Commercial vehicles

What’s driving Daimler Truck?

16 April 2024

13 December 2022

Latest low emissions innovations and the barriers to their wider adoption in China’s heavy-duty vehicles

Tighter emissions regulations for heavy-duty vehicles that have been introduced in China since 2021, combined with the country’s ambition to become carbon neutral by 2060, are driving change to long-haul heavy-duty truck vehicles. Yang Shuqing, Infineum Industry Liaison Advisor, assesses the growing number of options being considered for truck propulsion, explores the multi-energy landscape that can be expected to emerge in China in the future, and looks at the many barriers that still need to be overcome.

In 2021 some 39 billion tons of freight was transported across China by road in more than eight million heavy-duty trucks: most of which were running on diesel fuel. However, China’s tightening emissions regulations and carbon neutrality ambitions combined with hauliers’ growing demands for cleaner, more reliable, lower total-cost-of-ownership vehicles, mean things are set to change. The sales volume of heavy new-energy trucks (hybrid, hydrogen and battery electric) are reportedly up >300% in the first eight months. In this fast changing market, the opportunities for OEMs, fuel producers and lubricant marketers are very exciting.

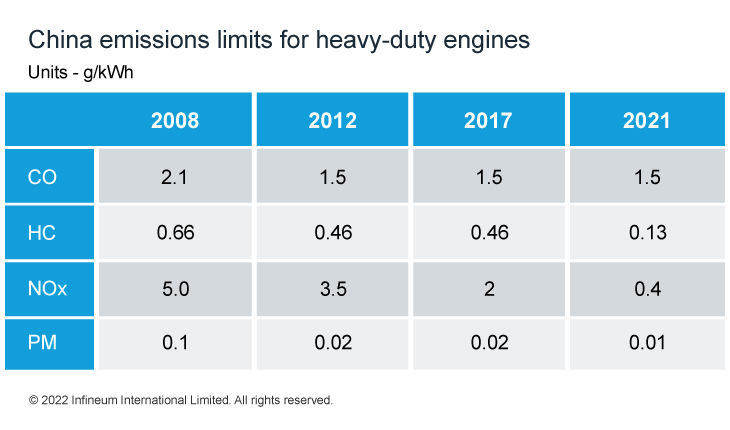

In terms of cutting air pollution, China VI emission standards have been phasing in for new heavy-duty diesel vehicles nationwide in two stages. China VIa, largely equivalent to Euro VI, has applied to all new heavy-duty vehicles since July 2021 and China VIb is coming into force for all new vehicles from July 2023. This second stage will add requirements, such as remote on-board diagnostics data reporting, that are expected to enhance real-world emissions compliance. However, the complex emission reduction technology, high associated costs and limitation of performance improvement for conventional diesel vehicles means OEMs are looking for alternative energy sources, which have lower emissions and are cheaper to run than their diesel counterparts.

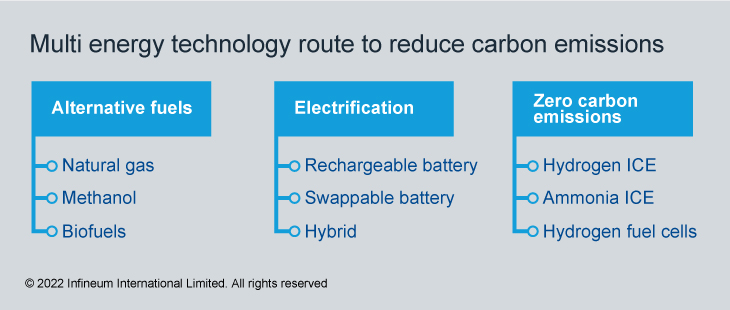

China Stage 3 National Standard for fuel economy requirements has applied for all new truck sales from July 2021, tightening fuel consumption limits by 13.8% compared to the previous Stage 2. However, as China makes firm commitments to carbon reduction through its ‘dual carbon’ goals, which are to reach its carbon emissions peak in 2030 and become carbon neutral before 2060, significant change lies ahead. Not only can we expect diesel fuel consumption limits to be tightened by the future China Stage 4 National Standard in July 2024 but also incentives, regulations and policy changes are expected to drive the use of multiple energy technologies such as battery electric, natural gas and hydrogen in heavy-duty applications.

