Passenger cars

Severe hybrid engine oil testing

20 May 2025

17 May 2022

With 350 battery electric models available in 2022 the pace of vehicle electrification could be set to change

As more countries introduce tougher CO2 emissions targets for vehicles en route to their net-zero by 2050 commitments OEMs are responding by offering more electrified models to ensure they comply. Al Bedwell, Global Powertrain Director at LMC Automotive, talks to Insight about the technologies he expects to dominate the future markets and how the pace of change may differ across the regions.

The climate crisis and the need to limit global warming are driving policymakers in all the major automotive markets to introduce new CO2 emissions reduction and fuel economy targets. Al Bedwell from LMC Automotive, a global provider of automotive sales, production, powertrain and electrification forecasting and market intelligence, explains, this is one of the clear drivers for powertrain technology change. “These CO2 reduction targets, driven by net-zero commitments, are steering car buyers away from pure fossil-fuel vehicles and towards cleaner alternatives, predominantly battery electric vehicles (BEVs). At the same time, in China and other Asian countries the problem of urban air quality in major cities is also a key concern and at a global level, becoming less dependent on fossil fuel is another driver for change.”

In terms of the passenger car market as a whole, where sales were hard hit through the pandemic, LMC Automotive expects a return to normality from next year, although the impact of the chip crisis may last into 2024. “We have seen sales being production-constrained over the last 1.5 years and the assumption was that when the supply side normalised that the underlying demand would lead to market recovery to pre-pandemic levels within a few years. However, recent events and the impact on living standards and disposable incomes, leads us to doubt that this will be the case and a more drawn-out market recovery is now possible.”

That said, the industry can’t stand still. Although the rigour of CO2 reduction targets varies by country there is one direction of travel now that 130 countries have signed up to net zero carbon commitments – with most setting 2050 as the target date.

“To have a net zero vehicle fleet in operation by 2050, new car sales need to be zero emissions from around 2035 or a bit later depending on typical vehicle life in the market concerned.”

Al Bedwell LMC Automotive

“We are starting to see firm commitments from OEMs to stop selling internal combustion engine (ICE) light vehicles from around this time in several jurisdictions. This includes the EU, even though the 2035 100% reduction in CO2emissions from new light vehicle sales is not yet legally binding. In my view, the realistic options for zero emission light vehicle technology are either BEV or fuel cell electric vehicle (FCEV). Momentum is hugely with the former while the latter looks likely to be largely the preserve of heavy vehicles.”

However, Al sees considerable regional variation in OEM approach. “Most western OEMs have put their light vehicle FCEV research on ice and are placing all bets on BEV. Japanese and Korean OEMs continue with small scale FCEV projects, but volume expectations remain low for the foreseeable future, with global sales reaching only 17,000 in 2021 compared with 4.6 million BEV. The roadmap to zero emission vehicles (ZEVs) includes technologies that help to satisfy interim CO2/fuel efficiency targets, but that are not necessarily ZEV. These include hybrids (plug-in and non-plug-in), which have a lengthy but ultimately limited lifespan if we accept that the end game is global ZEV.

As the barriers to BEV are slowly removed Al says he expects their popularity to grow – although cost justification may not be top of consumer’s justification list. “It just so happens that BEVs tend to be fun to drive and, from the consumer side, this is a significant attraction. Savings can be made on fuel (vs. the cost of fuel for an ICE car), but whether total cost of ownership savings can be made by switching to BEV depends on the segment and market. For example, according to LMC modelling, in the UK for a mid-size crossover style of vehicle, BEV loses out to ICE over the first three years of ownership by a modest amount due to high acquisition costs. The idea is that BEV prices will fall as battery costs fall and hence BEVs will achieve price parity (or better) with ICE across the segments and markets. However, there are growing threats to this assumption. In favour of BEVs, there are the positive impacts they have on urban air quality, although it must be said that most issues of poor urban air quality are related to older vehicles and that new ICE/hybrid vehicles also make a huge contribution to improved air quality, assuming that an old ICE vehicle is replaced.”

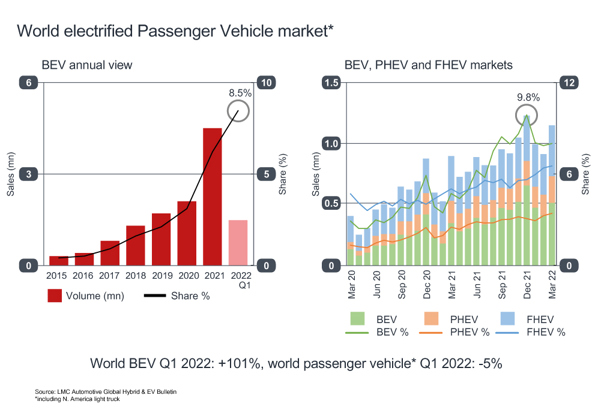

Global demand for electrified cars has grown in recent years and, as Al explains this is particularly true for BEV where model availability, policy incentives and expanding infrastructure are making them more attractive.

