Passenger cars

Severe hybrid engine oil testing

20 May 2025

20 March 2023

Flexfuel engine technologies support Brazil’s climate action and energy security goals

Back in the 1970s The National Alcohol Program, Proálcool, kick-started a strategic policy of the Brazilian government to replace petroleum-based fuels for vehicles with sugar cane derived ethanol. This initiative aimed to not only reduce dependence on imported oil but also to play a fundamental role in controlling emissions and improving sustainability. Jorge Manes, Infineum Industrial Liaison Advisor in Brazil, explains how, despite the ups and downs seen over the past 50 years, it has led to flexfuel engines and new legislation.

Recently the Brazilian Administration committed to reach climate neutrality by 2050 instead of 2060 and to keep its nationally determined contribution (NDC) target of reducing 43% of greenhouse gas (GHG) emissions by 2030, compared to 2005 levels. Ethanol is a fuel that can be used in vehicles either as a blend with gasoline or alone. Since it has a lower carbon footprint from well to wheel than gasoline and is made from sugar cane, it not only contributes to GHG reduction and sustainability targets, but also supports fuel production security. Brazil has had a long history of developing and improving its use in vehicles.

When the Proálcool programme first started to promote the production of sugar cane derived ethanol for use in ethanol cars in the early 1970s, its use was not without issues. These included challenges such as the corrosion of materials in contact with the new fuel, leaks, difficulty of starting from cold and gum formation in the carburettor. A number of these difficulties were solved - for example, cold start failures were prevented with the introduction of an auxiliary gasoline tank. But, other issues that persisted, such as the swelling of seals in contact with ethanol that eventually broke and caused leaks, have been solved gradually over time.

The late ‘70s saw an expansion of Brazilian automotive engineering innovation, through the involvement of industry stakeholders including manufacturers, auto parts suppliers, government and universities.

This collaboration process enabled the development of specific vehicles, technologies and materials to better enable the use of ethanol.

The programme was given a real boost when the Brazilian Association of Automotive Vehicle Manufacturers (ANFAVEA) formally joined the Proálcool in September 1979. In addition, some standard quality definitions were introduced such as water content in the ethanol, avoiding regional differences. The alcohol content in gasoline was standardised, with a minimum limit added to the existing maximum, which allowed the later elimination of tetraethyllead in gasoline. And, lubricants with specific formulations started to appear.

Proálcool went through a critical period by the mid-80s. By 1986, the crude oil barrel price plummeted from 35 USD to 15 USD. This counter shock brought into question the substitution of gasoline by ethanol in Brazil. From 1986 to 1990 most of the independent sugar cane and ethanol suppliers fell into debt and switched to a different activity. The Brazilian government cut back its support for the Proálcool programme, bringing it to a halt in 1999. In turn, between 1996 and 2002, ethanol-only car production fell to practically zero.

However, in 2003, key engineering innovation allowed the introduction of flexfuel technology. The flex internal combustion engines (ICE) were now able to run on gasoline and ethanol in any mixture ratio. This enabled the industry to scale up production, giving the Brazilian consumer real freedom of choice when fuelling up.

In 2005, just two years after the debut of the first flexfuel car, the technology was already present in 80% of light-duty vehicles sold in the country.

From 2003 to 2021, around 37 million cars and pickup trucks rolled off the production line ready to receive both fuels.

Today, it is estimated that sugar cane occupies 9 million hectares, or about 1% of the national territory, of which 60% is intended exclusively for the production of ethanol. In 2022, the total Brazilian ethanol production was estimated at more than 31 billion litres, up 6% relative to 2021, owing to an increase in sugar cane production and the steady increase in corn ethanol production.

Despite the experience accumulated in vehicle technology, fuels and lubricants over the years, the use of high ethanol containing fuels pose lubrication challenges that need to be considered.

