Fuels

Fuel additive sea trials

08 July 2025

02 July 2019

IMO 2020: the sulphur reduction programme with a difference

The International Maritime Organization’s 2020 regulations requiring reduced fuel sulphur levels will have far reaching impacts for many refiners as they work to overcome the challenges associated with removing sulphur from their heavy residual fuels. Steve Benwell, Infineum Global Fuels Key Accounts Manager, explains why this is no ordinary sulphur reduction programme.

To meet the requirements of the new MARPOL regulations from January 1 2020, ship operators have a number of compliance options:

As with any regulation, non-compliance is also an option. Views about the levels here vary considerably, with industry watchers suggesting anywhere between 10-30% in year one. However, to aid consistent implementation and effective enforcement, ships without a scrubber will be banned from carrying non-compliant fuel oil (>0.50% S) by March 2020.

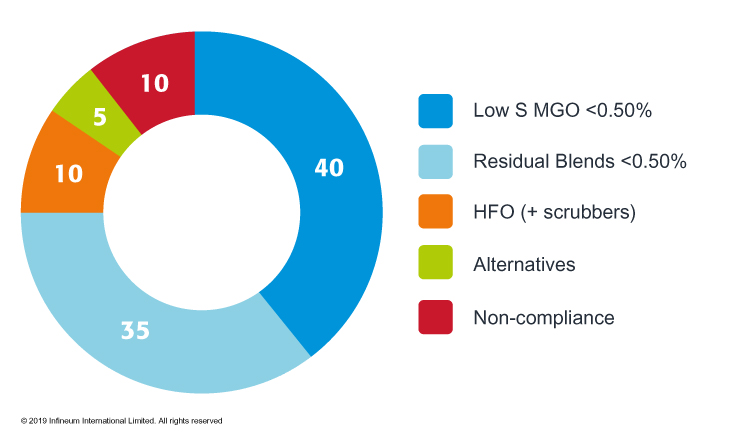

Currently, the exact percentage uptake of each compliance option remains uncertain. What does seem clear is that we are entering a multifuel future, one in our view, where at least initially and likely for some time to come, low sulphur conventional fuels will be the predominant solution.

One picture of a multi fuel future, where low sulphur conventional fuels are the preferred solution

One picture of a multi fuel future, where low sulphur conventional fuels are the preferred solution

So why is IMO 2020 no ordinary sulphur reduction programme? It is simply because these changes create new challenges not only for refiners who must decide how to best produce compliant fuels but also for the shipping industry that needs to handle the compositional differences that will arise.

At the refinery things are about to become much more complex. The fuel sulphur reduction requirements to meet IMO 2020 are more difficult and expensive to realise than past sulphur reductions that have been achieved for lighter automotive fuels. The routes to low sulphur distillate fuels are pretty well defined but refiners have a number of tools and/or processing options to choose from to fulfill the anticipated demand for so called ‘very low sulphur fuel oil‘ (VLSFO) or other hybrid low sulphur fuels:

These new VLSFOs will exist at the interface between mainly paraffinic and mainly aromatic materials and most will contain at least some asphaltenes. The challenge here is that, depending on their final composition, the various marine fuels may no longer be compatible with each other, which could limit interchangeability.

For the vessel operator, the transition to low sulphur fuels brings a number of potential fuels related challenges.

In our view, three of the most critical performance areas where issues associated with the use of low sulphur fuels may arise are asphaltene stability, wax management, and lubricity.

Performance area 1: Asphaltene stability

Incompatibility of the fuels or components makes asphaltene destabilisation a very challenging problem to overcome. Because complete segregation of fuels through the supply chain is almost impossible, ship operators need to consider what will happen when fuels from different manufacturers or blenders are mixed in their fuel tanks or fuel delivery systems.

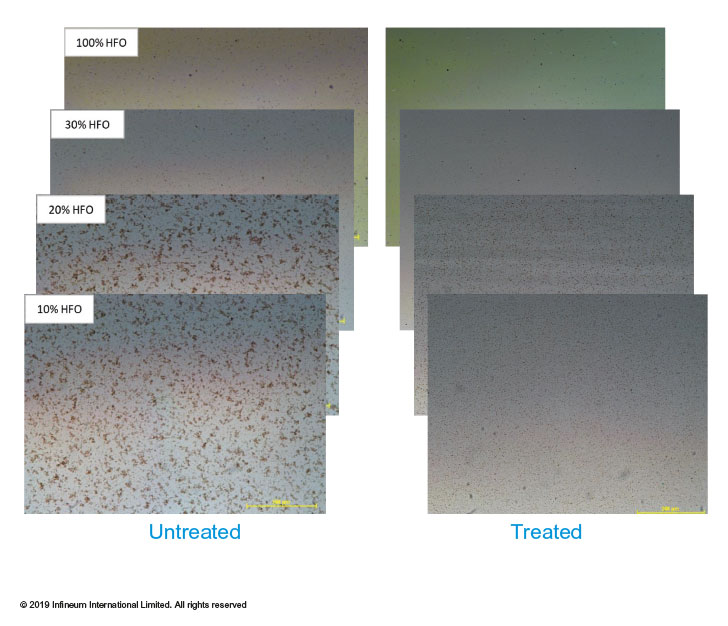

While microscopy is not a standard test, it provides useful insights into the mechanisms that can affect asphaltene stability. In blends of aromatic HSHFO with more paraffinic low sulphur distillates, asphaltenes can destabilise (see ‘untreated’ microscopy images) and precipitate to form sludge deposits in tanks, clog up the fuel delivery system and upset purifier operation. Unfortunately, using today’s typical fuel sulphur levels, distillate blend ratios of 70% or above are required to achieve a final sulphur content of <0.50% - a very clear demonstration of one of the challenges that the industry is facing.

