Fuels

Fuel additive sea trials

08 July 2025

14 December 2016

Industry must work hard to meet the 2020 sulphur cap

The shipping and refining industries have just three years to decide how to meet the new global sulphur cap being implemented by the International Maritime Organization (IMO). Francesca Cupellini, Infineum Fuels Market Development Advisor, talks about the challenges and highlights the bunker fuel quality concerns that could be expected.

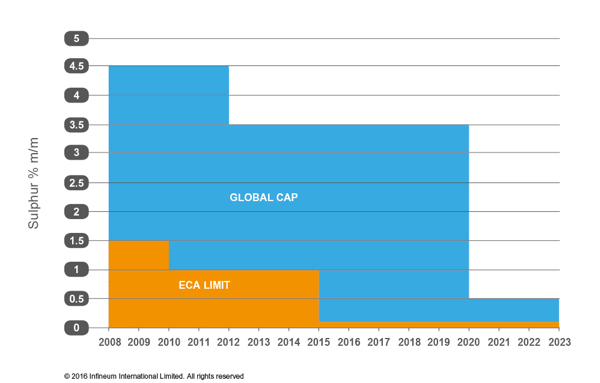

In October, IMO took the decision to set 1 January 2020 as the date to implement a global sulphur cap of 0.50% mass/mass (m/m). This is a significant reduction from the current 3.5% m/m global limit and it is creating a huge wave of activity across the refining and shipping industries.

This is not the first sulphur cut from IMO. Most recently, in 2015, the limit in Emission Control Areas (ECA) was reduced from 1.0 to 0.1% m/m and in 2012 the global limit was cut from 4.5 to 3.5% m/m.

However, the effects of this upcoming global sulphur cut will be felt far wider than before. Refiners and ship operators need to assess and implement major investments and operational changes relatively quickly. But, beyond these immediate impacts, the potential low sulphur fuel availability issues mean all transport sectors and world markets are likely to be affected.

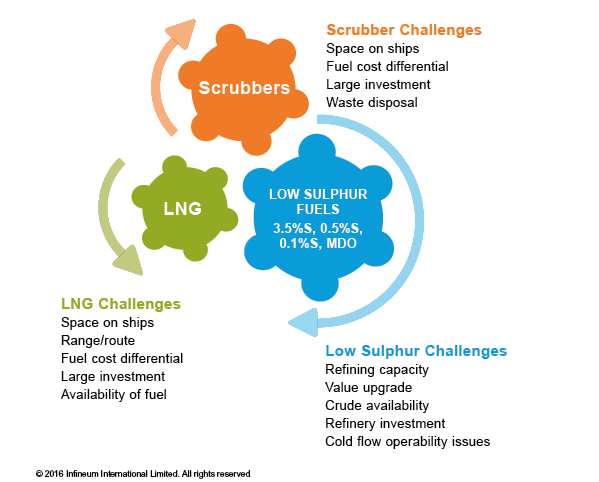

Shippers have three key options to meet the 2020 requirements: the use of low sulphur fuels, liquid natural gas (LNG), or the installation of exhaust gas cleaning systems (EGCS) / scrubbers. Currently, it is unclear which route will be the preferred option and, as each poses different challenges, it is quite likely there will be no outright winner.

The decision on which to adopt will be a tough one to make, and one that will need to involve some level of guesswork.

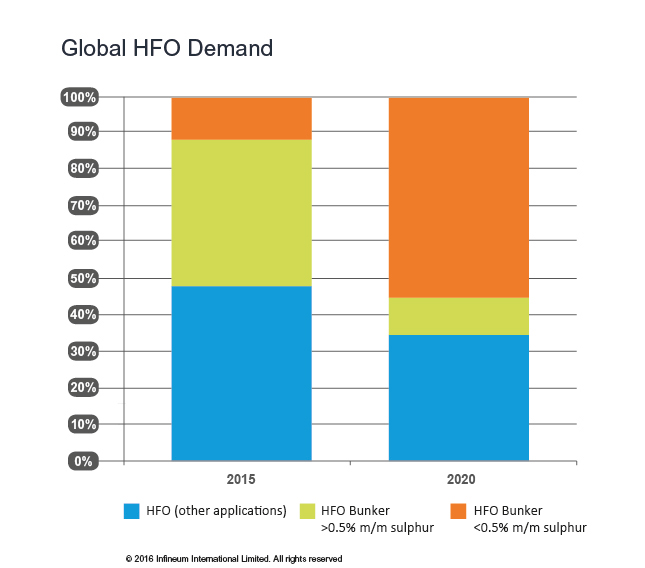

The key elements of the decision making process are the changes in the demand for HFO and the price differential between high and low sulphur bunker fuels.