While these alternatives to diesel fuel have their advantages, there are still many hurdles, in terms of technology, cost and facility construction, which need investment in time and money to overcome to enable them to be competitive in the market.

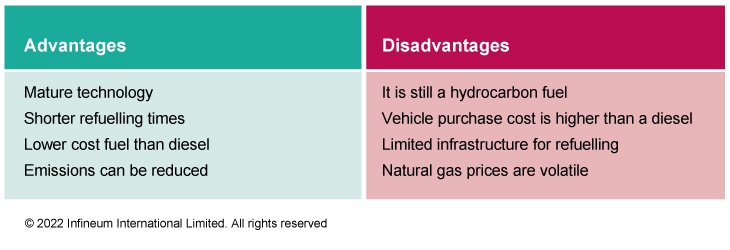

Liquid and compressed natural gas (LNG and CNG) are not new options and, while these gases are still hydrocarbons, they are estimated to produce 20-25% less emissions vs. diesel, which means vehicles can operate in diesel vehicle restriction areas. Currently LNG & CNG power only a small percentage of China’s trucks, but sales are forecast to grow. This is partly driven by policy changes and partly because these fuels can cost significantly less than diesel on average at Chinese gas stations. While the initial purchase price of a gas-powered rig may be higher than a diesel truck, the fuel savings that can be made on long-haul journeys, when gas prices are low, could allow the extra cost to be recouped relatively quickly.

Methanol is another lower-cost alternative fuel that is also gaining some ground in China. However, there are some hurdles to overcome in its storage and transportation. In addition, as a result of the low combustion temperatures, more sludge and acid can be generated, which means advanced engine lubricants may be required.

Used alone, LNG/methanol fuels are unable to meet the requirements of longer-term carbon reduction targets.

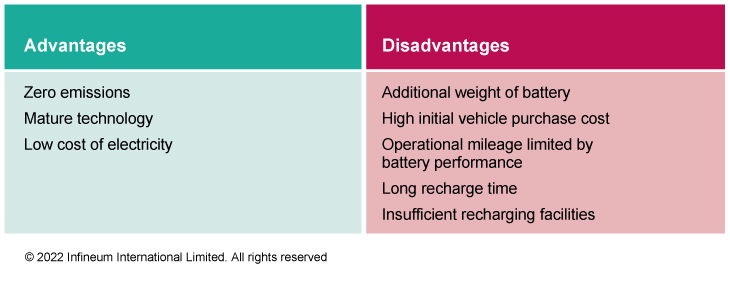

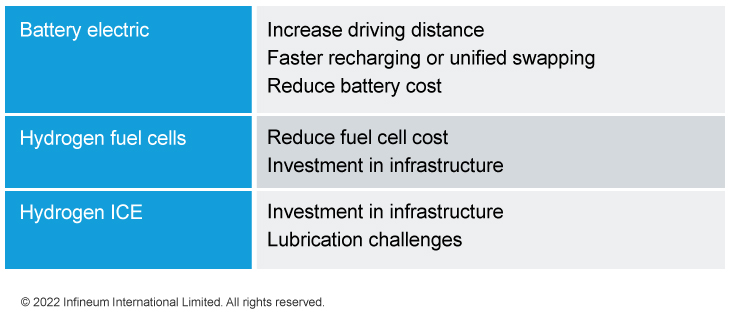

The application of rechargeable/swappable batteries in trucks is increasing in China. Although currently the sales volume of new energy vehicles (NEV) accounts for only a small proportion of all heavy-duty truck sales, with the vast majority of the NEVs sold being pure electric. It is a busy and changing picture, with all major local OEMs having battery truck options in the market. Many of these vehicles are used in shorter-range applications such as in mines and ports and in municipal vehicles.

