Driveline

Balancing efficiency and durability

20 May 2025

28 June 2022

Transmission fluids support hardware design trends and the latest e-technologies as OEMs look for further carbon dioxide reductions

Tough new CO2 emissions regulations and the need to meet net-zero aspirations are driving automotive OEMs across the globe to look at every element of their operations, technology platforms and supply chain for carbon reduction opportunities. In the transmissions market, while efficiency has been the biggest driver for change for many years, these new demands mean the pace of change is now accelerating. Insight takes a close look at the shifts in the market and assesses the ways transmission fluids can support the changes.

Manual and conventional stepped automatic transmission designs have dominated the automotive market for many years. But, as the drive for CO2 emissions reduction forced OEMs to capture efficiency from the entire vehicle system, transmission technology has evolved. Initially, smaller, lighter automatic transmission systems with increasing numbers of forward speeds gained popularity, and the number of continuously variable (CVT) and dual clutch (DCT) transmission installations grew. However, the introduction of new CO2 emissions legislation in North America and Europe and the commitment of a growing number of OEMs to net-zero emissions means we are now entering another period of change.

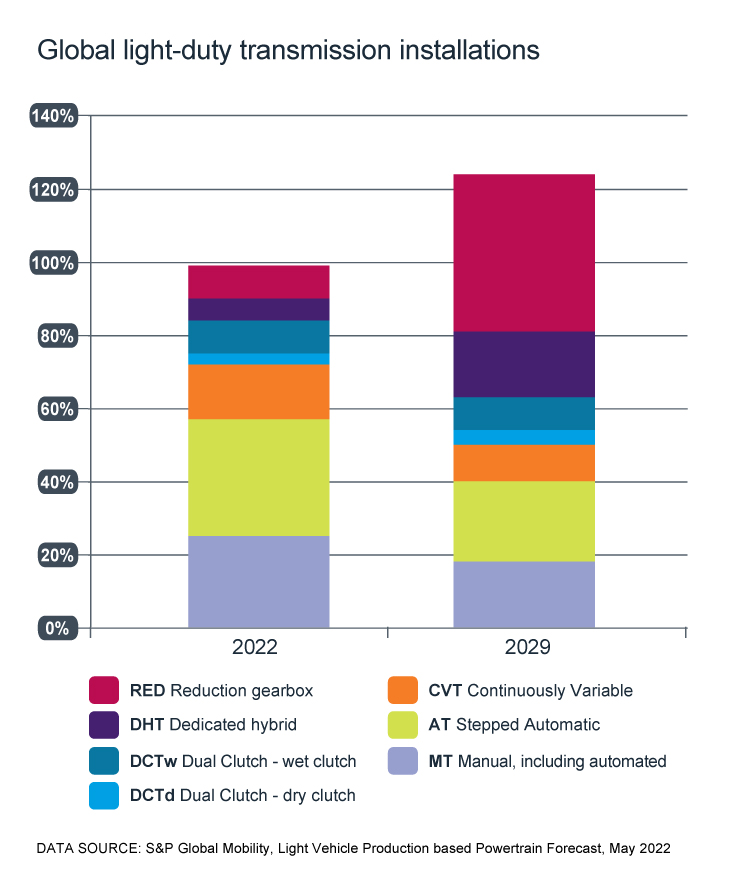

As OEMs offer a wider line-up of electrified vehicles, dedicated hybrid transmissions and reduction gearboxes (RED) are expected to experience substantial and rapid growth. While these segments represent less than 20% of global installations today, by 2029 they are expected to account for around half of new installations, with most growth in reduction gearboxes.

Although the older technologies are losing ground, conventional automatic and manual transmissions are still expected to account for around 40% of installations in 2029.

However, the regional picture is very variable. The greatest uptake or RED is likely in Europe and China, where manuals, automatics, and CVTs really lose out. In North America, Japan and Korea there is a shift away from automatics and CVT to hybrid and electric, while in South America and South Asia there is some growth across all segments but from a small base.

The global car parc is about to pass the 1.6 billion mark and is continuing to expand, which means the service fill transmission fluids market is also expected to grow. Out to 2028, manual and automatic transmission fluids retain the largest volume share of the service fill market at about 75%. However, demand for CVT and DCT fluids is expected to outpace that of automatic transmission fluids, owing to their shorter drain intervals.