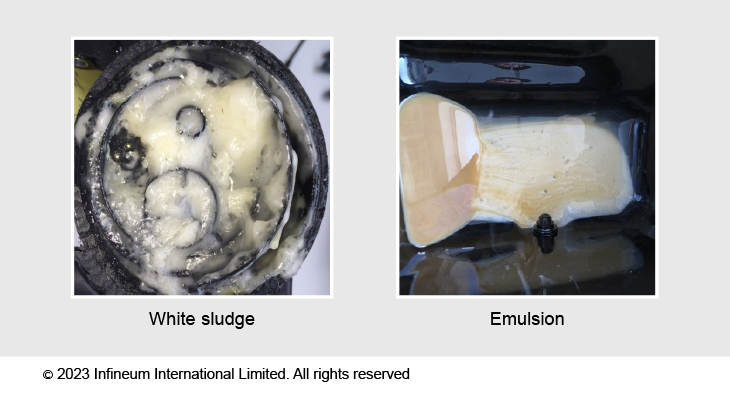

The first challenge concerns fuel and water build-up in the crankcase oil, when short journeys accumulate, especially when the engine does not get to full temperature before being switched off. This may result in the formation of white sludge, usually found in the oil mist separator, oil cap, rocker cover and/or valvetrain and emulsions, usually found in the oil sump.

The mechanisms of the formation, where it occurs, of sludge and emulsions are dependent on a number of parameters including:

All of these challenges are proportional to the ethanol level in use – which currently vary in Brazil from E27 (Brazilian gasoline containing 27% of bioethanol), up to ‘E100’ (the Brazilian bioethanol, here shown in quotes as it is a hydrated ethanol).

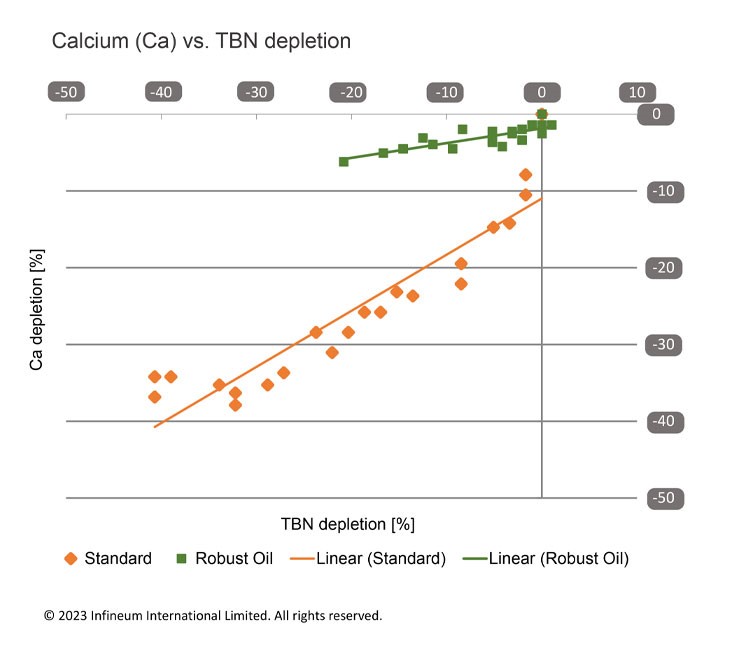

White sludge and emulsions may be accompanied by rapid base number depletion and destabilisation of the engine oil, resulting in increased premature wear and corrosion.

Despite the fact that white sludge and/or emulsions may appear as cosmetic issues in specific circumstances, albeit not leading to engine failures, Infineum has conducted field trials running on E100 fuels to better understand these lubricant issues. We found that fuel and water accumulation is much more visible under specific cold and hot cycle operations.

Such demanding conditions have highlighted the importance of using engine oils specifically formulated to handle high ethanol and water dilution without causing destabilisation or phase separation. The engine oil must be formulated to prevent, accelerated base number depletion, which can lead to engine corrosion.