“We can expect to have some 350 BEV models to choose from globally by the end of this year."

Al Bedwell LMC Automotive

"This combined with policy, incentives (generous in some countries) an expanding charging infrastructure and the success of Tesla will drive BEV demand to new heights. Q1 2022 BEV growth was 100% YoY whereas passenger vehicle sales overall fell by 5%.”

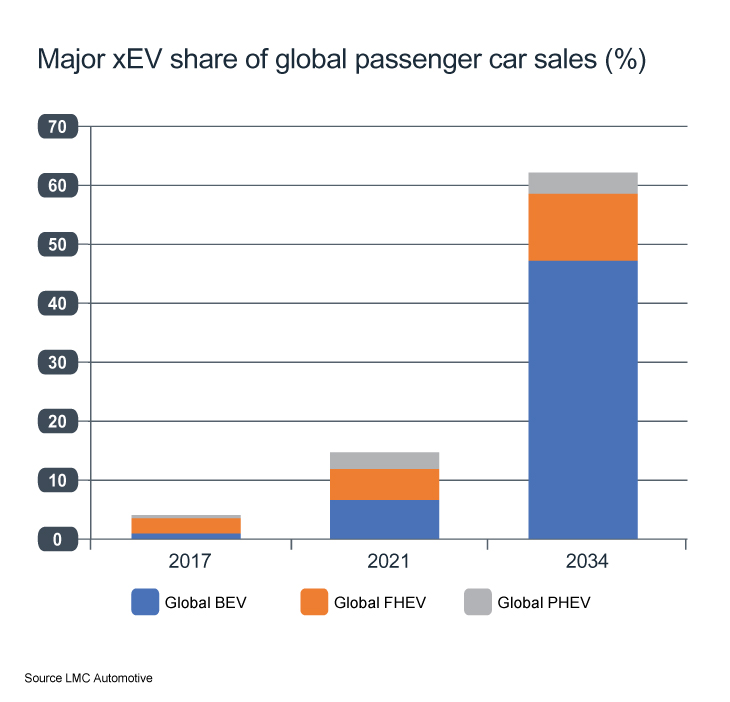

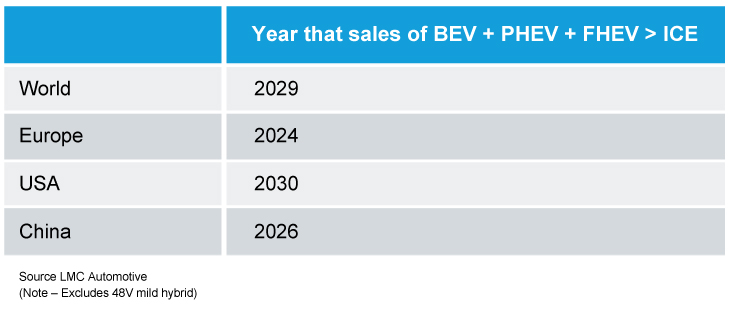

According to LMC automotive BEV sales have now moved clear of full hybrid (FHEV) and plug-in hybrid (PHEV), and Al expects them to pull even further ahead. “In volume terms, Europe and China are leading the way in BEV sales although from a growth standpoint, the US BEV market is keeping up with Europe. It’s likely that BEV growth may moderate this year but there’s little doubt that BEV volumes will continue to expand significantly. In Europe, unlike 2020 and 2021, there is no fresh CO2 target this year, and we expect OEMs to push plug-in vehicles a little less hard than in the last two years. In China, and more widely across the globe, BEV prices are climbing as carmakers are forced to pass on rising raw material costs, a trend that we expect to dampen the huge growth seen last year. We expect passenger vehicle pure ICE to fall below 50% by 2027 at which point BEV will be circa 25% of the market and hybrids will form another 25%.”

From an Infineum standpoint, despite the relatively rapid uptake of EVs, it will take some time to flow through to the vehicle fleet and, in our view, in 2030 more than 90% of vehicles on the roads will still contain an internal combustion engine.

This means Infineum expects the ICE platform to be with us for a long time to come and will continue to need advanced lubricants to ensure compliance with the latest emissions regulations. At the same time, battery electric vehicles will bring a new set of challenges requiring the use of advanced dedicated fluids.

