Commercial vehicles

ACEA HD Sequences released

22 January 2025

20 March 2023

Latest updates on the new heavy-duty engine oil performance category

The introduction of new emissions regulations in the US are driving significant change to heavy-duty diesel engine and exhaust aftertreatment hardware. This has prompted engine makers to request API for a new heavy-duty diesel engine oil performance category, PC-12, to ensure lubricants continue to deliver sufficient hardware protection. David Brass, Infineum Lead Industry Liaison Advisor, gives an update on PC-12 progress and explores the challenges that can be expected.

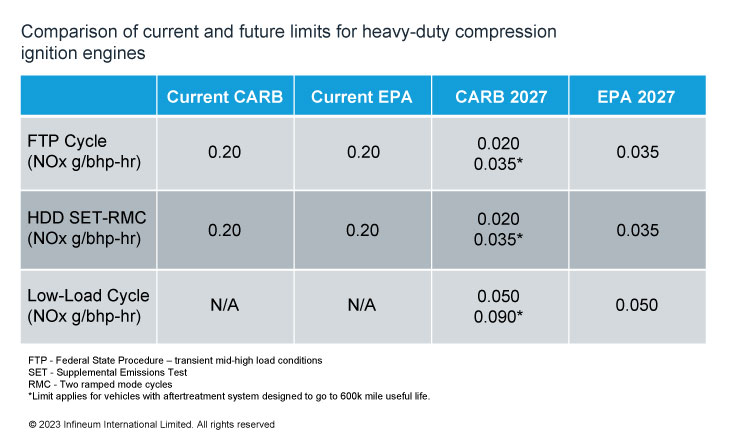

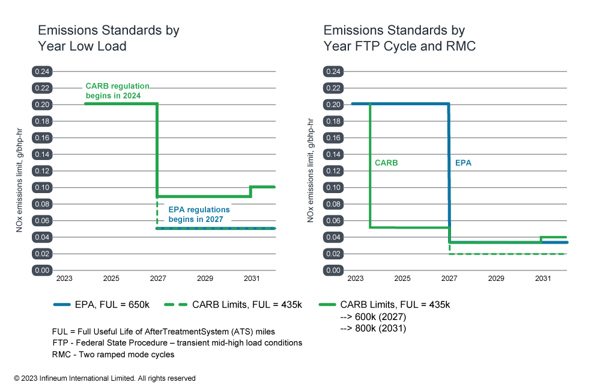

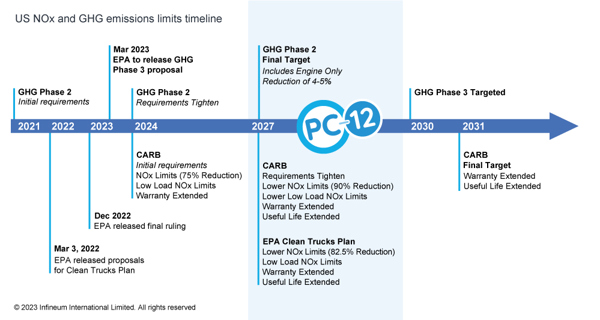

In the US, the regulations mandating emissions from heavy-duty trucks are set to tighten. The Environmental Protection Agency (EPA) Clean Trucks Plan sets a series of regulations that will be developed over the next three years to reduce pollution from trucks and buses, starting in model year (MY) 2027. This EPA initiative will regulate a number of pollutant emissions including hydrocarbons, particulate matter and carbon monoxide. But, the one having the biggest impact on heavy-duty vehicle hardware is the reduction of oxides of nitrogen (NOx) emissions from today’s 0.20 g/bhp-hr. For the EPA regulations this will require an 82.5% reduction in NOx for on-highway type driving cycles and add in a new parameter of a low load cycle to mimic local and stop/start type driving. At the same time, further action on NOx reduction comes from the California Air Resources Board (CARB) that has also set new ultra-low NOx limits to cut emissions by 75% and 90% from current requirements in 2024 and 2027 respectively.

These tougher regulations reduce emissions over a wider range of operating conditions, including the new low load limit designed to cut emissions from idling trucks.

The severity and timelines for the two emissions regulations are easy to see in chart form.