However, Infineum has already developed new asphaltene management additives that, when added to the residual portion of the fuel, significantly inhibit their natural tendency to destabilise.

Microscopy images of asphaltene management additive performance

Microscopy images of asphaltene management additive performance

A number of tests can be used to assess asphaltene stability and compatibility, with the ROFA (ASTM D7157), Zematra (ASTM D7060) and Porla (ASTM D7112) being identified as the most likely to provide meaningful guidance to users. Industry bodies are currently working to better define guidance and specifications in this area, but Infineum additives have already demonstrated the ability to positively impact the stability/compatibility parameters of these tests, thereby enhancing a fuel’s fitness for purpose.

Performance area 2: Wax crystal modification

The more paraffinic nature of low sulphur crudes and other low sulphur components means marine fuels are likely to become increasingly waxy.

Infineum has been using wax crystal modification additives successfully in land transportation fuels for many decades and, in our experience, the same basic principles will apply to marine fuels. As the temperature falls, wax in the fuel comes out of solution and grows into wax crystals. In untreated fuels these are large, flat structures that can plug tank output screens, which can starve the ship’s engine of fuel. As temperatures continue to fall, the crystals grow to form lattice structures, quickly gelling the fuel (the pour point), even in cases where as little as 1-3% of wax may be out of solution.

Cold flow additives change the morphology of wax as it crystalises and if treated appropriately create thin needle shapes, which helps to prevent wax plugging and deposition issues, thus ensuring trouble free operation.

Infineum research has revealed that marine distillate fuels treated with cold filter plugging point (CFPP) additives do not cause tank screen/filter plugging, while those solely treated with pour point depressants may cause plugging. Although the CFPP test, which is used pervasively in on-road transportation fuels, may not be the most optimal measure of operability in marine applications, it can provide better protection than pour point alone and CFPP is now a reporting requirement in the latest ISO 8217-2017 specification for marine distillates.

When stored at temperatures below the fuel’s cloud point or wax appearance temperature, either at marine terminals or on board ship, wax can also settle, solidify and be deposited in tank bottoms and other low flow areas. Use of Infineum’s cold flow improvers has also been shown to significantly mitigate this phenomenon.

Wax deposition in a marine vessel tank (Left), and an Infineum marine simulation rig (centre and right)

Wax deposition in a marine vessel tank (Left), and an Infineum marine simulation rig (centre and right)

Performance area 3: Lubricity

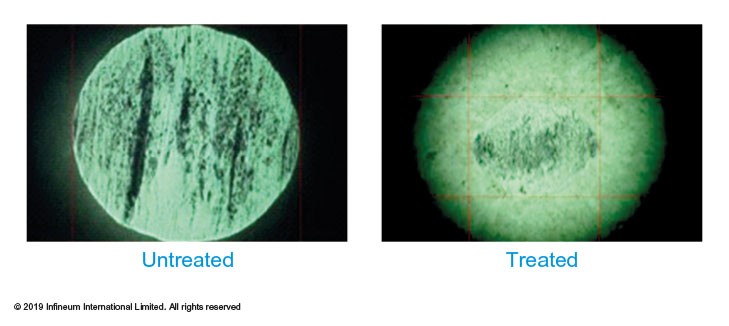

There is a strong relationship between a fuel’s viscosity and its ability to help in the lubrication of the fuel delivery system components. Low sulphur marine fuels, including MGO/MDO/VLSFO, typically have lower viscosities than their HSHFO counterparts, and their use may result in higher wear rates in, for example, pumps and injectors.

Increased wear scar is observed in unadditised low sulphur fuels

Increased wear scar is observed in unadditised low sulphur fuels

Lubricity additives, have been tried, tested and trusted for many years in other transportation areas, where fuel composition has compromised lubrication. Since Infineum lubricity additives have been tested under rigorous US Navy testing protocols, designed to account for the specific needs of marine fuels, they will be especially useful in marine applications.

The future looks far more complex in the marine world as a much wider range of fuel compositions become available and the ways in which fuels are produced changes.

Future fuels may be increasingly incompatible, something that will introduce new concerns for the marine industry in terms of fuel selection, storage and use.

Fuel additives designed to solve these emerging issues can help refiners produce fit-for-purpose fuels and ship operators to achieve trouble free operation.

Sign up to receive monthly updates via email