Future of Mobility

ASEAN a market in transition

09 December 2025

04 November 2025

The automotive decarbonisation journey is far from straightforward

Europe’s automotive sector is deep in transition, caught between ambitious regulatory targets, economic headwinds, and tough global competition. In a rapidly evolving policy landscape, while progress towards net zero continues, the automotive decarbonisation journey is proving more complex and uneven than many had hoped. Uwe Zimmer, Infineum Industry Liaison Strategy Advisor, shares the latest 2025 data and examines where the market stands today, how OEMs and policymakers are responding, and what the next chapter might mean for Europe’s green mobility ambitions.

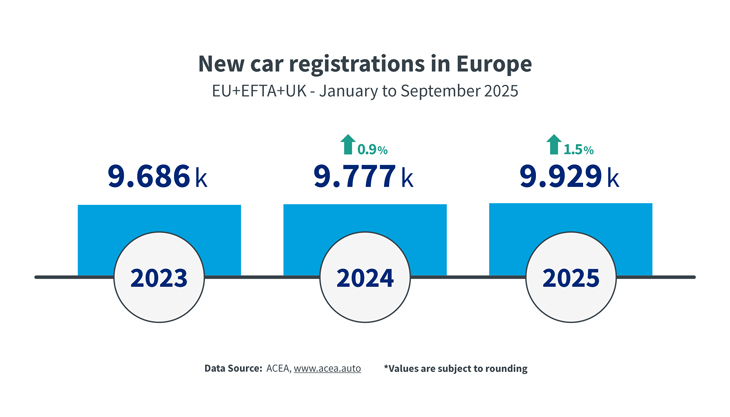

To set the scene, let’s look at the current market situation, before going on to explore the changes in policy, the competitive landscape and future outlook. At the time of writing, January to September 2025 data were available for new car registrations in Europe and these have been used throughout this article. New car registrations in the European market - comprising the European Union, the EFTA states (Iceland, Norway, and Switzerland), and the United Kingdom - reached 9.29 million in the first nine months of 2025. Strong growth in September means volumes increased by 1.5% compared to the same period last year.

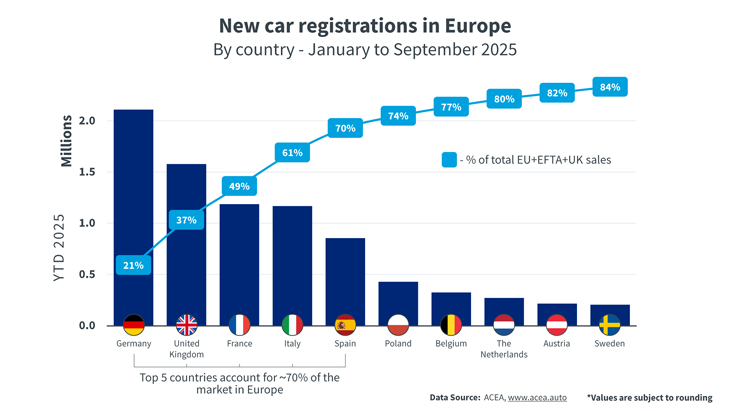

Regional differences remain stark. Germany retains its position as Europe’s largest market, followed by the UK, France, and Italy. These four account for 60% of Europe’s new registrations, and the top five countries cover close to 70% of the European car market.

Relative to the same period last year, Spain saw the strongest growth with nearly 110,000 additional registrations, whereas France recorded the most significant decline with 72,000 fewer vehicles.

