Passenger cars

Severe hybrid engine oil testing

20 May 2025

Please note this article was published in March 2015 and the facts and opinions expressed may no longer be valid.

11 March 2015

Helping to meet the latest fuel economy legislation without compromising durability

At the recent ICIS World Base Oils & Lubricants Conference in London, Infineum’s Jonathan Flemming revealed how a tailored approach to low viscosity formulation, with aligned supply of the necessary base stocks, is essential to ensure fuel efficient lubricants that deliver sufficient hardware protection can be supplied

Legislation and consumer demand make improving fuel economy performance a high priority for today’s passenger car OEMs. And, because fuel economy derived from advanced lubricants comes at a smaller cost than redesigning hardware, it is increasingly being seen as an attractive route to efficiency improvement.

Reducing viscosity, which in turn reduces engine friction, is clearly an effective way for lubricants to contribute to the fuel economy performance of a vehicle.

We already see SAE 0W-16 in the market, and some OEMs are beginning to look at viscosities as low as SAE 0W-8, or even 0W-4. In this low viscosity era it is becoming increasingly important for us to understand the implications this has on the formulation envelope and on hardware protection.

Lowering a lubricant’s high temperature high shear (HTHS) viscosity might result in fairly small improvements in fuel consumption. But, the potentially significant fines for non-compliance to emissions and fuel economy legislation mean OEMs value every contribution to help them meet their fleet-wide efficiency targets. This means the trend to ultra low viscosities is extremely likely to continue.

However, because vehicle population age and OEM market share both impact viscosity grade trends, it will take some years before these new viscosity grades make up a significant portion of the market. Take North America as an example, here SAE 5W-30 is currently the most common viscosity grade, but it took from the late ‘80s until 2006 for it to reach this position. And, even though SAE 5W-20 and 0W-20 are now the most widely recommended grades for new cars, it will take a long time for SAE 5W-30 to exit the market.

Because low viscosity grades will only be used in new vehicles, it is unlikely that significant volumes will be seen in the market until 2020.

Even this far in the future, SAE 0W-16 and below will account for a just small percentage of oil sold in North America – a picture likely to reflect global viscosity grade trends.

The first formulation challenge presented by moving to lower viscosity lubricants is how to balance the desire for fuel economy with the need to protect the engine and all its components.

The thinner oil films associated with low viscosity fluids mean it is harder for the oil to keep the loaded contact surfaces in the engine sufficiently apart from each other. This can lead to accelerated wear rates, and even locally increased friction.

It makes little commercial sense to trade engine durability for fuel economy gains.

Infineum studies indicate that, in some engines, reducing lubricant viscosities to 2.3 HTHS presents little risk of engine component wear. Below this level, specific engine components, for example the top ring and bearings, observe higher wear rates. To ensure ultra low viscosity lubricants deliver fuel economy and wear protection it is becoming increasingly important to co-engineer the vehicle hardware and lubricant system.

This collaborative development approach becomes even more important when you consider that not all engines deliver the same fuel economy performance with low viscosity formulations.

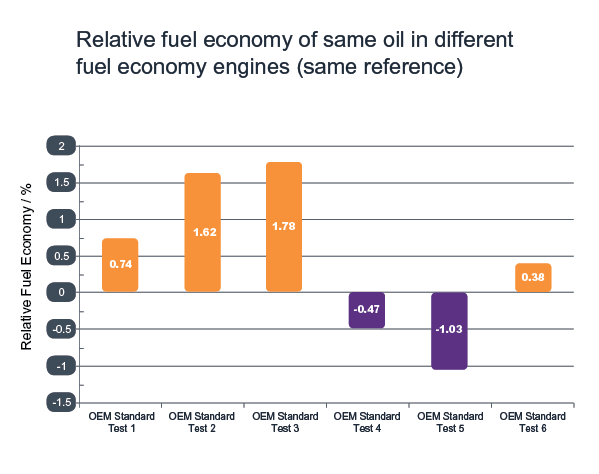

In recent testing Infineum examined a variety of engines using the New European Drive Cycle. The engines were run on the same SAE 0W-30 oils and measured against the same reference oil. The chart below shows the different fuel economy performance seen across the range of engines.