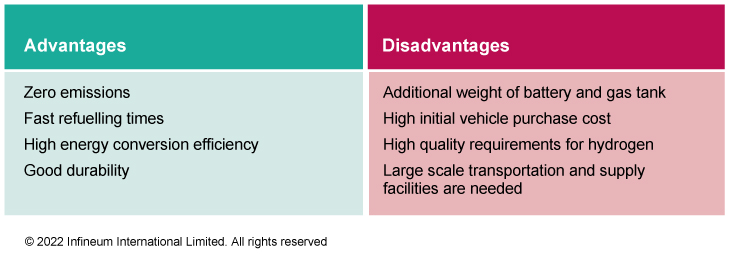

Faster refuelling times and suitability for long-haul applications give hydrogen fuel cells an advantage over rechargeable batteries for heavy-duty truck transportation. However, very few hydrogen fuel cell heavy-duty trucks have been sold in 2022 – and although growth percentages look strong, sales are still only a small fraction of total truck sales. While continued growth is forecast there are clearly significant barriers to their wider adoption - in part it is their higher cost and complexity and the need for the construction of large-scale hydrogen supply systems.

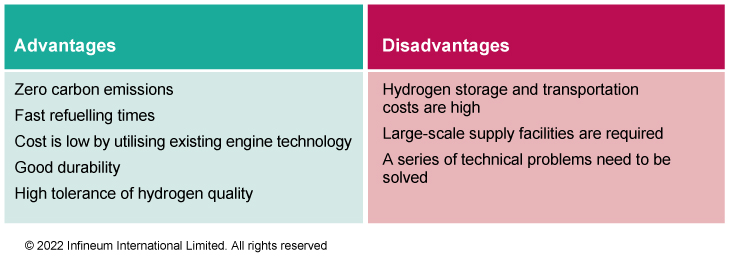

The use of internal combustion engines (ICE) running on hydrogen or ammonia fuels is an area gaining the attention of several heavy-duty truck OEMs. One of the key advantages is the ability to use many conventional diesel engine technologies and facilities, which means lower up-front investment and running costs. However, there are still transportation and supply challenges to overcome. In addition, it is likely that advanced lubricants will be needed to handle in-use issues including oil emulsification, pre-ignition and metal hydrogen embrittlement. Although based on established hardware platforms, this is a new and exciting development and recently in China Weichai Power, Yuchai and FAW Jiefang have all made announcements concerning the progress of hydrogen ICEs for use in heavy-duty applications.

Ammonia is another fuel under consideration and, while it can overcome the issues associated with hydrogen storage and transportation, its production, storage and transportation are not considered environmentally friendly. There are also issues around its use in that it has very unstable combustion, high NOx and is toxic and corrosive. In April 2022, Dongfeng Commercial Vehicle and Tsinghua University jointly fired China’s first ammonia fueled heavy-duty internal combustion engine.

Meeting China’s evolving emissions regulations and decarbonisation goals are clear drivers that are shaping the direction of the entire heavy-duty truck industry. OEMs are at various stages of developing, testing and commercialising a wide range of energy sources including batteries, fuel cells, hydrogen/ammonia ICE and natural gas. As yet, no single energy source has been able to achieve a decisive leading position in the Chinese market and many issues are still to be addressed:

A number of OEMs, fuels, lubricants and additives suppliers are working collaboratively to overcome the main challenges associated with the use of these new energy sources. It is a long, challenging and costly journey and, in our view, while these multi-energy trends may start alongside the new emission regulations, diesel will continue to be the major fuel used in heavy-duty trucks in China at least in the next decade.

Sign up to receive monthly updates via email