Marine engines

Fuel additive sea trials

08 July 2025

12 January 2021

Just a year after the IMO 2020 sulphur cuts, industry must set course to lower carbon intensity

The introduction of the International Maritime Organization (IMO) legislation to reduce fuel sulphur, just one year ago, which was expected to have a huge impact on shipping and its associated industries, seems to have gone fairly smoothly. To date, there have been only a few reports of availability issues, off-specification fuels and some concern over increased cylinder liner wear. Insight explores these issues and reports on the upcoming greenhouse gas emissions reduction measures recently approved by the IMO Environment Committee.

At the end of 2019, those associated with the shipping industry were busy assessing how best to comply with the immanent IMO sulphur requirements. These IMO 2020 regulations meant, from January 1 2020, ships would be unable to use fuels containing more than 0.50% sulphur, unless fitted with an appropriate exhaust gas cleaning system. At the time it was billed as the ‘biggest thing that has happened to shipping for a century’, with implications for the whole industry from refiners and bunkerers, ship operators and owners to lubricant and additive suppliers.

Despite the uncertainties around the impact on refinery product mix, compliant fuel availability and ship operability the transition to the new low sulphur norm passed with little fanfare and relatively few issues.

Throughout 2020 the Lloyds Register fuel oil bunker analysis advisory service (FOBAS) issued seven bulletins regarding fuel quality issues, which have been associated with sediment levels, water and flash point. Total Sediment Potential (TSP) exceeding the specified ISO 8217 limit of 0.10% mass has been reported at Rotterdam, Balboa, Singapore and Port Elizabeth. The TSP results of these off-specification fuel samples ranged from 0.16–0.43% mass.

High TSP fuels can result in excessive sludge deposition in tanks and throughout the handling and treatment/fuel injection systems.

The use of high TSP fuels can also result in highly compromised combustion leading to engine and turbocharger damage. In August 2020, FOBAS suggested that the issue of high TSP with these ‘new’ fuels was becoming a more regular occurrence. In our view, to ensure fuels do not cause serious operational issues it is essential to fully understand the TSP level of the fuel throughout its lifetime on board. Click here to read our latest article on TSP.

As the world emerges from the impact of the COVID-19 pandemic, marine fuel manufacturers and blenders are likely to stretch their formulation boundaries in order to optimise sourcing costs. This means the continued monitoring of fuel quality will be important in order to determine if further sedimentation and other quality and operability issues surface.

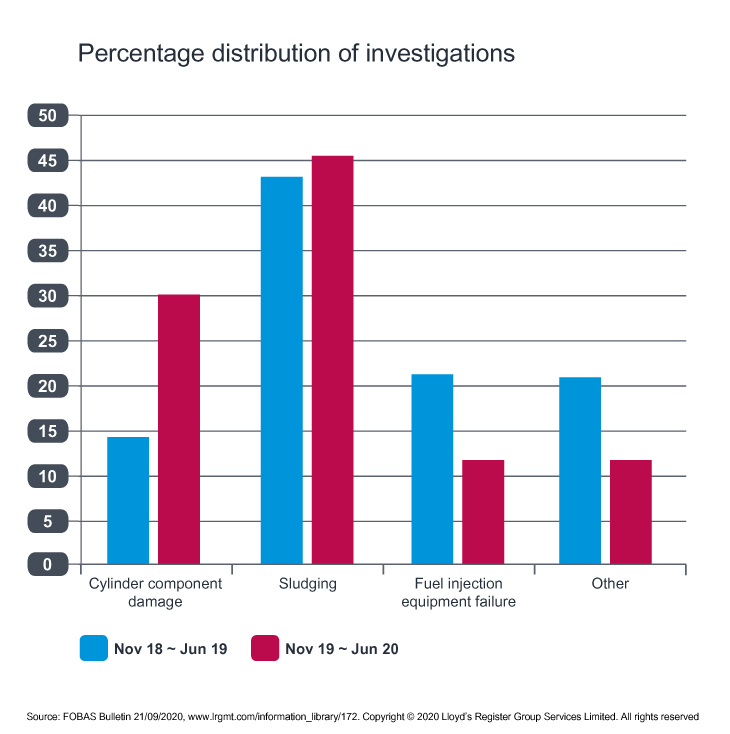

In September, FOBAS issued a report showing excessive cylinder component wear in large two-stroke engines during the use of 0.50% sulphur fuels. Its data indicate that overall incidents related to cylinder component damage almost doubled for the period November 2019 to June 2020 vs. the same period in 2018/19.

