Commercial vehicles

ACEA HD Sequences released

22 January 2025

03 October 2023

Growing natural gas commercial vehicle market spurs demand for advanced lubricant formulations

The need to work towards a decarbonised future is driving heavy-duty vehicle manufacturers in India to explore lower carbon fuel sources, including natural gas. Dr Amol Nilpawar, Senior Technologist at Infineum, explains the impact of these fuels on engine oils and how, with limited industry lubricant specifications for these more challenging applications, there is a growing need for field proven technologies that can demonstrate sufficient engine durability over long drain intervals.

To help improve air quality in India significant changes have been made to vehicle emissions regulations. In 2020 the introduction of Bharat Stage 6 (BS 6) reduced oxides of nitrogen (NOx), hydrocarbons and particulate matter (PM) emissions from heavy-duty vehicles. From April 1 2023, the implementation of BS 6 on-board diagnostic (OBD-2) norms mandated a tighter NOx and PM limit for OBD for heavy-duty diesel vehicles. In addition, the country has announced its aim to reach net zero emissions by 2070 and, at COP 27 in 2022, submitted its Long-term Low Emission Development Strategy.

Over the coming decades, India plans a smooth, sustainable and all-inclusive transition away from fossil fuels towards electrification, hydrogen and other alternative fuels in transportation.

However, it is a long path and, to reduce emissions now as the industry works towards decarbonisation, the use of lower carbon fuels, such as natural gas, are growing in popularity.

In the heavy-duty sector, compressed natural gas (CNG) brings several advantages. Relative to diesel fuel, it is cleaner burning, emits lower particulates, NOx, carbon monoxide and greenhouse gas (GHG) emissions. CNG’s clean burning property results in less carbon build-up, potentially reducing engine wear and extending engine life. In addition, CNG is generally less expensive than gasoline or diesel, which can result in significant cost savings for driver-owners and fleet operators.

In India, FY 2023 has been a strong year for CNG, with overall vehicle sales surging 46% to reach over 650,000 units.

Currently most are in the passenger car and three-wheeler segments, but there is also interest in the commercial vehicle segment – where 10% of the almost 1 million units sold were powered by CNG.

However, natural gas vehicles still have barriers to overcome. Currently there is limited refuelling infrastructure, although forecasters suggest that the number of CNG fuelling stations in India could triple by 2030 from the 4,000 available today. Also, despite the reduced running costs, higher initial vehicle purchase prices mean that the payback period would be longer for vehicles used infrequently. But, OEMs are increasingly including CNG models in their commercial vehicle lineups with Tata announcing five new CNG trucks in September last year – including the country’s first CNG-powered Medium & Heavy Commercial Vehicle in the 28 and 19 tonne nodes.

However, recent steep increases in the price of CNG has dampened CNG commercial vehicle sales, and sales are likely to remain pegged to the market price of CNG in the foreseeable future.

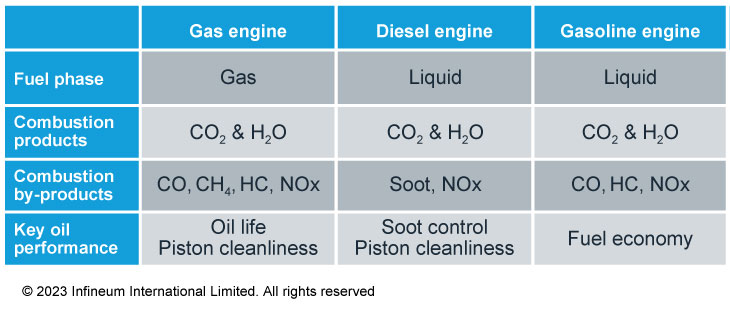

Oils designed for internal combustion engines that are developed to run entirely on natural gas must handle different conditions to those formulated for conventional liquid fuels.

In a CNG internal combustion engine, higher combustion temperatures lead to higher oxidation and nitration of the engine oil, which depletes base reserves, resulting in corrosion and deposit issues. More water is produced during combustion, which can lead to deposit formation. In addition, the gaseous fuel does not provide any valve lubrication, which means striking the correct sulphated ash balance in the finished oil is essential to prevent valve recession, guttering and torching. And, as oils trend to thinner viscosity grades for improved fuel economy, it is essential to ensure they can continue to deliver robust wear protection over an extended oil drain interval (ODI).