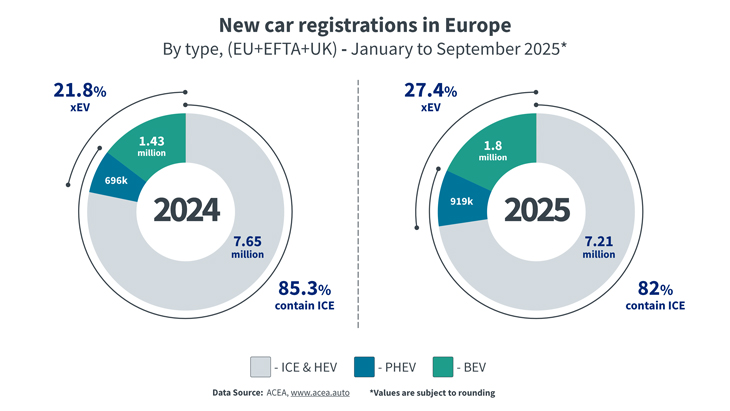

Electrification is progressing, but at a measured pace. Battery electric vehicles (BEV) accounted for 18.1% of new registrations across the EU, EFTA, and UK during the reporting period, an increase of 3.4 percentage points compared to the first nine months of 2024. Plug-in hybrid electric vehicles (PHEV) also edged up to 9.3%, from 7.1% in 2024. Yet, internal combustion engines (ICE), including non-plug-in hybrid electric vehicles (HEV), still power nearly three out of four new vehicles (72.7% in 2025 YTD versus 78.2% YTD 2024), underscoring the scale of the transition challenge.

At the country level, Germany retains its pole position in the number of registered BEV and PHEV vehicles, reaching a market share of 18.1% for BEVs and 10.3% for PHEVs. In terms of absolute EV registrations, the UK follows closely. Relatively, the UK has higher EV shares (BEV: 22.1%, PHEV: 10.9%). France and Italy have similar total market volumes, but Italy lags significantly in both absolute and relative EV numbers.

Compared to the same period last year, Spain nearly doubled its EV registrations and shows strong momentum in absolute terms. Poland ranks last among the top 10 countries in terms of EV adoption. Belgium, the Netherlands, and Sweden impress with absolute EV registration numbers that are on par with much larger markets, and EV shares (BEV + PHEV) of 42.7%, 55.2%, and 62%, respectively. Austria cannot quite keep up in absolute numbers but still achieves an EV share of over 30% in new registrations.

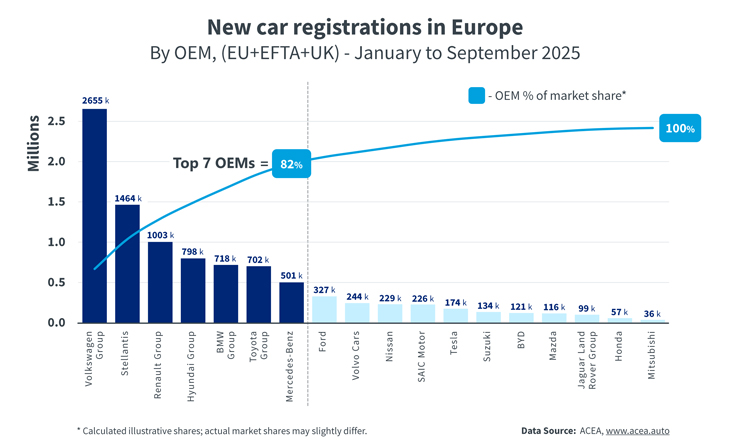

Volkswagen continues to dominate the European market, holding steady at around 27% share, followed by Stellantis and Renault with approximately 15% and 10% European market share, respectively.

Hyundai, BMW, and Toyota form a strong mid-field with market shares around 7-8%. Mercedes-Benz stands at approximately 5%, bringing the combined European market share of the mentioned OEMs above the 80% mark.

