Lubricant trends

Advances in automotive lubricant design

04 March 2025

15 January 2019

Engine design changes bring significant challenges for lubricants

Driven by emissions regulations and consumer demands for fun to drive, affordable yet efficient vehicles, engine technology is changing fast. Simon Arbuthnot, European Regional Director at global transport, engineering and environmental consultancy Ricardo Strategic Consulting, offers his perspective on the changes ahead and the ways lubricant companies will need to work to keep up.

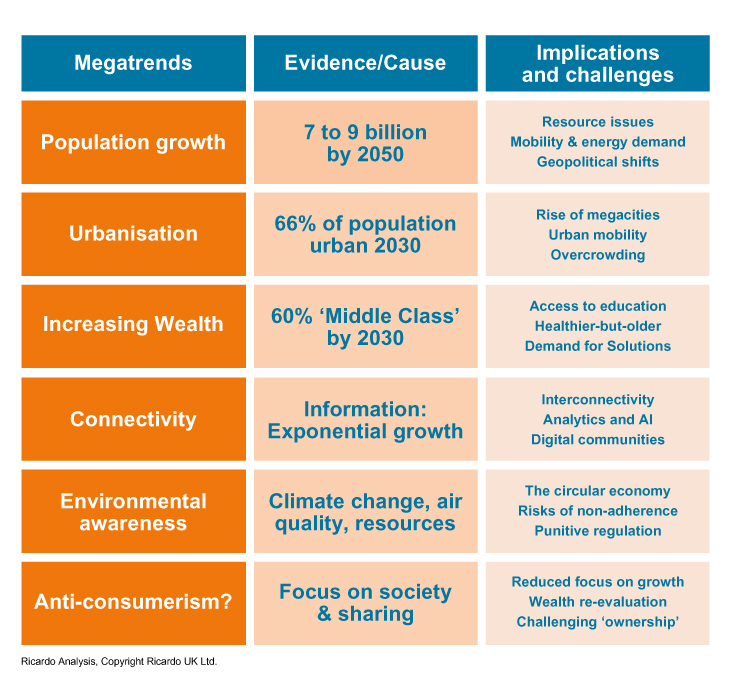

Today’s complex and rather uncertain passenger car market is being shaped by a number of megatrends, including population growth, urbanisation, connectivity and environmental concern, which are all driving a new set of requirements and behaviours.

We can expect the rising population and growing personal wealth to drive growth in global vehicle demand, - even if the markets in mature economies will stagnate. While on the other side of the equation come environmental awareness, urbanisation and vehicle sharing, which could dampen vehicle sales.

But whatever the sales scenario, I see three clear drivers that will compel OEMs to make improvements to vehicle technology: air quality, climate change and urbanisation. These will all shape automotive emissions and fuel efficiency – demanding dramatically reduced tailpipe and CO2 emissions, fuel economy improvements and ultimately zero emissions travel.

In terms of the biggest challenge - reducing fossil fuel consumption so that fewer emissions are generated - there remains significant discontinuity amongst not just regulators, but also consumers and mobility service providers, which spells disruption for the future.

For example, many jurisdictions across the globe are tightening CO2 emissions regulations and we will see real step changes in Europe, India and China over the next few years. In the US, under the current administration, there is a level of uncertainty on the future of emissions cuts, with EPA backing off future targets, while individual states make decisions to further cut CO2.

Since a range of technologies will be required to meet challenging future targets, OEMs are looking across the whole vehicle for solutions to deliver affordable, lower carbon and cleaner transport options. Activities range from improved aerodynamics and light weighting, to greener fuels and lower CO2 forms of electricity, right through to major new advances in conventional combustion engine technology. What seems clear to me, is that we are nearing the point where the limit on internal combustion engine (ICE) efficiency will be reached and vehicles will need increasing degrees of electrification to comply with future fleet-wide targets.

