Passenger cars

ASEAN a market in transition

09 December 2025

26 August 2025

Incentives, lower battery costs improved infrastructure and consumer demand help drive up new energy vehicle sales

China is undoubtably the largest electrified vehicle market in the world. Looking ahead, we can expect continued growth in new energy vehicles sales, largely driven by fresh incentives, advancing technology, improved infrastructure, and increasing consumer acceptance. In this Insight article, Siyuan Gao, Infineum Industry Liaison Advisor, talks about the latest market trends and key initiatives that support China’s continued push towards a fully electric mobility future.

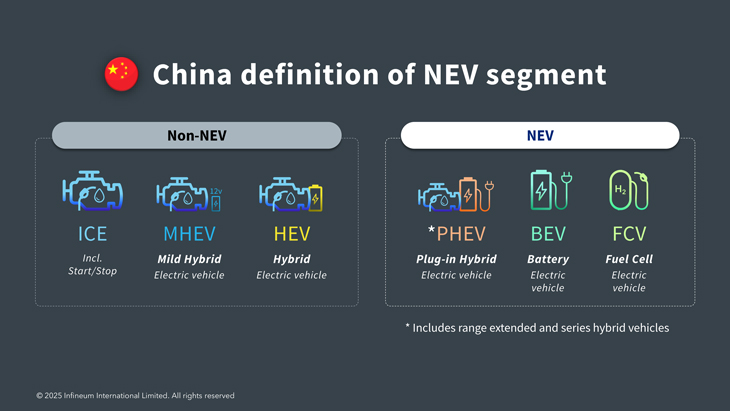

China’s passenger car sales reached 27.56 million units in 2024, up 5.8% from the previous year. New energy vehicle (NEV) sales, including battery, plug in hybrid (which includes range extended) and fuel cell electric vehicles (BEV, PHEV/REEV and FCEV), exceeded 12 million, making up almost 44% of total passenger vehicle sales and representing two-thirds of electric cars sold globally.

According to year-end data from the China Ministry of Public Security, China NEV ownership surpassed 30 million, which means 1 in 10 cars on Chinese roads is now a NEV.

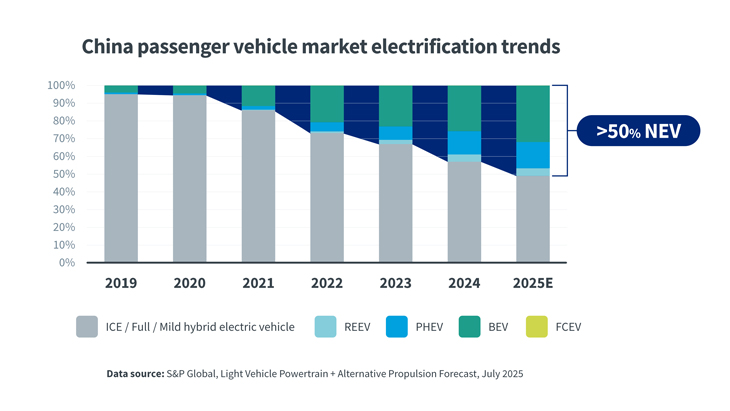

In 2025, China’s automotive market continues to grow and the pace of electrification is accelerating. By May, passenger vehicle sales reached 11 million, an increase of 13% year on year (YoY) - mainly driven by a booming NEV market. The penetration of electrified vehicles in new passenger car sales touched 48%, an increase of 4% vs 2024.

The NEV penetration of passenger vehicles in China’s domestic market now exceeds 50%.