While the global hybrid and electric transmission fluid market is small today, it is expected to experience significant relative growth.

A strong growth rate is expected in North America, China and Europe as vehicle electrification takes off. However, volume growth in full hybrid and battery electric vehicle service fill demand is relatively low, since it comes from a small base number and because these vehicles have a smaller sump size and very long oil drain interval. As a result, the full hybrid and battery electric vehicles service market is expected to have a 9% market share by 2028.

Until recently conventional transmission fluids were commonly used in both full hybrid and battery electric vehicles. However, as designs become increasingly demanding, tailored e-fluids are now required. It is essential that these new tailored e-fluids continue to deliver the traditional transmission lubrication requirements including:

But, at the same time, they must also meet the new e-specific requirements of heat transfer, materials compatibility and electrical properties.

Heat transfer: It is important for e-fluids to cool both the electronics and the battery, since high temperatures may lead to loss of motor performance and demagnetisation, and winding heads and rotors may experience localised hot spots at peak loads. In terms of heat transfer, fluids must cool the windings and here, although a separate jacketed cooling system with a dedicated fluid can be used, it makes the system larger and more complex and is not as efficient as direct contact cooling, which can improve motor efficiency and enable smaller, higher power density e-motors, which are being introduced by some OEMs. This means that the fluid must be able to withstand higher temperatures and have a higher oxidation resistance.

Electrical properties: Higher voltages in electric vehicles enable faster charging times but also mean utilisation of newer materials that can handle such high voltages. E-fluids must have a balanced formulation for electrical properties, ensuring there are no electrical shorts or current leakages but equally, they must not be so insulating that a static charge builds up. Good electrical properties can also enable higher e-motor voltages, allowing smaller motors to deliver equal power, thus reducing overall package size.

Materials compatibility: A further challenge for the e-fluid is materials compatibility, as new materials such as copper, resins and plastics are introduced in hybrid and electric vehicles. Chemical attacks on the plastics of the connectors, corrosion of the copper windings or resin degradation can generate electric current leakages or even a short circuit in the transmission, which makes materials compatibility critical for e-fluids.

Click here to watch a video on our broad portfolio of dedicated e-mobility products covering all the major hybrid and full battery electric vehicle models - tailored for every type of electrified transmission application.

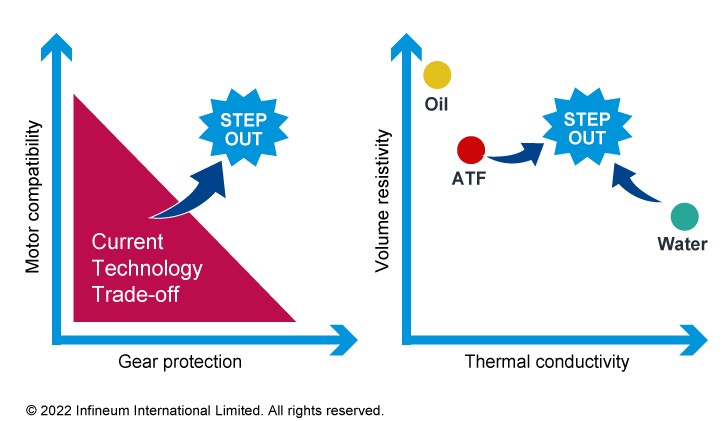

As OEMs look to overcome the barriers to consumer acceptance of electric vehicles, e-fluids need to offer reduced energy consumption, in order to increase the pure electric range of the vehicle. To do this, while also ensuring improved heat transfer, it may be necessary to move to an ultra-low viscosity fluid - something that will be enabled by the use of next generation additives. We are now charting a new formulation space to break away from current performance trade-offs, of for example extending pure electric range vs. gear protection and resistivity vs. conductivity.

Charting new formulation space to break away from current performance trade-offs

In our view these next generation e-fluids are step out technologies, which will enable the optimisation of smaller, more powerful e-motor integrated transmission designs.

Infineum has been working to develop transmission fluids tailored to meet the latest OEM requirements, which includes ensuring their suitability for use in electric vehicles. Click here to read our article on overcoming the challenges of optimising fluids for increasingly electrified powertrains.

Sign up to receive monthly updates via email