Electrification stands out as a key pillar of OEM strategies. And, as costs start to fall, OEMs are expected to employ the full spectrum of electrification options – from micro, to mild hybrids, through full hybrid, plug-in hybrid, range extender and up to full battery electric vehicles. As we move through the range of possibilities, although the electric power and energy storage potential increases, so does the cost. OEMs will need to balance the advantages against the higher price tag, which may make the vehicles less appealing to consumers. But, what has been evident, since Dieselgate and the introduction of ultra-low emissions zones in some cities, is a publicly stated commitment from many OEMs to introduce increasing levels of electrification (albeit with an ICE still providing some power to the wheels) and full electric vehicles.

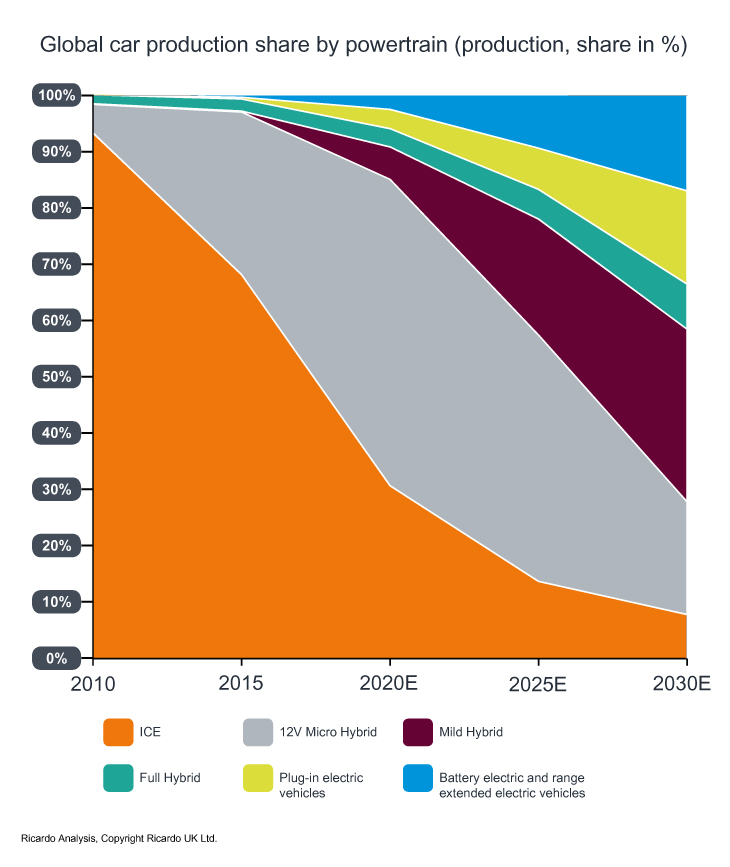

However, despite the bold press statements from some OEMs, forecasts on vehicle electrification are generally low and subject to a high degree of variation.

Using various scenarios, market watchers are estimating anywhere from as low as 4% to as high as 65% for the market penetration of battery electric vehicles and plug-in hybrids by 2030; depending on technology breakthroughs for energy storage and levels of price decreases.

Based on industry feedback post Dieselgate, Ricardo estimates that the manufacture and sales of these vehicles will reach 30-40% by 2030. What I can say with some certainty is that this trend to hybridisation and electrification will be mirrored by increasing levels of powertrain complexity and differentiation.

What our estimates suggest is that there will be little room for non-electrified, ICE-only vehicles in the future and their share will continue to decline rapidly. Micro hybrids will become mainstream by 2020, but decline drastically post 2025, as higher levels of electrification take increasing market share.

Mild hybrids, will grow to about 30% by 2030 as confidence in 48V systems improves. Battery electric and plug-ins will both experience growth towards the end of the forecast period, together accounting for around 34% of the market by 2030.