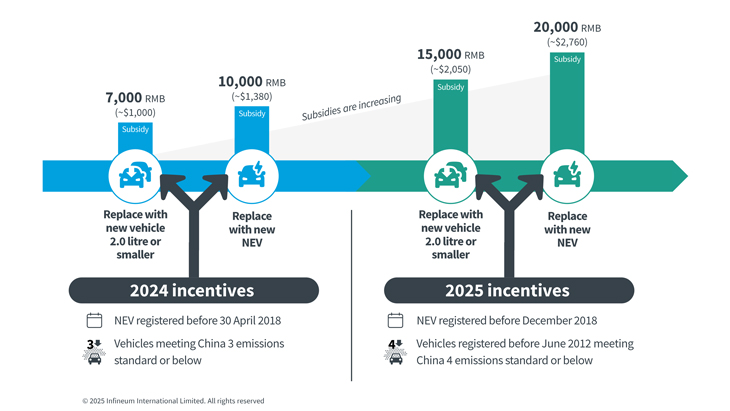

In 2024, the government introduced a policy offering a one-time fixed subsidy to encourage people to trade in old vehicles and buy new NEV and internal combustion engine (ICE) vehicles. The policy, in effect until December 31 2024, was clearly a success since according to CAAM (China Association of Automobile Manufacturers) data, almost 4 million NEV sales last year were as a result of old car replacements. Not surprisingly, the trade in incentive policy has been renewed for 2025.

The new scheme also allows consumers to sell vehicles on the second-hand market rather than scrapping them. In this case, the subsidy amounts are slightly reduced, offering up to 15,000 RMB ($2,050) towards a new NEV and 13,000 RMB ($1,780) towards a new ICE vehicle.

In the China passenger vehicle market NEV sales are forecast to continue to grow, with S&P Global suggesting they could reach 51% of new vehicle sales in 2025 – an increase of 7% - 8% vs. the previous year.

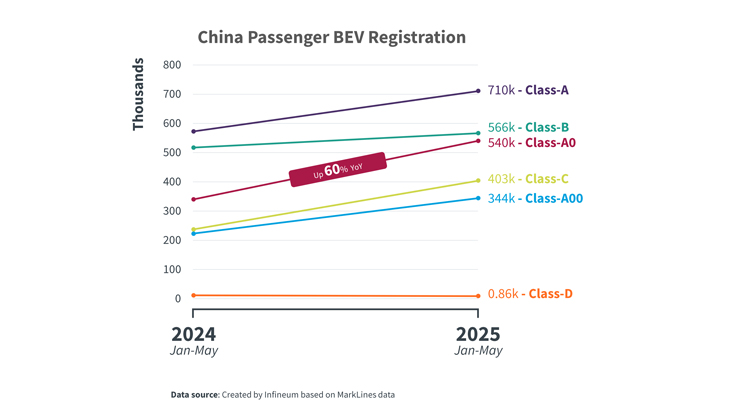

At the time of writing, the sales of BEV in China have maintained a faster growth rate than PHEV/REEV (48% and 35% YoY respectively), underlining China’s continued push toward fully electric mobility. The compact car segment (Class-A, Class-A0 and Class-A00) is the largest contributor to this growth. Among these smaller vehicles, Class-A0 increased by 60% compared to the previous year. These vehicles are typically priced at 60,000 RMB ($8,360) - 100,000 RMB ($14,000), which can be further reduced by using the trade in subsidy. This trend is reshaping the global automotive market as Chinese automakers expand their reach with affordable vehicles.

The huge drop in lithium carbonate prices has slashed battery pack costs. As a result, we have seen the average BEV price fall by 18% since 2023 and the price gap between BEVs and PHEV/REEV has narrowed. Government subsidies and tax incentives have also played a crucial role in making pure electric vehicles in China more accessible to the average consumer.

According to MarkLines, the best-selling BEV model in the retail market from January – May 2025 is the Geely Xingyuan (156 K units), followed by the BYD Seagull (142 K units), both of which are Class-A0.