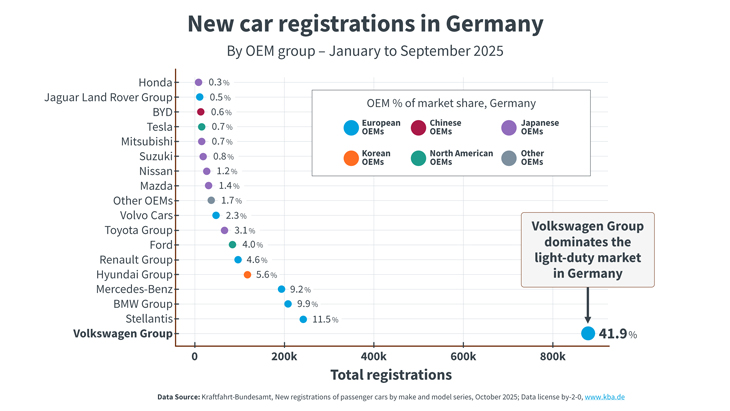

In Germany, Europe’s largest market, Volkswagen’s leadership is even more pronounced, with sales almost four times higher than its nearest competitor. As shown below, the share of 'Other OEMs' in the overall German market remains well below 2%.

Data License Germany dl-de/by-2-0, www.govdata.de/dl-de/by-2-0

Volkswagen Group also holds a commanding lead in absolute EV registrations. Compared to January to September 2024, Volkswagen increased its BEV share by nearly 10 percentage points to 19.3%. The PHEV share also rose by 6.2 percentage points to 10.2%. BMW, Hyundai, and Volvo perform slightly better in relative BEV share, with 21.8%, 26.7%, and 21.4%, respectively.

Excluding Tesla, BYD leads with a 60.5% BEV share. The 'Other OEMs' group also shows a high BEV share at 40.1%, likely driven by the much-discussed Chinese BEV brands. In Germany, from January to September 2025, Chinese OEMs held a market share of 1.9% (+0.9%). By vehicle type, Chinese OEMs accounted for 5.5% of German BEV registrations in 2025 (-0.2%), and 3.7% of PHEV registrations (+3.2%). While the market penetration of Chinese brands in Germany is small, the fast year-on-year growth is a trend to watch.

Data License Germany dl-de/by-2-0, www.govdata.de/dl-de/by-2-0

As reported in our earlier article on European automotive trends, a major regulatory milestone arrived this year as the EU’s car and van CO₂ performance standards entered their 2025 phase, requiring a 15% reduction versus 2021 baselines.

At the same time, the Strategic Automotive Industry Dialogue was officially launched. The first high-level meeting took place on January 30 2025, in Brussels, bringing together key stakeholders from the automotive industry and policymakers. This initiative, announced by Commission President Ursula von der Leyen in November 2024, aims to swiftly propose and implement measures to support the sector’s competitiveness and decarbonisation goals.

As a first measure, the EU introduced a three-year averaging window (2025-2027) for compliance with the 2025 CO₂requirements, replacing annual checks during this period.

This move is widely seen as a recognition of the slower than expected uptake of electric vehicles in the EU, a trend that automakers attribute in part to the EU’s failure to provide sufficient enabling conditions, such as charging infrastructure and consumer incentives. The economic pressures facing the sector are likely to also have played a role in the decision to allow a three-year averaging window.

The EU has a pooling system for CO₂ compliance, where manufacturers with more emission-intensive fleets can form pools with those producing more zero- or low-emission vehicles. There is now increasing recognition that the primary beneficiaries of this system are often located outside of Europe. Simply put, the highest demand for CO₂ credits comes from European OEMs with a currently high share of conventional ICE and HEV powertrains, while the main providers of credits are US manufacturers, such as Tesla, and Chinese EV makers. This results in a significant monetary outflow from EU OEMs to their US and Chinese competitors.

While some non-governmental organisations (NGOs) warn that this flexibility could dampen EV momentum if efforts are backloaded to 2027, the European Commission frames it as a pragmatic step to ensure predictability without diluting ambition. Earlier analyses suggest the 2025 targets remain achievable, provided OEMs continue to ramp up zero-emission vehicle (ZEV) shares to about 25%.

In the run‑up to the September round of the Strategic Dialogue on the Future of the European Automotive Industry and the forthcoming review of the EU vehicle CO₂ framework, the European Automobile Manufacturers' Association (ACEA) and the European Association of Automotive Suppliers (CLEPA) have been lobbying for a more holistic and pragmatic policy plan. Their joint letter to Commission President Ursula von der Leyen argues that Europe must recalibrate its CO₂ pathway to reflect today’s market, geopolitical and cost realities, rather than rely on penalties and legal mandates alone.

