Small Engines

Field trial confirms superior performance

08 November 2017

24 September 2019

Tough limits effective in 2020 will require a lubricant formulation rethink

In 2020, Bharat Stage VI and Euro 5 legislation will impose strict limits on the emissions from motorcycles. Pei Yi Lim, Infineum Small Engine Market Advisor, explains the impact these regulations will have on motorcycle hardware and what will be expected from future motorcycle engine oil formulations.

According to figures from the Manufacturers’ Associations, sales of two wheelers in India, Europe and Japan exceeded 22.7 million in 2018, with more than 90% of these being sold in India. But, from 2020 new vehicles in this category sold in the three regions will need to meet tough new emissions regulations, which will necessitate significant change to engine and aftertreatment technology.

With effect from 1 April 2020, all vehicles manufactured and sold in India are required to be Bharat Stage VI (BS VI) compliant. This is a leap from the existing BS IV standard and will apply to all vehicle classes, including two wheelers. New legislation is also coming into force in Europe and Japan for two wheelers, where there will be a shift from Euro 4 to Euro 5 from January 2020 and December 2020 respectively.

The BS VI and Euro 5 emission standards are very similar to each other. They will tighten the permissible levels of carbon monoxide (CO), hydrocarbons (HC) and oxides of nitrogen (NOx) and introduce new particulate matter (PM) and pollutant non-methane hydrocarbon (NMHC) limits. However, the new performance requirements are made even more challenging by the fact that the levels must be achieved under the world motorcycle test driving cycle (WMTC), which is designed to represent typical driving conditions. Currently, BS VI and Euro 5 for two wheelers do not include particulate number limits, making the use of particulate filters unlikely in the near term. Also absent from the requirements are CO2 limits and fuel economy performance targets, although OEMs are required to report them.

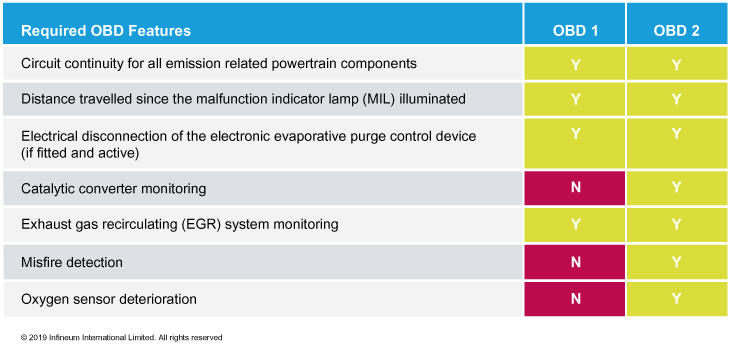

The new standards require on-board diagnostic system (OBD 1 and 2) so that the bike can self-diagnose and self-correct to ensure emissions control is maintained.

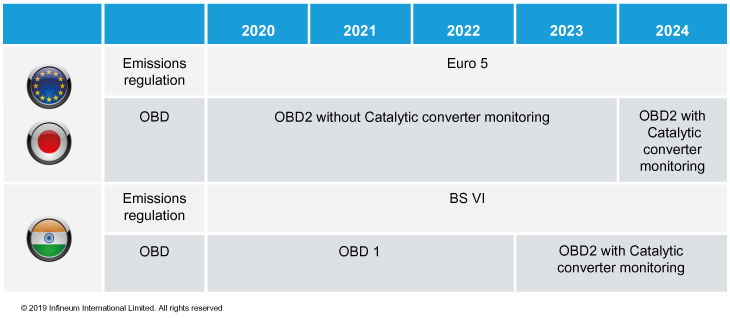

While OBD is a norm for today’s passenger cars, it is new for motorcycles and, owing to the complexity of the OBD features, will be implemented in different stages. The catalytic converter monitoring will be introduced later, in 2023 for BS VI and 2024 for Euro 5 in both Japan and Europe.

India is leapfrogging from BS IV to BS VI and the large cut in emissions necessitates the transformation of engine hardware design. Bikes currently sold in India have predominantly carburetted engines with two-way catalysts but, come 2020, there will be a need to change to closed-loop fuel injection systems and three-way catalysts to tackle the more stringent emission limits.

The three-way catalyst often comprises a mixture of precious metals to catalyse the required reactions. One industry concern is the potential for the three-way catalyst system to be poisoned by phosphorus present in the motorcycle oil. Although this could be overcome by redesigning the catalyst with a bigger surface area and a larger amount of precious metals, this solution comes with additional manufacturing costs for the OEMs.

Some degree of lubricant phosphorus restriction or in-use performance targets could be required in the future.

There is also some uncertainty about the timing of the next JASO T-903 specification update. However, the introduction of catalyst deterioration detection in OBD, which comes into effect in Japan in 2024, is likely to influence industry’s decision on the future phosphorus limit. The challenge here is that a minimum phosphorus level is in place to ensure sufficient gear pitting protection. To allow levels to be lowered, the industry needs a standardised gear pitting test.

In addition, engine modifications required to control NOx production represent a trade off with fuel economy. Since fuel economy is a differentiation factor for OEMs, particularly in India, it is important to find ways that the fuel economy debit can be offset, which may lead to the review of SAE lubricant viscosity grades, with a move to thinner grades expected.

All these changes present opportunities for formulators to introduce higher quality motorcycle oils into the market. These advanced lubricant systems must not only deliver excellent protection to the engine, clutch and gears but also help to meet the challenges of the new emissions requirements by supporting OEMs in the evolution of a new generation of hardware systems.

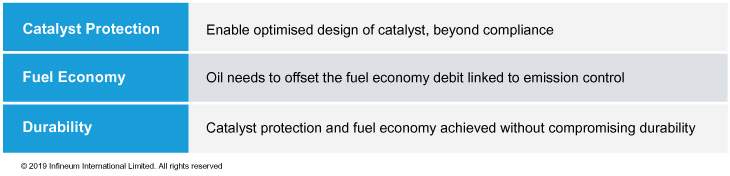

In our view, both OEMs and end users will require future motorcycle formulations to deliver catalyst protection and fuel economy.

Beyond meeting legislative requirements, an oil with added catalyst protection allows OEM to optimise catalyst design and hence manufacturing costs. Fuel economy will no doubt continue to be a key demand from end users, particularly in the huge Asian market. However, the potential levers to achieve these lower phosphorus levels and thinner SAE viscosity grades, will pose significant challenges to lubricant formulators, mainly with respect to engine durability.

To deal with these challenges from a lubricant design perspective, zinc dialkyldithiophosphate (ZDDP) chemistry and quantity must be optimised in the formulation to minimise its impact on the catalyst. To offset the fuel economy debit that may arise from the changes introduced to meet the new emissions regulations, a shift to lower viscosity grades is expected. However, it is essential that these changes are achieved without compromising durability performance.

Through the use of robust components and a carefully balanced additive system, lubricants can achieve a well rounded performance for future motorcycle needs. Infineum has proven its motorcycle engine oil additive technology in SAE 5W-30 at the low phosphorous range of the JASO T903:2016 specification in extensive field trials in Thailand and Brazil. Results demonstrated that the candidate oils delivered excellent protection to the engine, gears and clutch against market benchmarks.

Click here to read more about the field trials in Brazil and watch the outcome on video.

Sign up to receive monthly updates via email