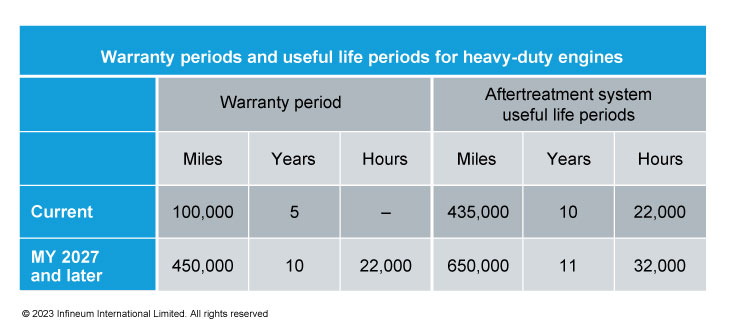

In addition, these limits also require a longer useful life for aftertreatment equipment and emissions devices and for engines to be covered by longer warranties.

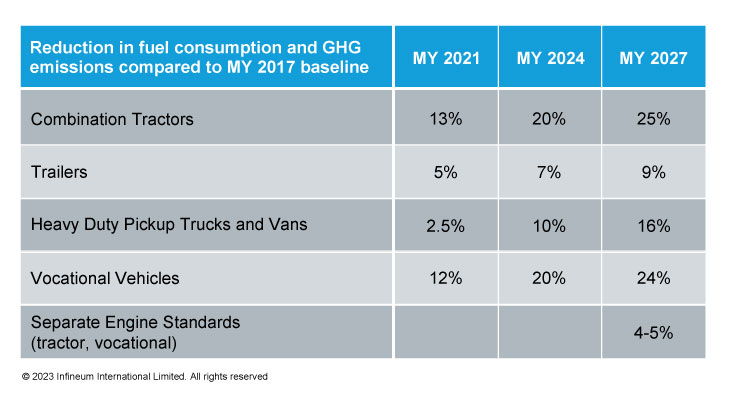

The EPA is also cutting greenhouse gas (GHG) emissions through its GHG Phase 2 requirements. This regulation covers model years 2021-2027 for semi-trucks, large pickup trucks, vans, and all types and sizes of buses and work trucks. EPA says it expects the final standards to lower CO2 emissions by approximately 1.1 billion metric tons and reduce oil consumption by up to two billion barrels over the lifetime of the vehicles sold under the programme. This has led vehicle manufacturers to pay attention to the aerodynamics, tyres and heating, ventilation, and air conditioning (HVAC) systems on their vehicles. According to the EPA, combination tractors and vocational vehicles account for approximately 85% of fuel use and GHG emissions in the heavy-duty truck sector. And, in an effort to curb them further, GHG Phase 2 requires these vehicle classes to achieve 4-5% fuel consumption and CO2 improvement over MY 2017 vehicles coming from just the engine alone.

These GHG rules are likely to drive hardware technology changes such as improvements to combustion, air handling, and emissions aftertreatment technology as well as the wider use of waste heat recovery systems and lower viscosity lubricants. Looking further ahead, EPA is expected to set updated GHG standards as soon as MY 2030 in what will be the expected GHG Phase 3.

US NOx and GHG emissions limits timeline

Clearly, significant heavy-duty diesel engine technology changes can be expected. And, to ensure lubricants continue to protect engines and aftertreatment system hardware for longer periods the Engine Manufacturers Association (EMA) has requested a new engine oil category - PC-12 - for MY 2027 vehicles, targeting a First License date of January 1 2027.

