Fuels

Fuel additive sea trials

08 July 2025

12 May 2020

Sustainability goals are driving change in the fuels mix

As the world looks to decarbonise the transport sector and to increase the use of fuels from renewable sources, regulators are introducing and tightening bioenergy and CO2 emissions targets. Javier Montes, Infineum Fuels Technical Sales Account Manager, explores the challenges for oil companies in Europe, where biofuels, such as hydrotreated vegetable oil, are expected to play an increasingly important role in the future transportation fuels mix.

Across the world, governments and regulatory agencies are legislating to reduce greenhouse gas (GHG) emissions in an effort to slow global warming. At the same time, as the desire to be more sustainable grows, authorities, companies and individuals are looking for renewable forms of energy as an alternative to fossil-based oil and natural gas.

The transport sector is a key consumer of energy in Europe, and an important contributor to GHG emissions. In the next ten years, in line with projected GDP growth, transport activity is expected to significantly increase, which will lead to an intensification of energy consumption. The European Union (EU) Reference Scenario projects that energy demand from the transport sector will increase to around 32% of total energy demand by 2030. This will essentially be driven by increased freight transport, while passenger transport is expected to steadily fall.

The decline in energy demand from passenger vehicles, the introduction of alternative powertrains in this segment and the improvement of engine energy efficiency will lead to a steady reduction of gasoline demand over the next decade. Conversely, rising freight transport activity, especially on-road heavy-duty diesel vehicles, means automotive diesel oil (ADO) or diesel fuel demand is expected to maintain its share, offsetting the expected reduction in demand for this fuel from passenger transport. To 2030, about 90% of transport energy consumption is forecast to be oil products, 55% of which will be diesel fuel (including marine bunker fuels).

The European Commission (EC) has set a long term strategy for global climate action and has recognised the important role that low carbon fuels, particularly biofuels, have to play in decarbonising the transport sector.

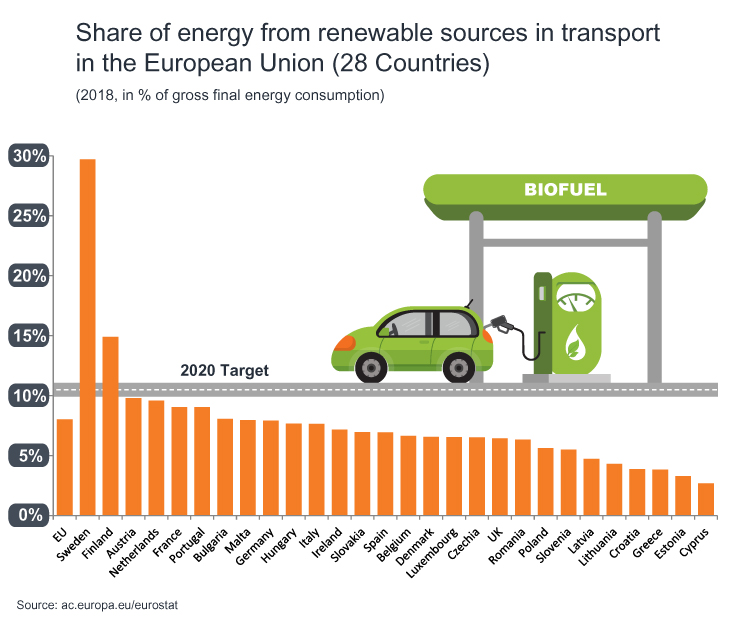

The Renewable Energy Directive (RED I), introduced in 2009, required Member States to set specific national renewable energy targets to achieve at least a 10% share of renewable energy in road and rail transport by 2020. However, progress has been mixed with the EU as a whole still around 2% below the 10% 2020 target.

In line with Paris Agreement climate goals, in terms of reduction of CO2 emissions, the second stage of the Renewable Energy Directive (RED II) has been issued. This sets a higher renewable energy share target for road and rail transport of 14% in 2030. Within the 14%, there is a dedicated sub-target of 3.5% for advanced biofuels, which can be produced from around 20 pre-defined feedstocks – mostly biomass residues and waste-based, but excluding used cooking oil and category 1 & 2 animal fats.

Focusing on the diesel fuel segment, the RED II bioenergy target will create new challenges for oil companies.

To date, refiners have in the main been coping with the RED I bioenergy target by blending fossil diesel fuel with first generation fatty acid methyl ester (FAME) from crop-based feedstocks such as palm, rapeseed and soy oils.

Recently, in the EU there has been a significant increase in the use of non-crop based, second generation biodiesel, for example, FAME from waste materials, mainly used cooking oil methyl ester (UCOME) and tallow methyl ester (TME) produced from animal fat. This trend is driven by the fact that these biodiesels are likely to provide higher GHG reduction at lower cost, due to a lower residue feedstock price and double-counting(1), which halves the amount of biodiesel required for refiners to achieve the bioenergy target in many EU Member States.

