Future of Mobility

Europe at a crossroads

04 November 2025

09 December 2025

Sales growth, market fragmentation and pace of electrification present opportunities and challenges for automakers

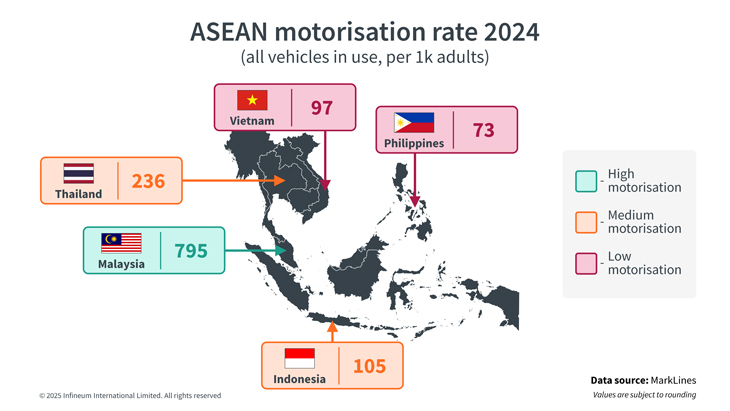

Continued economic growth combined with a burgeoning middle class and low motorisation rates mean ASEAN is seen by global automakers as an exciting opportunity for new personal mobility vehicle sales. But, it is not without its challenges. Siew Wen Wong, Infineum Head of Operational Marketing for the Asia Pacific region, takes a close look at what is impacting the region’s vehicle sales, explores the drivers and barriers to electrification and assesses the impacts on future lubricant demand.

The Association of Southeast Asian Nations (ASEAN) is an intergovernmental organisation of ten Southeast Asian countries: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam. It is a large and dynamic economic bloc, with over 670 million people, making it the third most populous region in the world, with a combined GDP of more than $3.9 trillion. Analysts regard it as a significant force in global trade and production, suggesting it could become the world’s fourth largest economy by 2030. However, the market is still in transition towards becoming a developed economy and is highly fragmented, since the needs of each country vary significantly. This article considers the ‘ASEAN-6’, Indonesia, Malaysia, Thailand, Vietnam, the Philippines and Singapore, which are the region’s largest economies and most exciting automotive markets.

