Passenger cars

Severe hybrid engine oil testing

20 May 2025

05 March 2024

Diversity of passenger car power sources in growing European market will impact future lubricant performance requirements

Following the slump in vehicle sales owing to the pandemic, the subsequent supply chain issues and rising raw material costs, the European market for passenger car vehicles finally saw an expansion in 2023. But, it is not a uniform picture across the region and, given the EU’s challenging decarbonisation targets, the uptake of alternative power sources was lower than might have been expected. Insight reports on the new vehicle and powertrain trends and explores the potential impact on future fluids.

The European Automobile Manufacturers’ Association (ACEA) unites 15 major car, truck, van and bus makers and is the voice of the European automotive industry. As part of its activities, the organisation gathers statistics on European vehicle sales figures and recently published its 2023 summary, indicating the state of the market and the uptake of alternative power sources. In this article Insight takes a look into the figures, explores how the market is diversifying and assesses what this might mean for future fluid technology.

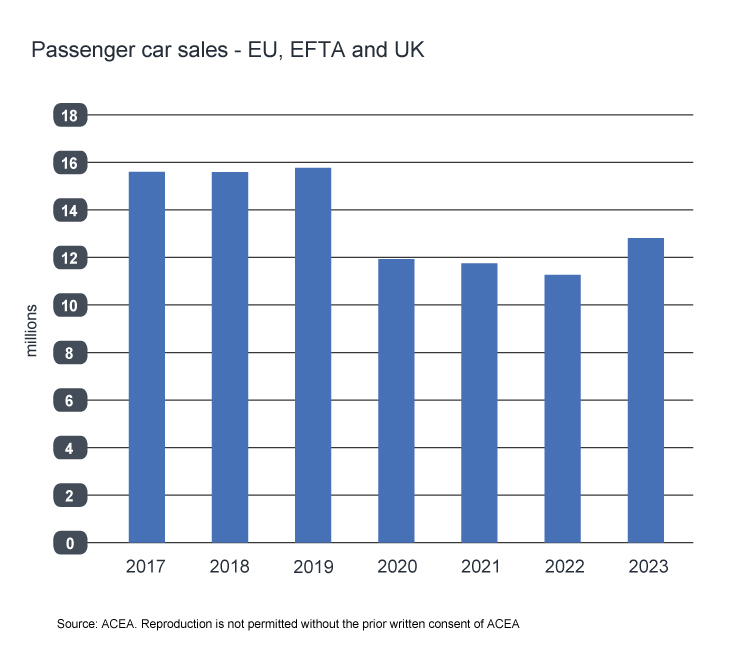

In 2023, ACEA reports that in the wider region, which includes the 27 European Union countries, plus EFTA (Iceland, Norway and Switzerland) and the United Kingdom, passenger car vehicle sales grew by almost 14% compared to 2022, reaching a full year volume of more than 12.8 million units. However, as can be seen in the chart below, this is still well below pre-Covid levels.

Diving deeper into ACEA’s 2023 data, we find that all the markets reported on, with the exception of Hungary, grew. However, it is a mixed picture across the five largest, where Germany, while retaining its number one position, recorded single digit growth, while the UK, France, Italy and Spain all had double digit growth figures. Most of the manufacturers also saw sales increases. By far the largest, in terms of sales volume, Volkswagen Group, reported sales of more than 3.3 million units – a growth of over 18% on the previous year. Together, the region’s top five automotive Groups, Volkswagen Group, Stellantis, Renault Group, Hyundai Group and BMW Group, account for more than two thirds of passenger car sales in this region.

But, it is quite a fragmented market, with the leading brand, Volkswagen, holding 10.6% of the market. The others making up the top 10 brands include Toyota, Audi, BMW, Mercedes, Renault, Skoda, Peugeot, Kia and Dacia, who together hold a further 47.5%.

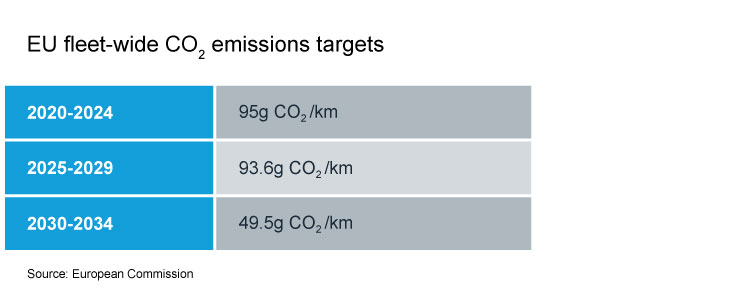

The EU reports that passenger cars are responsible for around 12% of total EU emissions of carbon dioxide (CO2). In 2023, the European Parliament and the Council adopted a regulation to strengthen the CO2 emissions performance standards in line with the European Union’s increased climate ambition. The following EU fleet-wide CO2 emission targets will apply to the region’s new passenger cars, with significant financial penalties for non-compliance.

