Commercial vehicles

ACEA HD Sequences released

22 January 2025

15 September 2020

Latest diesel technology is ready to progress emissions reduction goals now

As legislators around the world work to reduce emissions from commercial fleets, they often focus on measures to promote electric vehicle sales. However, a number of barriers, such as vehicle cost-parity with diesel and sparse refuelling infrastructure, are currently hindering their broad uptake. Rose Gill, Infineum Insight Editor, explores the latest situation and looks at how a faster adoption of the latest available and proven diesel technologies, lower carbon fuels and advanced lubricants could help reduce tailpipe emissions today.

The latest commercial vehicle emissions reduction activity in July 2020 saw 15 North American states sign a memorandum of understanding (MOU) that aims to eradicate emissions from heavy- and medium-duty trucks. It will do this by ensuring 100% of new vehicle sales are zero emissions by 2050, with an interim target of 30% by 2030. The signatories are: California, Connecticut, Colorado, Hawaii, Maine, Maryland, Massachusetts, New Jersey, New York, North Carolina, Oregon, Pennsylvania, Rhode Island, Vermont, and Washington along with the District of Columbia. These states hope that by promoting and investing in electric and fuel cell trucks and buses and the charging and hydrogen fuelling infrastructure needed to serve them, they will support job creation, and help to build a resilient and clean economy.

In Europe, as the European Commission (EC) works to decarbonise transport, it has introduced measures that will cut carbon dioxide emissions from new trucks on average by 15% from 2025 and by 30% from 2030, compared with 2019 levels. This again is likely to manifest itself in further advances in powertrain and vehicle efficiency, alternative fuels and ultimately a push to electric vehicle technology. In addition, Euro VII is in public consultation, with a view to introducing it in 2021. According to the EC it provides an opportunity to eradicate pollution from road transport, regain technological and regulatory leadership, and align standards with its new ‘Zero Pollution Ambition’ and the objective of net-zero greenhouse gas emissions by 2050.

While OEMs are considering some electrification in this timeframe, these are mostly in niche applications. However, there is still much efficiency to be gained in internal combustion engine (ICE) based platforms and this will drive not only the uptake of lower viscosity fluids, but also new hardware and engine management strategies that will demand advanced lubricants.

What these long-view emissions reduction plans miss is that a shift to proven and available diesel technology could mean cleaner air and less greenhouse gas emissions right now.

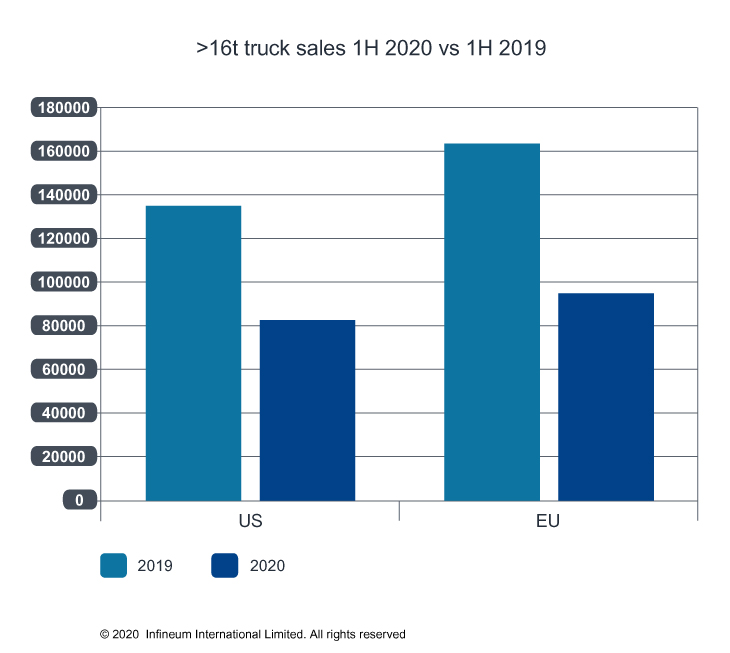

With all the ramifications of the global COVID-19 pandemic, the investment needed to meet these emissions expectations are going to be harder for OEMs and their customers to make. As lockdown measures implemented to slow the spread of the disease continue, the resulting economic downturn has left many companies to focus on how best to survive. The freight industry has seen its ups and downs. After an initial surge in demand for food and goods, the slump that has followed has hit the transportation industry hard and, as a result, new heavy-duty vehicle sales around the globe have plummeted. In North America, for example, sales of Class 8 trucks were reported to be down 38.7% in the fist half of 2020 vs. the same period in 2019. Across the European Union it was a similar picture, with ACEA reporting first half >16t truck sales down 44.2% on the previous year.

Although sales are starting to pick up slightly, with still so many unknowns remaining, including the speed of economic recovery and potential future lockdown measures, forecasters are finding it hard to call full year sales. According to a report from Automotive World, the truck industry was always expected to enter a downturn in 2020, as part of the usual industry cycle. However, the COVID-19 pandemic is likely to steepen the curve and the report anticipates 2020 world sales to fall by 25%.

