Passenger cars

ASEAN a market in transition

09 December 2025

01 October 2025

Uncertainty ahead means the future trajectory of the US auto industry is hard to forecast

The US automotive industry faces a rapidly changing landscape, with much uncertainty still ahead. In this second article on personal mobility trends in this region, Dan Pridemore, Infineum Industry Liaison Manager for the Americas, explores the latest trends, assesses how automakers are responding and how industry performance is being impacted.

The long planning cycles of the automotive industry rely heavily on a stable and predictable environment in which to operate. 2025 has been a roller coaster ride as automakers face an extremely dynamic environment of trade tariffs, loss of electric vehicle and infrastructure incentives, and changing fuel economy and emission regulations – all of which have had a significant impact on market performance to date.

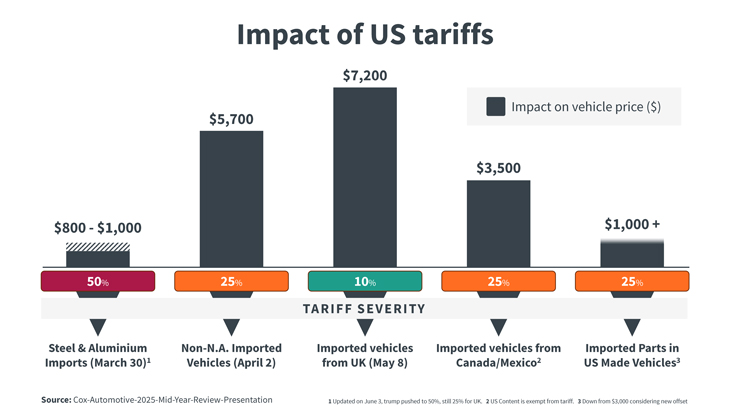

New trade tariffs have been introduced with the intent to strengthen and expand the US domestic automotive manufacturing sector. While this is applauded by US automakers, these have significantly challenged the cost-effective global supply chains the automakers have built. In the second quarter of 2025 alone, Ford announced an $800 million tariff impact, General Motors (GM) put its tab at $1.1 billion, and Stellantis’ estimated cost was $350 million according to the Wall Street Journal.

If the intent is to strengthen domestic manufacturing, why then are the Detroit 3 automakers incurring such losses?

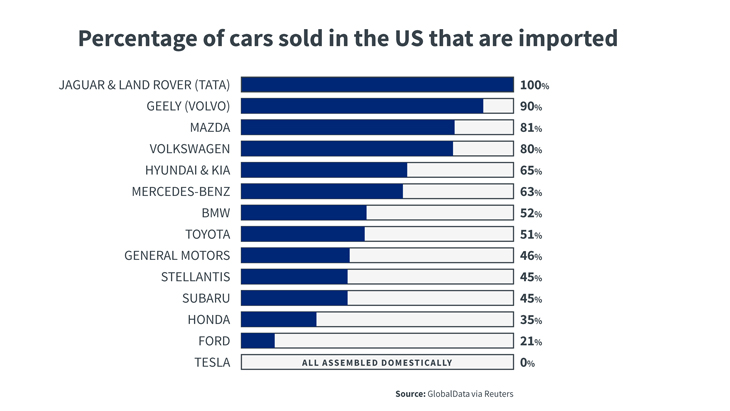

First, the tariffs apply not only to imported vehicles by foreign manufacturers but also to those built elsewhere by the American automakers and brought back to the US. For vehicles imported from Canada and Mexico, previously United States-Mexico-Canada Agreement (USMCA) duty-free compliant, only the non-US-sourced content is taxed. You can see below the most imported brands in the US and each brand's imported share of US car sales.

Secondly, the tariffs apply to imported vehicle parts and materials, such as steel and aluminium. According to the National Highway Traffic & Safety Administration (NHTSA) data, for all models assembled and available for sale in the US, only 47% of the parts (by value) originated from the US or Canada. Interpreting the full impact of the auto, parts and material tariffs is difficult with multiple announcements regarding USMCA exemptions, import relief adjustments, and measures to avoid tariff stacking.

Ford prides itself on domestic production of almost 80% of the vehicles it sells in the US, while GM imports about half of the vehicles it sells in the US. Ford relies heavily on imported parts and is one of the industry’s biggest consumers of aluminium, which is now subject to import duties upwards of 50%. Tesla, which sources many parts and assembles their vehicles domestically, estimates tariff costs of $200 million last quarter from imported components and materials.