The letter is notably direct, stating that: 'Meeting the rigid car and van CO₂ targets for 2030 and 2035 is, in today’s world, simply no longer feasible.' It also calls for a review that better balances decarbonisation with competitiveness, social cohesion and strategic resilience. It urges technology neutrality as the guiding principle: 'While EVs will lead, there should also be room for plug‑in hybrids (including range extenders), highly efficient ICE, hydrogen and decarbonised fuels to accelerate real world emissions cuts and consumer acceptance.'

ACEA and CLEPA also caution against tightening the PHEV ‘utility factor’ (the assumed share of electrically driven kilometres in compliance), arguing that doing so now could unintentionally advantage non‑EU competitors. They frame dropping the potential utility factor restriction as the logical option to preserve an industrial perspective for manufacturing technologies and components in Europe as the transition unfolds.

In Brussels, the European Commission maintains its commitment to the climate target, while signalling technology openness and interim flexibilities - such as the new three-year averaging window and engaging industry through the Strategic Dialogue on the Future of the European Automotive Industry.

As the Strategic Dialogue continues, uncertainty about the 2035 ICE ban remains.

Germany’s political debate has sharpened in recent months, with concerns over job losses and soft EV demand fuelling calls for greater flexibility. At the September 2025 ‘Autogipfel’ (auto summit), Chancellor Friedrich Merz reiterated his government’s commitment to fighting the 2035 combustion engine ban or, at minimum, securing exemptions for plug-in hybrids and low carbon fuels. Industry leaders echoed the need for certainty and realism, arguing that earlier EV uptake forecasts were overly optimistic.

The market data presented at the outset show a European market with stable new registrations and continued progress in electrification, including among European manufacturers. Nevertheless, the half-year reports from Europe’s leading OEMs are alarming. Market leader Volkswagen reported an operating profit one third lower than in the first half of the previous year. BMW posted a 29% decline, and Mercedes-Benz reported a 55% drop.

OEMs are unanimous in attributing recent profit declines primarily to weaker sales abroad, a shift toward lower margin models, and the impact of import tariffs in the US and China.

Additional uncertainty for long-term investment and strategic planning across the industry comes from the persistent ambiguity surrounding Europe’s vehicle CO₂ roadmap.

Despite these challenges, the European Commission remains confident that the bloc is on track to meet its 2030 climate targets. In her 2025 State of the Union address, President Ursula von der Leyen reaffirmed that the EU is on track to meet the 55% reduction target for 2030, tying climate progress to Europe’s economic security and industrial competitiveness. Recent estimates suggest the EU is close to the required trajectory, although much depends on the quality of execution and the ability to adapt policy in response to market realities.

Amid all the discussion about how the EU can increase the share of ZEVs in new registrations, it is important to remember that even a ZEV is not CO₂-free over its entire lifecycle.

As reported in our earlier article on European trends, the European Commission is expected to publish a report by the end of this year outlining a methodology for assessing and consistently reporting the full lifecycle CO₂ emissions of passenger cars and light commercial vehicles. This will be a crucial step toward a more holistic understanding of the sector’s true climate impact.

While the 2035 EU combustion engine ban is certainly open to critical debate - and in our view should be - there is an urgent need to establish an objective assessment framework. Such a framework must, in all our interests, place the actual CO₂ emissions over the entire vehicle lifecycle at the centre of the political discussion.

It is to be hoped that regulators will focus on the goal of reducing emissions rather than on the technology path.

This approach would allow OEMs to introduce a variety of powertrains, including PHEV, to cut emissions today while net zero emission options are further developed and commercialised.

The road ahead will demand agility, collaboration, and a willingness to challenge assumptions on technology, policy, and business models. Europe’s green mobility transition is irreversible, but its success will depend on how well policymakers and industry navigate the complexities ahead.

Sign up to receive monthly updates via email