This means OEMs could have less to invest in the R&D programmes needed to advance their electric innovations. And, their customers, if forced towards electrification, may simply choose to hold on to the exiting vehicles in their feet for longer, which would be counter productive in terms of emissions reduction and further impact new truck sales.

In North America, 97% of Class 8 trucks run on diesel, with 44% being powered by the latest generation of advanced diesel engines. While this uptake of the latest diesel technology sounds impressive, the American Truck Association (ATA) says that right now, more than half of Class 8 trucks on the roads are more than 10 years old.

With 56% of North American Class 8 trucks running on older technology, the opportunity to accelerate the turnover to the latest generation diesel engines is substantial.

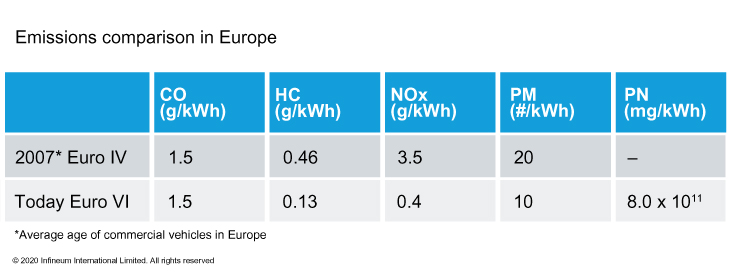

Across Europe, there are estimated to be over 41 million commercial vehicles in use with an average age of 12.3 years. This means that since Euro VI was only introduced in January 2013, a significant portion of vehicles on Europe’s roads emit higher levels of HC, NOx and particulates than the latest technology trucks.

And, in view of EPA and EC near-term intentions to further reduce greenhouse gas and NOx emissions, future diesel trucks will contain new technology and systems to make them cleaner, more efficient and even closer to zero-emissions than those of today. For example, EPA suggests that its Phase 2 GHG emissions standards for heavy-duty vehicles, expected for model years 2021-2027, are likely to:

To work towards zero emissions, in addition to making the necessary investment in extensive electric vehicle charging networks, it would be sensible in the short-term for policy makers to invest in promoting sales of the latest technology diesel vehicles through incentives or tax breaks. In North America, the industry is pushing Congress to suspend the 12% federal excise tax (FET) on new truck and trailer sales in the next coronavirus stimulus bill to help revive the market.

An ATA survey showed 60% of fleets were more likely or very likely to purchase new trucks and trailers if the FET was suspended this year.

In Europe, ACEA is actively calling for the introduction of EU-wide purchase incentives, with the objective of boosting demand. It is concerned that many of the national plans to stimulate sales focus exclusively on passenger cars and is urging governments and the EU to include dedicated fleet renewal schemes for heavy-duty vehicles in their recovery plans as soon as possible.

The introduction of these rescue measures during this critical time could help fleets purchase new trucks and trailers, which would not only support truck and trailer manufacturing, supplier, and dealership jobs, but also advance industry goals of improving safety and reducing emissions.

The faster rollover of the commercial vehicle fleet to the latest diesel technology would be a quick win for air quality improvement and greenhouse gas emissions reduction.

Another step that could be taken towards the reduction of GHG emissions is the use of lower carbon intensity fuels. The promotion of first generation (plant based) biofuels, and the wider use of second generation waste and residue derived biofuels, and renewable fuels from ‘power to liquid’ sources such as wind, solar and water are all options that could be further explored, supported and incentivised.

In addition, developing lubricants to support hardware innovation that reduce emissions while also extending component life and delivering improved fuel economy over longer oil drain intervals is a key focus for lubricant and additive suppliers.

The latest ICE vehicle technologies are designed to use lower viscosity lubricants, which can help to reduce fuel consumption.

Currently, in North America, the workhorse grade is SAE 15W-40, which holds some 65% of the market. In Europe SAE 15W-40 remains the primary grade, but SAE 10W-40 is growing. Looking ahead, the considerable fuel saving benefits of lower viscosity lubricants and the introduction of OEM specifications to support their use, mean the growth of lower viscosity grades should be significant.

However, since most commercial vehicle fleets comprise a range of vehicle technologies, there is some hesitation to use very low viscosity fluids that may not be appropriate across all the vehicles in use. The early rollover of fleets to the latest diesel technology would enable the wider uptake of advanced lubricant technology and SAE 5W-xx and lower viscosity oils that would support emissions reduction and fuel economy improvement.

In our view, to enable heavy commercial vehicle fleets to switch to electric, there are some very significant barriers to overcome. Investment in charging and fuelling infrastructure is by far the most obvious requirement. However, industry must also work to close the cost difference between diesel and electric vehicles to attract customers.

In the mean time, while these issues are being worked, a good transition step to lower emissions would be to speed up the replacement of aging, more polluting trucks with the latest diesel technology models and to ensure they use lower carbon fuels and the latest high efficiency lubricants.

Sign up to receive monthly updates via email