What is clear from our research is that fuel economy lubricants must be individually tailored to suit each vehicle type, something that will add significant complexity to their development, or compromises must be made to balance fuel economy across a range of engine types.

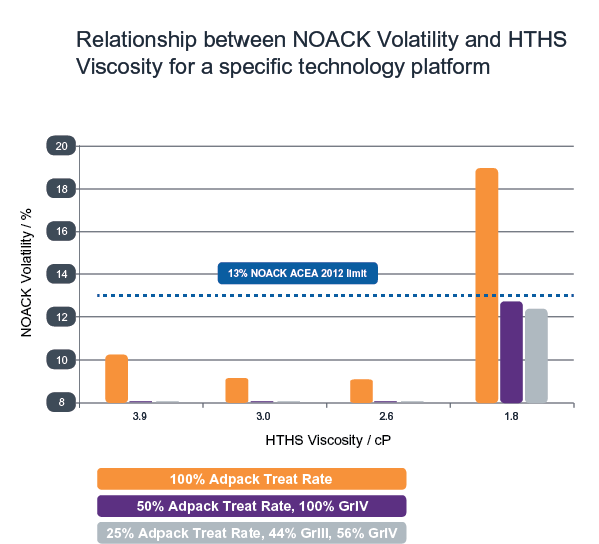

Increased wear is not the only consequence of lowering lubricant viscosity - as viscosity goes down volatility also increases.

In the high operating temperatures of modern engines the lighter ends of the hydrocarbons in a lubricant can evaporate. This pushes the viscosity of the lubricant up and, as a result, any fuel economy improvement gained from the low viscosity of the oil may be lost due to an increase in friction.

There is a minimum HTHS level before volatility increases above limits specified in lubricant specifications. And while using less of the additive package can improve this situation it could also compromise performance.

Clearly the fine balance between viscosity and volatility is an important consideration that must be addressed in the design of innovative additive technologies, which must offer sufficient performance at lower viscosity levels.

To produce effective low viscosity lubricants, base stocks with lower viscosity, higher viscosity index (VI) and lower volatility are needed. This means the pace at which we move to ultra low viscosity will be heavily influenced by the availability and cost of high quality base stocks.

Currently sufficient volumes of Group III should be available to meet the demand for SAE 0W-16 and 0W-20 viscosity grades. But it is not clear if there will be sufficient very high VI or PAO base stocks to meet demand for ultra low viscosity oils - something that could increase investment challenges for all stakeholders.

This is a very complex area, where decisions are often driven by OEM specifications. And, because these are not all the same, the Group III, high VI Group III, PAO, and ester base oils mix can vary depending on which characteristics in the specification are the most challenging to meet. Part of our job is to provide the most cost effective and supply reliable formulation solution to the market.

Fuel economy is undoubtedly one of the biggest drivers for change in the automotive industry, which means moving to ultra low viscosity engine oils is a trend that is bound to continue.

Thorough formulation development and careful base stock selection is essential to ensure we strike the right balance between fuel economy and hardware protection and between lubricant viscosity and volatility.

Right now, we believe the technical wear protection challenges presented by SAE 0W-16 oils can be handled by lubricant and engine design advances. But, some OEMs are already going below SAE 0W-16 – and now that the definition of SAE 0W-8 and 0W-12 has been approved the move to low viscosity grades may accelerate. In our view, because lubricant derived fuel economy is engine specific it is increasingly important to create tailored formulations.

This will ensure the most benefit is derived without needing to compromise on performance across a myriad of different engine designs with different needs. Infineum is continuing to assess the impact of a number of variables including the effects of using different combinations of viscosity modifier polymers and high quality base stocks.

Viscosity grades are fragmenting – adding significant complexity to the market. Close collaboration with OEMs is increasingly important to ensure that changes in the design of hardware and lubricant systems deliver enhanced fuel economy performance without compromising engine durability.

Sign up to receive monthly updates via email