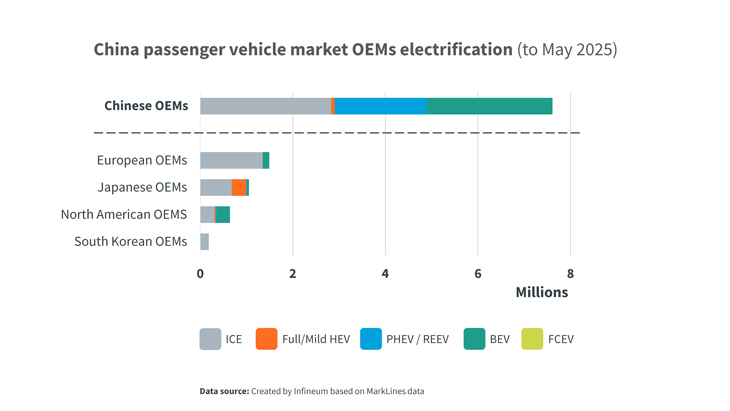

Figures for 2025 show more than 60% market share of Chinese brands are NEVs, an increase of 3% vs the previous year – way ahead of sales by OEMs from other regions.

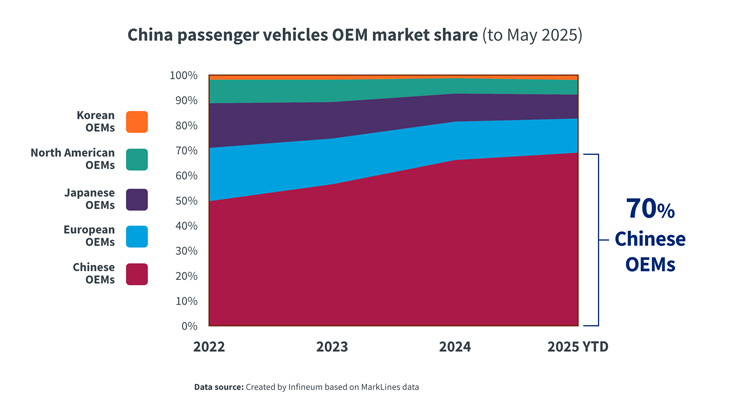

The strong performance of Chinese OEMs in NEVs sales, both BEV and PHEV, is helping them to continue to gain market share in China’s passenger car vehicle market. By May 2025, the market share of Chinese passenger car OEMs in China was close to 70%, an increase of 5% vs 2024.

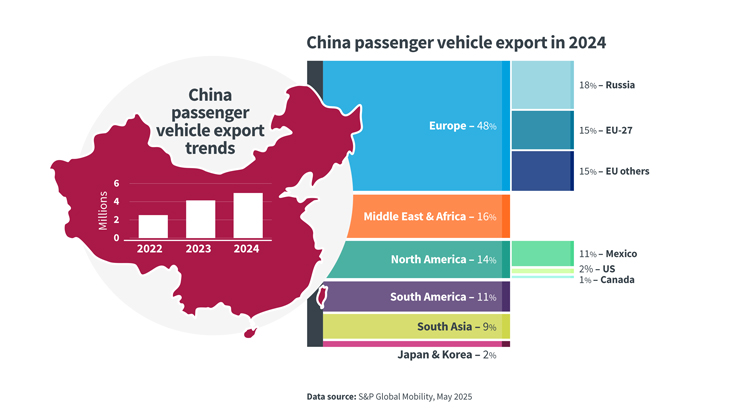

It is not only China’s domestic sales that are growing, in 2024, almost 5 million passenger vehicles were exported out of China. With a YoY increase of 20%, Chinese branded cars going overseas is clearly becoming a new trend. Among these exports, 1.3 million were NEVs, with Europe being a key destination market, accounting for more than 30% of total NEV exports.

However, continued growth in vehicle exports could be challenging owing to trade barriers and outright bans in some markets, such as the US and EU. Slumping exports will put pressure on Chinese automakers, further intensifying competition. With slower export growth, Chinese carmakers, including BYD, Geely and Chery, are working to build up their plants located in overseas markets to improve competitiveness.

The booming NEV market in China is stimulating intense market competition and the resulting price war and OEMs’ vigorous pursuit of technological innovation are trends that we are actively monitoring.

Ahead we see a period of rapid transformation and intense competition in the automotive market in China.