However, with biodiesel alone, it is not possible to attain the more challenging RED II bioenergy share targets in terms of both total bioenergy and energy from advanced feedstocks. There are several reasons for this. The first is related to the chemical composition of FAME, which is different to fossil diesel fuel, resulting in its blending ratio with fossil fuel being limited to 7% max. v/v, to protect engines from damage. The energy content of FAME (even when using doubling-counting feedstock biodiesel) cannot provide the required 14% bioenergy share at the maximum blending limit. The second reason is related to technology readiness for advanced so-called 3rd generation biofuels production. The available technology pathways to produce biofuels from the most of advanced feedstocks are not suitable for making FAME, but rather to yield paraffinic biofuels.

The two most relevant paraffinic biofuels are hydrotreated vegetable oil (HVO) and biomass-to-liquid (BTL).

HVO can be produced from vegetable oil and animal fats (lipids) by hydrotreatment and isomerisation, whereas BTL is produced through Fischer Tropsch synthesis. They can be made from both, crop-based feedstocks and from diverse advanced renewable feedstocks such as wood, manure and lignocellulosic materials. The resulting product is a paraffinic renewable diesel that, unlike FAME, can be blended with fossil diesel fuel without limitation according to the EN 590 standard as they are chemically comparable. For this reason, the use of paraffinic renewable diesel fuel is appropriate to achieve both the total bioenergy and advanced bioenergy targets set by RED II.

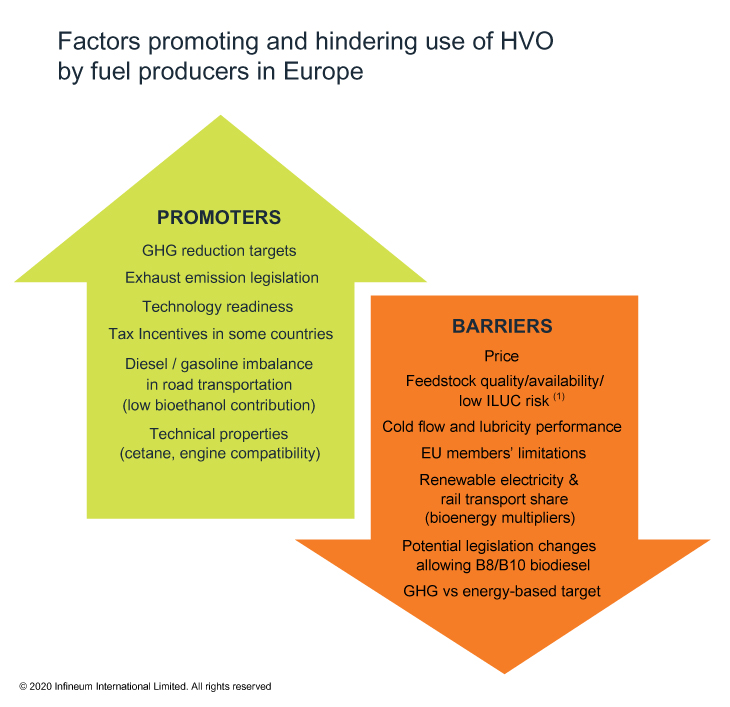

While the technology to produce BTL on an industrial scale is not yet ready, HVO is already commercially available, and its global production has increased, with most consumption in the EU and US. HVO is playing a major role in meeting the growing demand in the refining sector for a liquid biofuel with high GHG reduction potential according to RED II goals.

HVO is becoming the single available alternative for refineries to bridge the bioenergy share gap between what FAME can provide and what RED II requires.

It is important to note, that refiners need to meet RED II targets in both diesel and gasoline fuels. Bioethanol for gasoline provides a lower energy contribution compared with biofuels for diesel fuel. Therefore, a considerably higher bioethanol blending share in gasoline would be required to achieve RED II targets. However, the bioethanol blending ratio in gasoline (even if incorporated as ETBE) is limited due to technical constraints, with the maximum set at 10% v/v share (E10) by the Fuel Quality Directive. In many countries, because existing vehicles cannot use higher bioethanol content, 5% v/v ethanol (E5) is used as a protection grade. As a result, at the refinery level, paraffinic biofuels, such as HVO, will not only bridge the gap for FAME but also offset the bioenergy debit in the gasoline pool.

The use of HVO is not uniform across Europe, with Nordic countries leading the way, driven by their more ambitious GHG savings targets and tax incentives. However, the use of HVO as a drop-in component in European refineries is expected to continue growing, from ~1.4% (2) share of total on-road diesel fuel used in 2019 to ~2-6% by 2030. Although more ambitious country specific bioenergy targets or a lower introduction of renewable electricity may lead to higher HVO volumetric share, within the RED II timeframe it is unlikely its share will reach double-digits.

