Marine engines

Fuel additive sea trials

08 July 2025

09 June 2023

Emissions and decarbonisation goals set big challenges for shipping

The International Maritime Organization (IMO) is introducing new emissions cuts and working towards the decarbonisation of the international shipping fleet. Huge changes can be expected and Andrea Ghionzoli, Infineum Marine & Gas Engines Strategic Marketing Manager, examines what challenges lie ahead for this fast-changing industry.

The marine industry has been through a period of radical change in recent years. First the uncertainty around the implementation of IMO sulphur cuts was swiftly followed by the impacts of the global pandemic and recent geo-political tensions. Now, the pace of marine emissions legislation is accelerating. The IMO is introducing further restrictions on NOx and black carbon and expanding its emissions control areas to improve air quality. And, at the same time, is introducing ambitious plans to reduce, and eventually eliminate, greenhouse gas (GHG) emissions from international shipping.

In order to curb NOx emissions, controls have been widened to cover ships constructed on or after January 2016 operating in North American and US ECAs and to ships constructed on or after 1 January 2021 operating in the Baltic and North Sea ECAs. Outside of these areas Tier II limits apply. Limits are based on ship rpm and, with most large two-stroke slow-speed diesel engines operating below 120 rpm, a Tier III limit of 3.4 g/kwh applies, which is more than 76% reduction vs Tier II limits. Aftertreatment systems, such as selective catalytic reduction (SCR) and exhaust gas recirculation (EGR) are being used to meet these tightening NOx regulations. However, both technologies come with cost and operational issues.

The need to reduce black carbon emissions from ships is being driven by the IMO’s 4th Greenhouse Gas Study, which makes the case to regulate substances (including black carbon) that may contribute to climate change. As the regulations firm up there are expected to be impacts on fuel use, the need for additional aftertreatment systems on board vessels, changes in operation and perhaps even a move to new propulsion technologies.

In our view the use of specifically formulated and proven fuel additives can provide tangible reductions in NOx and black carbon emissions as well as providing fuel economy benefits.

With the world’s attention focusing on climate change, the efforts to curb the emissions of GHG (and most specifically carbon dioxide) from shipping are intensifying.

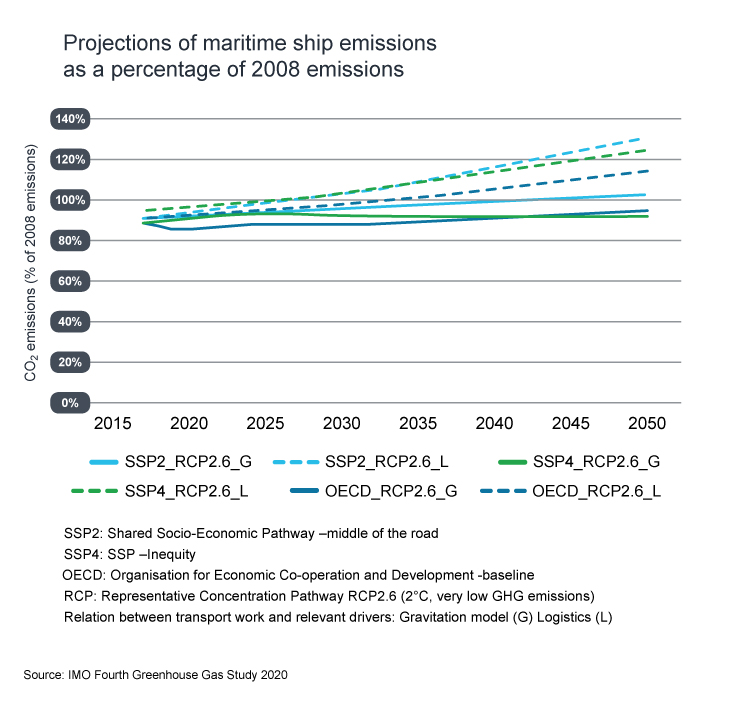

The IMO GHG Study reports that between 2012 and 2018 not only did total GHG emissions from maritime shipping rise by 9.3% but also that demand for shipping grew twice as quickly as fuel efficiency improved. In addition, IMO suggests that in a business-as-usual scenario emissions are projected to increase from about 90% of 2008 emissions in 2018 to 90-130% of 2008 emissions by 2050.

In its initial strategy IMO has a goal of cutting GHG emissions from international shipping by at least 50% from 2008 levels by 2050 with an aim to phase them out as soon as possible in this century. It also envisages a reduction in carbon intensity as an average across international shipping of at least 40% by 2030 pursuing efforts towards 70% by 2050 compared to 2008.