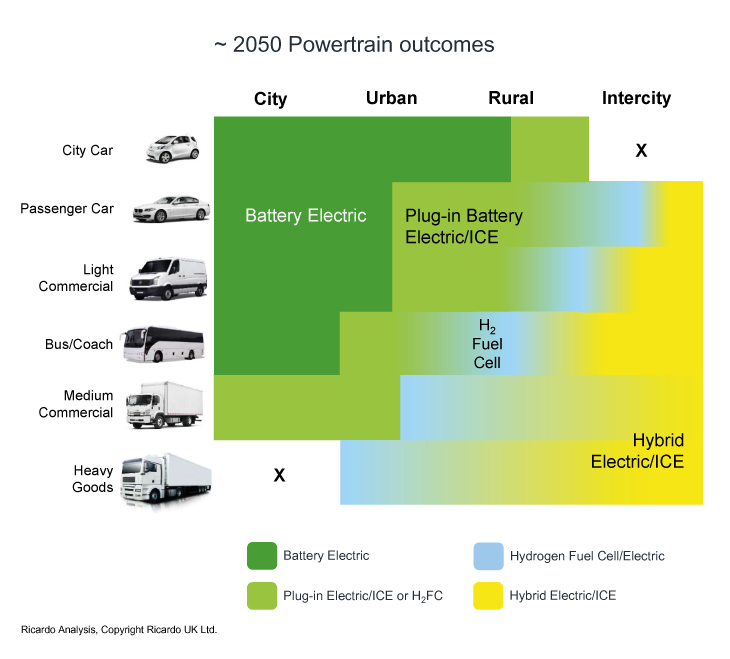

All these changes mean that by 2030 we will be heading down three very different powertrain paths:

Clearly, in options 1 and 2 advanced conventional ICE technology will still have a role to play. However, conflicting demands for air quality improvement, refuelling infrastructure and sustainable fuels means we can expect a very diverse powertrain landscape for many years to come.

Even by 2050, when we expect all vehicles to be electrified with a minimum 48V for ICE and 300-800 volts for battery electric vehicles, up to 30% of vehicles will still contain an ICE. This means continued efficiency improvement of conventional - predominantly gasoline powered - ICE technology is a high priority.

What we can expect is that downsizing, increased turbocharging, friction reduction and down-speeding will be common to all engines. In addition, we will see advancements in aftertreatment and combustion technology, along with an increased use of biofuels. All of these changes will create challenges for lubricant formulations.

Lubricants need to deliver engine protection at higher temperatures and pressures and offer advanced hardware protection over their lifetime in the crankcase. However, they will also need to achieve these performance requirements in a more chemically constrained environment, at lower viscosity levels and over a broader range of operating conditions.

Issues such as catalyst sensitivity, particulate filter regeneration, low-speed pre-ignition, and increased fuel in oil dilution will all need to be carefully managed.

At Ricardo we think that, despite all these changes, lubricant volumes are likely to be maintained, although regulatory changes mean lubricant specifications with higher performance targets are very likely to be introduced.

The regulatory focus on emissions and CO2/fuel economy is intensifying, with high expectations on the potential for improvements in the transport sector. Powertrain electrification is now a central thrust in the development of mainstream vehicles for many OEMs.

Despite all the electrification activity, more than 80% of a growing, global market for light-duty vehicles will still need an internal combustion engine by 2030.

This means investing in efficiency improvements of these conventional powertrains still makes sense. To this end we can expect further engine downsizing, friction reduction and combustion improvements - although none must come at the expense of power output and driveability.

All of these changes impact the lubricant. To reduce internal friction over a broader range of operating conditions, viscosity will continue to decrease. However, these thinner lubricants must also deliver sufficient hardware protection at much higher levels of thermal loading over longer service intervals. Despite the smaller engine displacements OEMs are tending to maintain lubricant volume. This is because, although traditionally smaller displacement engines required a smaller volume of lubricants, the fact that future downsized, boosted ICEs are in themselves ‘working harder’ means that higher volumes of lubricants per displacement will be required. At least in the medium term, we can expect the demand for advanced powertrain lubricants to be fairly stable.

Sign up to receive monthly updates via email