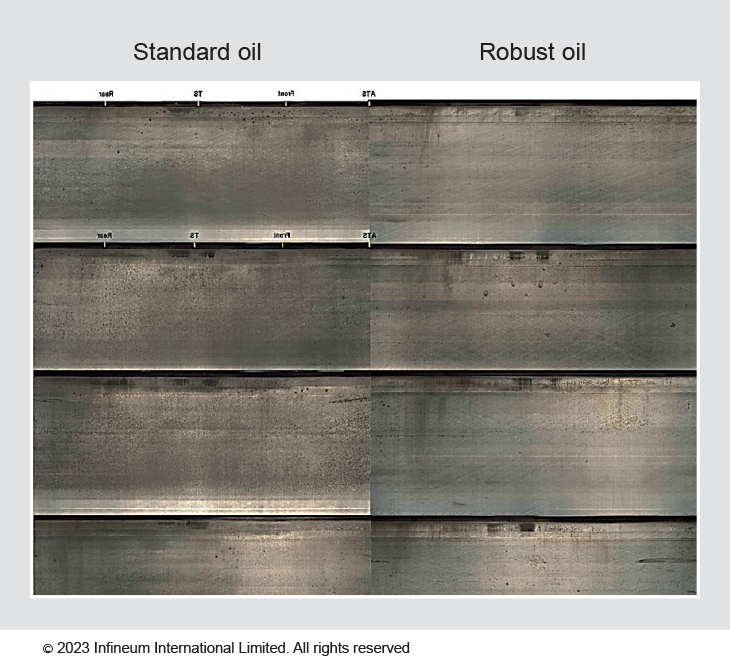

Under the severe conditions of the Infineum field trial using E100 fuels, corrosion can be observed in different locations throughout the engine.

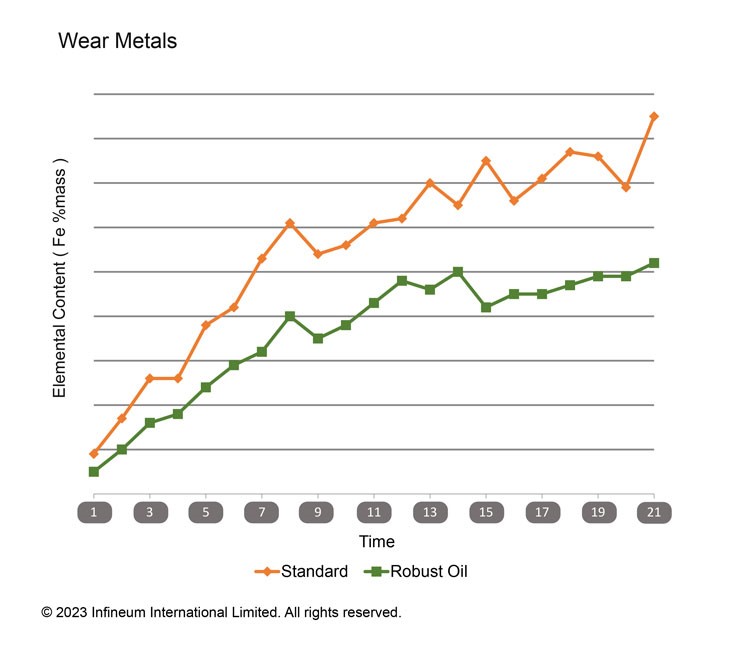

In addition, the standard oil resulted in higher wear metals, which could lead to accelerated engine wear with time.

These results highlight the need for robust engine oils that are tailored for use in flexfuel vehicles.

Vehicle OEMs are faced with the challenge of how to tackle fuel efficiency mandates. In Brazil, the governmental programme, called ROTA 2030, set up limited tax incentives in five-year cycles, the first of which concluded in 2022. The next phase, with increased fuel economy mandates, will be assessed by 2027, and the third phase, by 2032.

One path for OEMs is to go full electric vehicle (EV), a choice that some seeking the harmonisation with their global engineering plans have made. Another path is the transition to localised electrification or hybridisation of the flex ICE. Various OEMs have clearly selected this route for a number of reasons:

This move to the flex-hybrids could exacerbate flex engine lubrication challenges, making it increasingly important to use proven engine oils.

Sign up to receive monthly updates via email