Recent trade deals with the European Union, Japan and South Korea have established a 15% tariff rate on imported vehicles, which is lower than the earlier announced 25% automotive tariff rate for imported vehicles and parts. With well-established parts manufacturing and vehicle assembly supply chains in Mexico and Canada, which previously enjoyed tariff-free North American Free Trade Agreement (NAFTA) protection, it’s unclear if similar trade deals will be reached with those countries. The unequal tariff rates may even entice companies with established manufacturing footprints outside the US to import more vehicles from the lower tariff countries.

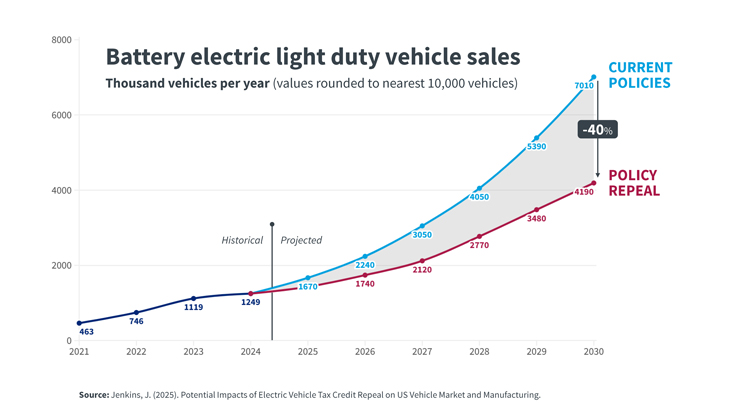

Shortly after inauguration, an Executive Order from the President rescinded the 2021 Biden order targeting 50% of all new vehicles sold in the US to be electric by 2030. It also revoked unspent government funds for electric vehicle (EV) charging stations and eliminated the waiver that allowed States to limit or ban sales of gasoline powered automobiles. However, legal challenges are in progress, which could take some time to work through a very crowded judicial system.

More recently, Congress passed the ‘One Big Beautiful Bill’ on July 4 2025, which eliminated federal tax credits for new and used EV purchases after September 30 2025, and for home EV chargers after June 30 2026. Additionally, the Bill reset the Corporate Average Fuel Economy (CAFE) non-compliance penalty to zero ($0), waiving automaker fines retroactively to Model Year (MY) 2022. With enforcement removed, this significantly weakens – some say effectively ends – automaker incentive to further improve fuel efficiency and greenhouse gas (GHG) emissions.

REPEAT Project. license CC BY 4.0

The NHTSA has delayed issuing annual notifications to companies as to their compliance status with CAFE, which has halted the CAFE credit trading market among automakers. Companies whose vehicles exceed CAFE rules can generate credits and sell those to competitors who are in violation of the rules, helping offset any fines they may face.

GM, Ford, and Stellantis have traditionally purchased large amounts of credits to offset their product mix favouring large SUVs and trucks, while EV manufacturers, such as Tesla, Rivian, and Lucid, have financed their growth with revenue generated from the sale of credits.

According to the Wall Street Journal, Rivian faces a $100 million loss of revenue because of this action. Tesla, the largest US EV manufacturer, has said the regulatory action has led to a $1.1 billion decrease in expected revenue from credit sales. Since 2008, Tesla has made more than $12 billion selling regulatory credits globally per earnings reports. An EV trade association has asked the US Courts to intercede and require NHSTA to resume issuance of compliance letters.

Following the guidance of the Executive Order, the US Environmental Protection Agency (EPA) and NHSTA are reviewing emissions and fuel economy regulations, respectively, to ensure alignment with the Administration’s intent of ‘no EV mandates’. These reviews may lead to significant changes in the US regulatory environment.

NHTSA issued an interpretive rule in June 2025 that outlines how the agency will change its approach to setting fuel efficiency standards. CAFE standards have previously been defined through MY 2031 for light-duty vehicles. NHSTA is currently reviewing these standards retroactively to MY 2022. No date for a final decision has been announced.

In parallel, the EPA announced a proposal to rescind their prior 2009 endangerment finding, which considers GHGs as air pollutants and underpins the Agency’s authority to regulate new motor vehicle, engine, and industrial facility GHG emissions. The original finding indicated that the current and projected concentrations of six mixed GHGs, including carbon dioxide, methane, nitrous oxide, hydrofluorocarbons, and others, in the atmosphere threaten public health.