In the future powertrain mix, plug in hybrid vehicles adoption is expected to be limited and, according to LMC Automotive, over the last few years PHEV share and volume growth has been modest. “While PHEV remains a critical part of the roadmap to ZEV, the fact that it isn’t a ZEV technology moves it down the list of options for long-term solutions. It remains popular when supported by incentives or favourable taxes but, without these benefits, it may make little financial sense for most users due to typically higher acquisition costs than non-plug-in hybrids or pure ICE vehicles. Nevertheless, for some OEMs it has been a key part of meeting CO2/fuel efficiency targets and will continue to be so through this decade.”

PHEV sales lag full hybrid and battery electric sales

PHEV sales lag full hybrid and battery electric sales

But, as Al continues, from some OEMs’ perspectives PHEVs do make sense. “PHEVs can be built on existing ICE platforms with additional mechanical components accommodated within the drivetrain and batteries not being so large that they need a dedicated BEV platform. Tier one suppliers have developed off-the-shelf PHEV solutions that OEMs can incorporate into their vehicles at relatively low development costs versus BEVs. However, cost versus traditional ICE or FHEV is seen as the key barrier to adoption, with typically, a substantial premium to pay for a PHEV to offset the additional engineering costs plus the bigger Li-ion battery cost. PHEVs are also generally being forced to offer longer e-ranges to qualify for incentives and this keeps prices high. In the long term, the key barrier is that PHEV are not zero emissions vehicles and so are not attractive from an OEM perspective as a technology in which to continue investing large sums of money.”

From an Infineum standpoint, while BEV is expected to be the long-term future, over the next decade we expect the production of hybrids to grow at a much faster rate that BEVs. And, combining hybrid powertrains with e-fuels is a promising short- to mid-term solution that can help to reduce CO2 emissions.

Infineum expects hybrids to be a large component of the light-duty market for years to come and lubricant solutions will need to continue to evolve with the changing hybrid configurations.

In terms of the challenges that have hindered the rapid adoption of BEV electric vehicles, Al suggests that many have now been addressed. “It is fair to say that challenges of everyday usability have largely been overcome by increases in the vehicle range, which BEV drivers view as a key attribute - hence the popularity of Tesla cars.”

“The BEV adoption barriers that remain are chiefly cost, the reliability of the fast charger network to enable hassle-free longer journeys and the availability of a BEV as the type of car consumers wish to purchase.”

Al Bedwell LMC Automotive

“The latter and charger infrastructure will be solved over time as more models are released and as charging networks are rolled out, which in our opinion leaves cost as the key barrier to adoption.”

With that in mind, LMC Automotive forecasts that the day electric vehicle sales outnumber ICE sales is not too far in the future.

In terms of other powertrain technologies in passenger car applications Al does not see much of a future. “In our view, there is little opportunity for H2ICE in this sector unless a considerable weakness in the BEV supply chain persists. However, H2ICE is emerging as a viable option for heavy-duty applications. Hydrogen fuel cells are not likely to be successful in the light vehicle market since blue or green hydrogen is in short supply and there is high competition for it from other sectors such as aviation, heavy-duty transport, industrial energy and domestic heating. And, because light vehicles can use batteries, they are quite far down the queue for clean hydrogen. As for traditional ICE, the technology focus is largely on reducing emissions (toxic and non-toxic) to comply with regulations until such time as ICE is no longer viable for cost or emissions target reasons.”

“We’re not seeing any other large-scale technologies entering the market in the foreseeable future.”

Al Bedwell LMC Automotive

However, new challenges in realising an all-electric passenger car market are emerging. These are around the availability of certain metals, such as lithium and nickel, which may limit the ability to manufacture the batteries required.

“Both of these metals are critical battery materials but in the case of nickel there are likely to be ways out of the problem. Nickel-free chemistries, such as lithium iron phosphate (LFP) are available and being developed with performance beyond initial expectations. However, LFP isn’t suitable in all cases, which means nickel chemistries will still be needed. But, the nickel industry is mature and while nickel prices will remain higher than the long-term average, there are mechanisms for the supply of nickel to be adequate, and for the battery industry to adapt. As for lithium, cell makers are gearing up to increase production of li-ion cells. The assumption was that the lithium industry would keep pace and that while prices would be elevated, compared with long-term trends, lithium would be available at reasonable prices under long-term contracts."

"There are now significant concerns among analysts and miners that although many lithium projects are being developed, their output will not keep pace with demand for BEV batteries."

Al Bedwell LMC Automotive

"We agree with that analysis. Reaching target output from a lithium extraction project is fraught with potential delays and opposition on Environmental Social and Governance grounds and generally takes much longer than planned. In our view, this shortness of lithium, which is used in all mainstream battery chemistries is the biggest threat to the BEV sector. Not only will it put upward price pressure on batteries (and hence BEVs) in the medium to long-term but also it may limit the number of BEVs that can be built in coming years.”

Sign up to receive monthly updates via email