To set ships on a course to meet the 2030 carbon intensity reduction target, IMO adopted mandatory measures under the International Convention for the Prevention of Pollution from ships (MARPOL) Annex VI. These MARPOL Annex VI amendments combined technical and operational approaches to improve the energy efficiency of ships. In November 2022, new short-term measures entered into force to reduced ships’ carbon intensity. These introduced the Energy Efficiency Existing Ship Index (EEXI), which indicates the ship’s energy efficiency, the annual operational carbon intensity indicator (CII) rating and an enhanced Ship Energy Efficiency Management Plan (SEEMP).

From January 1 2023 EEXI has been mandatory and ships of 400 gross tonnage and above are required to meet a specific EEXI based on a reduction factor relative to the baseline. The new CII determines the annual reduction factor needed to ensure continuous improvement of the operational carbon intensity for ships of 5,000 gross tonnage and above. The first annual reporting on carbon intensity will be completed this year and the first A to E ratings will come out in 2024.

Ships will be targeted with attaining a ‘C’ or better on the A to E CII rating.

The performance level will be recorded in a Statement of Compliance to be further elaborated in the ship’s SEEMP.

IMO is required to review the effectiveness of CII and EEXI implementation by January 1 2026, and if necessary to develop and adopt further amendments. In addition, Member States are already working on the revision to the Initial GHG Strategy, which is set for adoption in mid-2023, which could drive further change.

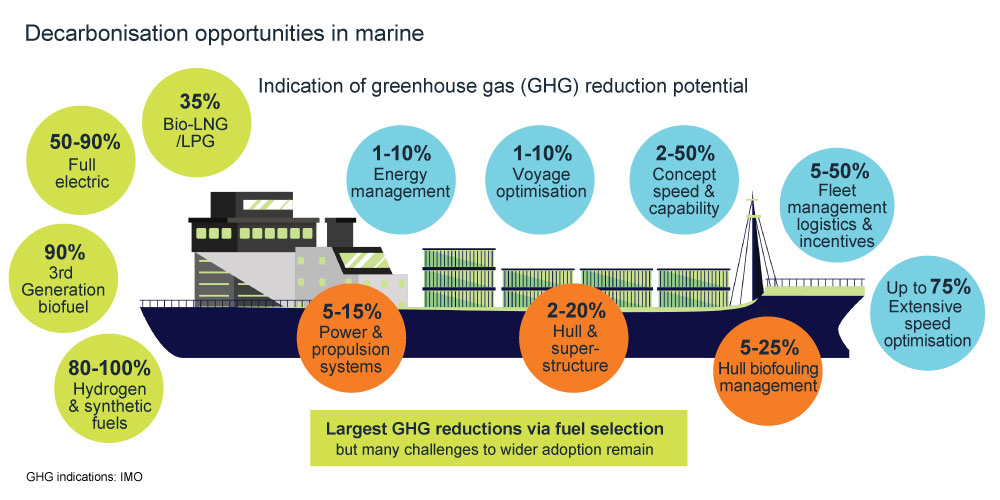

There are a number of available design, fuel and operational options to reduce GHG emissions including hull and superstructure modifications, the use of alternative fuels such as 3rd generation biofuels and extensive speed optimisation. And, in this sector, the choice of fuel has some of the greatest potential to reduce GHG emissions.

The IMO is already making moves to restrict the use of heavy fuel oil (HFO). First, the introduction of measures to prohibit its use by ships in Arctic waters on or after 1 July 2024. In addition the Marine Environmental Protection Committee (MEPC) is considering a proposal for a mandatory levy of 100 dollars/tonne carbon dioxide equivalent on heavy fuel oil.

What we can expect to see ahead is a an even more diverse multifuel world, with zero carbon propulsion energy source solutions likely to be different for each vessel type and sector.

Some low carbon options such as liquid natural gas, methanol and biofuels, although not without their issues, are already available, while others, such as ammonia and hydrogen, are undergoing extensive trials before full commercialisation. But, as more of these options become available, the complexity of the fuel supply chain will inevitably increase.

To make a substantial difference to GHG emissions, the penetration of these fuels needs to be more than 10% of the market. However, right now supply chains may not be ready for this monumental change and significant investment would be needed from an industry that may not currently have high enough returns.

With so many challenges on the table all at once, extensive collaboration between OEMs, ship operators, fuel, lubricant and additive suppliers will be essential to ensure we can gain the maximum value and benefit for all stakeholders.

Innovative additive chemistry can help to support the changes that will be needed in engine hardware and aftertreatment systems, fuel types and vessel operation in order to cut NOx, black carbon and GHG emissions. As a technology leader, Infineum is continuing to invest in the optimisation of marine lubricant and fuel products and is actively developing solutions to meet future market needs.

Sign up to receive monthly updates via email