Per the July 29 2025 EPA news release: "If finalized, this proposal would remove all greenhouse gas standards for light-, medium- and heavy-duty vehicles and heavy-duty engines, starting with EPA’s first greenhouse gas set in 2010 for light-duty vehicles and those set in 2011 for medium-duty vehicles and heavy-duty vehicles and engines - which includes off-cycle credits like the much hated start-stop feature on most new cars.”

Once again, the US Courts will be asked to decide on the legality of these actions and, if upheld, will create a regulatory vacuum for vehicle and stationary sources of GHG emissions.

According to Bank of America Securities Analyst, John Murphy, in the firm’s annual Car Wars report: “The unprecedented EV head-fake has wreaked havoc on product plans. The next four plus years will be the most uncertain and volatile time in product strategy ever.”

The US automotive and commercial vehicle industry navigates in an extremely complex and dynamic external environment of technology advancements, consumer preferences, competitive threats, global supply chains, regulatory pressures, and other factors. Success depends on highly refined strategies, long-term planning, and large, well-placed investments. Uncertainty in the external environment can bring all of these to a halt until greater confidence in the forward path is known.

Although some short-term actions are possible, long planning cycles prevent the industry from quickly pivoting in a new direction.

Areas in which the vehicle manufacturers are adapting include:

Adjusting production and product mix. With the elimination of CAFE penalties, many automakers have announced product and/or production changes aligned with US consumer preferences. For example, GM and Stellantis have announced plans to increase production of V-8 engines, including the famed HEMI engine, while Ford is gearing up for greater production of Super Duty pickups and shifting its product mix in favour of gasoline hybrid models.

Honda, in their 2025 Business Briefing, announced a shift to strengthening its hybrid electric vehicle (HEV) lineup and a realignment of its electrification strategy, including postponing the establishment of a comprehensive value chain in Canada. Adjustments are also occurring in EV production volumes, such as GM’s temporary shutdown of its Factory Zero shifts and Volkswagen (VW) has reduced production of the ID.4 compact electric crossover as it struggles with slowing demand.

Delaying or cancelling product launches. In parallel with production adjustments, future product launches are being revisited with the current market environment in mind. Recently, Ford informed suppliers that a full-size electric pickup - the successor to the F-150 Lightning - will be delayed to 2028. Production of its E-transit van, to be built at its Ohio Assembly Plant in Avon Lake, Ohio, has been delayed until 2028, and it is cancelling its planned three-row large EV launch. Stellantis has cancelled its RAM battery electric truck and announced the delay of its RAM range extended electric vehicle (REEV) until 2027.

The uncertainty is also weighing on heavy-duty diesel engine and truck manufacturers. As reported in Transport Topics, Cummins will delay the launch of its latest X15 diesel engine for the heavy-duty on-highway truck market until late 2026, citing ongoing uncertainty around the introduction of federal tailpipe regulations. According to Jennifer Rumsey, Cummins CEO, they are continuing to work towards launching the engine but are no longer launching the X15 earlier in the year they expect to launch new platforms to comply with the 2027 regulation. Cummins still expects there to be NOx regulations that the engine will comply with. Other engine manufacturers will likely promote better fuel economy and lower operating costs associated with the new engines they have developed to meet the GHG Phase 2 targets.

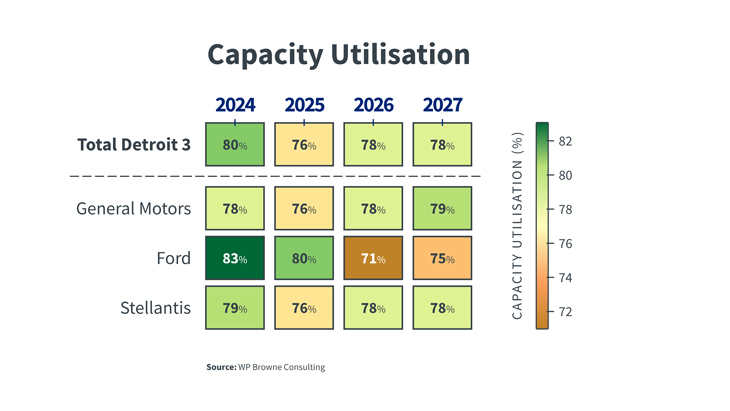

Use of underutilised facilities. Last year, the Detroit 3 reached 80% of US capacity utilisation, a level closely approximating full production. Moving forward, the reduction in overall capacity utilisation is the result of underutilised battery electric vehicle (BEV) capacity according to analysis from Lawrence Technological University.

The study reveals that GM, Ford, and Stellantis already have multiple product launches through 2027. Additional work to move production from Canada and Mexico may not be feasible. Importantly, there is not enough excess capacity at a single plant to move high-volume programs in Mexico back to the US.

