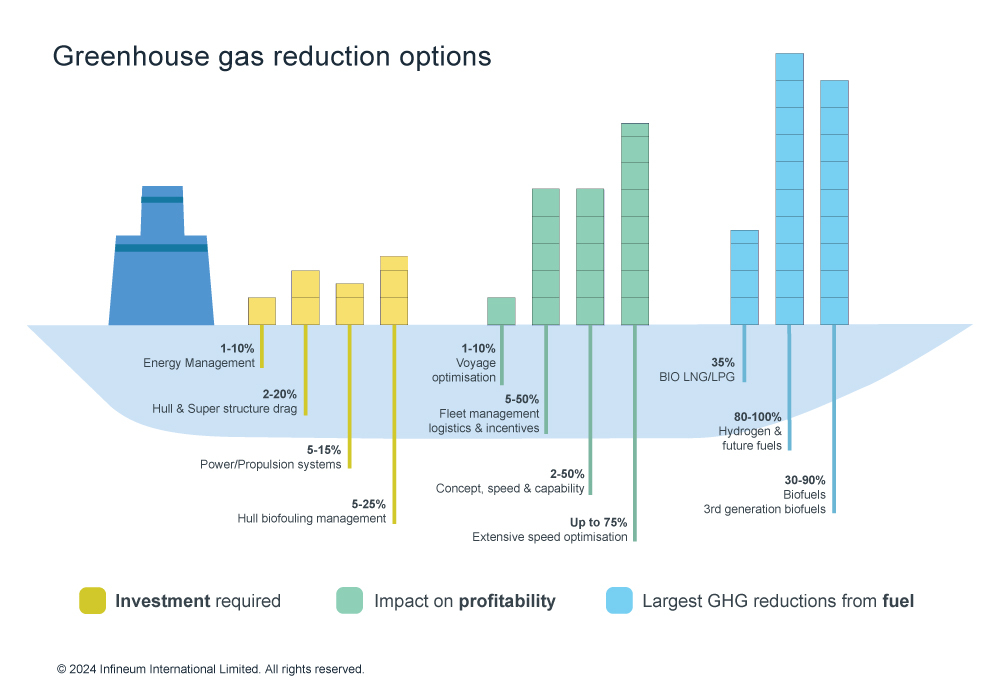

There are already a number of GHG reduction options available to shippers - with some of the largest GHG savings coming from fuel selection.

However, the wide availability of net zero carbon fuel options is still some way off, which means, other carbon cutting measures are needed to help ships improve reduce fuel consumption without significantly increasing running costs.

Today two easy to implement options for cutting GHG emissions are slow steaming and the use of proven fuel combustion improver additives.

Slow steaming

This might not be a new idea, but it’s easy to do and has a big GHG reduction potential, which makes it an attractive option. However, it is important to consider what running the engine at lower speeds and therefore at less than optimal operating load might mean.

During slow steaming, the cooler in-cylinder temperatures mean that sulphuric acid, formed from the combustion by-products, can condense onto the liner surface as a consequence of the temperature dropping below the dew point. This can result in increased corrosive wear of the cylinder liners. Unfortunately, the use of lower sulphur fuels does not stop cold corrosion because a significant amount of acid is still produced

Infineum has developed advanced formulations so that lubricants can deliver excellent performance even at lower base number.

Using field-proven lower base number (BN) marine lubricants that meet the latest OEM standards (specifically formulated for 2-stroke engines that meet MAN ES Cat II requirements) and ensuring correct feedrate optimisation helps to control deposit build up. These lubricants are designed to provide all round protection to the engine, operating in real world conditions. In addition, they protect the engine when operating on the different fuels available today and those new fuels being introduced into the market.

Combustion improvement

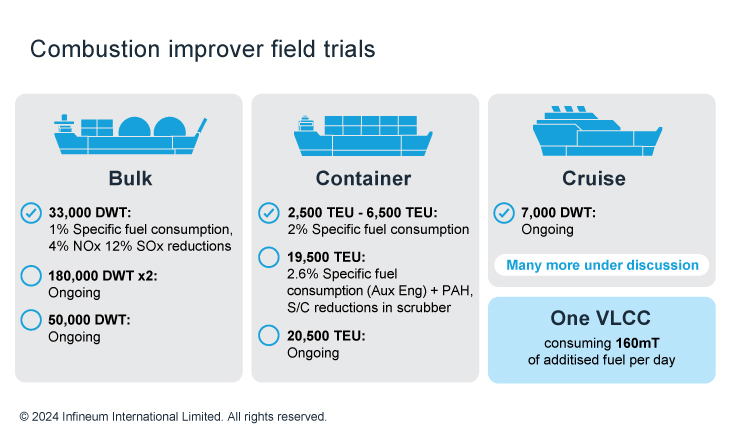

Another easy to implement, zero capital expenditure way to cut vessel fuel consumption and lower the CO2 emissions is the use of proven combustion improver fuel additives.