Cylinder lubricant quality could be a contributing factor here. It is important to understand that it is not just a matter of taking current technology that works in a high sulphur fuel environment and down treating it for use in a low sulphur fuel situation.

Formulations in heavy sulphur fuel oil environments can be almost completely detergent that comprise a core, which provides the neutralising power to handle the acids from the sulphur in the fuel. This core is stabilised by the surfactant that comes as a chemical sheath. If the neutralisation power is removed in a lower sulphur fuel environment then coincidentally the ability of the detergent to clean up the vessel is reduced.

In our view, the use of advanced cylinder oils with balanced formulations matched to the engine and fuel type is now more essential than ever.

The shipping industry has been hard hit by the COVID pandemic. Year-on-year port calls of container ships went down by as much as 8.5% in mid-June. They have somewhat recovered, but in early August were still 3% below the levels of one year earlier. Forecasts expect maritime trade growth to return to a positive territory in 2021, assuming world economic output recovers. As the shipping industry picks up, it will be interesting to see if there is also an increase in the incidence of issues, and if they are related to the use of VLSFO.

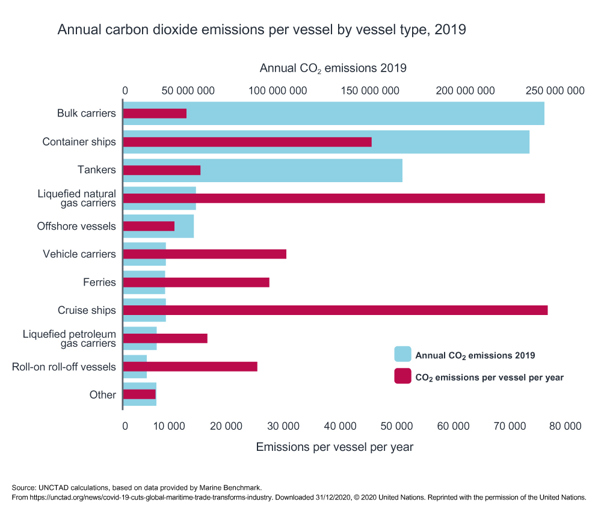

Despite the challenges and uncertainties facing the marine industry, post-COVID-19 recovery policies need to support further progress towards green solutions and sustainability. Carbon emissions from shipping are already coming under scrutiny.

In November, the IMO Marine Environment Protection Committee (MEPC) approved amendments to cut emissions from existing ships. Draft new mandatory regulations require ships to combine a technical and an operational approach to reduce their carbon intensity. This is inline with the Initial IMO GHG Strategy, which aims to reduce carbon intensity of international shipping by 40% by 2030, compared to 2008.

Current requirements are based on the Energy Efficiency Design Index (EEDI), for new build ships, which means they have to be built and designed to be more energy efficient than the baseline; and the mandatory Ship Energy Efficiency Management Plan (SEEMP), for all ships. The draft amendments build on these measures by bringing in requirements to assess and measure the energy efficiency of all ships and set the required attainment values.

The latest set of amendments include the technical requirement to reduce carbon intensity, based on a new Energy Efficiency Existing Ship Index (EEXI) to be calculated for ships of 400 gross tonnage and above, which indicates the energy efficiency of the ship compared to a baseline. Ships will be required to meet a specific EEXI based on a reduction factor relative to the baseline. Also included are the operational carbon intensity reduction requirements, based on a new carbon intensity indicator (CII) for ships of 5,000 gross tonnage and above, which determines the annual reduction factor needed to ensure continuous improvement of the ship’s operational carbon intensity within a specific rating level. The dual approach aims to address both technical (retrofitting and equipment) and operational measures.

The draft amendments to cut emissions are under review and are likely to be adopted at the next MEPC 76 session in 2021.

While switching to alternative fuels is one approach to cutting emissions, improving the fuel economy performance of existing ship operations will become increasingly important; an area where advanced fuels and lubricants can help. Improving combustion efficiency and the use of lower viscosity lubricants to ensure more energy is transferred into forward propulsion are elements that Infineum has already proven in passenger car and heavy-duty diesel truck applications. The experience gained here, both on the lubes and the fuels side, can be used to evolve rather than revolutionise fuel economy technology for the marine industry.

Sign up to receive monthly updates via email