From 2035 onwards, the amended regulation sets a 100% reduction target for cars, meaning 0g CO2/km.

It is clear the intent is to drive the market towards increasing the number of low and eventually zero carbon emissions passenger car sales.

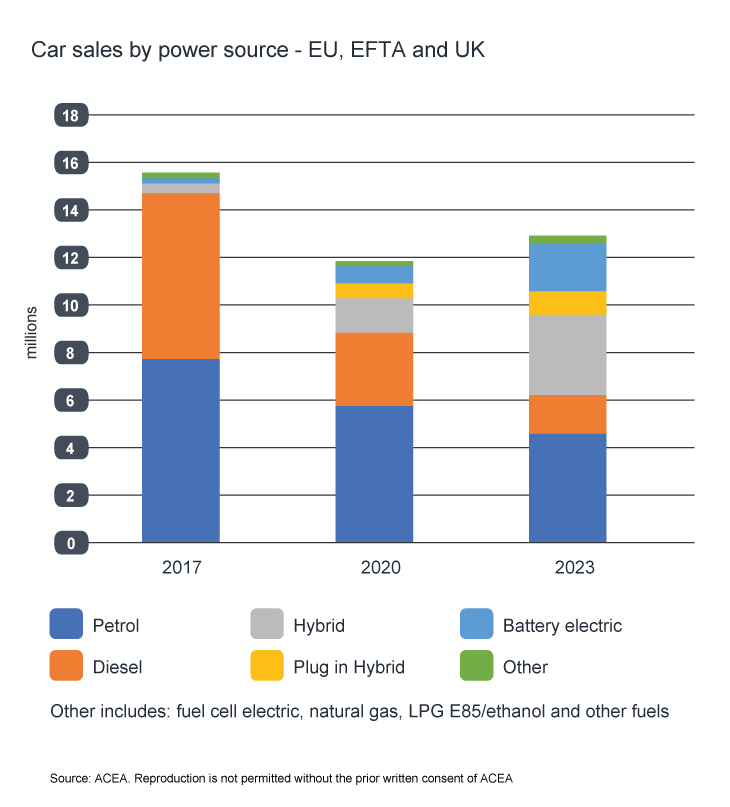

In this wider European region, there has been a decline in the sales of diesel vehicles and to a lesser extent petrol vehicles in recent years. The lower carbon emissions hybrid options, which still contain an internal combustion engine (ICE), have grown to reach over 33% of 2023 sales.

There still appear to be barriers to full user acceptance of battery powered vehicles. For example, in some countries there are issues around the limited availability, cost and slow performance of public recharging points and in others, this year’s extreme cold has caused anxiety over battery performance. But, despite these concerns, electrification seems currently to be one of the best zero carbon options for future smaller vehicle powertrains.

In 2023, of the almost 13 million cars sold in the region, just over 2 million (15.7%) were full battery electric vehicles (BEV).

In 2023, more than 80% of the vehicles sold in Europe contained an internal combustion engine

In 2023, more than 80% of the vehicles sold in Europe contained an internal combustion engine

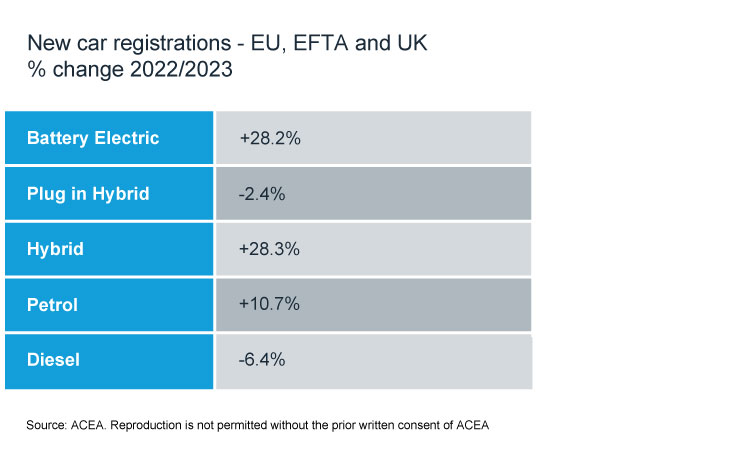

In the wider European region, when comparing 2023 vs 2022 sales performance, there was a mixed picture for the different powertrains.