This is being driven by renewed price wars, the fast pace of innovation in battery and advanced driver assistance system (ADAS) technologies, and continued overseas expansion, despite a dynamic geopolitical situation, all of which bring opportunities and challenges for those involved.

In 2023, Tesla took the lead by officially announcing price cuts and, to attract sales and increase market share, China’s auto market followed suit. However, according to the China National Bureau of Statistics, profits are down. While total revenue increased by 4% to 10.6 trillion RMB in 2024, profits fell by 8% YoY to 462.3 billion RMB, with a profit margin of only 4.3%.

In the first quarter of 2025, this trend has continued, with revenue up by 8% YoY to 2.4 trillion RMB, but profits down by 6% YoY to 94.7 billion RMB, and a profit margin of 3.9%.

The government is now taking action. In June, the Ministry of Industry and Information Technology said that it will cooperate with other relevant departments to carry out Anti-Unfair Competition Law enforcement, take necessary regulatory measures to maintain a fair and orderly market environment, and effectively protect the fundamental interests of consumers.

Many OEMs are investing in technologies to speed up charging and improve intelligent driving functions, which are both key factors consumers consider when buying a new car.

For example, BYD released the Super e-Platform in March 2025, which includes the Megawatt Flash Charge, a new technology for battery fast charging. The Platform adopts a 1000V vehicle architecture and uses a low resistance ‘flash charge battery’ with the maximum charging current of 1000A. BYD says it is the fastest for mass-produced vehicles with five minutes of charging delivering 400 kilometers of range and it is now available for pre-order in China. CATL also released their 12C fast-charging battery in April at the Shanghai Auto Show, this innovation enables a 400 km range on a 10 minute charge.

According to data from the China Passenger Car Association (CPCA), by April 2025 the adoption of level 2 and above assisted driving functions (such as adaptive cruise control, lane keeping assist, and automated braking) in NEVs reached 78%. BYD, Geely, Chery and ChangAn have released their intelligent assistant driving systems and say they have plans to introduce them into lower tier models. As an example, the urban NOA (Navigate on Autopilot) function, initially only available in models above 300,000 RMB ($42,000), is now available in 150,000 RMB ($21,000) models. This change fully reflects the rapid popularisation and cost reduction of intelligent driving technology in the China market.

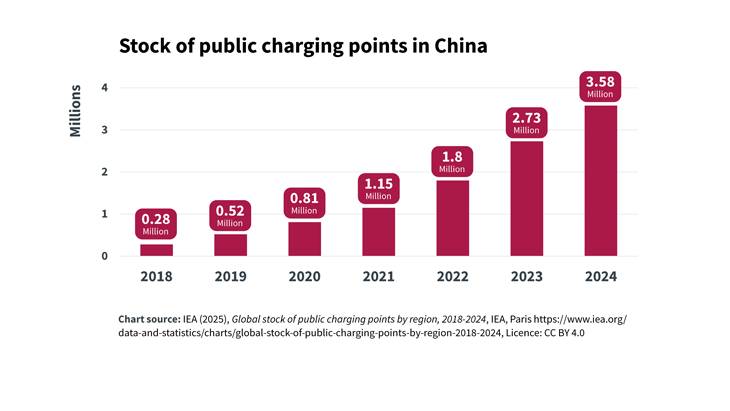

According to the China National Energy Administration, by the end of March 2025, the number of charging units reached 13.7 million, a YoY increase of 47.6%, this includes 3.9 million public charging points and 9.8 million private charging facilities. The chart below shows the huge increase in public charging points in China in recent years.

This growth brings the coverage rate of charging facilities in the whole country to 97%.

Looking ahead, a key objective for charging infrastructure improvement in China is the development of more high power charging facilities. However, the scale, benefits and economic feasibility of megawatt flash charging technology for passenger cars are yet to be verified. Currently, the actual utilisation rate is low, owing to the limited number of compatible models, which means in reality it could take some time for high power charging facilities to be widely used.