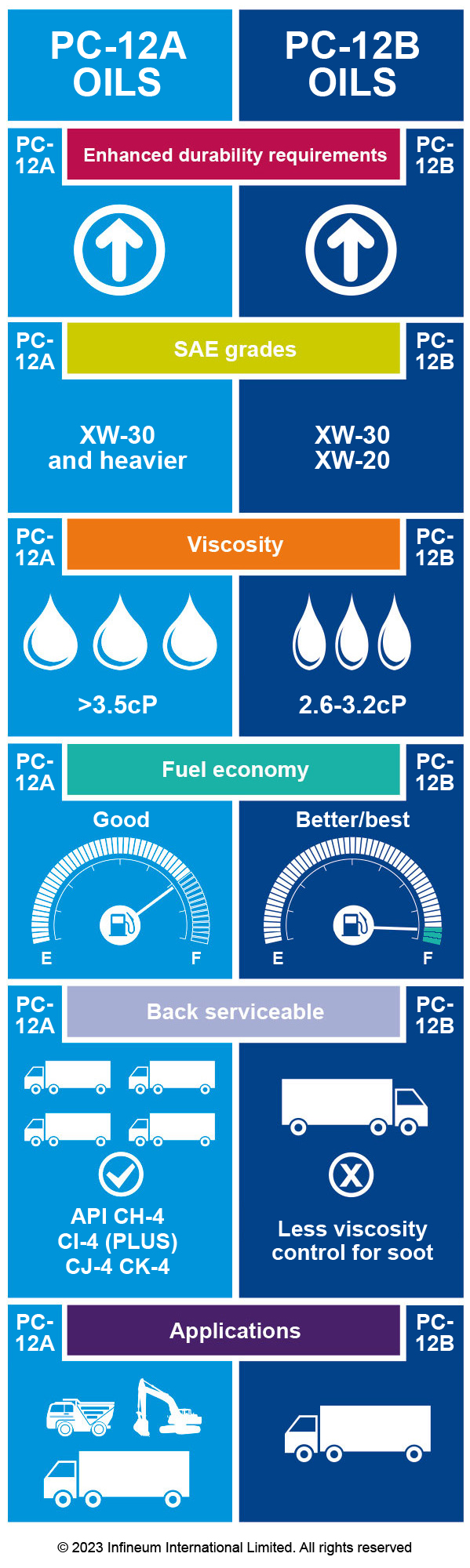

Work is already underway on the development of PC-12, which is expected to bring two new categories that align with the viscosity divide that exists today with API CK-4 and FA-4. The first, API ‘C’ category (PC-12A), is likely to retain the existing high temperature high shear (HTHS) viscosity minimums and to be backward compatible to older categories. The second, lower HTHS viscosity API ‘F’ category (PC-12B), is likely to extend down to 2.6 cP HTHS to enable the use of SAE XW-20 viscosity grades for further fuel economy improvement. It is targeted for use in modern and future engines and will not be backward compatible by API to older categories.

Progress is underway on the development of new and replacement tests for the new categories.

Wear protection: Two wear tests are being proposed for addition to PC-12. First, the Ford 6.7L Valvetrain Wear Test, was introduced by Ford for the Ford WSS M2C171-F1 specification to help ensure engine oils protect the valvetrain of their 6.7L engine platform. This engine test development is currently working on ensuring a long-term reliable supply of engine test parts by converting to the most recent MY 2023 6.7L engine platform. Also, the Detroit Diesel DD13 Scuffing Test, was developed during the PC-11 timeframe to address concerns around scuffing in the power cylinder with lower viscosity fluids. Although not included in PC-11, it was added to Daimler Truck and Detroit Diesel specifications.

Oxidation resistance: Improved oxidation protection is needed as engines run hotter and OEMs look to retain the oil drain intervals they are accustomed to under PC-11 in these harsher conditions. This means tighter limits in the Volvo T-13 test.

Aftertreatment protection: Tighter chemical limits can also be expected to help reduce aftertreatment system poisoning. Current targets of 0.10% max phosphorus (P), 0.35% max sulphur (S), and 0.9% max sulphated ash (SASH) have been asked for by EMA as a compromise position between the varying needs of OEM members. Some OEMs have suggested that their own OEM specification chemical limits will be even tighter at levels of 0.08% max P, 0.3% max S and 0.8-0.9% SASH and possibly include new limits for potassium and sodium.

A member of EMA has also asked for the addition of a phosphorus retention parameter to be considered, based on concerns about the reduction of durability protection from the reduced amount of phosphorus in the oil and the potential for aftertreatment poisoning from certain types of phosphorus components.

Seals Protection: Protection for hydrogenated nitrile seals has been requested to be added as an additional material to be aligned with the seals materials that are currently used in the ACEA specifications.

Replacement tests: The Mack T-11 soot-induced viscosity increase control test will be replaced by a Cummins soot viscosity control test, which is expected to directly replace the Mack T-11 with similar viscosity control parameters for the new higher viscosity grade API ‘C’ category. This test development is expected to be used to fill multiple voids formed by the Mack T-11 and Mack T-8, which are approaching their end-of-life. This test development will:

The following PC-11 tests will not be included for PC-12:

In addition, there are challenges of ensuring tests are suitable for use with new lower viscosity fluids. Here, new reference oils at SAE XW-20 are needed for some tests that were developed in the PC-10 timeframe with SAE 15W-40 reference oils.

There is a still much work to be done to develop and test engine oils ready for market in MY 2027 vehicles. Infineum Insight will keep you informed of PC-12 progress – sign up here to receive regular updates to your inbox.

Sign up to receive monthly updates via email