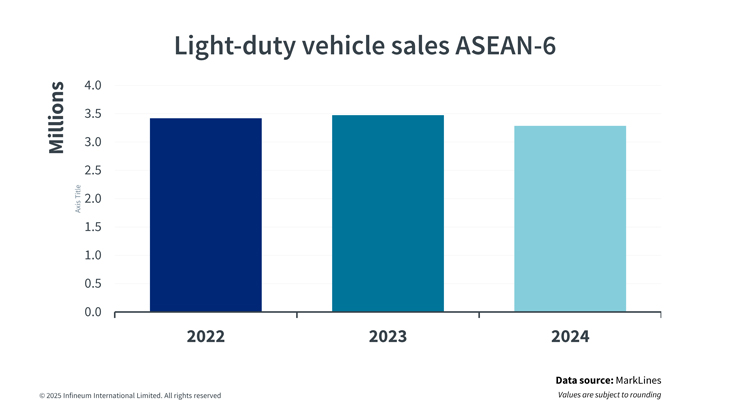

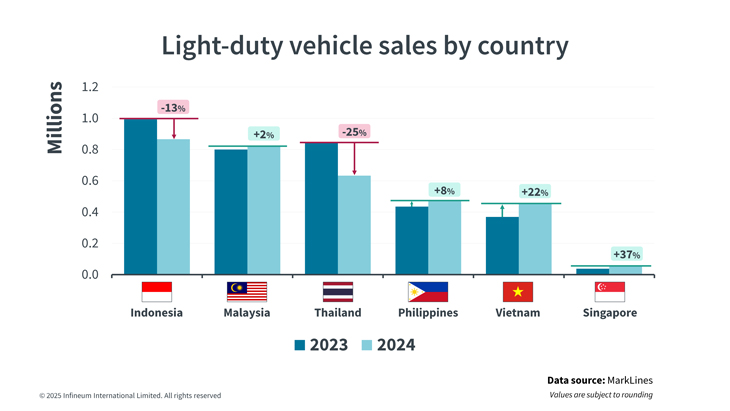

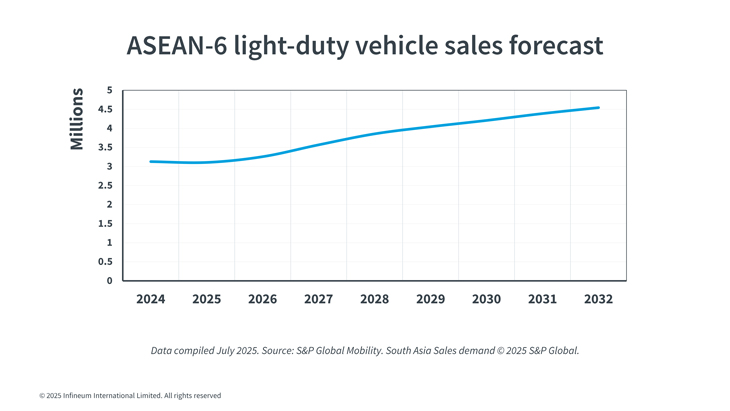

Despite the potential for growth, total ASEAN-6 light-duty vehicle sales were down in 2024 and across the region market performance is rather mixed.

In some countries, sales are being driven by EV incentives, lower interest rates, competitive pricing and new product launches, while in others they are constrained by higher household debt, tighter lending and global trade headwinds. In Thailand and Indonesia, for example, vehicle sales plunged in 2024 as tighter lending and economic uncertainty took hold. Malaysia overtook Thailand as the bloc’s second largest market. At the same time, Vietnam and Singapore experienced strong sales growth, driven by registration fee and interest rate cuts in the former and Certificate of Entitlement adjustments in the latter.

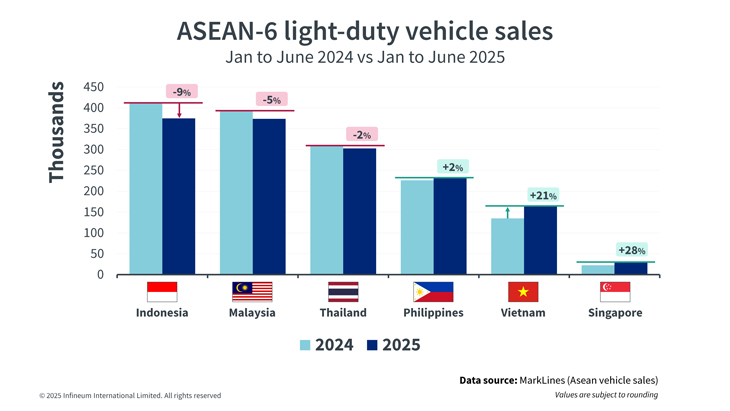

A similar pattern continued in the first six months of 2025, with sales declining in the three largest markets and sales increasing in the three smallest. Notably again, Vietnam and Singapore experienced double digit growth.

In the 3rd quarter, sales remain sluggish in Indonesia, relatively steady in Malaysia and the Philippines, have picked up in Thailand and continue to see strong growth in Vietnam and Singapore.

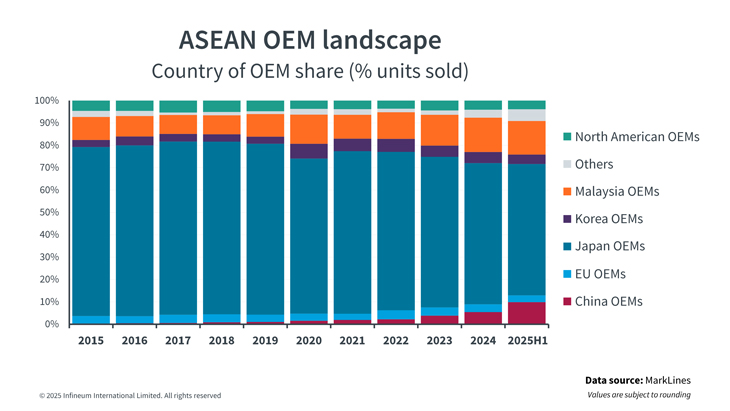

Currently the passenger car market is dominated by Japanese OEMs, although their 2024 sales fell by ~12%. This shift is largely driven by the increasing preference for electrified vehicles and the growing popularity of Chinese brands, which captured 5% of the ASEAN passenger car sales in 2024.

