Driveline

Balancing efficiency and durability

20 May 2025

09 December 2025

Opportunities for advanced service-fill dual clutch transmission fluids in light-duty markets

Thanks to their fast-shifting characteristics, compact sizing and versatile compatibility with engine layouts, dual clutch transmissions (DCTs) are being adopted by many OEMs as a good option to help improve vehicle fuel economy performance. As a result, the use of DCTs in light-duty vehicles in some regions has grown in recent years. Leandro Benvenutti, Product Manager & OMM for Latin America, Enabling Electrification, talks to Insight about the latest market trends, the specific fluid requirements of DCTs and the anticipated demand growth for advanced service-fill fluids for these applications.

As fuel economy and CO2 emissions regulations tighten across the globe, automotive OEMs are looking at every component of the vehicle for efficiency gains. One trend that is emerging in some regions is a shift away from the use of conventional stepped automatic and manual transmissions. In China and Europe, for example, dual clutch transmissions (DCTs), are proving to be a good fit. This is mainly because DCT manufacturing facilities are similar to existing manual transmission production facilities in these regions. In addition, the improved efficiency of DCTs versus manual and automatic options, along with faster and more responsive shift performance are also seen by many OEMs as key benefits.

Currently, Europe and China account for more than 90% of the global DCT market.

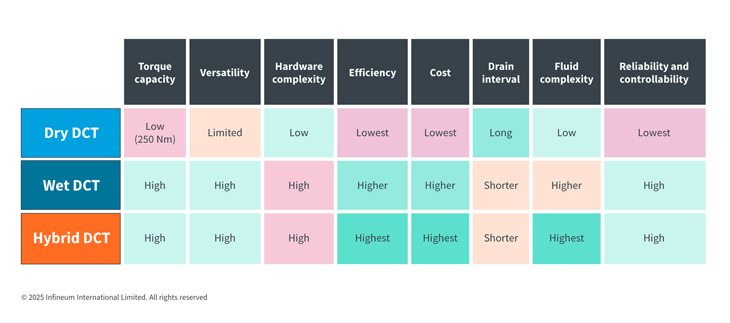

DCTs are automatic transmissions that use a manual gearbox architecture with two sets of gears that are always engaged – providing quick and responsive shifts. There are three broad types: wet, dry and hybrid, each with their distinct attributes.

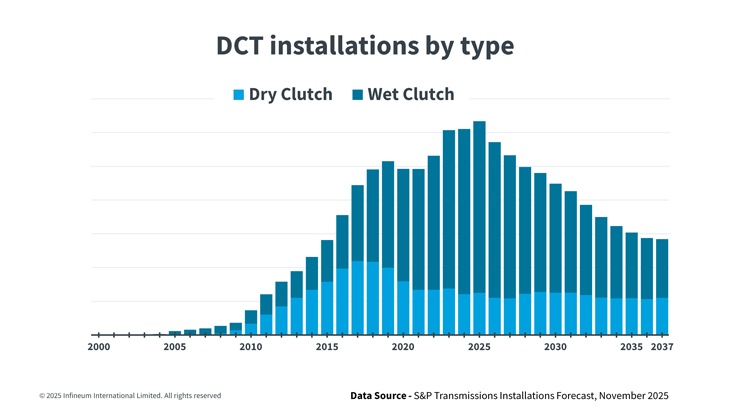

In 2024, according to the European Automobile Manufacturers’ Association (ACEA), 75.5 million cars were produced across the globe. In the same year, DCT installations peaked at 12 million globally, which means almost 16% of vehicles manufactured that year contained a DCT. Looking out beyond 2025, global DCT installations are expected to decline slightly as the use of dedicated hybrid transmissions in electrified powertrains increases.

ACEA estimates that more than 248 million cars are on the road in the European Union, with an average age of 12.5 years. While in China, it is suggested that the vehicle fleet could exceed 350 million, with cars having an average age of around 10 years.