Every country bar one in this region saw an increase in BEV sales vs 2022. The exception was Norway where BEV sales were down 24.4% in 2023 – although BEVs still represent 82% of new vehicles sales in the country. The largest car markets of Germany, UK, France, Italy and Spain all posted double digit BEV growth.

Plug in hybrid sales contracted slightly – mainly owing to a more than 50% drop in sales in Germany. Hybrid and petrol vehicles had a strong year, with all five top country markets recording double digit growth figures and only a few smaller markets seeing a downward trend.

Electrically chargeable cars (BEV and plug in hybrid) still only account for 1.2% of the total EU car fleet.

The picture for diesel vehicle sales was much more mixed. Of the largest markets, Germany and Italy saw an increase in sales vs 2022, whereas France, Spain and the UK all reported a double digit decline in percentage sales.

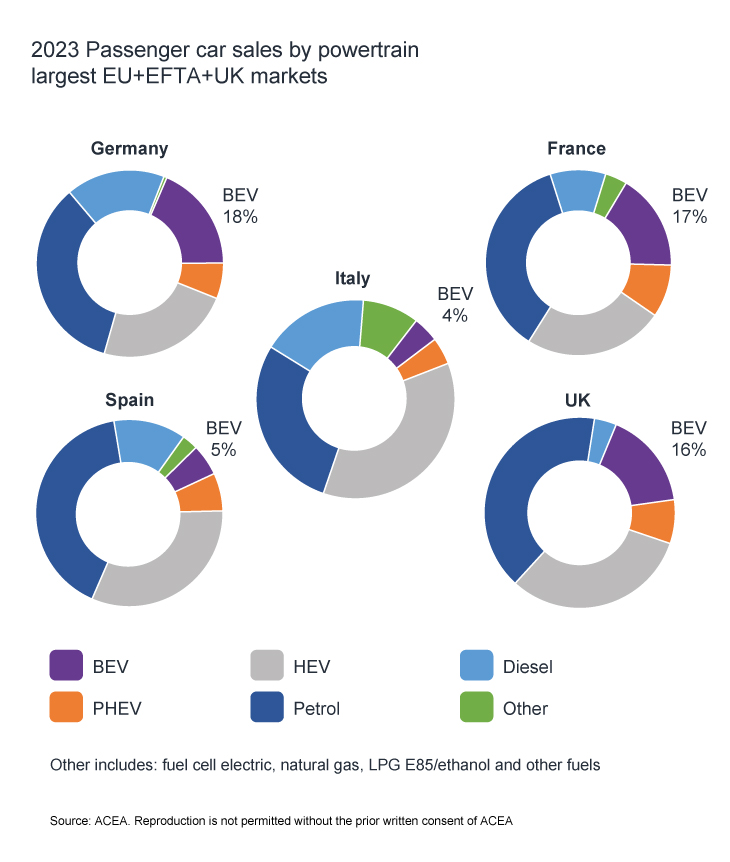

For new car sales the powertrain technology split is not uniform across the largest car markets of Europe

For new car sales the powertrain technology split is not uniform across the largest car markets of Europe

These trends in the passenger car powertrain mix have a significant impact on fluid requirements. As full battery electric vehicle sales continue to rise, the demand for more advanced e-specific products can be expected to grow. Here, lower viscosity e-driveline fluids have been shown to provide significant benefits including improved heat transfer, materials compatibility and excellent electrical properties, without sacrificing wear protection.

As the complexity of hybrid vehicle systems increases it will create a very challenging environment for conventional lubricants. In our view, as the vehicle parc expands, the market for next generation hybrid-specific oils that can deliver the required protection will grow.

For conventional ICE powered vehicles, the implementation date for Euro 7 emissions regulations for passenger cars is just over a year away. Here we can expect tougher emissions limits along with the shift from laboratory-based engine testing to real-driving emissions (RDE) testing to make an impact. In our view, lubricant compatibility with emission aftertreatment technologies will be even more important to ensure the performance and efficiency of the whole system is maintained.

The future powertrain landscape and fuel mix can be expected to continue to evolve, which will in turn drive change to the fluids needed to protect the entire system.

And, as the industry explores new zero carbon options, such as running ICEs on hydrogen, we are already anticipating and working to understand the lubrication challenges that will need to be overcome to support their introduction in the not too distant future.

Sign up to receive monthly updates via email