Marine engines

Fuel additive sea trials

08 July 2025

24 September 2019

Multifuel future creates new opportunities for marine engine oils.

Much of the attention of the marine industry is currently focused on the implications that the upcoming IMO sulphur reductions will have on fuels. Adam Marsh, Senior Lubrication Technologist at Infineum, explains that it is just as important to consider how changes in fuel use may affect marine lubricant formulation requirements.

Shippers have a number of options available to meet the International Maritime Organization sulphur mandate (IMO 2020). Some may install abatement technology and use heavy fuel oils (HFO), here sulphur levels could still exceed 3.5%. This means lubricants with higher base number will be needed to neutralise combustion acids and ensure engine cleanliness.

In our view, compliance will be largely achieved through the use of low sulphur fuels since this represents the least disruptive option for shippers.

It is likely that these new fuels will have highly variable compositions, which may result in a number of operational and logistical challenges for the shipping industry. A significant knock-on effect will be on the compositional requirements of the lubricant in both two-stroke and four-stroke applications to ensure flawless protection is still delivered to the engines. The areas of key concern are asphaltene handling and crankcase cleanliness, along with viscosity control, cat fines and wear. However, the challenges do not stop there; it is likely that the industry shift to Group II base stocks, new labelling requirements and operational changes, such as increased slow steaming, will raise additional concerns.

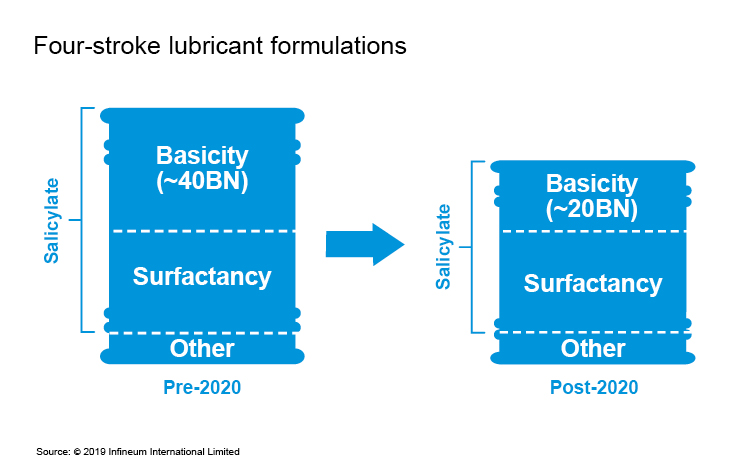

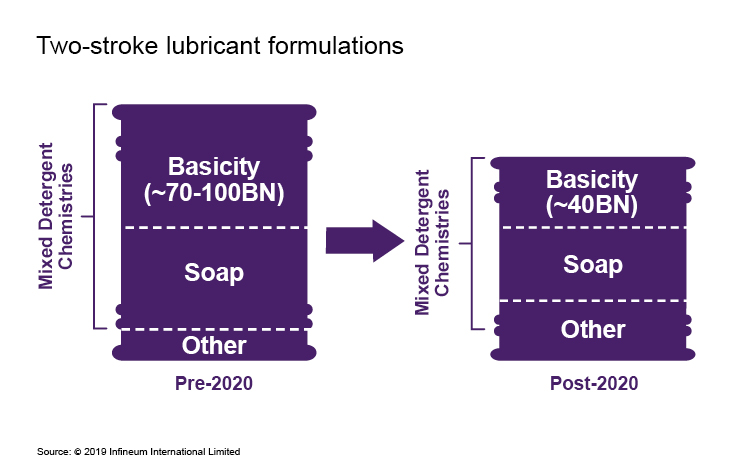

Current marine lubricant products have been primarily designed to deliver performance features necessary for engines running on high sulphur HFO, features that may not be directly replicated for the lower sulphur fuel options. And, as low sulphur fuels are increasingly used, the composition of the lubricant will evolve, with one critical factor being the balance between basicity and surfactancy.

The shift from 3.5% to 0.5% fuel sulphur is initiating the development of the next generation of marine lubricants.

In four-stroke marine vessels, changes to trunk piston engine oil (TPEO) formulations are driven by a number of factors. Lower sulphur fuel use equates to lower combustion acids, which in turn translates into less base required from the lubricant. However, the presence of asphaltenic substituents and other residual species in marine fuels means it is also essential that the level of surfactancy (soap) is optimised to disrupt asphaltene agglomeration. Additionally, as more marine gas oil (MGO) or MGO fuel blends are used in these applications, there is expected to be a growing need for additive technology to prevent lacquering.

Another key trend here is the shift from Group I to Group II base stocks in TPEO formulations as the latter become increasingly available and affordable. However, the biggest issue here is the contamination of the lubricant by the fuel. Since Group II formulations have lower natural solvency than Group Is, the asphaltenes present in the fuel are less easily stabilised. This can result in deposits on the piston undercrown and on the cold parts of the engine, which can cause severe engine damage. Proven additive solutions are needed to improve asphaltene handling and to restore the level of engine cleanliness to that equivalent to Group I formulations.

In two-stroke marine vessels, marine diesel cylinder lubricant (MDCL) formulations may need to be redesigned in response to the IMO 2020 legislation. Again, the lower sulphur fuels being used here mean less basicity could be required from the lubricant. Since lower base number lubricants deliver less soap via the detergent chemistry, it is increasingly possible to use optimal high temperature additive chemistry. In addition, other chemistries can also be used to improve lubricant performance where non-residual fuels, such as marine gas oils and liquid natural gas, are used.

However, in the highly competitive two-stroke world, minimising operating costs is essential. The prospect that low sulphur fuel could cost $300-500/tonne more than HFO means vessels choosing this option for compliance could be expected to spend longer periods slow steaming, which is probably the easiest way to reduce additional fuel-related costs. If slow or super-slow steaming does become more commonplace, advanced oils with optimised basicity may be required to prevent excessive liner wear through cold corrosion. In addition, tetrapropenyl phenol (TPP) labelling requirements are also presenting challenges for marine lubricant formulators. Novel detergent chemistry is required to deliver the same performance as conventional lubricants but with TPP levels below the new labelling threshold.

As the fuels landscape continues to evolve, lubricants with higher performance will be required to ensure that medium and low-speed diesel engines can continue to operate effectively and without risk. While a single lubricant covering both 0.50% and 0.10% sulphur fuel grades may be an attractive option for ship operators looking to simplify logistics, careful formulation would be required to ensure that hardware protection is not compromised.

The current unavailability of new low sulphur marine fuels is making it extremely challenging for marine lubricant formulators to test and optimise new products in a diversifying fuels landscape.

However, in our view, the broad product line of marine lubricant products already available from Infineum will continue to be fit-for-purpose with 2020 low sulphur fuels. In addition, our extensive pipeline of additive chemistries means we are well positioned to support the evolving fuels mix with solutions tailored to specific engine designs and modes of operation that are approved for coverage across fuel sulphur levels.

Sign up to receive monthly updates via email