Diesel engine oils are typically formulated to handle soot and not nitration, with a high base number (high ash) for acid neutralisation, which means they are not ideally optimised for use in engines running on CNG. Additionally, as OEM warrantees are being extended in line with evolving customer demands, the need to maintain engine durability over extended drain intervals is increasingly important and is something that requires natural gas engine oil formulations tested to stringent OEM standards.

The engine oils used in heavy-duty vehicles are regulated by the ACEA oil sequences and API engine oil performance categories. However, these are not designed around the needs of mobile natural gas applications.

Since very few dynamometer engine tests exist for natural gas engine oils, lubricant performance is generally assessed via field trials.

Here, the Cummins CES 20092 engineering standard for mobile natural gas engine oils is an important specification, including performance tests for oxidation stability and protection of the power cylinder. The standard is designed around CNG and LNG mobile applications and covers SAE xW-30 and xW-40 viscosity grades.

One of the key requirements is an extended field test across a range of engine types, which demonstrates wear and corrosion protection, oxidation and nitration control, cleanliness performance and emulsion resistance. A second requirement is to pass an engine dyno test designed to stress the oil’s oxidation and thermal stability in the natural gas environment.

With a wide range of CNG vehicles expected to be introduced into the Indian vehicle parc in the coming years, there is a growing need to engineer lubricants designed to meet their specific needs.

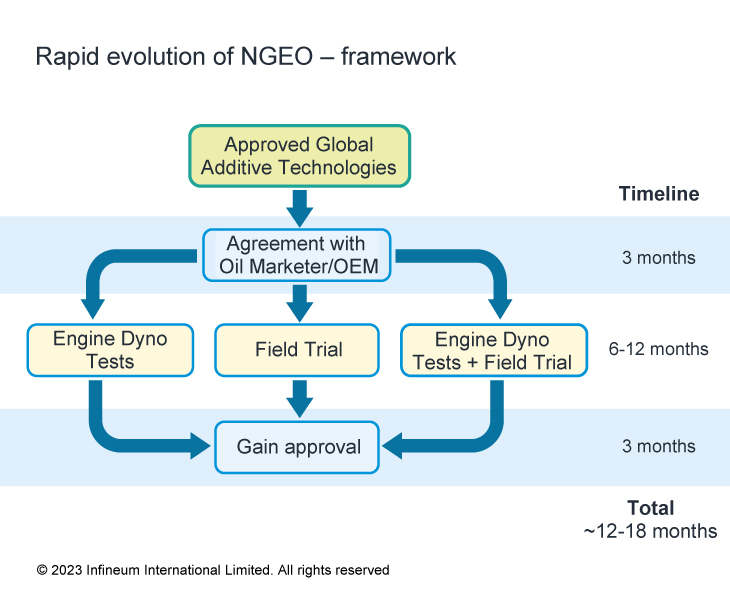

To cater for the fast evolving requirements of the Indian market Infineum selected a proven technology that has CES 20092 credentials and field test experience in heavy-duty CNG tractor trailers and buses. This technology provided significant data on the condition of engine components and used oil analysis. In our experience, the use of approved additive technologies in natural gas engine oil (NGEO) formulation helps to speed up the field/dynamometer testing, approval and marketing. In our framework we have been able to condense the timeline to 12-18 months.

Using the framework in recent testing of BS 6, long-haul cargo trucks running on CNG, our SAE 15W-40 candidate oil has doubled the length of the oil drain interval, exceeding 40,000 km.

Longer drain NGEOs are gaining market acceptance, although OEMs are already looking beyond current initiatives. While heavy-duty diesel engine oils can reach 80,000 km ODI in intermediate commercial vehicles, ODIs for NGEOs are still hovering around 20,000 km. The need to increase the latter means we can expect to see rapid developments in this oil category.

Using the Infineum framework for NGEO adoption enables customers to commercialise products faster. The use of high performance additive chemistries in formulations tailored to meet the requirements of CNG mobile applications delivers the long drains and engine durability necessary to service this high growth market. Through technology leadership, Infineum is well positioned to meet the upcoming challenges.

Sign up to receive monthly updates via email