100% HVO fuel has low exhaust emissions and is fully compatibility with both the existing fuel supply infrastructure and the vehicle fleet. These factors mean it is being used as an alternative to fossil diesel fuel for heavy-duty and bus fleets under the EN 15940 standard, mainly in Nordic countries and more recently in The Netherlands. In addition, high HVO content fuels such as diesel R33 (7% FAME + 26% HVO + 67% fossil diesel) or diesel + 15% HVO have been commercialised in recent years under the EN 590 standard. To meet the rising demand for HVO, global installed capacity is expected to increase.

Forecasts estimate that by 2030, global capacity could triple from the current ~7 million tons per annum, mainly in the highest HVO consuming areas of Europe and North America.

However, there are some barriers preventing further and faster introduction of HVO in refineries - particularly its higher production cost and retail price compared with FAME. Another factor that could dampen HVO consumption are the bioenergy ‘multipliers’ that RED II applies to renewable electricity - which when used in road transportation is considered as four times its actual energy content. Since the target for renewable energy in the transport sector is defined at a national level, this means that EU States could set lower bioenergy share targets for liquid biofuels as renewable electricity contribution becomes more relevant, diminishing the need of biofuels at the refinery level.

Oil companies need to define how to meet RED II mandates according to the specific biotargets set by each EU Member State. They must also consider strategies in terms of the mix of renewable energy generation in their portfolio (biogas, renewable electricity and its multipliers), as well as technical constraints related to increasing biofuels volume share. As a result, refiners will determine the blend rate and quality of FAME / HVO or co-processed vegetable oil they need to use to meet bioenergy targets by 2030.

HVO is a valued drop-in component for diesel fuel in refineries. Its low density allows heavier molecules to be upgraded – although in some cases the HVO blend ratio might be somewhat limited to prevent the final fuel falling below EN 590 minimum density requirements. Its high cetane number, adequate distillation range, very low sulphur, zero aromatics, good stability and suitable viscosity mean HVO can help to attain the required bioenergy content while also having positive effects on diesel fuel quality.

However, on the downside, for applications using HVO fuels there is a lubricity debit. This can be restored in both HVO 100% fuels and blends with very low sulphur fossil fuels containing less than 2-3% FAME by using effective lubricity improver additives.

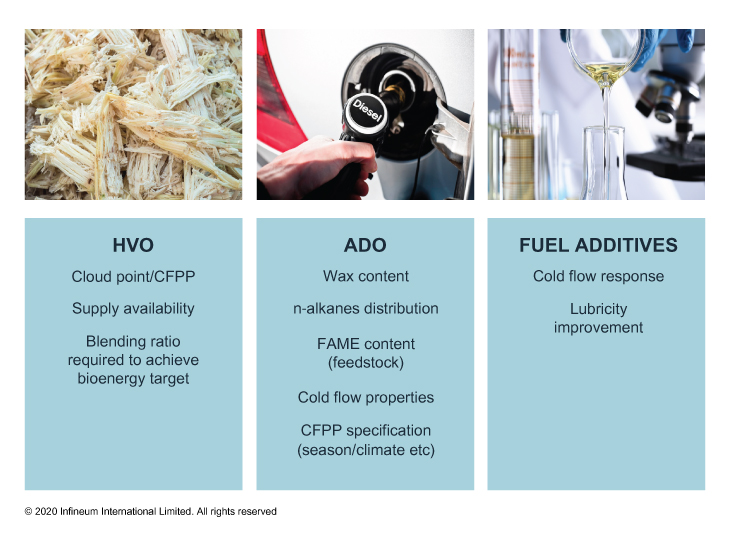

One of the most challenging technical features of HVO, often seen as the main limiting factor at the refinery, is its cold flow properties, characterised through cloud point (CP) and cold filter plugging point (CFPP).

The cloud point of HVO can be reduced by producers through the isomerisation process to low enough figures to make it suitable even for very cold winter arctic grades. But, high isomerisation involves high severity conditions in the reactor, which reduces catalyst lifespan, promotes cracking rather than isomerisation (resulting in higher naphtha and gas yield and lower main product yield) - all of which means it is more expensive to produce low cloud point HVO.

Another factor limiting the availability of very low cloud point HVO in the market is that some existing European HVO production facilities have evolved from refinery revamping projects, where the isomerisation reactor may not have been adapted.

Blending HVO into diesel fuel essentially means adding paraffins, i.e. wax; the higher the HVO cloud point and the higher the amount of HVO, the more wax is added.

In addition, HVO wax distribution (n-alkanes) is very narrow, compared with base diesel fuel, which also modifies the wax distribution of the final fuel where it is dropped in. Both factors, wax content and wax distribution, not only impact the properties of diesel fuel but also its response to cold flow additives. Therefore, when using HVO as a drop-in component for diesel fuels, the selection of an appropriate HVO cloud point is very important. In addition, the use of specialised cold flow additives, designed to treat narrow fuels, should be considered as a cost-effective way (by reducing treat cost) to ensure trouble-free operation.