On one side, the shippers need to decide if it is economically viable to install scrubbers and continue to use high sulphur fuels. On the other side, refiners need to maintain refinery economics and, at the same time, meet the new demand for low sulphur fuels.This is an interesting dilemma, and one that must be resolved and acted on relatively quickly.

In our view, the 2020 sulphur mandate will create a disruption in the oil market whatever solutions shippers adopt. But, the low sulphur fuel compliance route would clearly have the most impact on refiners. While those in ECA areas would continue to produce 0.1% m/m sulphur fuels, on a global level 0.5% m/m sulphur bunker heavy fuel oil (HFO) needs to be produced by 2020, which could result in a shortage of low sulphur HFO.

Clearly, refiners will have to make a number of assumptions if they want to be able to take timely decisions on future production strategies to meet market demand.

Although producing 0.5% bunker from heavy residue is feasible, it is also costly. Switching to producing low sulphur bunker fuel, in compliance with the 2020 regulation, only makes sense if the bunker fuel prices are high enough to cover the necessary investments. And, if as some suggest, the demand for diesel fuels for automotive applications falls, the surplus could be switched to the marine market to meet any shortfall.

It is unclear if the marine fleet will pay additional price premiums for low sulphur fuels.

Again, this could be a big market disruptor. The rise of hybrid fuels, a new bunker fuel type, which is in between middle distillate and residual fuels, could be another option here.

The mix of fuels that will arise is unclear. Although we expect HFO to remain the fuel of choice for a portion of the vessels – especially low speed long distance ships, there is also likely to be an increase in the amount of hybrid and distillate type fuels used. One thing that is very clear however, is that refiners who have not already decided on a strategy need to move quickly as only three years remain to implement the major refinery investments needed.

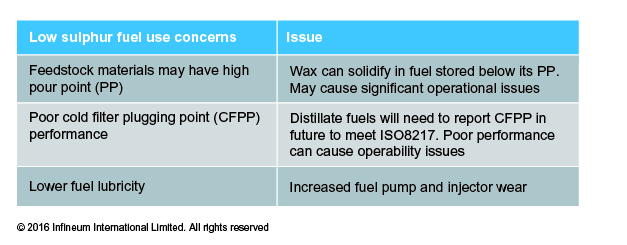

Infineum experience with low sulphur fuels in other transportation applications leads us to believe their wider use in the marine industry will present challenges. In particular, cold flow and lubricity performance may require careful attention.

Refiners will need access to a global network to ensure appropriate additive solutions are readily available so that the fuels they supply continue to meet the ISO8217 standard and the specific local requirements of individual countries.

Infineum has a long history of expertise in improving the properties of low sulphur fuels and preventing operability issues associated with their use.

By actively working with marine industry stakeholders, including the International Council on Combustion Engines (CIMAC), this experience is now being used to identify, better understand and resolve the issues associated with the use of new marine fuels.

One issue that has been observed with the use of low sulphur fuel mixtures is asphaltene precipitation, which can result in a variety of issues including complete blockage of lines. A collaborative project is already underway to develop technologies to resolve this specific problem.

Infineum has been carefully tracking the introduction of low sulphur fuels into the marine market. Building on the success of the well-established Winter Diesel Fuel Quality Survey, an additional survey has been undertaken to examine the quality of HFO, middle distillate and hybrid marine fuels currently available at European bunkering ports.

Click here to access the full Infineum Marine Fuel Survey.

In the future, as the introduction of low sulphur fuels increases, this survey will be extended to cover bunker fuels from the rest of the world. As the data set grows, Infineum will be able to provide a more in-depth analysis and track the global and regional trends in bunker fuel quality.

Article first published in Bunkerspot magazine

Sign up to receive monthly updates via email