In Indonesia, Thailand and the Philippines, Japanese OEMs hold more than 75% of the market. However, Chinese OEMs, such as BYD, Chery and SAIC, are showing strong growth and aggressive expansion in Thailand and Singapore as consumer preference shifts towards electrified vehicles and these OEMs offer affordable, cutting-edge options. Other OEMs, including Volkswagen, Hyundai, Kia, GM and Ford, are experiencing a decline in demand, while local OEMs, such as Malaysia’s national brands Perodua and Proton and Vietnam’s VinFast, have been gaining overall market share.

Despite a slight downturn in the sales forecast for 2025, looking out to the future, automotive industry analysts foresee steady growth potential, with sales volumes expected to reach over 4.5 million by 2032.

One of the key drivers is the changing population demographic, with the share of the middle class likely to continue to rise well into the future. These affluent consumers can be expected to transform consumption patterns, with an increased demand for higher quality products, advanced technology and new personal mobility solutions. In addition, when it comes to vehicle ownership, in some of the region’s countries there is a relatively low penetration, which presents a significant opportunity for automakers.

While GDP is expected to continue to rise from 4.2% in 2024 to 4.7% in 2025, there are several political and economic uncertainties that in the short-term are having an impact on the market. Heavy US tariffs, for example, are fuelling market uncertainty. These tariffs, combined with a cooling global economy are hitting exports hard, prompting ASEAN automakers and lubricant producers to double down on localisation, regional trade, and cost optimisation.

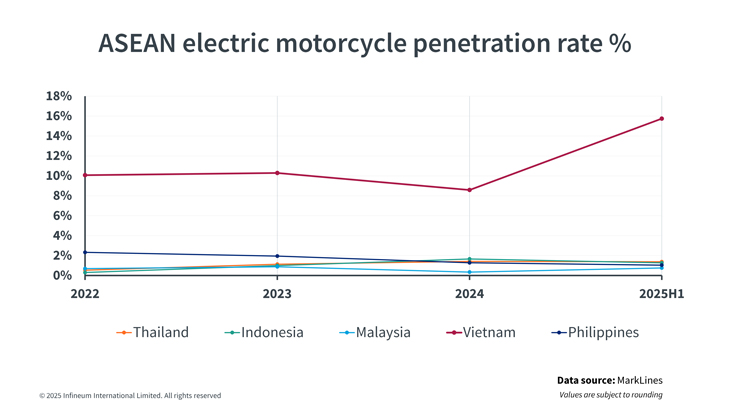

A key question is how fast will electric vehicles (EV) penetrate the automotive landscape in the ASEAN-6? In 2024, across the region, the x-EV share reached ~15% up from 9% in 2023 and the latest figures show continued growth in 2025.

However, the uptake of BEVs is far from even across the different countries. The sales volumes in Indonesia, Thailand and Vietnam were almost neck and neck in 2024. In terms of the percentage of total sales, Singapore is ahead, with Vietnam and Thailand close behind. Versus 2023 figures, sales in Malaysia, Thailand and the Philippines were relatively flat, while Indonesia, Thailand and Singapore saw some growth. Currently the key swing factor appears to be policy change – such as subsidies, incentives and emissions regulations.

While ASEAN governments continue to promote BEVs, their adoption is tempered by high cost of electric vehicles, charging infrastructure gaps, and consumer uncertainty – all of which are slowing the pace of adoption. In the short-term, hybrid vehicle sales could be expected to overtake full battery electric sales. However, EV ambitions are running high. Thailand and Indonesia are aiming to become EV production hubs for export and domestic needs by 2030, with Malaysia and Vietnam also making strides in the same direction. Across the region different electrification patterns are emerging.

Looking closer at the three largest electrified markets by volume, Indonesia, Thailand and Vietnam, we see differences in uptake. Indonesia is in the early stages of electrification. Success is heavily reliant on government subsidies, investment from foreign players and the development of local assembly and battery production capacity. While EV sales are expected to grow quickly in the coming years, there is still expected to be room for ICE growth as older cars are replaced and as the sales of hybrids, both imported Japanese brands and those converted from ICE platforms, experience steady growth.

In Thailand, BEV adoption is lagging owing in the main to market saturation, price competition, and economic slowdown. Hybrid and plug-in hybrid electric vehicles are seen as more practical and scalable for the current market and consumers are more accepting of these cost-effective electrified variants, with hybrids now accounting for more than 20% of total sales. Infineum sees a strong future growth for hybrids as Thailand recalibrates its electrification strategy: from BEV-centric to a more multi-technology pathway or x-EV.