These growing and aging vehicle parcs mean DCTs can be expected to be in vehicles on the world’s roads well beyond 2040. Wet DCTs are forecast to be in some 80% of installations and, since they require additional servicing and more advanced fluids compared to their dry DCT counterparts, opportunities to supply advanced fluids are expected to grow.

In terms of DCT fluid (DCTF) volumes, 2025 is forecast to be the year when the DCTF service-fill market overtakes that of the factory-fill market.

The requirements of dry DCTs can typically be met with conventional manual transmission fluids (MTF). However, wet DCTs, often used in high torque applications, generally require specifically tailored fluids that can deliver:

Customised friction control

Superior anti-shudder durability

Protection for synchronisers

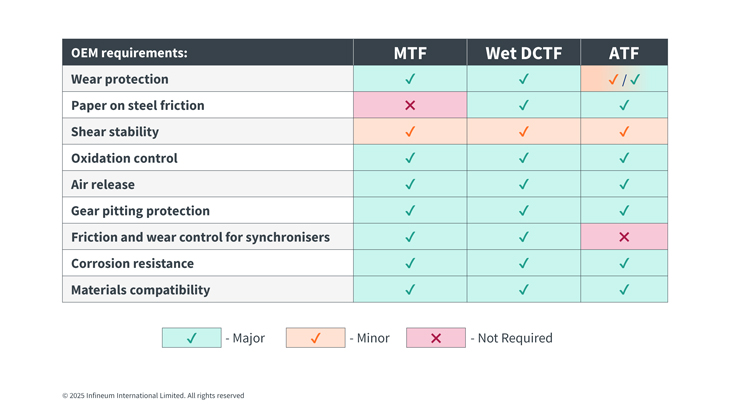

Comparing the fluid requirements of manual, dual clutch and automatic transmissions systems side by side we can see a number of key differences.

Wet DCTF, along with meeting all the requirements for a MTF, must also provide paper on steel (PoS) friction control for wet clutches, similar to an automatic transmission fluid (ATF). This means that it is essential to carefully balance friction control and wear protection additives in DCTFs.

In addition, wet DCTs are increasingly being used in full hybrid vehicles, which is the most challenging environment for a DCT fluid. This means it is essential that hybrid-specific DCT formulations, in addition to providing conventional protection and performance, also cool the motor, deliver electrical properties and offer advanced materials compatibility.

Currently the market is highly fragmented with several automotive manufacturers offering wet DCT technologies. While VW is the clear leader today, many other OEMs, including Magna/Getrag, Punch Powertrain and Hyundai Transys, are strengthening their market positions. With a large number of market participants, a diverse mix of wet DCT technologies is entering the servicing pool.

Looking ahead there is likely to be a much more fragmented DCT landscape, which increases complexity in the service-fill fluid market.

Through extensive testing, Infineum DCT additive technologies already have a broad spectrum of claims in place, which cover the top OEMs’ suitable for use (SFU) requirements. This means a DCTF capable of meeting the diverse OEM requirements in both conventional internal combustion engine and hybrid vehicles can be formulated. This multi-vehicle approach can help to simplify service shop logistics and avoid misapplication.

In the coming years the use of wet DCT transmissions looks set to grow, particularly in Europe and China. In these markets, as OEMs work to electrify their powertrains, it is likely that wet DCTs will also be increasingly used in full hybrid vehicles, which is a very challenging hardware set up for the transmission fluid.

To meet conventional performance requirements while also offering hybrid-specific protection requires a very careful balance of advanced and proven additive components.

These growth trends and challenges provide lubricant manufacturers with an opportunity to market high value fluids specifically designed to meet the service-fill requirements of wet DCT systems. A multi-vehicle technology for wet and dry DCTs offers significant advantages to fluid marketers looking for a single fluid to cover a range of light-duty applications.

Infineum additive technologies can help to create fluids that meet the needs of this highly complex and evolving market – now and into the future.

Sign up to receive monthly updates via email