The right balance of HVO cloud point, HVO blending share and cold flow additive technology are key to achieving bioenergy targets cost-effectively. Also, the synergistic effect of FAME in the cold flow properties of diesel fuel and additive response should be considered.

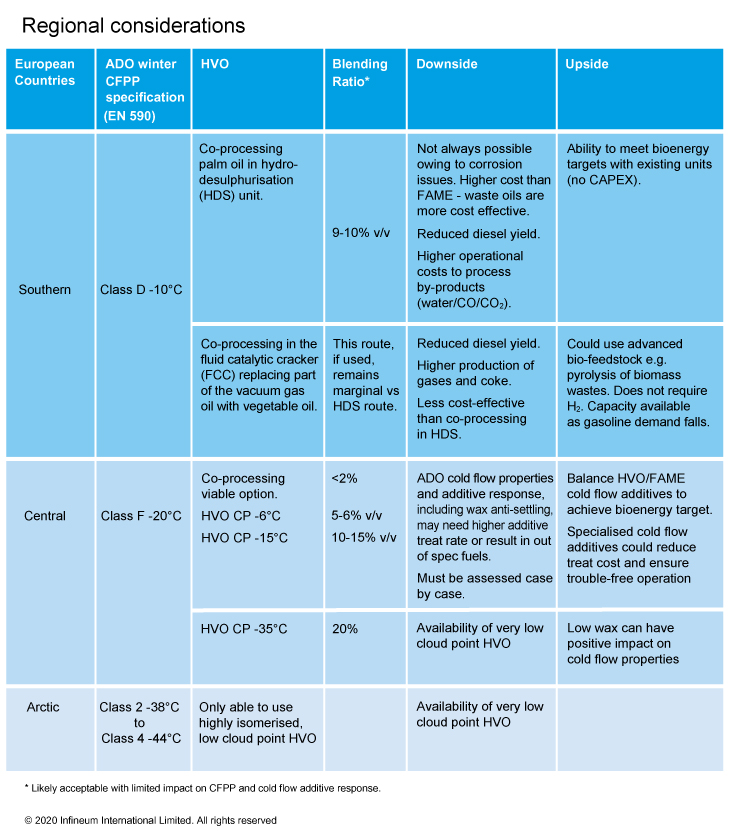

Refineries need to carefully assess how to use HVO by considering several factors as shown below.

HVO is not only suitable as a replacement of fossil diesel fuel for road transportation but also could provide several benefits in the marine sector, which is currently experiencing significant change and uncertainty. New International Maritime Organization regulations that cut fuel sulphur from 3.5% to 0.50% from January 2020 and introduce wider Tier III NOx limits from 2021, combined with future GHG restrictions are all driving changes to fuel choice and operations. Here, HVO could offer a low sulphur, high cetane and renewable alternative to conventional low and very sulphur bunker fuels. Currently, for example, marine bio-distillate fuels (MGO) containing 50% HVO and bio-residual fuel (HFO/LSFO) are available in the Port of Amsterdam.

Aviation transportation is also setting specific GHG reduction targets, which are expected to increase demand for liquid biofuels in the short to medium term. Among several ASTM certified pathways to produce alternative jet fuel for commercial flights, a highly isomerised and hydrocracked HVO fit for jet fuel use, known as HEFA, is taking the lead because the technology is mature.

As on-road, marine and aviation transportation modes increase their uptake of liquid biofuels in the coming years competition for available supply will intensify.

This trend is expected to create more pressure on sustainable feedstock supply availability and price volatility – a topic much debated in Europe.

In the long term, we can expect to see an increasing share of different types of biofuels, driven by RED II, a further need of hydrotreatment (for very low sulphur fuels and to increase yield of middle distillates for marine), growth in demand for jet fuel (meaning less kerosene availability for middle distillates) and low gasoline demand. All these factors will lead to increased complexity and variability of the molecular composition in automotive diesel fuels. Lubricity improvers and specialised cold flow additives, designed for narrow fuels, could be necessary to cost-effectivelcy treat these more complex future fuels.

Notes

(1) Higher GHG savings and sustainability criteria (low ILUC-risk - fuels produced in a way that mitigate ‘Indirect Land Use Change’ emissions) can be better met by advance biofuels, since RED allows them to be considered as twice its energy content (so-called double-counting), which is a high incentive for users.

(2) This includes vegetable oil co-processing. Co-processing is direct hydrotreatment of vegetable oil in existing hydro-desulphurisation units (HDS) in the refineries, as opposite to used HVO as drop-in in diesel blend.

Sign up to receive monthly updates via email