These additives can help reduce fuel consumption per nautical mile year-by-year and to that effect can become an integral part of achieving and retaining the target CII rating. Other benefits demonstrated in sea trials include the reduction of key emissions such as NOx and smoke. In addition, fuel stability minimises fuel lost as sludge - helping hardware stay cleaner for longer and also improving operational efficiency.

Infineum combustion improvers have undergone thorough verification across different engine and vessel types and their field performance has been independently verified.

By providing an easy to implement CO2 emissions reduction strategy today, combustion improvers can contribute to an improved CII rating while also helping to reduce operating costs and downtime, without the requirement for capital expenditure.

Increasing efficiency and optimising operations are the lowest hanging fruit for carbon reduction. But, after these measures have been applied, to reach the IMO targets, more significant changes are required, such as changing fuel. This is being supported by EU initiatives including the extended coverage of the emissions trading system and the FuelEU Maritime regulation.

Zero carbon fuels, such as e-fuels and ammonia, might be where the maritime industry is headed in the future. But, while production ramps up and the hardware and infrastructure needed is further developed, the industry is looking for lower carbon fuels today. The main options are biofuels, LNG, LPG and methanol – although each has its own set of challenges, represent only a small percentage of sales and, despite emissions reduction benefits, are generally seen as transition fuels towards net zero.

Methanol is a proven energy source, already being used as a marine fuel, as well as in the automotive and power generation sectors. It is a clean-burning, water soluble, biodegradable fuel that is easy to store and handle. Aside from its green credentials, another benefit of methanol is that it is compatible with existing dual-fuel engines and auxiliary engines - a single fuel solution that simplifies logistics, reduces storage complexity, and streamlines fuel management. However, methanol also has its challenges in terms of cost and handling.

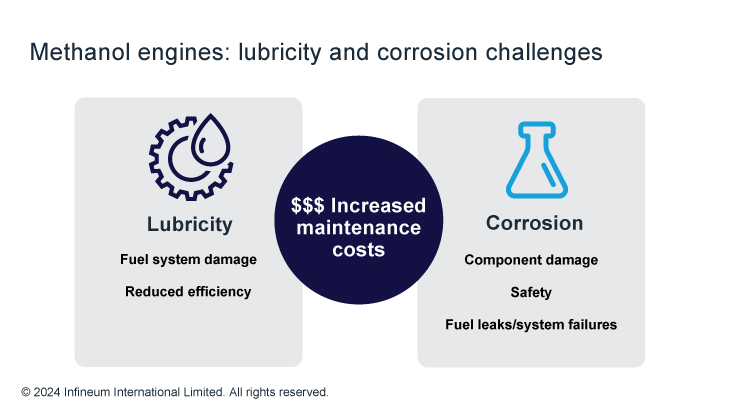

There are also challenges related to lubricity and corrosion in methanol engines and fuel supply systems, which fuel additives can easily and economically overcome.

Lubricity improver additives create a protective film on the metal surfaces of fuel supply equipment to reduce friction and wear, which ensures smoother engine operation and prolongs the life of engine components. Corrosion inhibitor additives form a barrier between the fuel and the surface of the metal to safeguard engines against corrosion-related damage

One of the most limiting factors to the adoption of methanol by shippers is the availability of green methanol for bunkering – particularly as other industries look for net zero options.

Although significant investment in green methanol production is anticipated, currently sales are limited. However, subject to the pace of developments of global supply chains, infrastructure, and regulations, demand for methanol as a marine fuel is expected to grow.

Despite limited methanol-ready infrastructure, methanol ships are already in operation. In 2024 orders for methanol capable ships reached 166, up from 138 the previous year, with container ships accounting for just over 50% of these orders. In addition to new builds 2 and 4-stroke OEMs report orders for retrofitting of main engines to run on methanol.