In the past 10 years, the Chinese market has made remarkable progress in the transformation of the automotive sector and has become an innovation field for the global transformation of electrification and intelligence. These huge changes are continuously influencing and reshaping the preferences of Chinese auto consumers. In addition, the preferences and behaviors of consumers are influencing and driving the Chinese auto industry to embrace electrification and intelligence more closely and accelerate related investments. This mutually reinforcing role not only determines the future of China's auto industry but will also gradually affect the international auto market. We can expect it to influence the technological development, business model and even the competitive landscape of the global auto industry in the next five to ten years.

According to a McKinsey survey report, consumers' understanding of intelligent driving technology is improving. Whether it is the exposure to various intelligent driving functions, the satisfaction after using the corresponding intelligent driving functions, or the expectation for higher-level intelligent driving functions, the respondents' understanding in all aspects has improved compared with previous studies. The wave of technological equality that has emerged, with the gradual deployment of intelligent technology, will also promote scenario-based applications - a factor for car companies to consider when creating differentiated products. The further popularisation of intelligent driving technology in the Chinese market also depends on the scientific dissemination of related technologies and consumer education by car companies, so that consumers can always use intelligent driving functions reasonably and scientifically within the boundaries allowed by current technical conditions.

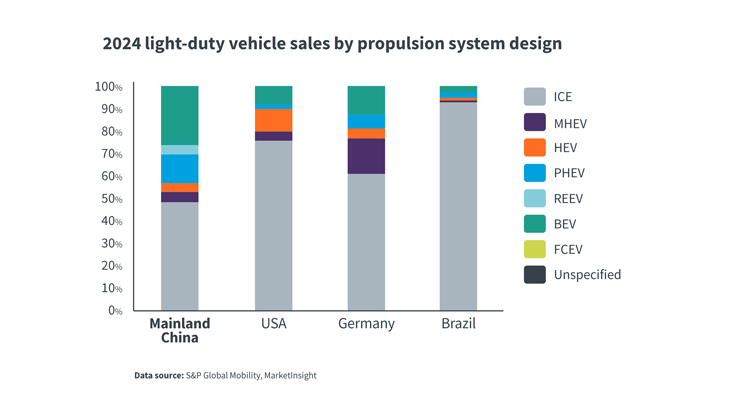

Over the past few years, alternative powertrain technologies, such as BEV, PHEV/REEV, have experienced robust growth in China. Notably, China's powertrain market structure differs significantly from those of other major global automotive markets such as US, Germany or Brazil. Beyond market competition, we can also expect regulatory policies and consumer preference to shape OEMs' future powertrain strategies. For example, PHEV/REEV vehicles are becoming more popular among consumers because they are more convenient to recharge and have advantages in alleviating range anxiety.