According to the Vietnam Automobile Manufacturers Association, hybrid vehicle sales surged over 73% year-on-year in the first nine months of 2025, reaching 9,785 units. This growth trend is expected to continue in 2026 as incentives for all hybrid types encourage consumers to adopt these more fuel-efficient, low-emission vehicles.

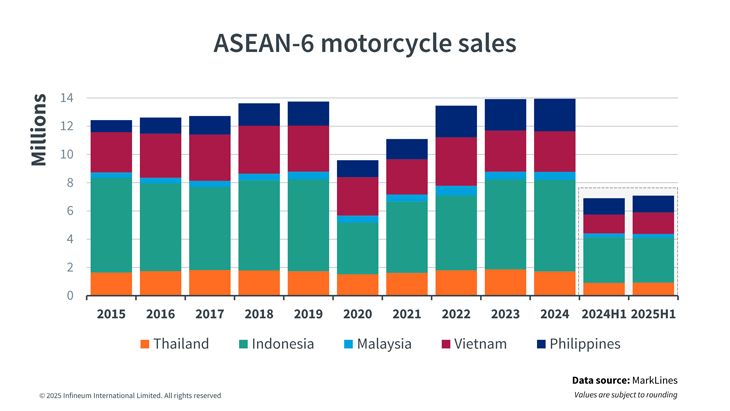

Some 70% of vehicles on ASEAN roads are two-wheelers and the whole region accounts for some 30% of the global motorcycle market, led by Indonesia and Vietnam. The market experienced strong growth in 2024, with the Philippines leading the region with a 7% sales growth.

Electric bikes made up less than 5% of total sales in 2024, with Vietnam in the lead. Despite subsidies in Indonesia and Thailand, along with Indonesia’s battery infrastructure efforts, overall adoption remains low.

In the first half of 2025, motorcycle sales have continued to grow, with sales of 7.3 million units reported, a 2.4% increase vs the same period in 2024. However, as can be seen below, sales performance across the region is far from homogeneous.

Despite the trend for consumers to shift to passenger cars for personal mobility, analysts expect the two-wheeler market to see continued growth in the coming years.

Rising vehicle ownership, an expanding vehicle parc, and longer service intervals are all driving long-term growth in automotive lubricants, across ASEAN’s evolving mobility landscape, with the largest growth expected in Indonesia and Vietnam. Currently API SN and above quality oils account for more than 50% of the ASEAN passenger car lubricants market.

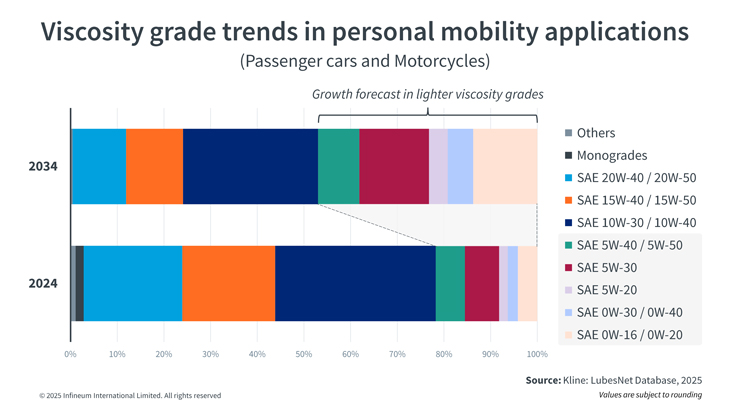

Driven by Euro V/VI emissions standards, fuel economy requirements and longer drain intervals the personal mobility lubricants market is shifting towards higher performance, lower viscosity, eco-friendly formulations. This means demand is expected to rise for synthetic and semi-synthetic lubricants that help to boost fuel efficiency.

It is a highly competitive and dynamic lubricants market, which features both multinational and regional players. There are significant opportunities for multi-functional and logistically simple solutions that address the needs of such a diverse market.

ASEAN provides a fertile yet fragmented market and looks set to be the next battleground for global automotive and lubricant industry players. We will watch with interest to see how the market evolves and how the actions taken by the various governments, the automotive industry, and other stakeholders impact the region’s future vehicle landscape.

Infineum is committed to powering a greener future and continues working to help ensure the success of the market transition towards net zero. If you have any questions or need further details please contact us.

Sign up here to receive email alerts so that you never miss out on new Future of Mobility content from Infineum - and make sure you follow Infineum Additives on LinkedIn.

Sign up to receive monthly updates via email