To address the underutilisation of battery and BEV assembly plants, the automakers are looking to strategic partnerships where synergies can be identified. One such example is Ford’s reported exploration of allowing Nissan to use part of its BlueOval battery plant.

Partnering with others. As reported by Marklines, Honda successively launched the Prologue in April and the Acura ZDX in May as its first mass-produced EVs in North America. Both models are supplied from GM's plants on an OEM consignment production basis, with the Prologue coming from the Ramos Arizpe Plant in Mexico and the Acura ZDX from the Spring Hill Plant in Tennessee, US. The batteries will be provided by Ultium Cells LLC, a JV between GM and LG Energy Solution.

Renewed focus on affordable EVs. Although automakers are adjusting to the new environment, this has not created a ‘pull the plug’ moment for EVs. Despite the uncertainty, the future of EVs is viewed by many as a delayed timeline rather than abandonment.

Ford announced plans last month to invest around $5 billion to reset its EV program with more affordable vehicles, that are produced more efficiently and at a lower cost. The key to the strategy is reinventing the assembly line.

“It represents the most radical change on how we design and how we build vehicles at Ford since the Model T,” Ford CEO, Jim Farley, declared during a ceremony at the Louisville Assembly Plant.

A new line of what Ford describes as affordable, electric, software-defined vehicles will be based on the Ford Universal EV Platform, built on the company’s Ford Universal Production System. The initial location to be converted to the new system is Ford’s Louisville Assembly Plant where the first vehicle will be a mid-size electric pickup truck.

Numbers suggest US automotive sales remained strong during the first half of 2025, with some indication that many consumers decided to purchase early to avoid the proposed tariffs. Cox Automotive and other forecasters anticipated a modest slowdown, with average transaction prices nearing $49,000 USD.

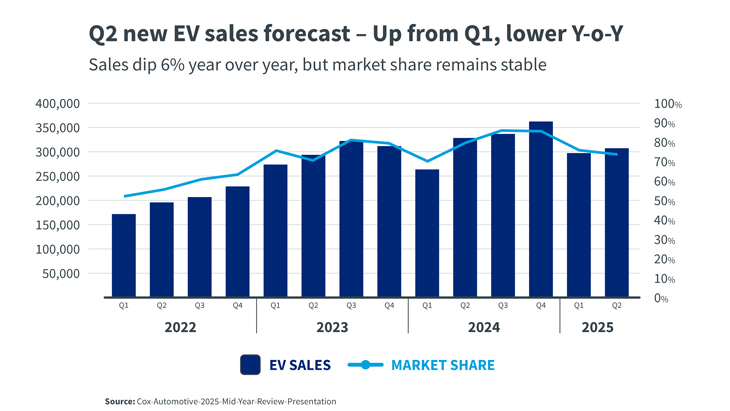

Looking closer, while EV sales declined year over year, market share remained stable in the second quarter of 2025. EV manufacturers slightly reduced average transaction pricing to ~$57.700 per unit, though the average sales incentive for EV buyers rose to over 14%. The ‘electrified’ (BEV, PHEV, and HEV models) share of new vehicle sales continues to grow with heavy influence from HEV in 1Q 2025.

In its recently released 3Q 2025 forecast, Cox Automotive has revised full year 2025 new vehicles sales to ~16.1 million units.

The data also suggest EV sales were very strong for the second month in a row as consumers act on EV deals before the $7,500 tax credit and ‘leasing loophole’ are shut down. GM is reporting record EV sales, as its collection of EVs provides consumers with a wide variety of EV models. Cox Automotive is expecting Q3 to be a record quarter for EV sales and, the record of 356,000 EVs sold in Q4 last year, is well within reach.

As we look to the second half of the year, the consensus of many analysts is a slowdown in new vehicle sales owing to higher prices associated with tariffs, reduced production from global supply chain challenges, and the elimination of EV tax incentives. Questions such as, 'Will Mexico and Canada specific trade deals lower the auto tariff to 15%?' and, 'Will the US eliminate new vehicle FE & emission regulations?' are heavy on the minds of US automakers. The industry will have to wait and see.

We will all watch with interest to see how the situation evolves as actions taken by the US administration, the automotive industry, and enabling partners impact the trajectory of EV adoption in the US.

Infineum is committed to powering a greener future and is continuing to work closely with industry stakeholder to help ensure the success of the market transition. If you have any questions or need further details, feel free to ask.

Sign up to receive monthly updates via email