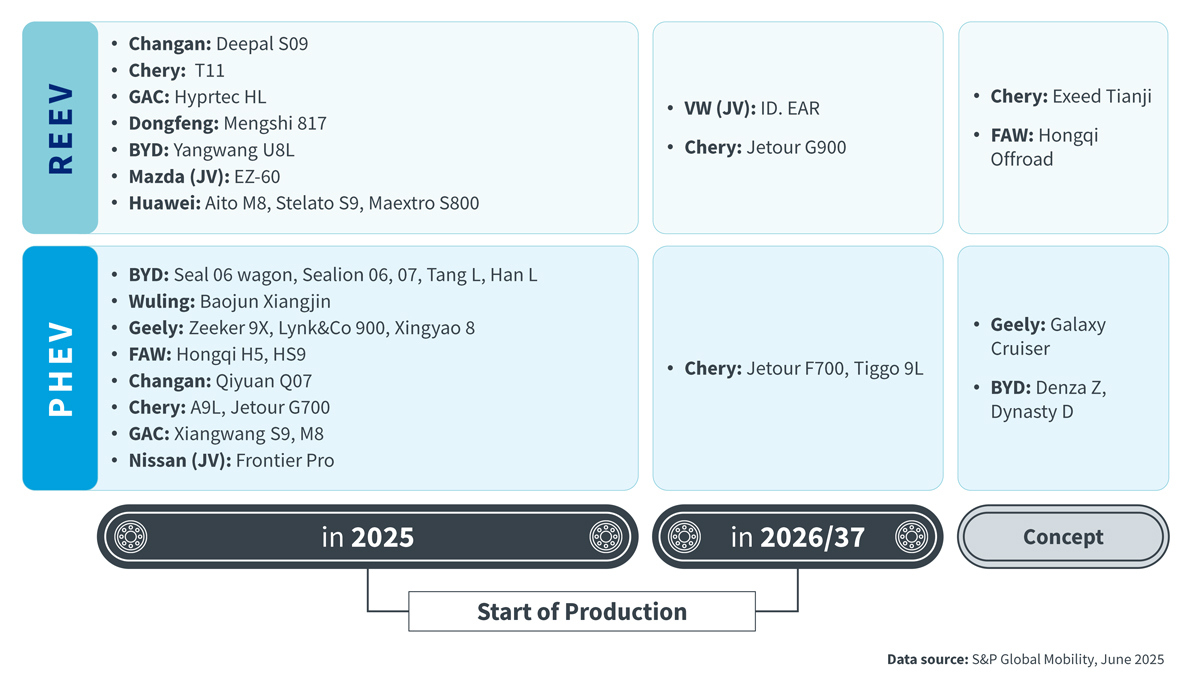

At the 2025 Shanghai Auto Show, more than 35 new PHEV/REEV models were released by various OEMs.

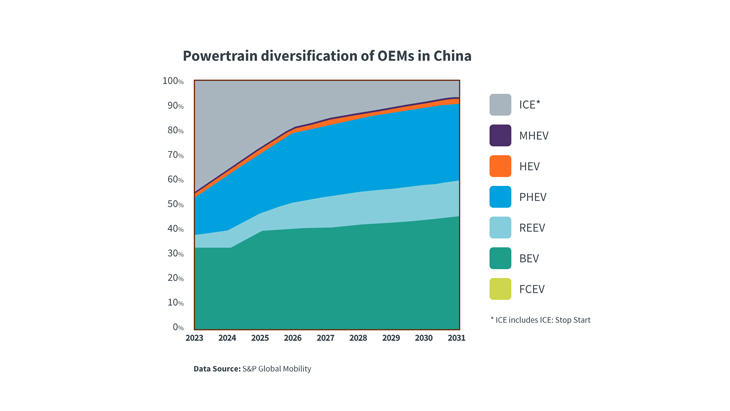

It is expected that Chinese OEMs will continue to develop ICE technology for PHEV and REEV. Forecasts indicate that the PHEV/REEV market share of Chinese OEMs could increase from 26% in 2024 to 45% in 2031. The diversified powertrain strategies may also encourage EU and US OEMs to promote PHEV/REEV models in the global landscape.

China holds the global lead in the electrification of the passenger vehicle market. However, most OEMs have released diversified powertrain strategies, which means the ICE is expected to continue to play an important role in the mobility transition for many years to come.

ICE innovation is likely to continue, with both China and international OEMs putting resources and investment into the development of higher brake thermal efficiency engines, and dedicated hybrid engines. Lubricants with lower friction, more robust performance for hybrid engine specific requirements (such as water handling under extreme operating conditions), longer oil drain interval for lower Product Carbon Footprint (PCF), and compatibility with multiple alternative fuels are expected to experience market share growth in future powertrains.

Although some markets are revising their vehicle electrification policies, China remains a staunch supporter of NEVs.

The combination of continued government support and promotion, investment and innovation from OEMs and the whole industry, a rapidly expanding charging infrastructure, and growing consumer preference for NEVs, mean China is expected to maintain the leading position in the global electric vehicle market.

These trends are bringing both challenges and opportunities across the automotive, lubricants, fuels and transportation additive sectors. Infineum continues to work closely with industry stakeholders to help ensure the success of the industry transition.

Sign up to receive monthly updates via email