In our view, the availability of methanol engines today, along with the sustainable additives and innovative lubricants needed to protect them, means methanol could have a fast uptake in the short term – providing a bridge towards a net-zero future.

Ammonia is another future fuel option for a maritime sector targeting net-zero emissions. An inorganic chemical compound of nitrogen and hydrogen, ammonia produces no CO2, SOx or particulate emissions when combusted.

In 2024, there were 27 orders for ammonia-fuelled vessels, compared to just eight for the whole of 2023. In addition, 9.74 mt of ammonia was bunkered for the first time globally amid trials in Singapore.

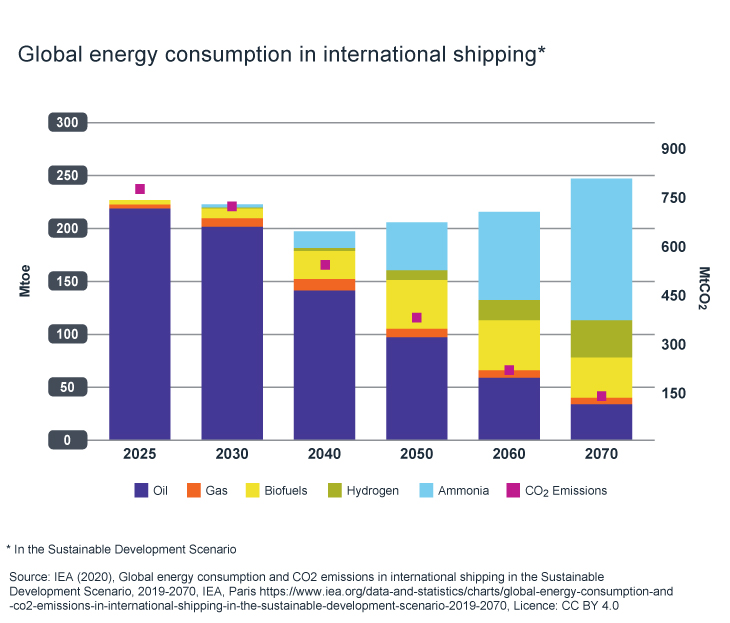

A big percentage of today’s global production is supplied to the fertiliser industry and it is hard to predict its uptake as a marine fuel – but many forecasters expect to see substantial growth beyond 2030. The IEA for example suggests that by 2060 ammonia could account for the largest share of low and zero carbon fuels, though questions around its availability remain.

Green ammonia can be produced using renewable energy or biomass to extract hydrogen from water and then combining the hydrogen with nitrogen from the air, via the Haber-Bosch process. Despite its green credentials, new and complex challenges around supply chain, bunkering and its onboard use are anticipated.

A key challenge is its toxicity to both humans and aquatic life, making the prevention of exposure to ammonia and spills high priorities. Emissions of NOx and nitrous oxides are higher than from conventional fuels, which means additional aftertreatment is needed onboard. In addition, the poor combustibility of ammonia may require the use of significant amounts of pilot fuel, which if not carbon neutral would contribute to greenhouse gas emissions. Finally, its lower energy density compared to some fuels - about half that of LNG - means vessels need to carry a substantial volume of fuel onboard to cover long distances.

Liquid ammonia will require new guidelines for successful bunkering operations. Hopefully previous experience gained from the fertiliser and chemicals industry, as well as the recent knowledge gained from LPG and LNG bunkering will help to establish the process.

Infineum is actively working to understand the hardware and lubrication issues associated with using ammonia in marine vessels.

The key challenges from an additive standpoint are related to the high basicity and corrosivity of ammonia that pose compatibility issues with hardware and lubricants. We have subjected our additives to ammonia in the laboratory and in engine tests to give us a firm foundation from which to develop innovative solutions for ammonia combustion engines. Read more here.

Significant investment, innovation and new infrastructure are all needed to enable near-zero emission ammonia production to meet expected demand. Despite the fact that most green ammonia technologies are not yet commercially available, confidence is growing in the use of ammonia in maritime applications. With fuel flexibility increasingly of interest, there are likely to be more ammonia ready vessels on order and an expansion in ‘green' port infrastructure.

Infineum will be ready with the sustainable additives and innovative lubricants needed to support the introduction of new fuels and hardware systems that will be needed as the maritime industry works towards a net zero GHG emissions future.

Based on the articles you've read

Sign up to receive monthly updates via email